The banking sector has undergone a significant transformation thanks to the introduction of cloud and open-source technologies. Previously, banks relied on legacy systems and proprietary software, resulting in operations being siloed, scalability being limited, and high costs. However, with the advent of cloud and open-source technologies, banks can adopt a more agile and collaborative approach to innovation.

In an interview, Jimmy Ng, Chief Information Officer and Group Head of Technology and Operations at DBS, and Marjet Andriesse, Senior Vice President (SVP) and General Manager of Asia Pacific Japan and China at Red Hat, delved into the role of cloud and open source in shaping the digital transformation journey of DBS Bank.

They discuss the strategic decisions, innovative approaches, and lessons learned from their experience to provide valuable insights for other organisations looking to embark on a similar path.

Open Source: A Key Component of DBS’s Digital Transformation

Open-source technology has considerably impacted DBS’s digital transformation, offering multiple benefits. “First and foremost, the bank has successfully reduced its licensing and hardware costs by transitioning from proprietary hardware and software to open-source technology and commoditized hardware. This shift has also allowed DBS to decrease the footprint of its data centers,” stated Jimmy.

Secondly, the flexibility and transparency of open source have enabled DBS to stitch together solutions in a highly adaptable manner. As a result, the bank can build solutions that are perfectly tailored to its unique needs.

Marjet Andriesse noted that open source remains the bedrock of innovation and transformation, highlighting DBS as an exemplary bank that has adopted a change to enhance customer service.

Two significant aspects characterize DBS’s journey toward digital transformation. First, the bank has focused on building an open ecosystem, which has helped create synergy between business processes and services.

Second, DBS has become “digital to the core” by leveraging digital technology to provide its customers comprehensive services. This holistic approach to multi-hybrid cloud adoption has allowed DBS to advance its data agenda, IT implementation, and application onboarding.

DBS’s Unique Approach to Cloud Adoption

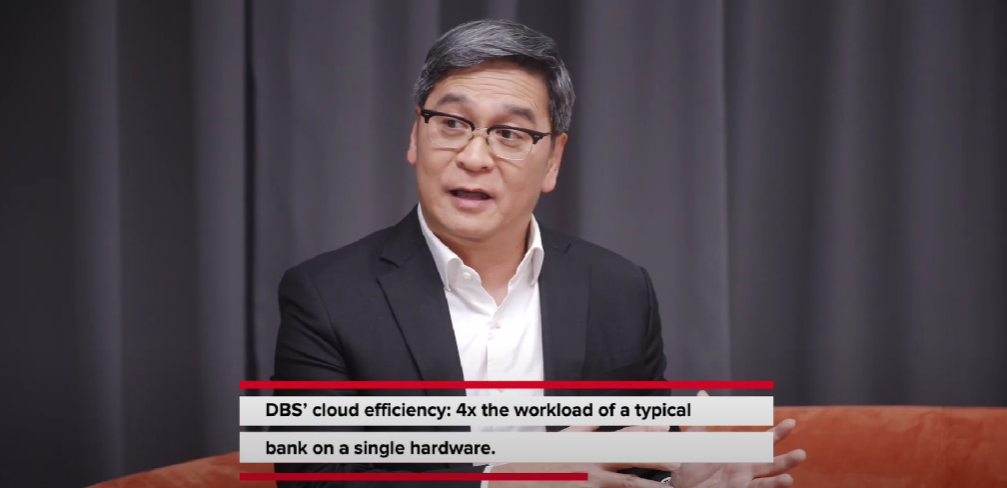

Many organisations choose to adopt the cloud through a “lift and shift” strategy, which involves rehosting an application or workload, along with its data store and operating system, from one IT environment to another – typically from on-premises to a public or private cloud. However, DBS Bank took a distinct approach by constructing its virtual private cloud (VPC) on-premises.

This decision was influenced by two primary considerations: the perception that public cloud solutions were insufficiently robust for a banking institution like DBS and the continued suitability of their existing data centers.

“Building and operating an on-premises VPC has been an essential learning experience. By mastering the underlying technology and incorporating automation and self-service features, DBS has been able to run its VPC as efficiently as a public cloud service provider,” said Jimmy.

DBS has set the foundation for growth and scalability by adopting a cloud-first strategy. The move to a hybrid, multi-cloud infrastructure has resulted in greater resiliency, scalability, and reduced infrastructure costs. DBS uses Red Hat OpenShift and Kubernetes to handle burst loads in the public cloud, enabling the bank to access native services provided by public cloud platforms unavailable on-premises.

Innovation and Future Horizons for DBS

DBS encourages innovation by creating teams and guiding them through a four-stage process known as the 4D approach: Discover, Define, Develop, and Deliver. This process fosters the development of new ideas and allows teams to showcase their accomplishments. Jimmy highlighted the importance of having a roadmap for each platform and function within the business, with three horizons representing short, medium, and long-term goals.

As DBS evolves into a different kind of bank, the organisation recognizes the need to do things differently in the operations area. By leveraging technology, DBS has enabled its operations staff to access systems from anywhere, performing their functions seamlessly as if they were in the office. This approach has allowed the entire operation to become a network model, with work in various locations and countries.

“DBS is currently in the experimentation phase with blockchain, tokenization, NFTs, and the metaverse. Although there is no fixed timeline for implementing these technologies, DBS understands the importance of being ready and receptive to innovative solutions to succeed in the future,” said Jimmy.

The Role of Partnerships and Collaboration

Partnerships and collaboration are crucial to the success of digital transformation journeys. Jimmy acknowledged that working with Red Hat has been an invaluable partnership for DBS, enabling them to gain insights, leverage open-source technologies, and access expertise.

Marjet emphasized the significance of collaboration and the sharing of best practices within the open-source community, as it possesses collective knowledge that can assist organizations in adapting and implementing new technologies more efficiently.

Additionally, Marjet stated that open-source technology is still the cornerstone of innovation and transformation. The technology has contributed significantly to creating a strong developer community, which has been crucial in driving the success of DBS’s digital transformation. The bank has been able to attract top talent and foster a culture of collaboration, enabling its teams to experiment with new ideas and push the boundaries of what is achievable in the banking sector.

Unlocking the Potential of Open Source and Cloud Technology

As DBS Bank and Red Hat continue to lead the way in digital transformation within the banking industry, the power of cloud and open-source technologies remain at the forefront of their success. By embracing an open ecosystem and adopting a cloud-first approach, DBS has set a new standard in innovation, efficiency, and resiliency.

The bank’s strategic alignment with business objectives, robust security architecture, and strong governance and risk management processes have been instrumental in building a scalable and agile IT infrastructure. This, in turn, has allowed them to stay competitive in an ever-changing market while delivering exceptional customer experiences. The partnership between DBS and Red Hat exemplifies the potential of cloud and open-source technologies in revolutionizing the banking landscape and shaping the industry’s future.

Ready to learn more about how DBS and Red Hat have transformed the future of banking through cloud and open-source technology? Watch the full interviews with Jimmy Ng and Marjet Andriesse by clicking this link. Discover how your organisation can become more agile, customer-centric, and innovative by embracing these technologies today.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://fintechnews.sg/72299/sponsoredpost/dbs-and-red-hat-transforming-the-future-of-banking-through-cloud-and-open-source-technologies/

- :has

- :is

- a

- Able

- About

- access

- accomplishments

- acknowledged

- adopt

- adopted

- Adopting

- Adoption

- advance

- advent

- agenda

- agile

- allows

- along

- also

- Although

- an

- and

- Another

- anywhere

- Application

- approach

- approaches

- architecture

- ARE

- AREA

- AS

- asia

- asia pacific

- aspects

- assist

- At

- attract

- Automation

- Bank

- Banking

- banking industry

- banking sector

- Banks

- become

- been

- being

- benefits

- BEST

- best practices

- between

- blockchain

- boundaries

- build

- Building

- business

- business processes

- by

- CAN

- caps

- Centers

- change

- characterize

- chief

- China

- Choose

- Cloud

- cloud adoption

- collaboration

- collaborative

- Collective

- community

- competitive

- component

- comprehensive

- considerations

- constructing

- continue

- continued

- contributed

- cornerstone

- Costs

- countries

- create

- Creating

- crucial

- Culture

- Currently

- customer

- Customer Service

- Customers

- data

- data centers

- DBS

- DBS Bank

- decision

- decisions

- decrease

- deliver

- delivering

- develop

- Developer

- Development

- different

- digital

- digital technology

- Digital Transformation

- discover

- discuss

- distinct

- do

- driving

- each

- ecosystem

- efficiency

- efficiently

- embark

- embracing

- emphasized

- enabled

- enabling

- encourages

- enhance

- Entire

- Environment

- essential

- Ether (ETH)

- ever-changing

- evolves

- exceptional

- exemplifies

- existing

- experience

- Experiences

- experiment

- expertise

- false

- Features

- fintech

- First

- fixed

- Flexibility

- focused

- Footprint

- For

- forefront

- foremost

- Foster

- Foundation

- friendly

- from

- full

- function

- functions

- future

- Gain

- General

- Goals

- governance

- greater

- Group

- Growth

- handle

- Hardware

- hat

- Have

- having

- head

- helped

- High

- Highlighted

- highlighting

- highly

- holistic

- Horizons

- How

- However

- HTTPS

- Hybrid

- ideas

- if

- impacted

- implementation

- implementing

- importance

- in

- incorporating

- industry

- industry’s

- influenced

- information

- Infrastructure

- Innovation

- innovative

- insights

- Institution

- instrumental

- Interviews

- into

- Introduction

- invaluable

- IT

- ITS

- Japan

- journey

- Journeys

- Key

- Kind

- knowledge

- known

- Kubernetes

- landscape

- lead

- LEARN

- learned

- learning

- Legacy

- Lessons

- Lessons Learned

- Leverage

- leveraging

- Licensing

- like

- Limited

- loads

- locations

- long-term

- looking

- management

- manager

- manner

- Market

- Mastering

- max-width

- medium

- Metaverse

- model

- more

- move

- multiple

- native

- Need

- needs

- network

- New

- New technologies

- NFTs

- no

- noted

- objectives

- of

- offering

- Office

- Officer

- on

- Onboarding

- ONE

- open

- open source

- operating

- operating system

- operation

- Operations

- or

- organisation

- Organisations

- organizations

- Other

- Pacific

- Partnership

- partnerships

- path

- perception

- performing

- phase

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- potential

- power

- practices

- president

- previously

- primary

- private

- process

- processes

- proprietary

- provide

- provided

- provider

- public

- Public cloud

- Push

- ready

- recognizes

- Red

- Red Hat

- Reduced

- remain

- remains

- representing

- result

- resulting

- return

- Revolutionizing

- Risk

- risk management

- roadmap

- robust

- Role

- Run

- Said

- Scalability

- scalable

- seamlessly

- sector

- security

- Self-service

- senior

- service

- Service Provider

- Services

- set

- shaping

- sharing

- shift

- Short

- showcase

- significance

- significant

- significantly

- similar

- Singapore

- Software

- Solutions

- Source

- Staff

- standard

- stated

- stay

- Still

- store

- Strategic

- Strategy

- strong

- succeed

- success

- Successfully

- suitability

- synergy

- system

- Systems

- tailored

- Talent

- teams

- Technologies

- Technology

- thanks

- that

- The

- The Future

- The Metaverse

- their

- Them

- There.

- These

- they

- things

- this

- three

- Through

- timeline

- to

- today

- together

- Tokenization

- took

- top

- toward

- Transformation

- transformed

- transforming

- transitioning

- Transparency

- TURN

- two

- typically

- undergone

- underlying

- understands

- unique

- uses

- Valuable

- various

- Vice President

- Virtual

- was

- Watch

- Way..

- were

- What

- What is

- which

- while

- with

- within

- Work

- working

- Your

- zephyrnet