Capacitando a próxima iteração do financiamento ao consumidor

Medium, JC Bahr-de Stefano | 31 de março de 2023

Building the next decade of consumer finance

- Last week in Las Vegas, I had the great pleasure of moderating a panel at Fintech Meetup re: building the next decade of consumer finance by leveraging real-time data and cash flow forecasting. I wanted to share some of the key insights shared during the session by our amazing panelists, Jose Bethancourt (Co-Founder of Method Financial), Ema Rouf (Co-Founder of Pave.dev), and Zane Salim (Co-Founder of Atlas)!

Vejo: CFPB Emite Pedido de Informações sobre “Data Brokers”

- 1/ Alternative data augments FICO across the entire credit spectrum — this is about FICO+ NOT replacing FICO.

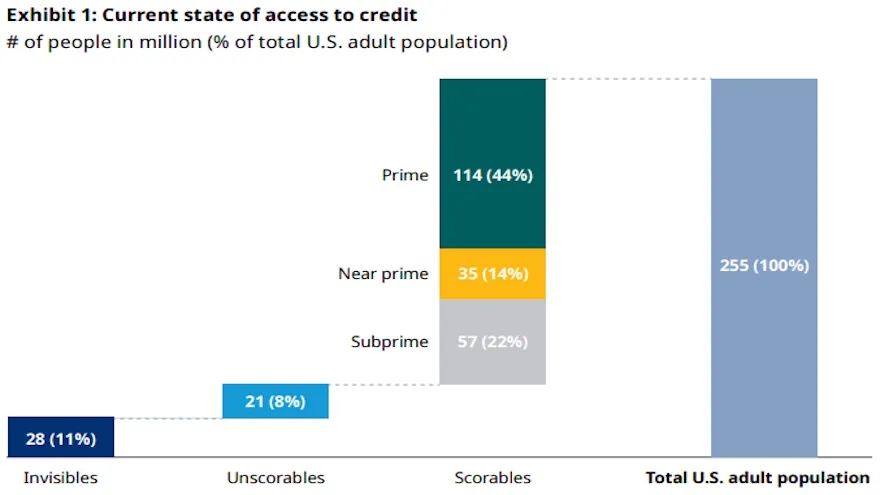

- A problem of credit invisibility in the US is growing, with an estimated 28 million adult Americans credit invisible and 21 million unscorable. To make decisions about these consumers and offer them financial services and products, alternative data, such as income and employment, can be used. This data can also help lenders make better risk-weighted decisions for many segments of users, not just credit invisible ones, and is particularly important during periods of economic stress.

- 2/ Real time data powers better products and outcomes by enabling greater access and improving the quality of risk management.

- Credit bureaus can take up to 45 days to report data, so lenders may not have the most up-to-date information on a borrower’s behavior. Atlas, a payroll-powered credit card, uses real-time data to monitor users’ financial health and adjust credit limits, allowing for better risk management and loss prevention.

- 3/ The movement to make alternative data mainstream has to happen outside of the credit bureaus.

- Credit reports do not provide a complete view of a consumer’s debt obligations as there is a lot of data that is not furnished to the credit bureaus, including most BNPL loans. However, companies like Method collect data from over 60k institutions to provide lenders with a more comprehensive view of a person’s debt obligations, combining data from credit bureaus with financial institutions’ core banking systems.

Vejo: A Jornada do Open Banking do Canadá: Entrevista com Abe Karar, Diretor de Produtos, Fintech Galaxy

- 4/ Recent innovation in infrastructure has made this data far more accessible than it has been in the past.

- Recent advancements in infrastructure and tools have made it easier to access and enrich the data. Companies such as Method and Pave are providing infrastructure that helps fintechs and banks adopt and use this data, leading to accelerated adoption.

- 5/ Mature lenders don’t want scores, they want raw data or attributes.

- Understanding the data is crucial for them to explain it to originating banks or capital providers, and the use of attribute generation can speed up model development. Pave is an example of a company offering transaction cleaning, enrichment, and their own attributes toolbox for lenders to use in their proprietary models.

Continue para o artigo completo -> aqui

A National Crowdfunding & Fintech Association (NCFA Canadá) é um ecossistema de inovação financeira que fornece educação, inteligência de mercado, administração do setor, oportunidades e serviços de networking e financiamento a milhares de membros da comunidade e trabalha em estreita colaboração com o setor, governo, parceiros e afiliados para criar um fintech e financiamento vibrantes e inovadores. indústria no Canadá. Descentralizada e distribuída, a NCFA está envolvida com as partes interessadas globais e ajuda a incubar projetos e investimentos nos setores de fintech, finanças alternativas, crowdfunding, finanças ponto a ponto, pagamentos, ativos e tokens digitais, setores de blockchain, criptomoeda, regtech e insurtech. Cadastrar Comunidade Fintech e Financiamento do Canadá hoje GRÁTIS! Ou se tornar um membro contribuinte e obter vantagens. Para mais informações por favor visite: www.ncfacanada.org

A National Crowdfunding & Fintech Association (NCFA Canadá) é um ecossistema de inovação financeira que fornece educação, inteligência de mercado, administração do setor, oportunidades e serviços de networking e financiamento a milhares de membros da comunidade e trabalha em estreita colaboração com o setor, governo, parceiros e afiliados para criar um fintech e financiamento vibrantes e inovadores. indústria no Canadá. Descentralizada e distribuída, a NCFA está envolvida com as partes interessadas globais e ajuda a incubar projetos e investimentos nos setores de fintech, finanças alternativas, crowdfunding, finanças ponto a ponto, pagamentos, ativos e tokens digitais, setores de blockchain, criptomoeda, regtech e insurtech. Cadastrar Comunidade Fintech e Financiamento do Canadá hoje GRÁTIS! Ou se tornar um membro contribuinte e obter vantagens. Para mais informações por favor visite: www.ncfacanada.org

Deseja obter acesso privilegiado a alguns dos avanços mais inovadores que estão acontecendo na #fintech. Registre-se no #FFCON23 e ouça os líderes globais sobre o que vem a seguir! Clique abaixo para obter ingressos de acesso aberto a toda a programação virtual e conteúdo sob demanda do FFCON23.Apoie o NCFA seguindo-nos no Twitter! |

Artigos relacionados

- Conteúdo com tecnologia de SEO e distribuição de relações públicas. Seja amplificado hoje.

- Platoblockchain. Inteligência Metaverso Web3. Conhecimento Ampliado. Acesse aqui.

- Fonte: https://ncfacanada.org/empowering-the-next-iteration-of-consumer-finance/

- :é

- $UP

- 10

- 100

- 2018

- 28

- 39

- a

- Sobre

- acelerado

- Acesso

- acessível

- em

- adotar

- Adoção

- Adulto

- avanços

- avanços

- Afiliados

- AI / ML

- Todos os Produtos

- Permitindo

- alternativa

- financiamento alternativo

- surpreendente

- Americanos

- e

- Abril

- SOMOS

- artigo

- AS

- Ativos

- At

- atlas

- atributos

- Bancário

- Sistemas bancários

- bancos

- BD

- BE

- tornam-se

- abaixo

- Melhor

- blockchain

- extensão BNPL

- mutuário

- Prédio

- by

- esconderijo

- CAN

- Localização: Canadá

- capital

- cartão

- dinheiro

- fluxo de caixa

- Categoria

- CFPB

- chefe

- diretor de produto

- Limpeza

- clique

- de perto

- Co-fundador

- coletar

- COM

- combinando

- comunidade

- Empresas

- Empresa

- completar

- compreensivo

- consumidor

- Finanças de consumidor

- Consumidores

- conteúdo

- núcleo

- Banco central

- crio

- crédito

- cartão de crédito

- Crowdfunding

- criptomoedas

- dados,

- dias

- Dívida

- década

- Descentralizada

- decisões

- Demanda

- Desenvolvimento

- digital

- Ativos Digitais

- distribuído

- não

- durante

- mais fácil

- Econômico

- ecossistema

- Educação

- EMA

- emprego

- capacitação

- permitindo

- contratado

- enriquecer

- Todo

- entrada

- estimou

- Éter (ETH)

- eventos

- exemplo

- Explicação

- FICO

- financiar

- financeiro

- saúde financeira

- inclusão financeira

- inovação financeira

- Instituições financeiras

- serviços financeiros

- FinTech

- Galáxia Fintech

- fintechs

- fluxo

- seguinte

- Escolha

- da

- cheio

- financiamento

- oportunidades de financiamento

- galáxia

- geração

- ter

- Global

- Governo

- ótimo

- maior

- GV

- acontecer

- Acontecimento

- Ter

- Saúde

- ouvir

- ajudar

- ajuda

- hi

- Contudo

- HP

- hr

- http

- HTTPS

- i

- importante

- melhorar

- in

- Incluindo

- inclusão

- Passiva

- indústria

- INFORMAÇÕES

- Infraestrutura

- Inovação

- inovadores

- Informante

- insights

- instituições

- Insurtech

- Inteligência

- Entrevista

- investimento

- questões

- IT

- iteração

- Jan

- juntar

- viagem

- jpg

- Chave

- grande

- LAS

- Las Vegas

- líderes

- principal

- credores

- empréstimo

- aproveitando

- como

- limites

- viver

- Eventos ao vivo

- Empréstimos

- fora

- lote

- moldadas

- Corrente principal

- fazer

- de grupos

- muitos

- Março

- mercado

- maduro

- max-width

- Posso..

- Meetup

- membro

- Membros

- método

- milhão

- modelo

- modelos

- Monitore

- mais

- a maioria

- movimento

- NEO

- networking

- Newsletter

- Próximo

- títulos

- of

- oferecer

- oferecendo treinamento para distância

- Oficial

- on

- Sob demanda

- online

- aberto

- banca aberta

- oportunidades

- lado de fora

- próprio

- painel

- particularmente

- Parceiros

- passado

- pagamentos

- peer to peer

- períodos

- regalias

- pessoa

- platão

- Inteligência de Dados Platão

- PlatãoData

- por favor

- prazer

- atribuições

- Prevenção

- Produto

- Produtos

- Programação

- projetos

- proprietário

- fornecer

- fornece

- fornecendo

- qualidade

- Cru

- dados não tratados

- RE

- reais

- em tempo real

- dados em tempo real

- recentemente

- cadastre-se

- Regtech

- Denunciar

- Relatórios

- solicitar

- Risco

- gestão de risco

- s

- Setores

- segmentos

- Serviços

- Sessão

- Partilhar

- compartilhado

- assinar

- So

- alguns

- velocidade

- partes interessadas

- Stewardship

- estresse

- tal

- sustentável

- sistemas

- TAG

- Tire

- que

- A

- deles

- Eles

- Este

- pensamento

- líderes do pensamento

- milhares

- bilhetes

- tempo

- Título

- para

- hoje

- Tokens

- Caixa de ferramentas

- ferramentas

- transação

- verdadeiro

- que vai mais à frente

- us

- usar

- usuários

- VEGAS

- vibrante

- Ver

- Virtual

- Visite a

- querido

- semana

- de

- trabalho

- zefirnet