After an incredible run at the start of 2021, the majority of large caps reached new ATHs and Total Value Locked (TVL) in DeFi also hit consecutive ATHs. After a market retracement over the summer. It’s looking primed for another run. Meanwhile, TVL and users have continued to grow within the DeFi industry since and have reached all-time highs, with over 3.2m total users. Yet, while the market has continued to flourish, capital efficiency remains one of the largest problems. At MonoX, we believe that the last year has shown us the baseline for value creation within DeFi, and now the next stage is solving capital efficiency. We have seen lots of innovation so far this year in 2021, yet DeFi is still expensive, intensive, and ample capital remains siloed.

The Promise of Tokenization

When ERC-20 emerged as the technical standard for tokens deployed to the Ethereum mainnet, the community was excited for such an opportunity to be able to tokenize ‘everything’. Years later more than 90% of tokens traded on both DEXs and CEXs are project tokens. However, more recently in 2021, as the industry matures, we have also begun to see the development and subsequent prospering of a new breed of innovative, already collateralized tokens. These tokens are different from the most commonly traded assets which are project tokens.

So what are ‘Value Backed Tokens’?

When we refer to ‘Value Backed Tokens’ we are talking about tokens that are already collateralized, meaning they already have been backed by some value.

- Fractional NFTs (already backed by the NFT itself)

- Synthetics (already backed by assets used to mint them)

- Gaming tokens (already backed by the in-game assets)

- Insurance Tokens (already backed by the assets used as collateral)

The market for such tokens has been growing exponentially and will only continue to increase as these types of tokens become more integrated into DeFi applications.

Capital Efficiency & Liquidity Pairs

Currently, any DEX trading of these assets is not capital efficient and is hindering the trading of such assets, rendering most illiquid. In turn, this is damaging for the DeFi ecosystem, including projects, developers, and traders.

MonoX helps projects save precious capital by listing on an exchange for free. We also help investors save on costly fees, and unlock liquidity for more kinds of tokenized assets to be traded.

ELI5 — How DEX’s work:

Liquidity pools are smart contracts to which Liquidity Providers (LPs) deposit funds. Once the funds have been deposited to the pool, the AMM’s algorithm creates the market for the digital assets to be traded, instead of using an order book.

Each smart contract or pair manages a liquidity pool composed of the reserves of the deposited ERC-20 tokens. The pool weight is allocated by the deposited reserve amounts of the reserve ERC-20 tokens. Pool weights vary depending on the protocol, for example, Uniswap uses a 50/50 split for pool weight of two tokens e.g. ETH/USDC.

Liquidity Providers can deposit an equal value of each underlying token and in exchange, receive LP tokens. The LP tokens represent shares of the total deposited reserves for both tokens in the pool. As a Liquidity Provider, you are rewarded with the trading fees accrued from swaps/transactions made through the pool. The fee rewards are relative to how much your LP tokens represent as a total of the deposited reserve.

Making Innovative Tokens Tradable in a Decentralized way

Such a design works perfectly for trading project tokens, however, it makes it very expensive and capital intensive to trade Innovative Tokens, which have already been collateralized. This is because there is no real incentive to collateralize the Token a second time when adding liquidity to the pool pair.

Example

Our killer use case here is giving users or projects the ability to launch with zero collateral.

As we mentioned above, with Uniswap, you’d have to put in $1m of ETH if you are launching $1m of Token A, in order to build the pair.

With MonoX, all you need is your own Token A. That’s zero collateral, or 100% capital savings.

This is especially valuable not just for projects launching their token but innovative tokens that have already been collateralized.

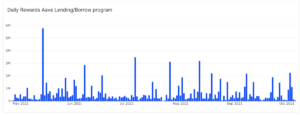

Let’s take a look at AAVE and Curve ETH. AAVe’s aETH and Compound’s cETH have low liquidity on Uniswap. An LP would need to do the following to make it tradable:

1. Deposit 1 ETH to get 1 aETH

2. Deposit another ETH to build an ETH-aETH pair with the aETH from step 1

3. At this point the LP deposited 2 ETHs to make 1 aETH tradable

Why should LPs have to back these assets a second time when depositing to a pool, when the token is already backed by collateral?

Example: Fractional NFTs

The NFT market has grown exponentially in the last three months. Open Sea has surpassed eCommerce giants Esty in transaction volume. We have also seen secondary trading volume increase exponentially for expensive NFTs that have been ‘fractionalized as erc20 tokens. For example, Fractional Art’s Total Value Traded has reached $485,743,410 as of (August 30th).

https://twitter.com/0xSisyphus/status/1430565231781089287

However secondary trading, post fractionalization poses the same problem for LPs.

- Use ETH to Mint NFT ERC20 shards

- Deposit an equal amount of ETH to build the ETH-NFTshard pair

- At this point, they have used ETH twice

a. Once to mint the NFT shards

b. Once to build the NFT shard pair

If users want to trade the NFT shard for any token on a DEX, why should LPs have to collateralize the shards a second time by adding an equal amount of ETH? The new ERC20 token is already backed by the NFT itself.

MonoX solves exactly these problems.

The market for these more innovative tokens is only going to grow faster just like it happened in the traditional finance market and we have the perfect solution to capture this value encapsulated by new ‘Value Backed Tokens’.

About MonoX

MonoX introduces the premier bootstrap decentralized exchange, Monoswap. Project owners can list their tokens without the burden of capital requirements and focus on using funds for building the project instead of providing liquidity.

It works by grouping deposited tokens into a virtual pair with our own vCASH stable coin, to offer a single token pool design.

MonoX will revolutionize the DeFi ecosystem by fixing the capital inefficiencies of current protocol models. With lower trading fees, capital efficiency, and zero-capital token launching — MonoX will expand the capabilities of DeFi.

📱 Stay Connected

Follow our official social media accounts and visit our website to stay up to date.

Website | Documentation | Twitter | Telegram | Discord

🚨 IMPORTANT

Be careful of fake Telegram groups, and Twitter accounts trying to impersonate MonoX. $MONO tokens ARE NOT in circulation.

Always verify that you are on our official Twitter page, Telegram group, or Discord

- &

- 2021

- aave

- algorithm

- All

- AMM

- applications

- Assets

- AUGUST

- Baseline

- build

- Building

- capital

- Coin

- community

- continue

- contract

- contracts

- Current

- curve

- decentralized

- Decentralized Exchange

- DeFi

- Design

- developers

- Development

- Dex

- digital

- Digital Assets

- ecommerce

- ecosystem

- efficiency

- ERC-20

- ERC20

- ETH

- ethereum

- ETHEREUM MAINNET

- exchange

- Expand

- fake

- Fees

- finance

- Focus

- follow

- Free

- funds

- ge

- Giving

- GM

- GP

- Grow

- Growing

- GV

- here

- How

- HP

- hr

- HTTPS

- Including

- Increase

- industry

- Innovation

- innovative

- Investors

- IT

- large

- launch

- Liquidity

- List

- listing

- LP

- LPs

- Majority

- Market

- Media

- medium

- months

- NFT

- NFTs

- offer

- official

- open

- Opportunity

- order

- owners

- pool

- Pools

- project

- projects

- Requirements

- Rewards

- Run

- SEA

- secondary

- Shares

- smart

- smart contract

- Smart Contracts

- So

- Social

- social media

- split

- Stage

- start

- stay

- summer

- talking

- Technical

- Telegram

- time

- token

- Tokens

- trade

- Traders

- Trading

- traditional finance

- transaction

- TVL

- Uniswap

- us

- users

- value

- Virtual

- volume

- Website

- within

- Work

- works

- year

- years

- zero