Summary: I talk about the mental game of investing, particularly as it applies to crypto markets. Subscribe here and follow me to get weekly updates.

[embedded content]

Last year, I saw a Netflix documentary that I’ve been recommending to everyone. It literally changed my life. (Watch the trailer here.)

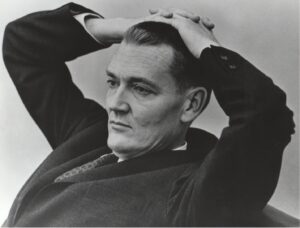

Stutz is a documentary by the actor Jonah Hill, about his psychotherapist Phil Stutz, who is kind of a legend in Southern California. Actors, money managers, Fortune 500 CEOs all go to Stutz, because he’s developed a system that works for people achieving the highest level of success.

This system works for investors, too.

The system, which Stutz calls “The Tools,” is a series of mental visualizations, accompanied by a feeling. You practice these tools throughout the day, whenever you need them.

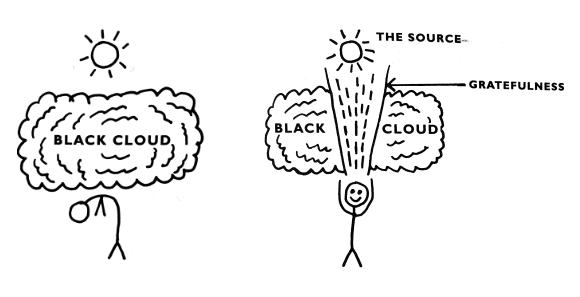

For example, one tool is called “Grateful Flow.” Whenever you feel worry or anxiety, you simply close your eyes, list three things you are grateful for, then hold your mind in the open “flow” of gratefulness. (Full instructions here.)

The documentary does a good job explaining these tools, along with hand-drawn illustrations from Stutz, to help you visualize the visualizations:

Stutz suffers from Parkinson’s and other neurogenerative diseases, which gives the black-and-white documentary a kind of sweet pathos. This is not a Tony Robbins-style self-help guru barking at you about peak performance: this is a wounded healer.

In fact, much of the documentary is about embracing the imperfect parts of ourselves – what Stutz calls “The Shadow” – that we don’t want the world to see. When Jonah Hill decides to embrace his own shadow in the film, it is a brave and memorable moment.

You realize, Well, he just did that, and he’s still alive. Maybe it’s okay for me to do that, too.

For the past few months, I’ve fallen down the Phil Stutz rabbit hole. With his co-author Barry Michels, he’s authored two books: The Tools and Coming Alive. They’ve got a podcast. He’s been a guest on other podcasts, from Marc Maron to Goop. The New Yorker did a feature story on him.

Most importantly, I’ve done the exercises. Rigorously. Every day. I have my Fitbit set to buzz me whenever I’ve been sitting on my ass too long, and I use those random reminders to practice The Tools.

They work. And they work, specifically, for investors. Here’s why.

Overcoming Your Mind

The biggest obstacle we have as investors is our own minds.

No matter how rational you think you are, it’s hard to buy when the market is down, when everyone is moping about “crypto winter.”

And it’s just as hard to avoid buying when the market is up, when the price of bitcoin (or whatever) is soaring to new heights.

It’s hard for me, too.

This is the opposite of how great value investors work: they buy when stocks are “on sale” (i.e., when the market is down). And if they sell, it’s when the stock is “overvalued” (i.e., when the market is up).

The Tools can be used to rewire this self-defeating mental behavior, by working with the emotions that drive us to make bad investing decisions.

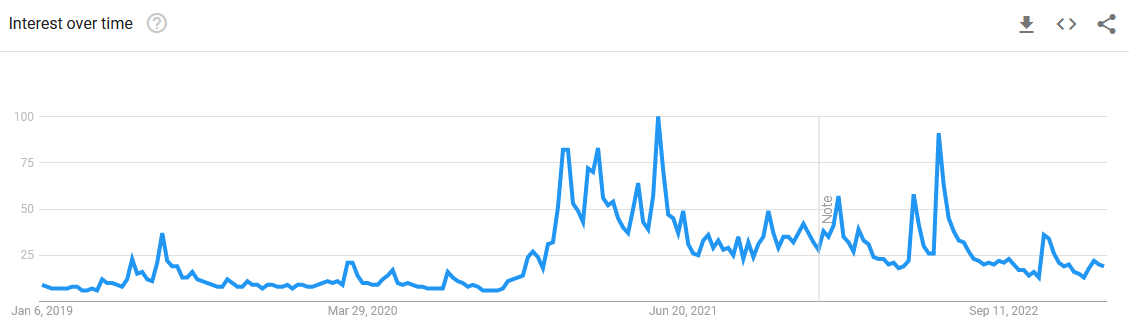

Emotions drive investor behavior, especially in crypto. As I’ve said a thousand times, just watch Google searches for the word “bitcoin,” which spike whenever bitcoin spikes. When the price goes up, suddenly everyone is interested.

The classic feelings are fear and greed. But look more closely, and there’s a tight knot of emotions under these two big boys. Chances are, these emotions dictate many of the life decisions you make – not just the investing decisions.

Fear, for example, comes in many different flavors:

- Fear of missing out

- Fear of looking foolish

- Fear of losing money/security

- Fear of losing status/standing

- Fear of the unknown

So many fears. But we can’t be afraid to work with these fears.

[embedded content]

In another one of The Tools called Reversal of Desire, you visualize:

1) You and your Shadow plunging headlong into a black cloud of these fears, like charging into a battle, shouting, “WE LOVE FEAR!”

2) Amid that chaos and discomfort, the two of you shout, “BRING IT ON!”

3) Eventually the black cloud propels you forward into clear white light, serene and tranquil. You shout, “FEAR SETS US FREE!” and sit for a moment, making a conscious effort to feel the bliss.

These Tools must be practiced over and over again, like a musician practicing scales, or an athlete running drills. Once or twice doesn’t cut it: you have to train your mind like you’re in a marathon.

As you get more proficient at practice, you also get better at identifying the “cues.” These are the emotions, largely unconscious, that signal us it’s time to practice. The more we practice these tools, the more we see when we need to practice them: when the feelings arise.

These feelings can be the investor’s mortal enemy – but they can also become our best friend. Here’s how it’s happening for me.

My Personal Story

At a recent company meeting, we did a StrengthsFinder analysis for all our employees, and my primary strength was an “Achiever.” You can read all about me here, especially my “constant need for attainment.”

Frankly, it’s exhausting.

This relentless ambition drives every minute of my waking day. I am an overachieving workaholic that wants – no, needs – to leave his mark on the world. My greatest fear is that I die without fulfilling my full potential.

(My Shadow – the part of me I don’t want you to see – is the sad-sack guy who once got fired from a job. There he is, standing outside his former workplace, holding a box full of his stuff, wearing an overcoat that’s one size too big.)

Yesterday, I’m walking through downtown Boston, and normally my mind is restlessly comparing my achievements to everyone else’s. “That company just moved into that sweet office space, why isn’t your company there yet?” It’s not an obsession, just a low drone of dissatisfaction, like a mild toothache.

But yesterday I noticed something subtle and profound: the voice was quiet.

It was an incredible relief. I couldn’t put my finger on why I felt so good, but I knew it was related to the inner work with the Tools. Later, with some time to reflect, I realized it’s not that the ambition or achievement are diminished; it’s that the self-critical voice learned to shut up.

“I just love how these tools make me feel,” says Jonah Hill near the end of Stutz. “And I want to share them with the world.”

I get it now.

Focus on the Process, Not the Results

One of Phil Stutz’s big mantras is to “focus on the process, not the results.”

This viewpoint is not natural for us, because our society is all about results. It’s about how much weight you lost, your fourth-quarter sales, your crypto net worth. We just want to see the bottom line, the final number. The results.

But the process is how you get to the results.

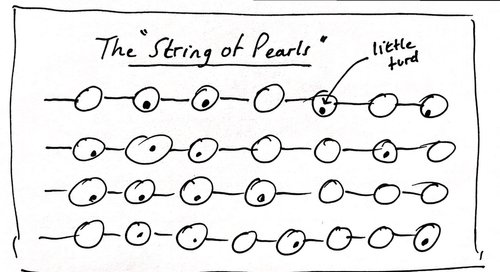

Stutz uses the analogy of a “String of Pearls” (another tool), where every day you get up and do the next right thing. Then the next right thing, and the next. Each right action — each positive habit — is like stringing pearls onto a necklace.

The catch is that each pearl has a tiny turd inside. In other words, each action will feel imperfect. It will not feel natural. It will feel boring, or pointless, or stupid. We want results now.

If you do the right things – like steady-drip investing – it will happen bit by bit, but excruciatingly slowly. Days, months, years will go by. You will think to yourself many times, “Why am I doing this again?”

But if you keep doing the right things, again and again, there comes a day where you look back and it’s like the results just sprang into being. They snuck up on you. Reality changed when you weren’t looking.

The crypto portfolio has suddenly become a comfortable nest egg that will let you retire early. Your body is suddenly in the best shape of your life. Or you walk down the street and realize that you have a newfound inner peace.

Of course we care about the results. It’s that our primary focus is not on the results, but on whether we are committing fully to the process: are we doing the right things, every day? Are we stringing pearls on the necklace?

If so, great things will happen.

Stutz is available on Netflix here. Cheat sheet for The Tools available here.

50,000 crypto investors get this column every Friday. Click here to subscribe and join the tribe.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.bitcoinmarketjournal.com/focus-on-the-process-not-the-results/

- 000

- a

- About

- achievement

- achievements

- achieving

- Action

- actors

- All

- Amazon

- ambition

- Amid

- and

- Another

- Anxiety

- Athlete

- available

- back

- Bad

- Battle

- because

- become

- being

- BEST

- Better

- Big

- Biggest

- Bit

- Bitcoin

- Black

- body

- Books

- Boring

- boston

- Bottom

- Box

- brave

- buy

- Buying

- california

- called

- Calls

- care

- Catch

- CEOs

- chances

- Chaos

- charging

- classic

- clear

- Close

- closely

- Cloud

- Co-Author

- Column

- comfortable

- committing

- company

- comparing

- conscious

- content

- course

- crypto

- Crypto investors

- Crypto Markets

- crypto portfolio

- Cut

- day

- Days

- decisions

- developed

- DID

- Die

- different

- diseases

- documentary

- Doesn’t

- doing

- Dont

- down

- Downtown

- drive

- drone

- each

- Early

- effort

- Else’s

- embedded

- embrace

- embracing

- emotions

- employees

- especially

- eventually

- Every

- every day

- everyone

- example

- explaining

- Eyes

- Fallen

- fear

- fears

- few

- Film

- final

- finger

- flow

- Focus

- For Investors

- Former

- Fortune

- Forward

- Friday

- friend

- from

- full

- fully

- game

- get

- gives

- Go

- Goes

- good

- good job

- google trends

- grateful

- great

- greatest

- Greed

- Guest

- Guy

- happen

- Hard

- headlong

- heights

- help

- here

- highest

- hold

- holding

- Hole

- How

- HTTPS

- identifying

- in

- In other

- incredible

- instructions

- investing

- investor

- Investors

- IT

- Job

- join

- Keep

- Kind

- largely

- learned

- Leave

- Level

- Life

- light

- Line

- List

- Long

- Look

- looking

- losing

- love

- Low

- make

- Making

- Managers

- many

- Marathon

- mark

- Market

- Markets

- Matter

- max-width

- meeting

- mental

- mind

- minute

- missing

- moment

- money

- months

- more

- Musician

- Natural

- Near

- Need

- Nest

- net

- Netflix

- New

- next

- normally

- number

- obstacle

- Office

- official

- Okay

- ONE

- open

- opposite

- Other

- outside

- own

- part

- particularly

- parts

- past

- Peak

- People

- performance

- personal

- PHIL

- plato

- Plato Data Intelligence

- PlatoData

- plunging

- Podcasts

- portfolio

- positive

- potential

- practice

- price

- primary

- process

- put

- Rabbit

- random

- Rational

- Read

- Reality

- realize

- realized

- recent

- recommending

- reflect

- related

- relentless

- relief

- Results

- Reversal

- Rewire

- running

- Said

- sales

- says

- scales

- sell

- Series

- set

- Sets

- Shadow

- Shape

- Share

- Signal

- simply

- Sitting

- Size

- So

- soaring

- Society

- some

- something

- Southern

- Space

- specifically

- spike

- spikes

- Still

- stock

- Stocks

- street

- strength

- success

- Suffers

- sweet

- system

- Talk

- The

- the world

- thing

- things

- three

- Through

- throughout

- time

- times

- to

- Tony

- too

- tool

- tools

- trailer

- Train

- Trends

- Tribe

- under

- Updates

- us

- use

- value

- Voice

- walking

- Watch

- weekly

- weight

- What

- whether

- which

- white

- WHO

- will

- Winter

- without

- Word

- words

- Work

- Workplace

- works

- world

- worth

- year

- years

- Your

- yourself

- youtube

- zephyrnet