Web3 Trends.

Everyone from the hotshot VC to the Starbucks barista is talking about it.

But whom should you listen to?

Maybe not my dude making a double venti cinnamon hazelnut macchiato (with extra whip cream of course!).

I mean, I love the guy, but every time I go in there, he asks me the price of SHIB. 🤣

As a VC firm, we’re listening to our fellow VC – Andreessen Horowitz (a16z).

A16Z has:

- been around since 2013

- invested in several web3 companies (OpenSea, Lido, Solana, Wormhole, etc.)

- put out a 🔥 report on web3 trends

We read through the 60-page report "State of Crypto 2023".

Here is the 1-2-3 on all the juice:

1️⃣ Big Theme

2️⃣ New Entrants

3️⃣ Things To Watch Out For

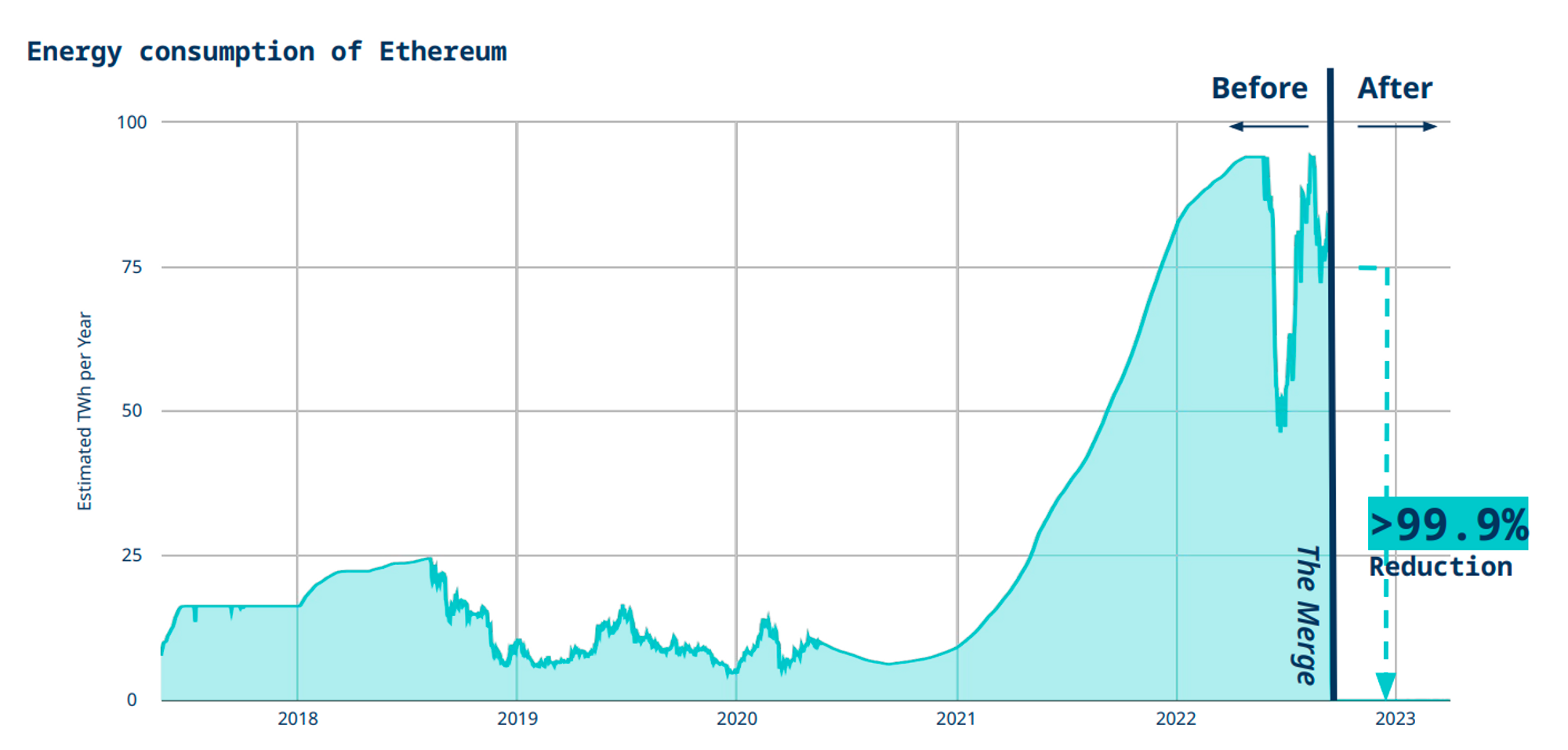

Crypto trend to watch 👉 Ethereum Scaling

Let’s be real, 2022 was a BIG year for Ethereum.

It’s not just because all competing L1s began to fall off the 🗾 but because Ethereum:

upgraded from PoW → PoS

This allowed Ethereum to process more transactions + consume less energy.

Check it out 👇

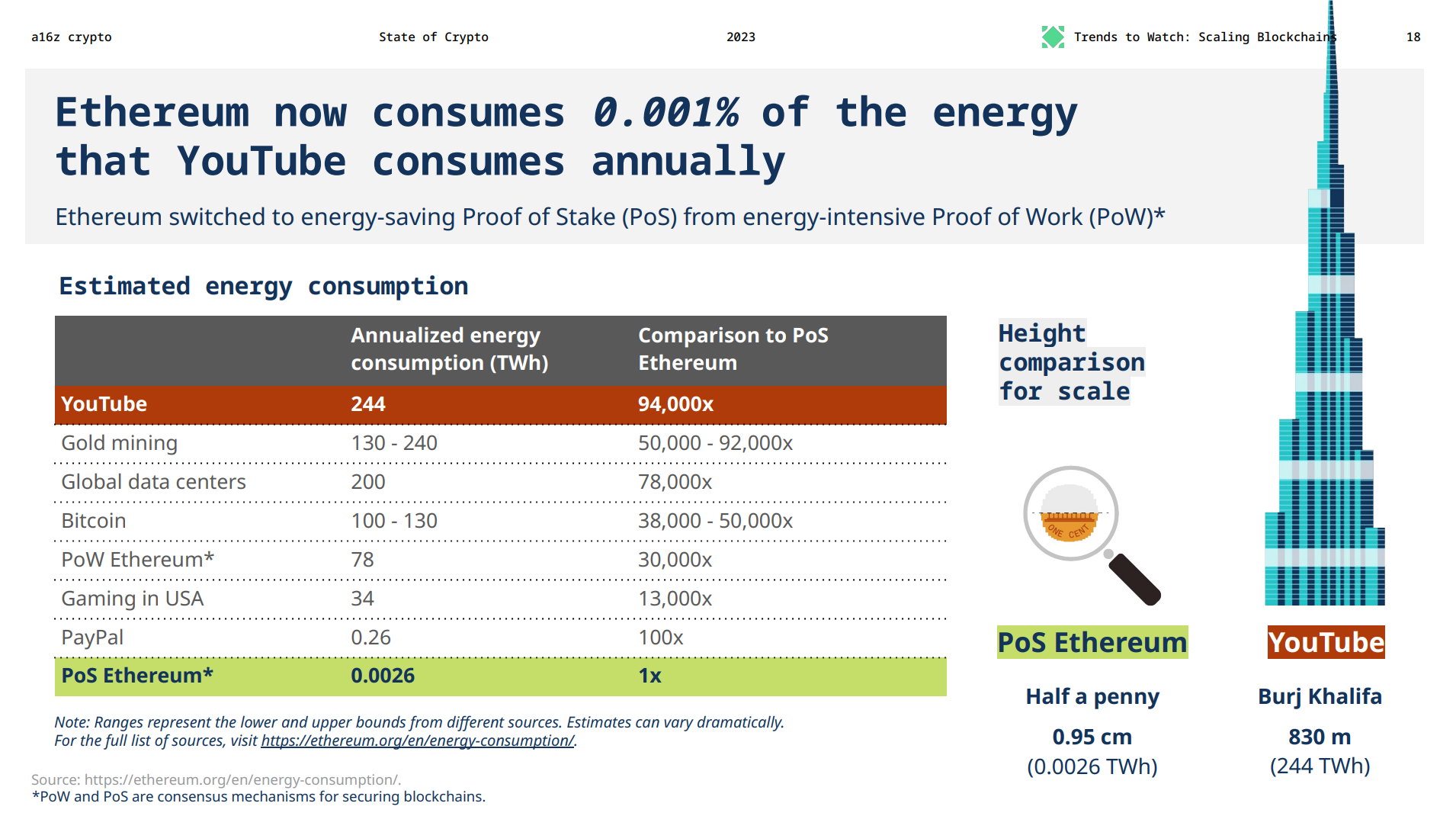

Yes, that’s a 99% reduction!

The last time the chances of something were reduced by 99% was Barcelona’s Champion’s League hopes when they let Messi go. 😭

After The Merge, Ethereum consumes 0.0026 Terrawatts per hour (TWh) to power the network and process transactions in 1 year.

1 TWh = 1 million megawatt-hours (MWh) or 1 billion kilowatt-hours (kWh).

Fun Fact: A typical toaster consumes ~1 kWh of energy per hour of usage. That’s about 356 kWh per year.

Compare this to (annual energy consumption):

- Youtube – 244 TWh per year

- Bitcoin – 115 TWh per year

- Gold Mining – 185 TWh per year

- PoW Ethereum – 78 TWh per year

Room for the growth of L2s

The [next] big lever for Ethereum scaling is – L2s.

Layer 2s like:

- Optimistic rollups – Arbitrum, Optimism, etc.

- Zero-knowledge rollups – ZK Sync, StarkNet, Polygon, ZKEVM etc.

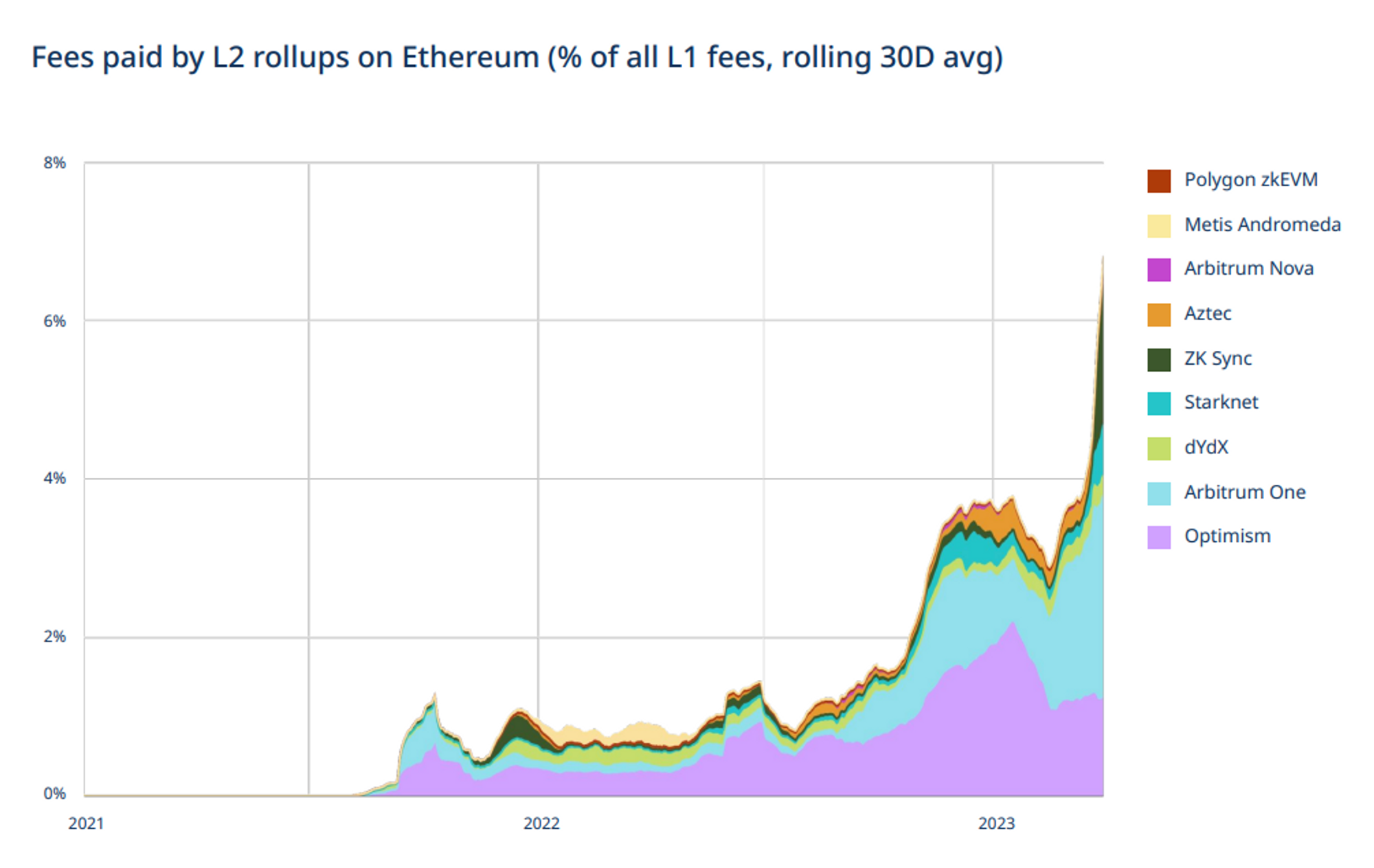

Currently, less than 7% of the fees generated on Ethereum are going to these L2 rollups.

That’s crazy, considering L2s are almost as big as Ethereum in terms of:

1. Value locked

Ethereum’s total value locked is – $31.7 billion

And the top-3 L2s have:

- Arbitrum → $7 billion

- Optimism → $2.1 billion

- zkSync → $0.2 billion

These Layer 2s ☝️ have almost a third of the value that Ethereum does.

2. Transactions

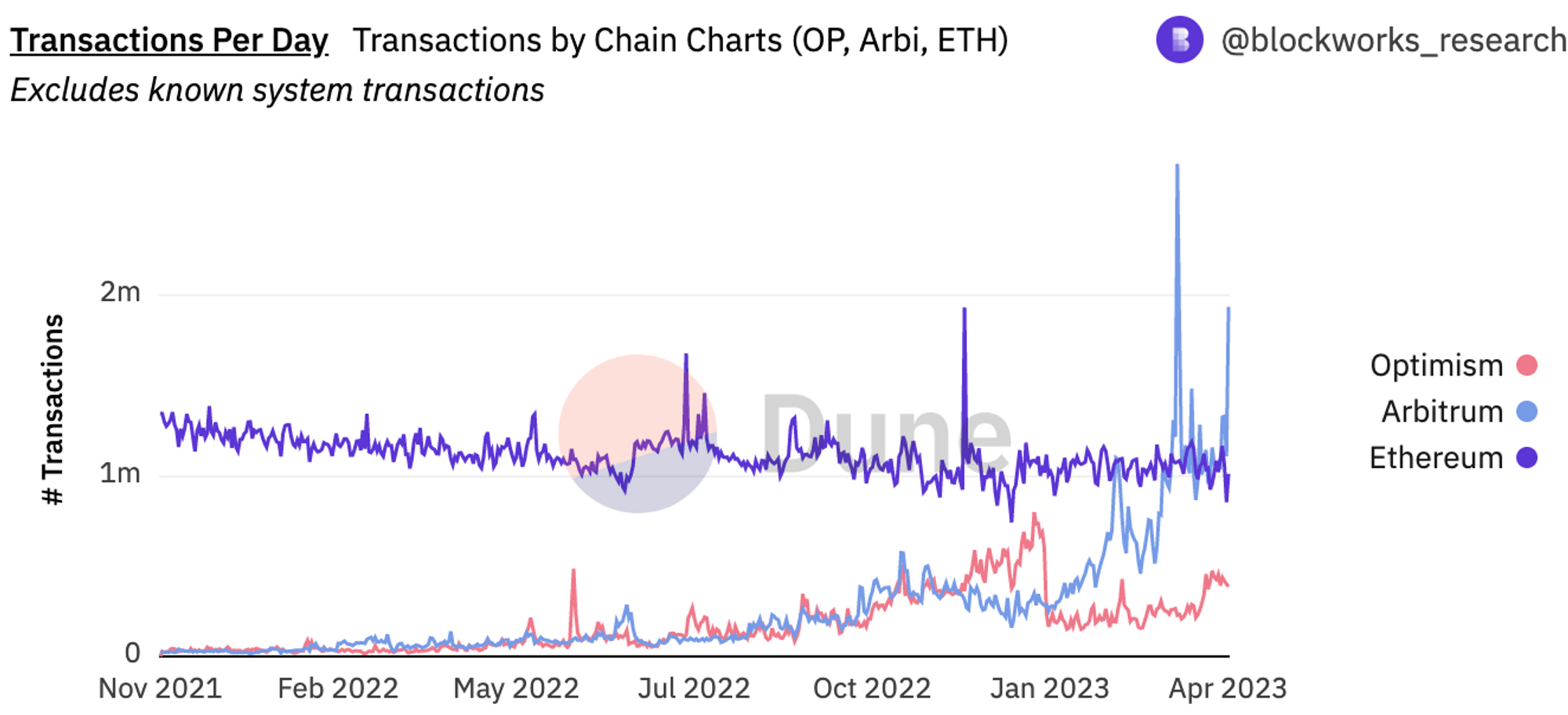

Ethereum’s transactions per day – 800k - 1 million

And the top-2 L2s have:

- Arbitrium → 1.2 million transactions per day

- Optimism → 410k transactions per day

Granted Arbitrim’s daily transactions are inflated because of the ARB airdrop last month. But even before the airdrop, Arbitrim’s transactions per day as around 700k.

Both L2s quite easily 🚀 over Ethereum in terms of combined daily transactions.

Developers experimented with rollups

Blockchain developers were like Quentin Tarantino constantly tinkering with his movies. One day it’s a movie about Jewish soldiers in Nazi Germany, the next it's a Hollywood movie about Hollywood movies. 🤣

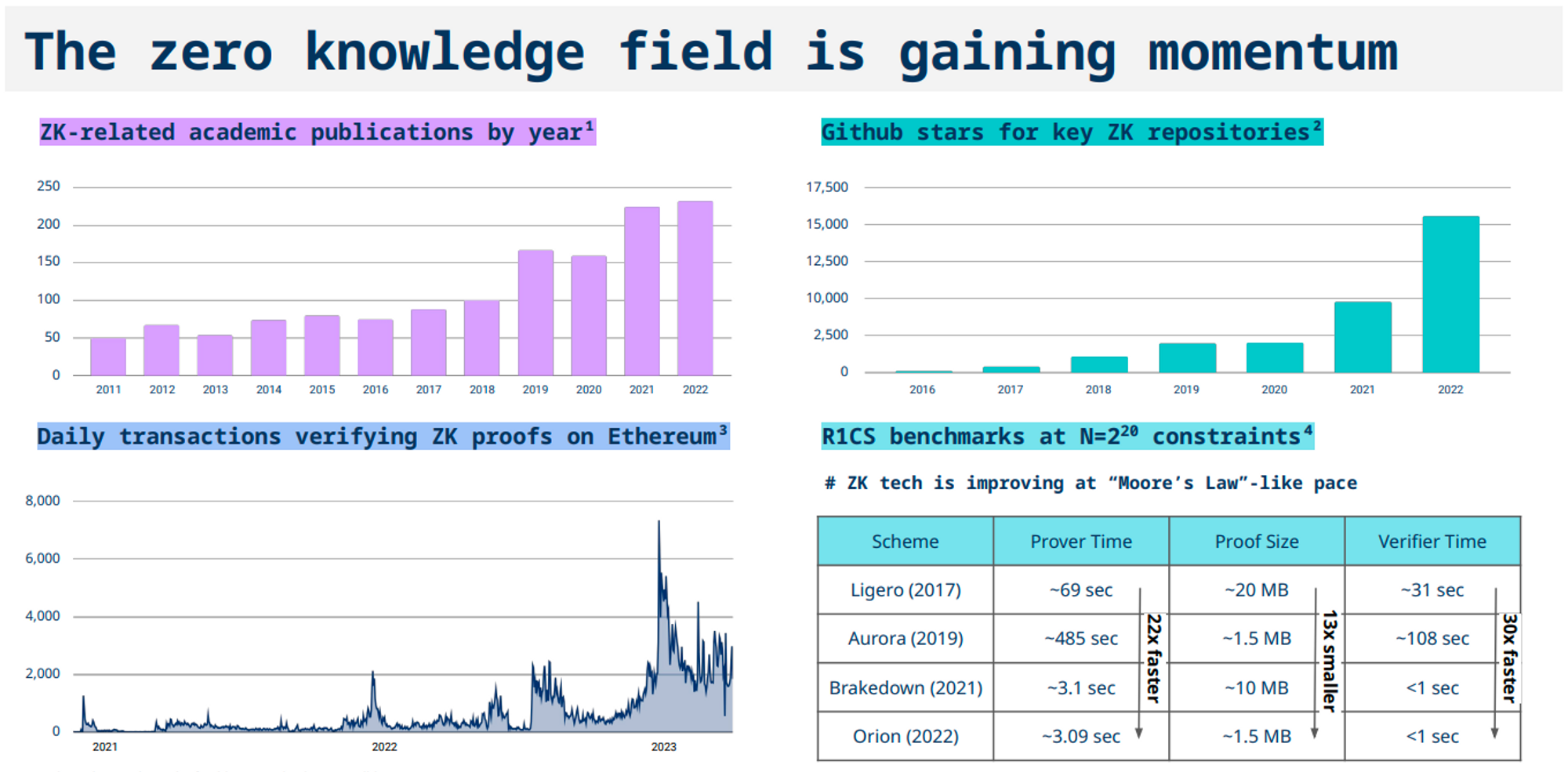

The biggest experiment that will pay off in 2023? → Zero-Knowledge proofs or zk proofs.

What are zk proofs?

A zk proof is a method of validity data without revealing the statement itself. The ‘prover’ is the party trying to prove a claim, while the ‘verifier’ is responsible for validating the claim.

These proofs make blockchains more:

- private

- scalable

And zk proofs are 🚀 by – academic publications, Githubs stars, and daily transactions.

Crypto trend to watch 👉 NFTs for brands and Web3 Gaming

1️⃣ NFTs for Brands

In 2022, despite the NFT wave going down like Chelsea’s title hopes, brands stuck with it.

Several brands like:

- Nike

- Porsche

- Starbucks

…got down and dirty with NFTs. Some did it well, others not so much.

Major companies will jump into the NFT bandwagon for 2 reasons: to earn revenue + create loyalty.

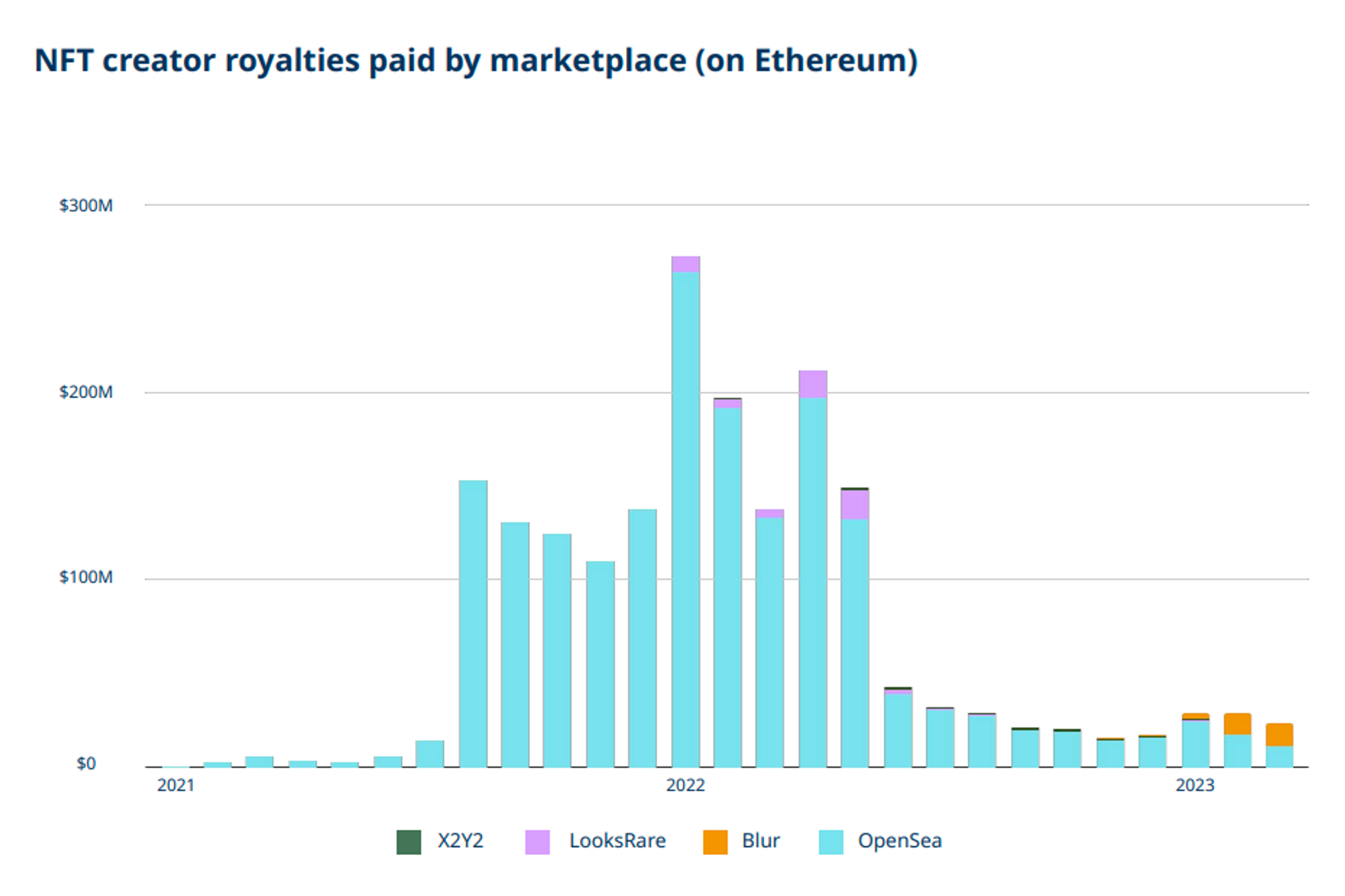

NFT creators earned nearly $2 billion in royalty revenues. And NFT marketplaces that facilitated these trades earned at least 10 times as much.

Brands want to bring this ☝️ value to their companies and engage their customers directly.

And that’s why every major lifestyle, luxury, and even comedic brand is jumping into NFTs.

2️⃣ Web3 Gaming

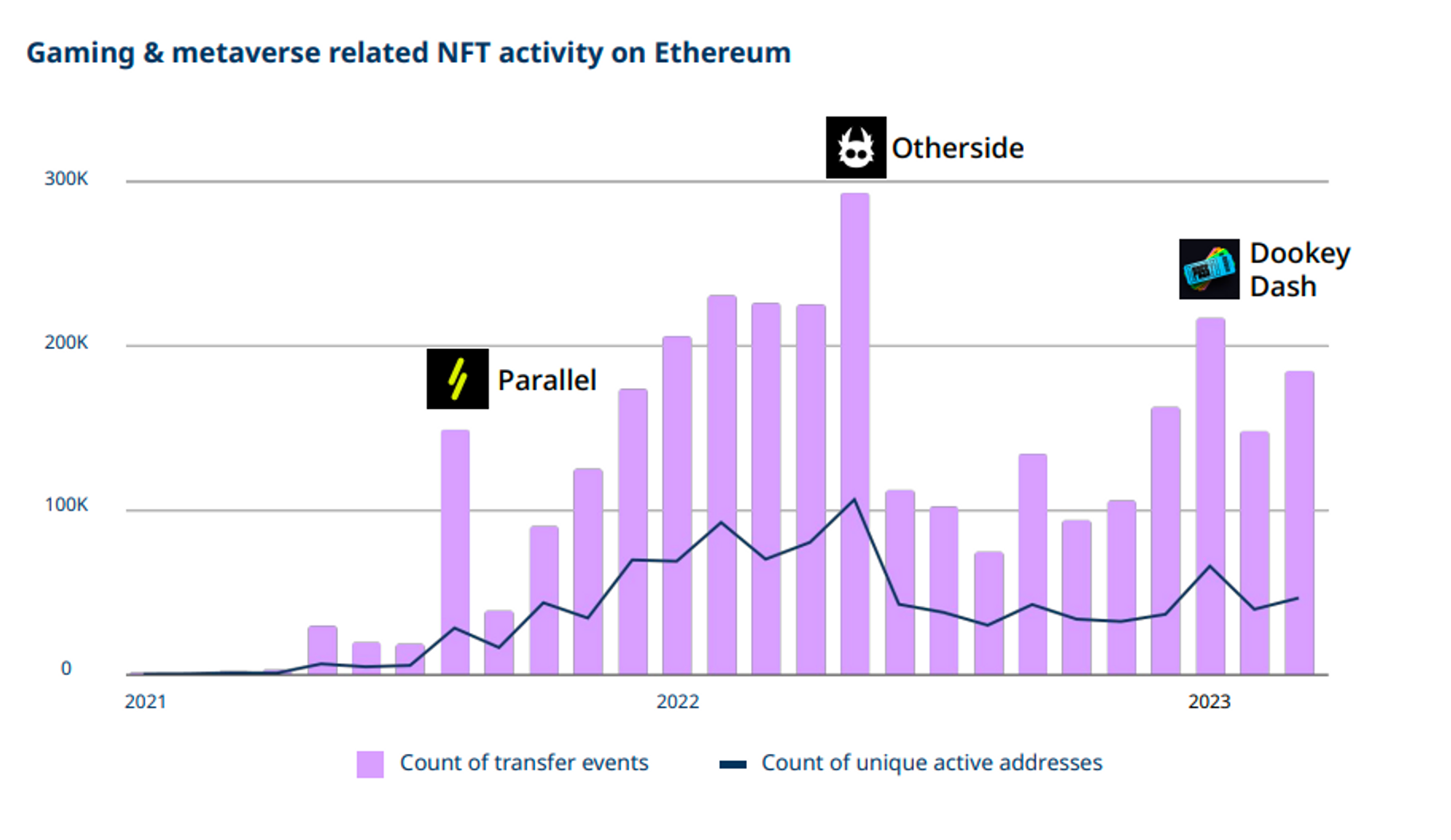

A16z calls Web3 Gaming a “huge opportunity” to bring newbies into crypto.

Here’s why:

💰 High spenders – Gamers spent $68 billion in 2022 on in-game purchases

🚀 Big launches – Over 700 web3 games were launched in 2022

🔥 More activity – Web3 gaming saw 23 times the transactions compared to DeFi.

Even with the bear market for cryptocurrencies, web3 gaming’s events + unique addresses resurged in 2023.

Check it 👇

👉 3 Things To Pay Attention To:

A16z highlights a few useful themes to watch out for in 2022.

Now, these might not have an immediate impact, but in a few years, these themes will influence a ton of what goes on in the crypto space.

DAO participation

Communities are the key to web3. And communities are organized through DAOs. The three metrics to measure a DAO’s worth are:

- total votes

- unique voters

- unique proposals

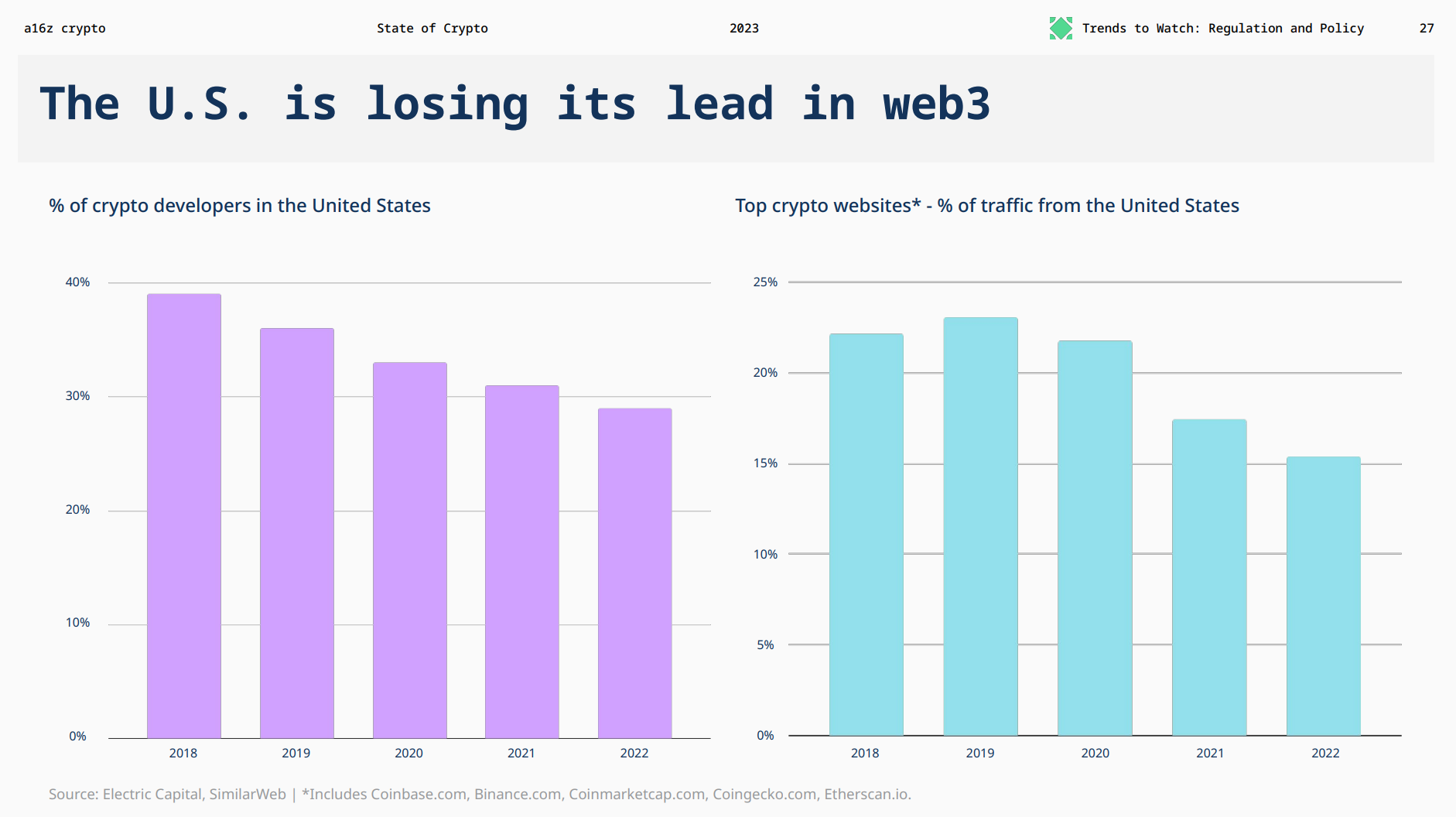

United States policy woes

The US is falling behind in the race to create an accommodative policy for crypto companies.

Here are 2 signs of this (between 2018-22):

- 📉 US dev count decreased by 20%

- 📉 US traffic to crypto websites is down 30%

Staking Regulation

One big policy decision for the US is – staking.

The US SEC considers ETH as a “security” and the centralized exchanges that provide staking services and rewards as offering the sale of “unregistered securities.”

This is affecting US exchanges like:

- Gemini

- Kraken

- Coinbase

But beyond the regulatory mess, a16z calls staking a way to transform “collateral into outsized economic security.”

TLDR of the report

1️⃣ Big theme – Ethereum Scaling

2️⃣ New trends – NFT for brands and Web3 gaming

3️⃣ Things to watch out – DAO participation, United States policy woes, and Staking Regulation.

Do you agree with a16z’s 2023 crypto trends? Let us know in the telegram group comments.

Read also:

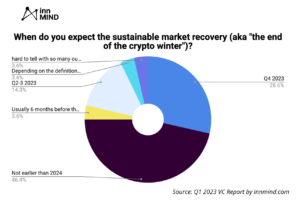

VCs Predict the End of Crypto Winter | Web3 Investment Trends

VC Investors in web3 and crypto verticals predict the end of “crypto winter” in Q4 2023 - Q1 2024, according to the new market report by InnMInd

What Happened to BUSD and WHY? | Weekly Digest by InnMind

Why BUSD & Paxos was slapped by the US regulator? How it will influence the stablecoins market? And why Binance is looking beyond the US dollar?

🦄Web3 Startups and VCs

FYI: Top 5 active crypto VCs that invested in the last 30 days 🤑 1️⃣ DWF Labs in the last 30 days invested in 6 startups: RACA (Gaming) - $16m seed round, Alchemy Pay (fiat-crypto payment gateaway) - $10m round, Fetch.AI (AI focuced crypto protocol) - $40m round, So-Col (socialfi) - $1.5m pri…

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: https://blog.innmind.com/a16z-state-of-crypto-trends-report/

- :has

- :is

- :not

- 1

- 10

- 2022

- 2023

- 2024

- 7

- a

- a16z

- About

- about IT

- academic

- According

- active

- active crypto

- activity

- addresses

- affecting

- AI

- airdrop

- Alchemy

- Alchemy Pay

- All

- also

- an

- and

- Andreessen

- Andreessen Horowitz

- Andreessen Horowitz (A16z)

- annual

- arbitrum

- ARE

- around

- AS

- At

- attention

- barista

- BE

- Bear

- Bear Market

- because

- before

- began

- behind

- between

- Beyond

- Big

- Biggest

- Billion

- binance

- blockchain

- blockchain transactions

- blockchains

- brand

- brands

- bring

- BUSD

- but

- by

- Calls

- centralized

- Centralized Exchanges

- chain

- chances

- Chart

- claim

- COM

- combined

- comments

- Communities

- Companies

- compared

- competing

- considering

- considers

- constantly

- consume

- consumption

- Cream

- create

- creator

- creator royalties

- creators

- crypto

- crypto companies

- crypto space

- crypto trends

- Crypto Winter

- cryptocurrencies

- Customers

- daily

- daily transactions

- DAO

- DAOs

- data

- day

- Days

- decision

- DeFi

- Despite

- Dev

- developers

- DID

- Digest

- directly

- Dollar

- double

- down

- earn

- earned

- easily

- Economic

- energy

- Energy Consumption

- engage

- etc

- ETH

- Ether (ETH)

- ethereum

- ethereum energy consumption

- ethereum scaling

- Even

- events

- Every

- Exchanges

- experiment

- extra

- facilitated

- Fall

- Falling

- Fees

- fellow

- Fetch.ai

- few

- Firm

- For

- from

- Gamers

- Games

- gaming

- Gaming and Metaverse

- generated

- Germany

- Go

- Goes

- going

- Growth

- Guy

- happened

- Have

- he

- highlights

- Hollywood

- hopes

- Horowitz

- How

- HTTPS

- i

- immediate

- Impact

- in

- in-game

- influence

- into

- invested

- investment

- Investors

- IT

- itself

- jpg

- jump

- just

- Key

- Know

- knowledge

- l2

- Labs

- Last

- launched

- layer

- Layer 2s

- League

- LIDO

- lifestyle

- like

- Listening

- locked

- looking

- losing

- love

- Loyalty

- Luxury

- major

- make

- Making

- Market

- Market Report

- marketplace

- marketplaces

- measure

- Merge

- Messi

- Metaverse

- metaverse nft

- method

- Metrics

- might

- million

- Mining

- Month

- more

- movie

- Movies

- nazi

- nearly

- network

- New

- New Market

- next

- NFT

- NFT Marketplaces

- NFTs

- of

- offering

- on

- OpenSea

- Optimism

- or

- Organized

- Others

- our

- over

- paid

- participation

- party

- Paxos

- Pay

- payment

- plato

- Plato Data Intelligence

- PlatoData

- policy

- Polygon

- PoW

- power

- predict

- price

- process

- proof

- proofs

- protocol

- Prove

- provide

- publications

- Q1

- Quentin Tarantino

- Race

- Read

- real

- reasons

- Reduced

- Regulation

- regulator

- regulatory

- report

- responsible

- revealing

- revenue

- revenues

- Rewards

- Rollups

- round

- royalties

- royalty

- s

- sale

- scaling

- SEC

- Securities

- seed

- Seed Round

- Services

- several

- SHIB

- should

- Signs

- since

- So

- SO-COL

- Solana

- some

- something

- Space

- spent

- Stablecoins

- Staking

- staking services

- starbucks

- starknet

- Stars

- Startups

- State

- Statement

- States

- Takeaways

- talking

- Tarantino

- terms

- than

- that

- The

- The Merge

- their

- theme

- There.

- These

- they

- things

- Third

- this

- three

- Through

- time

- times

- Title

- to

- Ton

- top

- top 5

- Total

- total value locked

- trades

- traffic

- Transactions

- Transform

- Trend

- Trends

- typical

- unique

- unique addresses

- United

- United States

- us

- US Dollar

- us regulator

- US Sec

- Usage

- value

- VC

- VCs

- verticals

- vs

- was

- Watch

- Way..

- Web3

- web3 companies

- web3 games

- web3 gaming

- websites

- weekly

- WELL

- were

- What

- while

- why

- will

- Winter

- with

- without

- wormhole

- worth

- year

- years

- you

- youtube

- zephyrnet

- zero

- zero-knowledge

- zero-knowledge proofs

- ZK

- zkEVM