- Australia’s retail sales fell in December after a big surge the previous month.

- There is a 70% probability of an RBA rate cut in August.

- The US Department of Labor Statistics will release data on job openings later on Tuesday.

Tuesday’s AUD/USD outlook leans towards a bearish tilt following the revelation of a dip in Australia’s retail sales for December, retracting from the previous month’s surge. As a result, this downturn has heightened investor confidence that the RBA is unlikely to implement a rate hike next week. Additionally, there is a 70% probability of an RBA rate cut in August.

-Vă interesează să aflați mai multe despre Brokerii ETF? Consultați ghidul nostru detaliat -

Meanwhile, investors are awaiting the highly anticipated four-quarter inflation report coming on Wednesday. Economists predict that headline consumer inflation might drop to a two-year low of 4.3%.

On the other hand, the US dollar was mostly flat ahead of employment data and the Fed’s monetary policy decision tomorrow. Traders will look for insights into potential rate cuts by the US central bank.

The US will release job openings data later on Tuesday, giving a preview of the upcoming payroll report on Friday. Meanwhile, tomorrow, the Fed will likely keep interest rates unchanged. However, everyone will focus on the messaging by Fed Chair Jerome Powell in Wednesday’s press conference.

Markets are currently pricing in a 46.6% chance of the US central bank starting rate cuts in March, down from 73.4% a month ago. This shift came after data showed that the US economy remains resilient.

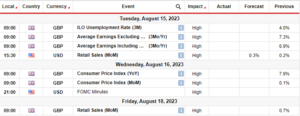

Evenimente cheie AUD/USD astăzi

- Încrederea consumatorilor CB din SUA

- Oferte de muncă US JOLTS

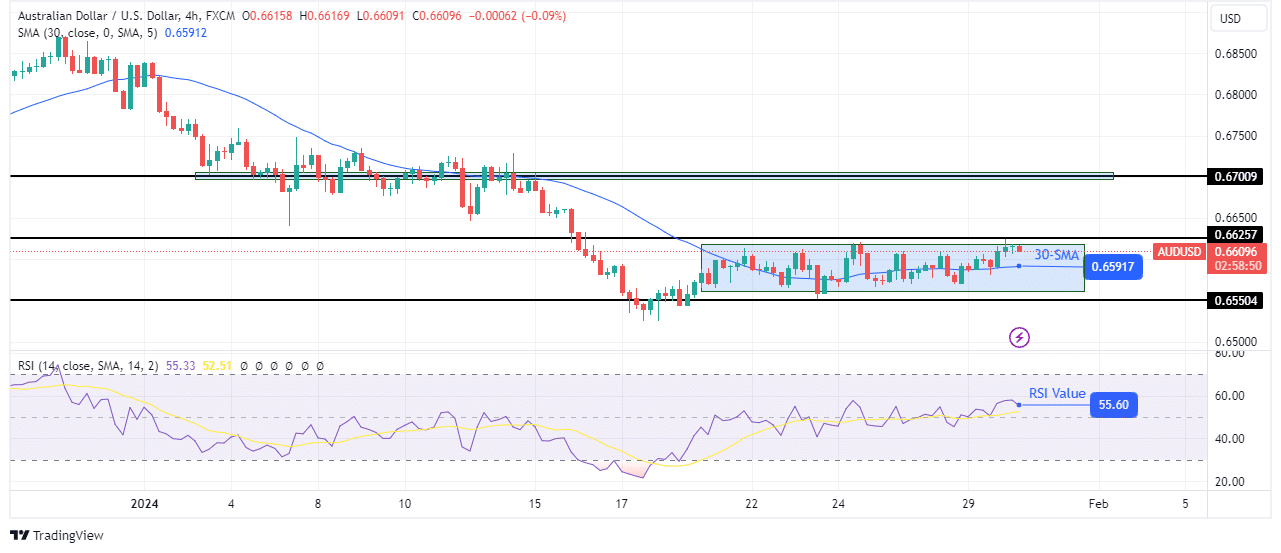

AUD/USD technical outlook: Price trades in a tight range

On the technical side, AUD/USD is trapped in consolidation, with the nearest support at 0.6550 and the nearest resistance at 0.6625. The ranging market came after a strong bearish trend that failed to go below the 0.6550 support level. Consequently, the price pulled back to the 30-SMA. At this point, the price confirmed a range by chopping through the SMA. Similarly, the RSI started chopping through the pivotal 50 level.

-Vă interesează să aflați mai multe despre Brokeri forex din Canada? Consultați ghidul nostru detaliat -

If this consolidation is a pause in the downtrend, then the price will likely soon break below the range support and the 0.6550 support level. On the other hand, the trend will reverse to bullish if the price breaks above the 0.6625 resistance level.

Doriți să tranzacționați forex acum? Investește la eToro!

68% din conturile de investitori de retail pierd bani atunci când tranzacționează CFD-uri cu acest furnizor. Ar trebui să vă gândiți dacă vă puteți permite să vă asumați riscul mare de a vă pierde banii

- Distribuție de conținut bazat pe SEO și PR. Amplifică-te astăzi.

- PlatoData.Network Vertical Generative Ai. Împuterniciți-vă. Accesați Aici.

- PlatoAiStream. Web3 Intelligence. Cunoștințe amplificate. Accesați Aici.

- PlatoESG. carbon, CleanTech, Energie, Mediu inconjurator, Solar, Managementul deșeurilor. Accesați Aici.

- PlatoHealth. Biotehnologie și Inteligență pentru studii clinice. Accesați Aici.

- Sursa: https://www.forexcrunch.com/blog/2024/01/30/aud-usd-outlook-australias-sales-dip-following-nov-surge/

- :are

- :este

- 1

- 46

- 50

- 73

- a

- Despre Noi

- mai sus

- Conturi

- În plus,

- După

- în urmă

- înainte

- an

- și

- Anticipat

- SUNT

- AS

- At

- AUD / USD

- August

- Australia

- așteaptă

- înapoi

- Bancă

- de urs

- de mai jos

- Mare

- Pauză

- pauze

- Bullish

- by

- a venit

- CAN

- CB

- central

- Banca centrala

- CFD-uri

- Scaun

- șansă

- verifica

- mărunt

- venire

- Conferință

- încredere

- CONFIRMAT

- prin urmare

- Lua în considerare

- consolidare

- consumator

- În prezent

- Tăiat

- reduceri

- de date

- decembrie

- decizie

- Departament

- Departamentul de Muncă

- detaliat

- Dip

- Dolar

- jos

- JOSIREA

- Picătură

- economiști

- economie

- ocuparea forţei de muncă

- evenimente

- toată lumea

- A eșuat

- fed-

- Catedra Fed

- Președintele Fed Jerome Powell

- plat

- Concentra

- următor

- Pentru

- Forex

- Vineri

- din

- Oferirea

- Go

- mână

- titlu

- sporit

- Înalt

- extrem de

- Excursie pe jos

- Totuși

- HTTPS

- if

- punerea în aplicare a

- in

- inflaţiei

- perspective

- interes

- Ratele dobânzilor

- interesat

- în

- Investi

- investitor

- Investitori

- Jerome

- jerome powell

- Loc de munca

- A pastra

- Cheie

- muncă

- mai tarziu

- învăţare

- Nivel

- Probabil

- Uite

- pierde

- care pierde

- Jos

- Martie

- Piață

- max-width

- Între timp

- mesagerie

- ar putea

- Monetar

- Politică monetară

- bani

- Lună

- mai mult

- Mai ales

- următor

- saptamana viitoare

- nov

- acum

- of

- on

- deschideri

- Altele

- al nostru

- Perspectivă

- pauză

- stat de plată

- pivot

- Plato

- Informații despre date Platon

- PlatoData

- Punct

- Politica

- potenţial

- Powell

- prezice

- presa

- Anunţ

- precedent

- preţ

- de stabilire a prețurilor

- probabilitate

- furnizorul

- gamă

- variind

- rată

- Evaluați creșterea

- tarife

- RBA

- Rata RBA

- eliberaţi

- rămășițe

- raportează

- elastic

- Rezistență

- rezultat

- cu amănuntul

- Vânzările cu amănuntul

- revelație

- inversa

- Risc

- RSI

- s

- de vânzări

- schimbare

- să

- a arătat

- parte

- asemănător

- SMA

- Curând

- început

- Pornire

- statistică

- puternic

- a sustine

- nivel de suport

- apare

- Lua

- Tehnic

- acea

- Fed

- apoi

- Acolo.

- acest

- Prin

- la

- mâine

- față de

- comerţului

- Comercianti

- meserii

- Trading

- prins

- tendință

- marţi

- improbabil

- viitoare

- us

- Banca Centrală SUA

- Dolar american

- Economia SUA

- a fost

- miercuri

- săptămână

- cand

- dacă

- voi

- cu

- tu

- Ta

- zephyrnet