Ethereum gracefully rose from the support formed at $1,750 to trade near $2,800. The recovery was not unique to the pioneer altcoin but cut across the market, with Bitcoin rising from $30,500 to $38,000.

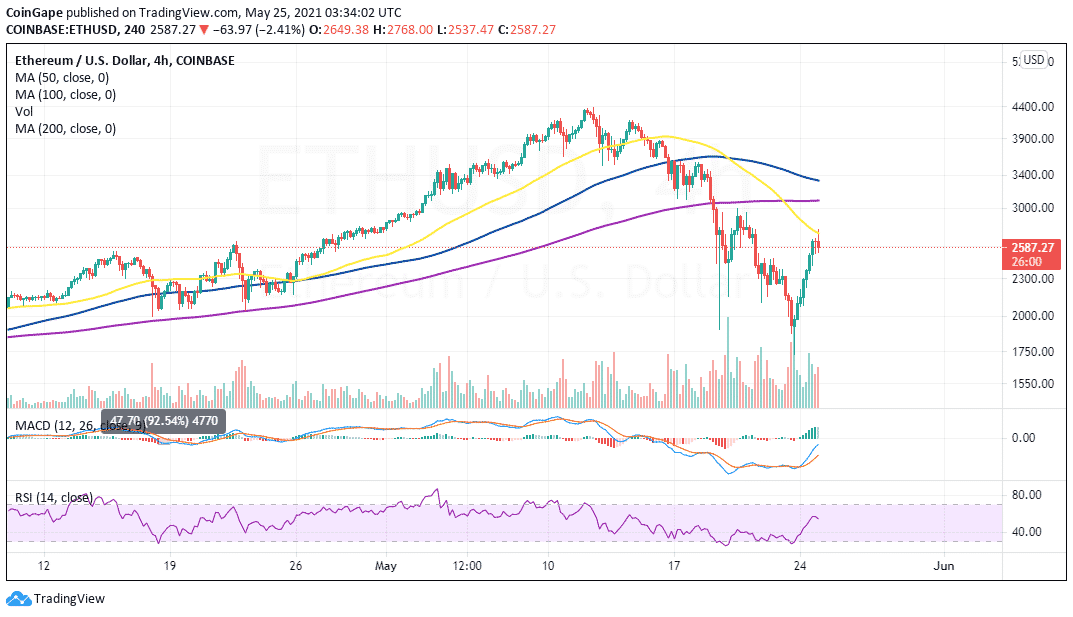

However, the 50 Simple Moving Average (SMA) on the four-hour chart curtailed the bullish development, adding credence to the bearish pressure. An ongoing correction has pushed ETH to trade slightly above $2,500 at writing.

The gigantic smart contract token currently seeks higher support to resume the uptrend eyeing $3,000. Nonetheless, the Relative Strength Index (RSI) shows that the bullish momentum is fading, and bulls may not have the ability to rally beyond $3,000 right away.

It is essential to keep in mind the formation of a death cross pattern on the four-hour chart. The highly bearish pattern came into the picture after the 50 SMA crossed below the 100 SMA. This formation implies that overhead pressure intensifies, and bears have the upper hand.

ETH/USD four-hour chart

Failing to make a four-hour close above $2,500 may lead to more losses. The next tentative anchor zones include, $2,000 and $1,750.

Looking at the side of the fence

The Moving Average Convergence Divergence (MACD) still has a bullish impulse despite the retreat from the highs traded on Monday. The wide divergence made by the MACD line (blue) above the signal line is a formidable bullish signal, likely to call more buyers into the market. Besides, trading above the 50 SMA may trigger immense buy orders as bulls gaze at levels beyond $3,000.

Ethereum intraday levels

Spot rate: $2,586

Trend: Bearish

Volatility: High

Support: $2,500, $2,300 and $2,000

Resistance: The 50 SMA on the four-hour chart and $3,000

To keep track of Crypto updates in real time, Follow us on Twitter & Telegram.

Disclaimer

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Handpicked Stories

- "

- &

- 000

- 100

- 9

- Altcoin

- analysis

- avatar

- bearish

- Bears

- Bullish

- Bulls

- buy

- call

- content

- contract

- crypto

- cryptocurrencies

- cryptocurrency

- Development

- ETH

- ETH/USD

- ethereum

- Ethereum Price

- financial

- Focus

- follow

- hold

- HTTPS

- index

- industry

- Industry News

- investing

- lead

- Line

- Market

- market research

- Momentum

- Monday

- Near

- news

- Opinion

- orders

- Pattern

- picture

- prediction

- pressure

- price

- Price Analysis

- Price Prediction

- rally

- recovery

- research

- Share

- Simple

- smart

- smart contract

- support

- time

- track

- trade

- Trading

- Updates

- us

- writer

- writing

- years

✓ Share: