I know our readers will have followed the events of the last two weeks, covering Silicon Valley Bank (SVB), First Republic Bank(FRC) and Credit Suisse (CS). Each different institutions, but each faced with massive depositor withdrawals caused by a loss of trust in the soundness of their business.

At the start of 2023, who would have believed that Credit Suisse, a firm founded in 1856, with a storied history and many acquistions under its belt (First Boston, DLJ, …) and a firm that navigatated the Great Financial Crisis of 2007-08 without a government bailout, a G-SIB too boot, would end up by forced by it’s regulator to be taken over by it’s competitor UBS.

There are a lot of excellent articles on each of the specific situations of SVB, FRC and CS, so in today’s blog I wanted to cover a secondary effect; the impact of the drop in dollar rate expectations as a flight to safety drove up US Treasuries (dropping yields) and the market priced in the expectation that the Federal Reserve would have to pause, stop or even drop rates to address stress in the banking sector.

This drop in USD rates, particularily in the important 2Y Treasury rate was massive and historically significant. We will look at it thru the lens of SOFR Swap rates and margin calls for cleared Swaps.

SOFR Swap Rates

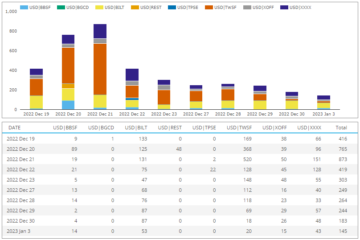

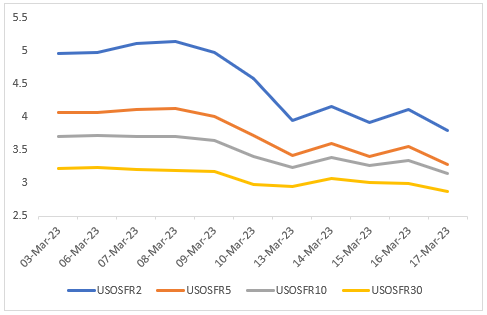

A chart of daily rates for SOFR Swaps cleared at LCH SwapClear.

Sharp drops from 9-March onwards, with the 2Y in particular dropping signficantly from just over 5% to below 4% in the 3-days between 8-March and 13-March.

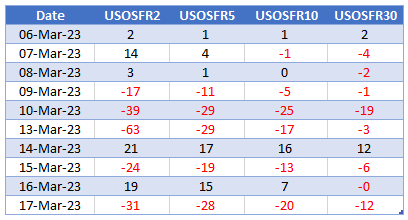

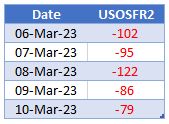

Showing these as a table of absolute basis point changes for each day and tenor.

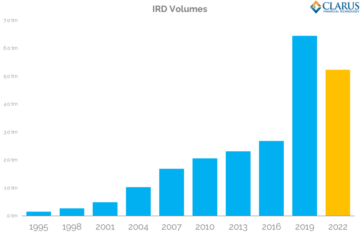

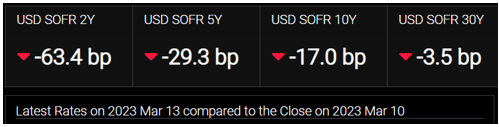

The moves on 13-March and in 2Y in particular were massive and even larger drops than we saw in the Covid Crisis (Feb 2020) or the Great Financial Crisis of 2007-08.

To see how significant, lets look at Swap margin calls, both Variation margin (VM) and Initial margin (IM).

SOFR 2Y Swap Trrade

A pay fixed Swap trade will lose money as rates drop and face daily VM calls from the Clearing House, in our case LCH SwapClear.

So let’s assume that on 3-March-2023, we entered into a SOFR 2Y $250m pay fixed swap at the then par rate of 4.9561%, a trade with a DV01 close to $50K.

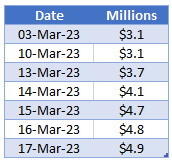

The LCH SwapClear House IM for this trade on 3-March-2023, would have been $3.1m or 62 bps in dv01 terms. While a Client cleared trade would haved required IM of $3.6m or 72 bps.

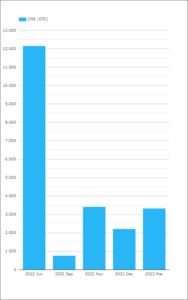

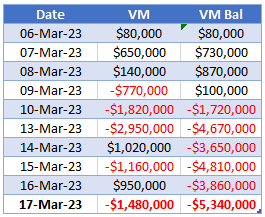

As 2Y rates dropped, LCH would mark-to-market the trade and require VM each-day to cover the 1-day loss. We can run such a simulation in Clarus CHARM and produce a table of daily VM Calls and the cummulative VM Balance.

VM Calls of $770k, $1.8m and $2.95m on 3 consecutive days starting 9-March, would have led to a cummulative VM Balance of negative $4.7m on 13-March, recovering to $3.65m on 14-March but increasing again to end at $5.3m on 17-Mar-23.

In just 2 weeks this trade would have required $5.3 million of cash to be provided to the CCP.

In addition by 13-March, the trades cummulative VM of $4.7m was greater than the IM at inception.

Initial Margin and Tail Losses

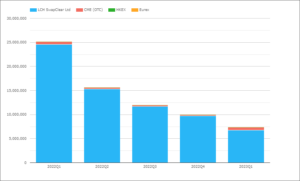

Next let’s run in Clarus CHARM what happend to Initial Margin over the same 2-week period.

A jump on 13-March to $3.7m, so an additional $600k would have been required by LCH SwapClear, in addition to the $3m VM call for this day.

LCH IM continuing to increase and reaching $4.9m or 98 bps on 17-March, an increase of 60% from the inception value of $3.1m or 62bps. For a client trade the increase was $3.6m to $5.8m or 72bps to 116bps, a similar 60% increase.

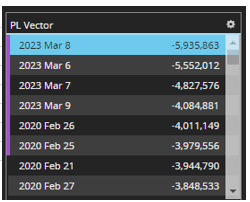

To understand why, we can look at the Tail Scenarios of the LCH IM calculation.

Showing the worst four tail scenarios are all March dates and the losses are significantly greater than the next four, which are all from Feb 2020 (Covid Crisis). These March dates correspond to the below changes:

The dates shown are the start of the 5-day period; so 2Y SOFR rates fell 100 Bps over the 5-days following 6-Mar-23 and the worst move was the 8-Mar-23 5-day period. This corresponds to our tail scenarions table above, with 8-Mar-23 the worst loss followed by 6-Ma23.

The LCH IM model is calibrated with a rolling window of recent market moves and so the IM increases with large market moves and higher volatility, ensuring that the trades remains adequately margined.

UnCleared Margin Rules

For Uncleared Margin Rules (UMR) ISDA SIMM is the method of choice and is calibrated with a 3-year hisotrical lookback period, a stress period currently defined as the 2007-2008 Finiancial Crisis, a margin period of risk of 10-days and a VaR confidence level of 99%.

An uncleared trade with the same DV01 as our 2Y Swap, would have required a SIMM of $2.9 million, as the risk weight for USD 2Y Interest rates is 61bps. This is re-calibrated on an annual basis with new market data and a new version implemented in December each year.

Given the SIMM at 61bps significantly lower than the current LCH IM of 98 bps, we can expect the new calibration of ISDA SIMM to have higher risk weights for USD rates, particularily the 2Y tenor and consequently result in higher margin requirements for USD interest rate risk.

Even the UMR Grid/Schedule method requires IM as 1% of notional for duration less than 2 years and 2% of notional for duration from 2 years to less than 5 years; so the IM requirement for our 2Y trade would have dropped from $5 million to $2.5 million a few days later.

Giving further credence to how significant in history the SOFR 2Y moves we have recently seen are.

That’s All

A quick summary.

SOFR Swap Rates dropped dramatically between 9-13 March.

The 2Y drop was greater than that in either the Covid or GFC Crises.

We show this thru the lens of cleared swaps margin.

LCH SwapClear VM and IM.

We also show this thru the lens of UMR.

Using Clarus CHARM to run the simulations.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.clarusft.com/usd-swaps-margin-calls-in-march-2023/?utm_source=rss&utm_medium=rss&utm_campaign=usd-swaps-margin-calls-in-march-2023

- :is

- $3

- $UP

- 1

- 100

- 1M

- 2%

- 202

- 2020

- 2023

- 9

- 98

- a

- above

- Absolute

- addition

- Additional

- address

- adequately

- All

- and

- annual

- ARE

- articles

- AS

- At

- bailout

- Balance

- Bank

- Banking

- banking sector

- basis

- BE

- believed

- below

- between

- Blog

- boston

- business

- by

- call

- Calls

- CAN

- case

- Cash

- caused

- ccp

- change

- Changes

- Chart

- choice

- Clearing

- client

- Close

- competitor

- confidence

- consecutive

- Consequently

- continuing

- corresponds

- cover

- covering

- Covid

- credit

- credit suisse

- crisis

- cs

- Current

- Currently

- daily

- data

- Dates

- day

- Days

- December

- defined

- different

- dlj

- Dollar

- dramatically

- Drop

- dropped

- Dropping

- Drops

- dv01

- each

- effect

- either

- ensuring

- entered

- Even

- events

- excellent

- expect

- expectation

- expectations

- Face

- faced

- Feb

- Federal

- federal reserve

- few

- financial

- financial crisis

- Firm

- First

- fixed

- flight

- followed

- following

- For

- Founded

- Free

- from

- further

- GFC

- Government

- great

- greater

- Have

- higher

- historically

- history

- House

- How

- HTTPS

- i

- Impact

- implemented

- important

- in

- inception

- Increase

- Increases

- increasing

- informed

- initial

- institutions

- interest

- INTEREST RATE

- Interest Rates

- ISDA SIMM

- IT

- ITS

- jump

- Know

- large

- larger

- Last

- Led

- Lens

- Lets

- Level

- Look

- lose

- loss

- losses

- Lot

- many

- March

- Margin

- Market

- Market Data

- market moves

- massive

- max-width

- method

- million

- model

- money

- move

- moves

- negative

- New

- New Market

- Newsletter

- next

- Notional

- of

- on

- particular

- Pay

- period

- plato

- Plato Data Intelligence

- PlatoData

- Point

- produce

- provided

- Quick

- Rate

- Rates

- reaching

- readers

- recent

- recently

- recovering

- regulator

- remains

- Republic

- require

- required

- requirement

- Requirements

- requires

- Reserve

- result

- Risk

- Rolling

- rules

- Run

- Safety

- same

- scenario

- scenarios

- secondary

- sector

- show

- shown

- significant

- significantly

- Silicon

- Silicon Valley

- silicon valley bank

- similar

- simulation

- situations

- So

- specific

- start

- Starting

- Stop

- stress

- subscribe

- such

- Suisse

- SUMMARY

- SVB

- Swaps

- table

- terms

- that

- The

- The Clearing House

- their

- These

- to

- today’s

- too

- trade

- trades

- Treasuries

- treasury

- Trust

- ubs

- under

- understand

- URL

- us

- us treasuries

- USD

- Valley

- value

- version

- Volatility

- wanted

- Weeks

- weight

- What

- which

- while

- WHO

- will

- with

- Withdrawals

- without

- Worst

- would

- year

- years

- yields

- zephyrnet