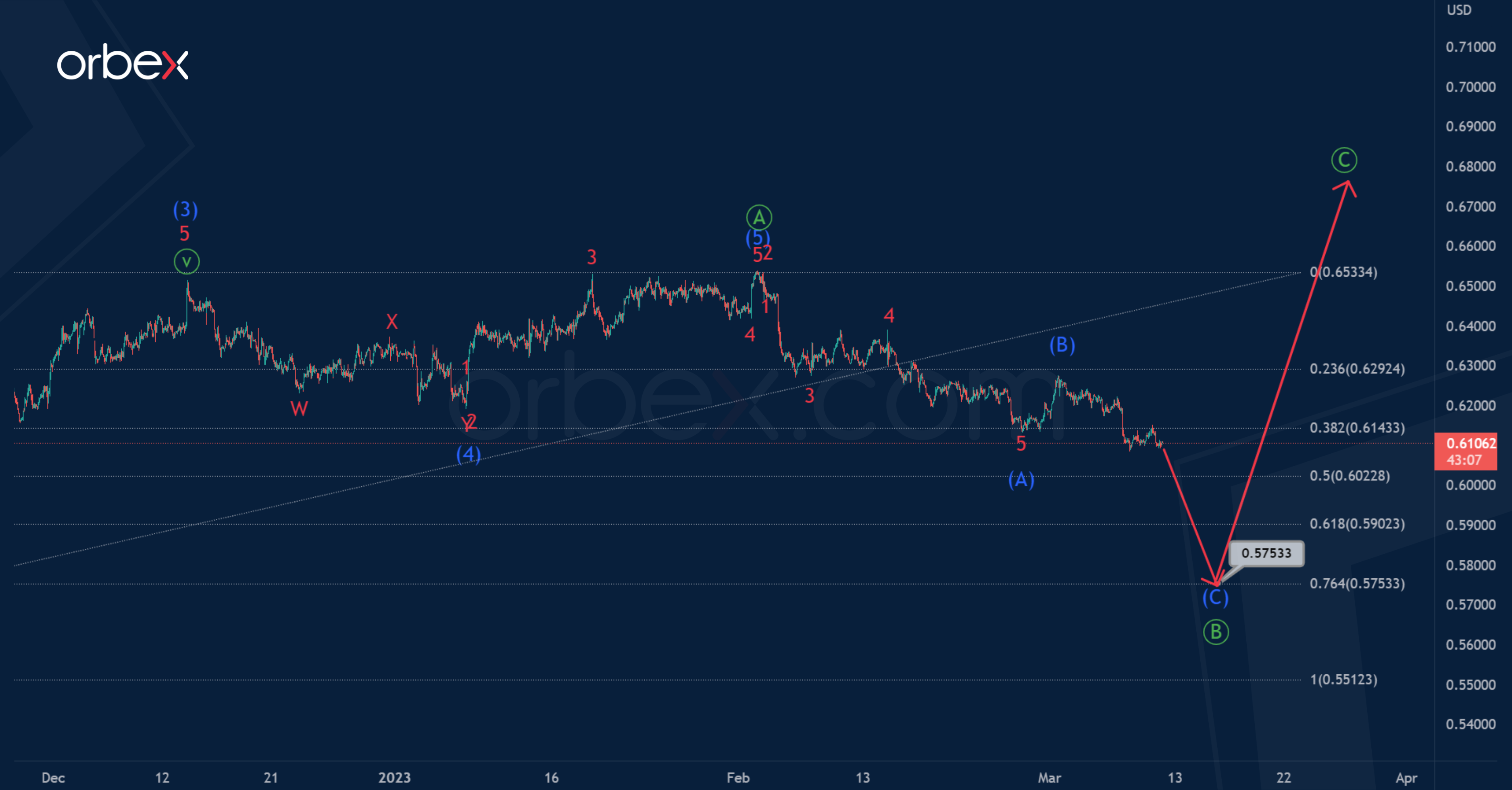

The NZDUSD currency pair could form a correction zigzag pattern Ⓐ-Ⓑ-Ⓒ in the long term.

The first impulse wave Ⓐ is completed. A bearish correction Ⓑ is under development with the internal structure being similar to a zigzag (A)-(B)-(C). The impulse (A) and correction (B) have both ended.

In the near future, the price could drop in the intermediate impulse (C) to 0.575. At that level, primary correction will be 76.4% of actionary wave Ⓐ.

However, the primary wave Ⓐ could continue developing, and end slightly higher than in the main version. It is an intermediate impulse (1)-(2)-(3)-(4)-(5).

It seems that the correction wave (4) has come to an end, it has an internal structure of a double zigzag.

If this scenario is confirmed, bullish growth in the intermediate wave (5) is likely towards 0.682. At that level, wave (5) will be 76.4% of impulse (3).

Test your strategy on how the NZDUSD will fare with Orbex

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.orbex.com/blog/en/2023/03/nzdusd-decline-in-the-final-zigzag-%e2%93%91

- :is

- 1

- a

- and

- At

- BE

- bearish

- being

- Bullish

- Chart

- come

- Completed

- CONFIRMED

- continue

- could

- Currency

- Decline

- developing

- Development

- double

- Drop

- final

- First

- form

- future

- Growth

- Have

- higher

- How

- HTTPS

- in

- Intermediate

- internal

- IT

- Level

- likely

- live

- Long

- Main

- max-width

- Near

- of

- on

- Pattern

- plato

- Plato Data Intelligence

- PlatoData

- price

- primary

- scenario

- seems

- similar

- Strategy

- structure

- that

- The

- to

- towards

- under

- version

- Wave

- will

- with

- Your

- zephyrnet