Word on the street is that traditional finance and payment titans are hitting the brakes on crypto-related partnerships following a tumultuous 2022. This couldn’t be further from the truth as Mastercard today announces the launch of Asia Pacific’s FIRST stablecoin digital wallet integration with Stables.

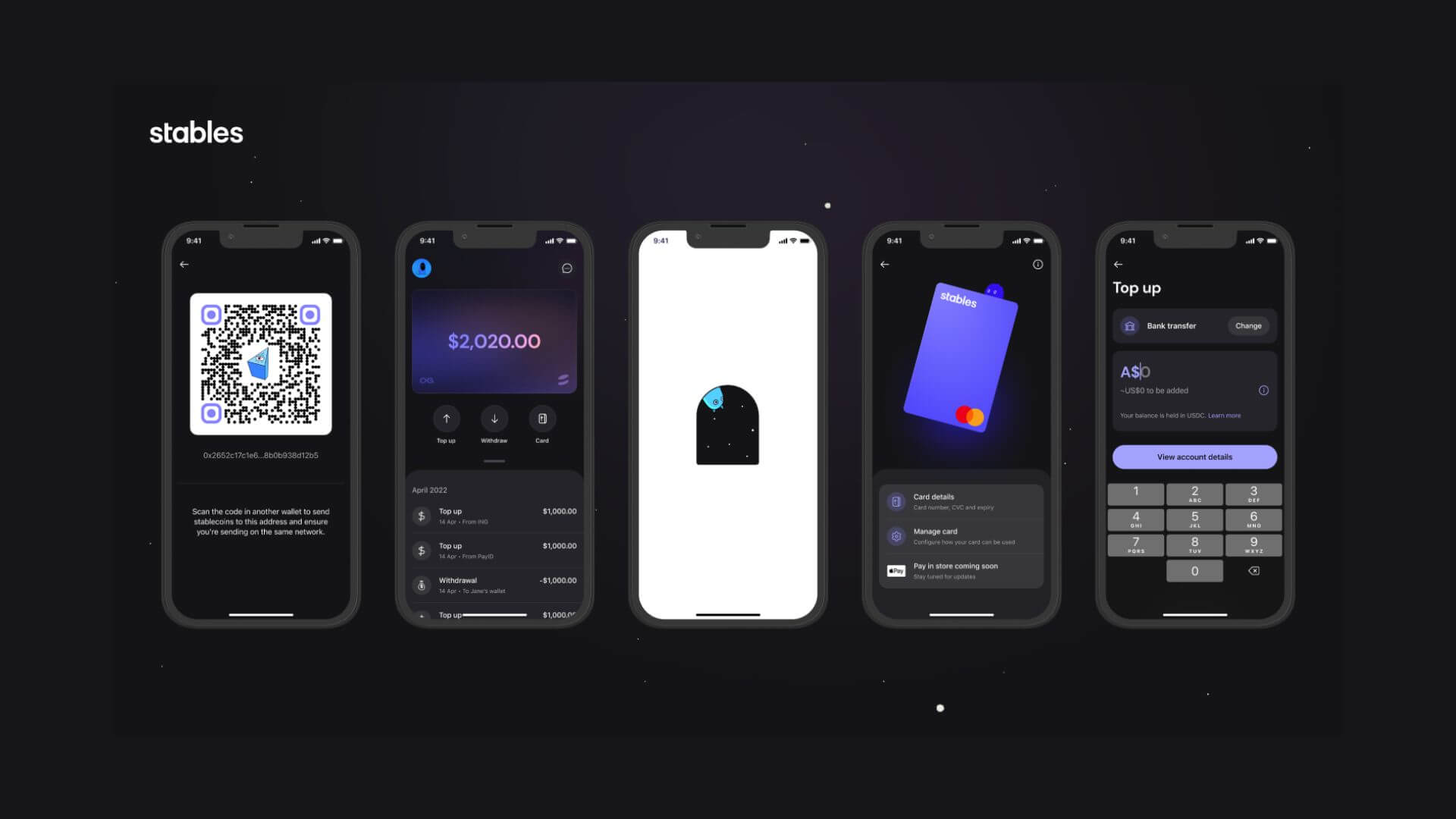

The Stables digital Mastercard gives retail customers the flexibility to spend their stablecoins anywhere Mastercard is accepted — with conversion and settlement occurring seamlessly in USDC.

Stables, formerly known as Tiiik, has partnered with Mastercard to create a digital wallet integration that will allow customers in the Asia Pacific (APAC) region to convert stablecoins into fiat currency and spend them anywhere Mastercard cards are accepted online or in-store globally.

Stables will partner with a third party to enable customers to save and spend USDC, which will be converted to fiat and settled on Mastercard’s network.

The card will be accessible through the Stables digital app via mobile wallets, making it available for everyday spending. The move is the first of its kind in APAC.

The introduction of stablecoin payments for everyday purchases is considered a significant step in the maturity of cryptocurrency in the APAC market. A recent global survey by Marqeta found that 82% of digital assets holders would be interested in using a debit card where they could spend cryptocurrency like dollars. In addition, 55% of APAC consumers would feel more confident investing in crypto or digital currencies that are issued or backed by a reputable organization.

Transactions will be settled by Stables’ payment gateway, which will enable real-time transactions using USDC, with conversion and settlement occurring behind the scenes, secured by ISO and SOC2 certified digital asset custody technology provider Fireblocks.

Stables is addressing the need for digital assets holders to have options to spend on everyday items and at online merchants seamlessly using stablecoins.

Stables’ co-founder and CEO Erez Rachamim says the objective of the innovative payment system is in line with the principles shared with Mastercard of stability, regulatory compliance, and consumer protection.

The move is part of Stables’ goal to transform digital asset payment offerings available.

Stables’ co-founder and Chief Technology Officer Tony Tao, who has extensive experience building payment systems, says the solution comes at a time when four out of five customers who hold digital assets have expressed a desire to spend their digital assets in the physical world.

Kallan Hogan, Vice President of Business Development and Head of Fintech, Australasia, Mastercard, said: “Mastercard is committed to powering innovative payment solutions that give cardholders the freedom to spend their assets where, how, and when they want.”

“Stables is building a solution for the Web3 sector leveraging Mastercard’s global network and cyber and intelligence tools, including CipherTrace and Ekata, with trust and security at the core,” Kallan added.

Read Also: Mastercard Strengthens Its Footprint In The Creator Economy

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://alexablockchain.com/mastercard-enabling-stablecoin-payments-on-its-network-with-stables/

- :is

- 2022

- a

- accessible

- added

- addition

- addressing

- and

- Announces

- anywhere

- APAC

- app

- ARE

- AS

- asia

- asia pacific

- Asia Pacific (APAC)

- asset

- Assets

- At

- available

- backed

- BE

- behind

- behind the scenes

- blockchain

- Building

- business

- business development

- by

- card

- Cards

- ceo

- Certified

- chief

- chief technology officer

- CipherTrace

- Co-founder

- committed

- compliance

- confident

- considered

- consumer

- Consumer Protection

- Consumers

- Conversion

- convert

- converted

- Core

- could

- create

- creator

- crypto

- cryptocurrency

- currencies

- Currency

- Custody

- Customers

- cyber

- Debit

- Debit Card

- Development

- digital

- Digital Asset

- Digital Asset Custody

- Digital Assets

- digital currencies

- digital wallet

- dollars

- down

- enable

- enabling

- everyday

- experience

- expressed

- extensive

- Extensive Experience

- Fiat

- Fiat currency

- finance

- fintech

- FIREBLOCKS

- First

- Flexibility

- following

- Footprint

- For

- formerly

- found

- Freedom

- from

- further

- gateway

- Give

- Global

- global network

- Globally

- goal

- Have

- head

- hitting

- hold

- holders

- How

- HTTPS

- in

- in-Store

- Including

- innovative

- integration

- Intelligence

- interested

- Introduction

- investing

- ISO

- Issued

- IT

- items

- ITS

- jpg

- Kind

- known

- launch

- leveraging

- like

- Line

- Making

- Market

- Marqeta

- mastercard

- maturity

- Merchants

- Mobile

- more

- move

- Need

- network

- objective

- of

- Offerings

- Officer

- on

- online

- online merchants

- Options

- organization

- Pacific

- part

- partner

- partnered

- partnerships

- party

- payment

- payment system

- Payment Systems

- payments

- physical

- plato

- Plato Data Intelligence

- PlatoData

- Powering

- president

- principles

- protection

- provider

- purchases

- real-time

- recent

- region

- regulatory

- Regulatory Compliance

- reputable

- retail

- Reuters

- Said

- Save

- says

- scenes

- seamlessly

- sector

- Secured

- security

- Settled

- settlement

- shared

- significant

- solution

- Solutions

- spend

- Spending

- Stability

- stablecoin

- Stablecoins

- Step

- Strengthens

- Survey

- system

- Systems

- Technology

- that

- The

- their

- Them

- Third

- Through

- time

- to

- Tony

- tools

- traditional

- traditional finance

- Transactions

- Transform

- Trust

- USDC

- via

- Vice President

- Wallet

- Wallets

- Web3

- which

- WHO

- will

- with

- world

- would

- zephyrnet