The decentralized finance (DeFi) market opens plenty of opportunities. We are sharing how to safely use the instruments of the niche to grow profits.

How to earn on DeFi

The key concept of decentralized finance is the absence of the necessity of middlemen. In the DeFi arena, there is no room for traditional banks with big fees and interest rates that financial organizations can hold as market monopolists.

Also, decentralized finance allows users to remain anonymous and “make” money work effectively.

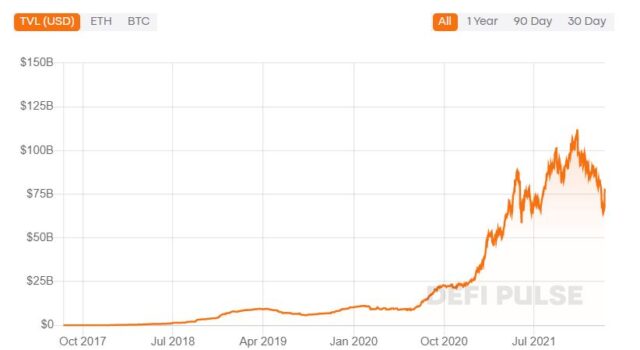

The growth of the DeFi popularity can be observed on the graph that shows the total value of assets locked in the projects of this segment:

Total value (USD) locked in DeFi projects. Source: DeFi Pulse

There are two approaches towards earning on DeFi. Let’s discuss both options:

1. Providing liquidity

Most of the DeFi protocols require assets for operational activity. The easiest and fastest way to launch a product is to attract liquidity from the market participants. Let’s explore it by drawing on the example of a DeFi app that is focused on providing loans. Here is how it works:

- Developers offer market participants to lock in assets for the new DeFi application’s needs.

- With the locked-in assets, the project’s founders start to grant interest-bearing loans.

- Developers share the profit earned on the loans’ interest with the liquidity providers.

Similar mechanisms are used by decentralized crypto exchanges that need liquidity to meet the market participants’ needs.

Interesting! Among liquidity providers, the yield farming community has emerged. The goal of “farmers” is to swiftly move assets among protocols to maximize profits.

2. Investments in the DeFi projects’ tokens

Plenty of decentralized protocols have their native token. The cryptocurrency price movement often reflects the project’s position on the market. This distinctive feature helps investors to earn on the tokens of the DeFi protocols.

For example, users that bought UMI coins from the decentralized cryptocurrency exchange Uniswap succeeded in getting tenfold yields on their initial investments in just 4 months.

Price movement graph for the cryptocurrency UNI by the project Uniswap. Source: TradingView

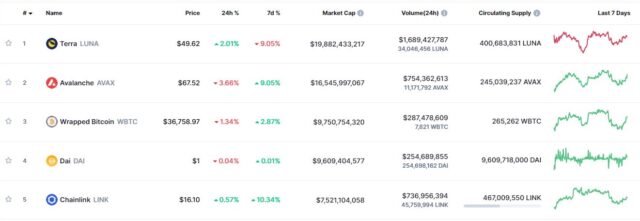

There are also plenty of other tokens from the decentralized finance segment that helped their investors with getting profits.

Top-5 cryptocurrencies by capitalization in the DeFi segment. Source: CoinMarketCap

Unfortunately, investments in DeFi often come with certain difficulties. Let’s dive into them for a detailed review.

Decentralized market issues

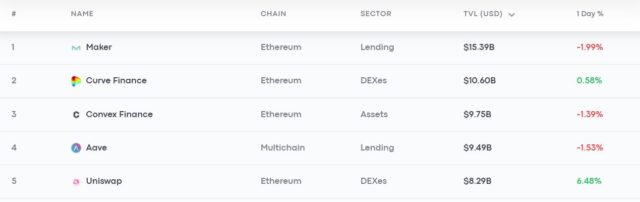

The majority of the most popular DeFi protocols do not yet support all the languages. For example, among the top-5 decentralized protocols only one – Uniswap – is really multilingual. This might reduce the number of active users of the platforms.

Top-5 DeFi protocols by the volumes locked in for the project’s needs. Source: DeFi Pulse

There are also other hidden pitfalls that hinder entrance into the DeFi market for potential investors. Among pitfalls, there are the following issues:

- Complicated technical component. DeFi market entry might be difficult for the non-tech-savvy user.

- Lack of technical support in local languages. If investors would need support, they would have to address the request in the projects’ native languages. Moreover, the language barrier could lead to potential losses if an investor did not understand all the information correctly.

- Limited functionality. Users often have to utilize third parties resources and tools that bring additional operational expenses.

With the growing impact of those issues, the DeFi market started to generate projects that are providing solutions. One of such projects is BaksDAO. The project team worked on the main pain points that users face during the entrance to the decentralized finance market.

How BaksDAO helps to avoid pitfalls in DeFi

BaksDAO is a multifunctional decentralized finance platform with its own stablecoin BAKS and the governance token BDV. Aimed to be a global player, the project works on the Binance Smart Chain (BSC) blockchain that provides high traffic capacity and low commissions. The safety of the platform was confirmed by the Solid Proof experts during the audit.

Among BaksDAO advantages, there are the following features:

- Intuitive and user-friendly interface with which even new players can enter the DeFi market and start earning.

- Transparent instruments for asset management. The BaksDAO developers emphasize that it is possible to earn profits in the platform while holding controls over the assets in your own hands.

- BaksDAO opens plenty of opportunities for its users. Among its features, there is a possibility to earn on granting loans. Also, users can take open payday credits in BAKS with low interest and exchange assets.

This being said, the BaksDAO developers formed the platform for project development in advance thanks to elaborated investment schemes and social promotions. For example, the team distributes approximately a quarter of the project’s profit in eco-initiatives. This fact places the project among socially significant projects.

Summary

BaksDAO simplifies market entrance by destroying the language barrier and uniting various services under the roof of a multifunctional platform with an intuitive and user-friendly interface.

- 2022

- active

- Additional

- address

- advantages

- All

- among

- app

- asset

- asset management

- Assets

- audit

- Banks

- being

- binance

- blockchain

- Capacity

- capitalization

- Coins

- community

- component

- could

- Credits

- crypto

- Crypto Exchanges

- cryptocurrencies

- cryptocurrency

- Cryptocurrency Exchange

- decentralized

- Decentralized Finance

- DeFi

- developers

- Development

- DID

- discuss

- example

- exchange

- Exchanges

- expenses

- experts

- Face

- farming

- Feature

- Features

- Fees

- finance

- financial

- focused

- founders

- generate

- getting

- Global

- goal

- governance

- Grow

- Growing

- Growth

- helps

- here

- High

- hold

- How

- How To

- HTTPS

- Impact

- information

- interest

- Interest Rates

- Interface

- intuitive

- investment

- Investments

- investor

- Investors

- issues

- IT

- Key

- language

- Languages

- launch

- lead

- Liquidity

- liquidity providers

- Loans

- local

- locked

- Majority

- management

- Market

- money

- months

- most

- Most Popular

- move

- movement

- offer

- open

- opens

- opportunities

- Options

- organizations

- Other

- Pain

- participants

- platform

- Platforms

- player

- players

- Plenty

- Popular

- price

- Product

- Profit

- profits

- project

- projects

- proof

- provides

- Quarter

- Rates

- reduce

- Resources

- review

- Safety

- Said

- Services

- Share

- significant

- smart

- Social

- Solutions

- stablecoin

- start

- started

- support

- Technical

- third parties

- token

- Tokens

- tools

- traditional

- traffic

- Uniswap

- USD

- users

- value

- Work

- worked

- works

- Yield