The cryptocurrency is inching slowly upwards after losses yesterday. Its total cap, at $922 billion, has fallen by 5% in a week, and by 32% in a month. It has, however, risen by 1% in 24 hours, along with most major coins. This invites hope for a weekend recovery, which the market is long overdue, even if macroeconomic conditions remain negative. As such, here's our pick of the 5 best cryptocurrency to buy for the recovery.

5 melhores criptomoedas para comprar para a recuperação

1. Bloco da Sorte (LBLOCK)

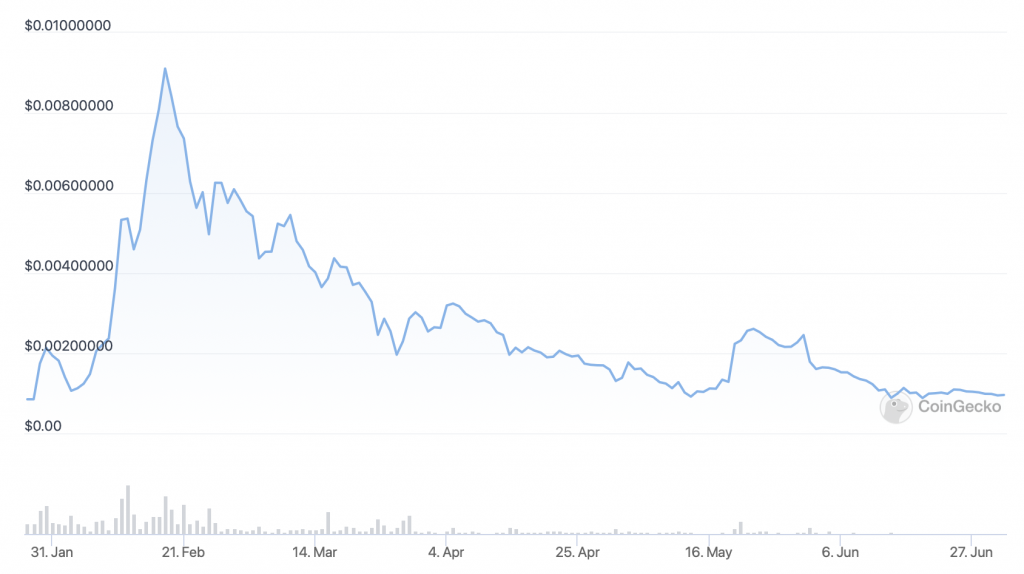

LBLOCK é de $ 0.00095626 no momento, representando um aumento fracionário (0.2%) nas últimas 24 horas. No entanto, a altcoin caiu 12% na semana passada e 46% nos últimos 30 dias.

LBLOCK is down by 90% since its all-time high of $0.00974554, set in February. On the other hand, it's up by 120% since launching in late January.

Que o LBLOCK ainda esteja ativo desde o lançamento é um bom sinal para o futuro, e os recentes desenvolvimentos do Lucky Block sugerem que ele pode crescer fortemente quando as condições do mercado melhorarem. Por um lado, a plataforma de jogos de criptografia Lucky Block agora está realizando sorteios regulares de prêmios, que garantem um jackpot mínimo de $ 50,000. Além disso, passou na auditoria de seu próximo token ERC-20.

Auditoria de token V2 aprovada! ✅

Isso significa que estamos nos aproximando de listagens em exchanges centralizadas! 🤩

Deixe o #CountdownToCEXs começar! 🥳 @SolidProof_io #crypto #auditoria #CEX #listas #blockchain pic.twitter.com/TZJMPdNOdZ

- Lucky Block (@luckyblockcoin) 23 de Junho de 2022

In other words, an Ethereum-based version of LBOCK is imminent. It had originally launched on Binance Smart Chain, yet a migration to Ethereum will open up significant liquidity for the coin. Likewise, it paves the way for more exchange listings, something which will expand its market substantially. This is why it's one of our 5 best cryptocurrency to buy for the recovery.

2. Bitcoin (BTC)

O BTC subiu 1.5% nas últimas 24 horas, chegando a US$ 19,664. Ele havia caído para US$ 18,780 ontem, destacando a possibilidade de novas quedas. E sua tendência atual permanece negativa, tendo caído 7% em uma semana e 38% em um mês.

BTC's indicators are at a very low ebb. Its relative strength index (in purple) is touching 30, indicating that the market is overselling it. Likewise, its 30-day moving average (in red) has fallen to its lowest level relative to its 200-day average (in blue) for a year. This strongly signals an eventual recovery.

Bitcoin remains the market's leader for a reason. It commands cerca de US$ 26 bilhões em investimentos institucionais, que deverá aumentar a médio e longo prazo. Por exemplo, A Jacobi Asset Management acaba de anunciar the launch of Europe's first-ever spot Bitcoin ETF. It will go live this month on the Euronext Amsterdam exchange, paving the way for more institutional and mainstream investment in bitcoin.

More generally, it's bitcoin that continues to attract outside interest. There continue to be nations which turn to BTC during periods of very high inflation (e.g. Peru e Argentina), bem como aqueles que lhe deram curso legal (El Salvador e República Centro-Africano). Essa tendência provavelmente continuará quando o mercado se tornar mais positivo novamente.

3. A Sandbox (SAND)

At $1.13, SAND has risen by 15% in a day. It's also up by 12% in a week and by 35% in the past 14 days. That said, it is down by 22% in a month.

Looking at SAND's chart, it had been due a rally. Its RSI has fallen below 30, while its 30-day average had collapsed far below its 200-day. Of course, with conditions remaining challenging, it can't be said how long its current spurt will last.

Parece que o SAND está subindo no momento devido à abertura da ponte entre o Sandbox e a plataforma Polygon da camada dois. Isso permite que os usuários do Sandbox transfiram tokens não fungíveis LAND e SAND para (e no) Polygon, algo que reduz custos e melhora a eficiência.

🌉 Estamos prontos para implantar LAND para @ 0xPolygon 🌉

🔸Cada LAND bridge concede um cashback de 10 mSAND!

🔸Os multiplicadores LAND em ambos os programas de staking mSAND estão de volta!

🔸As vendas de LAND e os recursos de staking de LAND (no Polygon) estão chegando em breve!PONTE AGORA ➡️ https://t.co/jlcSKxuBWh pic.twitter.com/1tuAAsqEZP

- A Sandbox (@TheSandboxGame) 28 de Junho de 2022

Olhando para o quadro geral, o Sandbox testemunhou muitas atividades de alto nível em sua plataforma de jogos/metaverso. Mais notavelmente, o fabricante de carteiras de hardware Ledger anunciou que escolheu o Sandbox como seu primeiro local virtual no metaverso. Este é um grande endosso para a plataforma, dado o peso que a Ledger tem no setor de criptomoedas.

Bem-vindo ao LedgerVerse para @TheSandboxGame: Ledger's first step into the metaverse and the first to turn gaming into Web3 education. 🎮

Conquiste missões, lute contra golpistas e ganhe recompensas da Web3. 🥇

Segurança de criptografia mestre.

Aprender. Toque. Ganhar. Chegando o verão de 2022. pic.twitter.com/56kS9FLZK6

- Ledger (@Ledger) 22 de Junho de 2022

It's worth remembering that the Sandbox racked up around US$ 350 milhões em vendas de terrenos virtuais em 2021, more than any other similar platform. This highlights its potential, and also why we've included it among our 5 best cryptocurrency to buy for the recovery.

4. Ethereum (ETH)

O ETH aumentou 2.5% nas últimas 24 horas. Com US$ 1,072, caiu 6% na semana passada e 45% no mês passado.

ETH's indicators are much like BTC's, suggesting a bottom. Its RSI is close to 30, while its 30-day average is far below its 200-day. Of course, the market is going through an unprecedentedly difficult time right now, so it's hard to say whether a rally is imminent.

Ainda assim, a ETH tem um grande potencial de médio e longo prazo. Isso ocorre em grande parte porque o Ethereum está em processo de mudança para um mecanismo de consenso de prova de participação. Isso tornará o blockchain da camada um menos intensivo em energia, mais escalável e mais atraente para os investidores.

Parabéns ao #Ethereum comunidade em uma fusão bem-sucedida na rede de testes Ropsten.

Há mais de US$ 22.78 bilhões em valor apostado e pronto para o próximo Merge to Proof-of-Stake da rede principal.

Isso representa 12.8 milhões $ ETH = 10.78% da oferta.

Gráfico ao vivo: https://t.co/PDQg3lCJCl pic.twitter.com/GiFI3BtSKa

- glassnode (@glassnode) 8 de Junho de 2022

Due at some point in late summer, the ‘Merge' will massively boost investor confidence in Ethereum. The introduction of staking will increase demand for ETH, and with 10% of ETH's supply already staked on the PoS Beacon Chain, the cryptocurrency could become deflationary. When you add the fact that Ethereum já é a maior blockchain em valor total bloqueado, it's easy to see why ETH is one of our 5 best cryptocurrency to buy for the recovery.

11/ At the current stake amount, the Ethereum network will be paying out ~600,000 ETH per year, instead of 4,850,000 under the current PoW model, or 88% less in "sell pressure"! At the same time, stakers will still be earning ~4.6% in their staked ETH, a nice return to attract.

- eric.eth (@econoar) 10 de Junho de 2022

5. Trançar (AR)

O AR aumentou 20% nas últimas 24 horas, a US$ 10. Também aumentou 2% em uma semana e 15% em quinze dias, mantendo-se 35% abaixo nos últimos 30 dias.

AR's chart shows a gradual increase in momentum. Its RSI has gone from under 30 a couple of weeks ago to nearly 50 today. At the same time, its 30-day average is still well below its 200-day, so there's plenty of room left for a bigger recovery.

It seems that AR is rallying right now due to the launch of Arweave's very own domain registry system. Basically, its Arweave's own version of the Ethereum Name Service, enabling users to purchase ArNS-based domain names using AR. This has caused demand for AR to rise as users move to claim their own domains.

Hoje estamos lançando nosso programa piloto do Arweave Name System (ArNS) – um diretório baseado em Smartweave de subdomínios amigáveis habilitado por https://t.co/ljKQFJO6vN portas de entrada @arweaveteam web permanente!

🧵 1/3 pic.twitter.com/62tQDABgyz

— 🐘🔗ario.arweave.dev (@ar_io_network) 29 de Junho de 2022

Looking at AR's fundamentals, it's encouraging to note that Arweave — a decentralised data storage network — testemunhou um aumento de transações no ano passado. From 1.75 million daily transactions August 2021, its traffic increased to 48.8 million daily transactions by May of this year. This figure has since declined, as a result of the market downturn, but it's likely to continue witnessing growth once the economic picture improves.

Seu capital está em risco.

Leia mais:

- "

- 000

- 10

- 2021

- 2022

- 28

- a

- atividade

- africano

- já

- Altcoin

- entre

- quantidade

- amsterdam

- anunciou

- AR

- por aí

- ativo

- gestão de activos

- auditor

- AGOSTO

- média

- Basicamente

- bbc

- cadeia de baliza

- tornam-se

- abaixo

- MELHOR

- entre

- maior

- O maior

- bilhão

- binário

- Bitcoin

- Bitcoin ETF

- Bloquear

- blockchain

- impulsionar

- PONTE

- BTC

- comprar

- comprar bitcoin

- capital

- causado

- central

- centralizada

- cadeia

- desafiante

- escolhido

- reivindicar

- mais próximo

- CNBC

- Moeda

- Moedas

- vinda

- comunidade

- condições

- confiança

- Consenso

- continuar

- continua

- custos

- poderia

- Casal

- cripto

- criptomoedas

- Atual

- diariamente

- dados,

- armazenamento de dados

- dia

- dias

- deflacionário

- Demanda

- implantar

- Dev

- desenvolvimentos

- difícil

- Ecrã

- domínio

- domínios

- down

- desistiu

- durante

- cada

- ganhar

- Ganhando

- Econômico

- Educação

- eficiência

- permite

- permitindo

- animador

- energia

- ERC-20

- ETF

- ETH

- ethereum

- ethereum (ETH)

- rede ethereum

- Europa

- exemplo

- exchange

- Expandir

- Funcionalidades

- Figura

- Primeiro nome

- fracionário

- da

- Fundamentos

- mais distante

- futuro

- Games

- jogos

- geralmente

- obtendo

- em Glassno

- vai

- Bom estado, com sinais de uso

- subsídios

- ótimo

- Cresça:

- Growth

- garanta

- Hardware

- Hardware Wallet

- ter

- SUA PARTICIPAÇÃO FAZ A DIFERENÇA

- Alta

- destaques

- segurando

- esperança

- Como funciona o dobrador de carta de canal

- Contudo

- HTTPS

- melhorar

- incluído

- Crescimento

- aumentou

- índice

- inflação

- DOCUMENTOS

- interesse

- investimento

- investidor

- Investidores

- IT

- janeiro

- Julho

- lançamento

- lançado

- de lançamento

- líder

- Ledger

- Legal

- Nível

- Provável

- Liquidez

- Anúncios

- viver

- localização

- trancado

- longo

- longo prazo

- perdas

- moldadas

- Corrente principal

- principal

- fazer

- de grupos

- Gerente

- Fabricante

- mercado

- significa

- mecanismo

- ir

- metaverso

- milhão

- mínimo

- modelo

- Ímpeto

- Mês

- mais

- a maioria

- mover

- em movimento

- nomes

- Das Nações

- negativo

- rede

- não fungível

- fichas não fungíveis

- aberto

- abertura

- Outros

- próprio

- períodos

- fotografia

- piloto

- plataforma

- Jogar

- Abundância

- ponto

- Polygon

- PoS

- positivo

- possibilidade

- potencial

- PoW

- pressão

- preço

- prêmio

- processo

- Agenda

- Programas

- Prova de Estaca

- público

- compra

- missões

- comício

- RE

- recentemente

- recuperação

- regular

- permanecem

- remanescente

- permanece

- representando

- representa

- retorno

- Reuters

- Recompensas

- ascensão

- Risco

- Dito

- vendas

- mesmo

- SAND

- sandbox

- escalável

- Scammers

- setor

- segurança

- vender

- serviço

- conjunto

- assinar

- periodo

- semelhante

- desde

- smart

- So

- alguns

- algo

- Spot

- estaca

- Staking

- Ainda

- armazenamento

- força

- bem sucedido

- verão

- supply

- .

- A

- Através da

- tempo

- hoje

- token

- Tokens

- topo

- tráfego

- Transações

- transferência

- para

- durante 30

- os próximos

- para cima

- usuários

- valor

- versão

- Virtual

- visibilidade

- W3

- Wallet

- Web3

- semana

- fim de semana

- se

- enquanto

- ganhar

- dentro

- palavras

- Equivalente há

- ano