Pitching Sessions are must-use opportunities for founders of Web3 startups seeking venture capital investment. It is a great chance for founders to present their project and product to potential investors, receive valuable feedback, attract investors' interest, and, ideally, get funded. But to succeed, it is important to understand the unspoken pitch rules and how to effectively communicate the value and big potential of a startup.

Of course, any pitching in front of investors is mildly exciting and unsettling for founders. However, it's important to remember that while the focus is on pitching, how you present yourself and your startup can have a huge impact on the outcome of the pitch meeting.

To help entrepreneurs better prepare for pitching and improve their chances of successful outcomes from the pitch session, we decided to gather a few tacit rules that may be of great use when preparing for such a meeting with venture capitalists.

How to prepare to the Pitching Session?

Make some preliminary preparations.

While preparing for the Pitching Session, startup founders should do some research and find out what kind of investors or VC funds will be at the event, especially if the meeting is planned online.

Find out which companies they are investing in and if there is any common ground between these startups and your project. Write these facts down and try to mention them during the Q&A session: tell them how your business model is better than these startups or if you have a value-add partnership with them. If the startup founder does his or her «homework» in this way, it will have a better chance of being noticed and remembered by potential investors.

Write out the structure of your pitch.

It is very important that your presentation follows a clear and logical structure and cause-and-effect relationships. It should represent the steps you are climbing. This will save time, make your thought more structured, and help take all the extra water out of the text.

Don't memorize the text by heart.

Before the pitch day, give yourself some time to plan your presentation. Try to «pack» one idea into one paragraph. And try to tell the essence of the presentation in your own words.

Anticipate investors' questions on a Q&A part.

Study in advance a list of the most common questions that crypto and web3 VCs may ask Web3 startups. Make your top 10-15 questions and formulate one or two sentences to answer them.

Add a key image to your pitch deck.

The key image is a kind of metaphor, an idea that investors will then associate with your project. Add to your pitch deck an image that will make your startup memorable.

What to remember during the Pitching Session?

Don't be afraid to repeat the main point.

A person can remember 10-15% of what you said. So, don't be afraid to repeat at the beginning, middle, and end of the pitching process the key points that distinguish your project from others.

Win attention in the first 20 seconds catcher.

In the first 20 seconds, investors' attention will be fully focused on you, so it is important to say a catchy and striking phrase that will impress them. These 20 seconds should be the start of a further interesting story about the project and its opportunities.

Use video in your pitch.

Include in your pitch not only a presentation with slides but also a video of you talking about your project. Try to make a teaser where you talk about your startup, its differences from competitors, and its advantages in simple words as easily and as uninhibitedly as possible.

Execution plan: tell HOW you will do it.

The biggest problem founders have is talking during the pitch about the importance and relevance of the project and completely ignoring how their vision will be implemented. That's why it's crucial to focus on the practical aspects of the presentation.

Find something to distinguish yourself with.

It is very important to tell what makes your startup interesting and how it differs from the competition. Outline the most important points and the key advantages you have. It can be a professional experience and huge industry expertise of your team, an innovative business model or product, or a new solution to a pressing consumer problem.

Don't abuse numbers.

A lot of people don't take numbers very well by ear. Try to put basic information related to budgets, expenses, and other numbers on the pitch deck slides.

Discuss confidential information in a private conversation.

If an investor asks a question that you do not want to discuss in front of a wider audience, you can tell a few non-confidential facts that investors are interested in, and then add the phrase «I would be happy to give you more details about our project after the Pitching Session during a personal conversation!». This can be a good hook to move your connection to the next level and start building investor relations

If you don't know the answer to a question, don't lie.

If you don't know what to say, be honest and say that you're still figuring out how to solve this problem. A Pitching Session is not an exam where there is a right pre-defined answer for everything. And remember: many investors will appreciate your honest and straightforward answers.

In conclusion, it's worth saying that understanding the unspoken rules of Pitching Sessions can play a crucial role in getting funding for your startup. Though not all startups will probably get funding at the first attempt, it's important to understand that a pitching session is a huge «mirror», in which you will see the reflection of your project and the first «distortions» that may occur. This will allow you to adjust the initial data: if you see that some ideas, theses, or techniques are not perceived quite correctly by potential investors, try to reformulate them or create a new pitch in a completely different format. This experience will make your Web3 startup stronger anyway and allow it to become a successful endeavor.

More about startup pitching sessions:

How To Prepare For A Startup Pitching Session?

A step-by-step guide on how to prepare for a startup pitching session, including an example of a successful pitch.

Startup Pitch Deck

An ultimate guide to build a great startup pitch deck. Download pitch deck template and get examples of successfully funded decks

Become the bravest web3 startup: defense your project among VCs

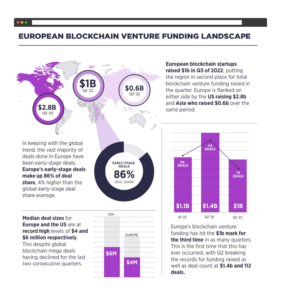

Despite the global economic situation, the market for investments in Web3 startups remains relatively stable. According [https://technode.com/2022/10/08/beyond-expo-is-investment-in-web3-a-hype-or-science/] to Crunchbase [https://www.crunchbase.com/…

8 Horrible Startup Pitch Deck Mistakes in 2021 | InnMind

Do you have a pitch deck for your startup? Probably yes. But if you are an early-stage startup founder (pre-seed, seed and even series A), attracting your first venture capital investments, be 99% sure: your current pitch deck sucks. Every active investor reviews hundreds of startup pitch decks…

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://blog.innmind.com/the-unspoken-rules-of-pitching-sessions/

- 1

- 2021

- 39

- a

- About

- abuse

- According

- active

- advance

- advantages

- After

- All

- among

- and

- answer

- answers

- appreciate

- aspects

- Associate

- attention

- attracting

- audience

- basic

- become

- Beginning

- being

- Better

- between

- Big

- Biggest

- Budgets

- build

- Building

- business

- business model

- capital

- capitalists

- Chance

- chances

- clear

- Climbing

- Common

- communicate

- Companies

- competition

- competitors

- completely

- conclusion

- connection

- consumer

- Conversation

- course

- create

- crucial

- CrunchBase

- crypto

- Current

- data

- day

- decided

- Defense

- details

- differences

- different

- discuss

- distinguish

- down

- download

- during

- early stage

- easily

- Economic

- effectively

- entrepreneurs

- especially

- essence

- Even

- Event

- Every

- everything

- exam

- example

- examples

- exciting

- expenses

- experience

- expertise

- extra

- feedback

- few

- Find

- First

- Focus

- focused

- follows

- format

- founder

- founders

- from

- front

- fully

- funded

- funding

- funds

- further

- get

- getting

- Give

- Global

- Global Economic

- good

- great

- Ground

- guide

- happy

- Heart

- help

- How

- How To

- However

- HTTPS

- huge

- Hundreds

- idea

- ideas

- image

- Impact

- implemented

- importance

- important

- improve

- in

- Including

- industry

- information

- initial

- innovative

- interest

- interested

- interesting

- investing

- investment

- Investments

- investor

- Investors

- IT

- Key

- Kind

- Know

- Level

- List

- logical

- Lot

- Main

- make

- MAKES

- many

- Market

- meeting

- Middle

- mistakes

- model

- more

- most

- move

- New

- new solution

- next

- numbers

- ONE

- online

- opportunities

- Other

- Others

- Outcome

- outline

- own

- part

- Partnership

- People

- perceived

- person

- personal

- Pitch

- Pitch Day

- pitch deck

- pitching

- plan

- planned

- plato

- Plato Data Intelligence

- PlatoData

- Play

- Point

- points

- possible

- potential

- Practical

- pre-seed

- Prepare

- preparing

- present

- presentation

- private

- probably

- Problem

- process

- Product

- professional

- project

- put

- Q&A

- question

- Questions

- RE

- receive

- reflection

- related

- Relationships

- relatively

- relevance

- remains

- remember

- repeat

- represent

- research

- Reviews

- Role

- rules

- Said

- Save

- seconds

- seed

- seeking

- Series

- session

- sessions

- should

- Simple

- situation

- Slides

- So

- solution

- SOLVE

- some

- something

- stable

- start

- startup

- Startups

- Steps

- Still

- Story

- straightforward

- stronger

- structure

- structured

- succeed

- successful

- Successfully

- such

- Take

- Talk

- talking

- team

- techniques

- template

- The

- their

- thought

- time

- to

- top

- ultimate

- understand

- understanding

- use

- Valuable

- value

- value-add

- VC

- venture

- venture capital

- venture capital investment

- Video

- vision

- Water

- Web3

- What

- which

- while

- wider

- will

- words

- worth

- would

- write

- Your

- yourself

- zephyrnet