Sharp Decline May Cast Doubt on Summer Rally

With network activity plunging, Ethereums transaction fees are now at their lowest level since the heady days of DeFi Summer in mid-2020, according to data from Ycharts.

Ethereums average fees are at their lowest level in two years, with transactions executing for less than 13 gwei a pop.

Summer Rally

The sharp decline in on-chain activity may also cast doubt on the bullish signal thats been driving a summer rally in Ethereum and other DeFi names: The Merge.

Investors may have to reckon with the likelihood that more Ether may not be destroyed than new coins are issued after the network shifts to Proof-of-Stake consensus in September.

In August 2021, Ethereums EIP-1559 upgrade went live, introducing the burning of base transactions fees. From then on, a portion of each Ethereum transaction fee is permanently destroyed.

The Merge

Coupled with the rapidly approaching Eth2 Proof of Stake chain-merge, many analysts tipped the network to become deflationary — meaning more Ether is removed from supply through burning than is created as validator rewards — after The Merge is executed next month.But with network activity plummeting amid the bear trend, Ethereums deflationary narrative is currently looking uncertain. Demand for block space must increase by roughly one-third from current levels in order for the burn rate to keep pace with post-merge Ether issuance.

Ethereums transaction fees are now at their lowest level since decentralized finance began to attract a significant user base during the DeFi Summer of mid-2020. According to Ycharts, average daily transaction fees are currently around 12.5 gwei, its lowest level since April 2020.

Gas fees are also falling to low single-digits during off-peak hours, with transactions executing for as little as 4 gwei.

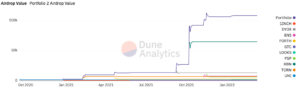

The recent drop in on-chain activity has dramatically driven down Ethereums burn rate with it. According to Ultra Sound Money, a website tracking Ethereums burn rate, just 7,440 ETH was destroyed over the past seven days — its lowest level since EIP-1559 went live last year.

By contrast, the burn-rate peaked in January amid the top of the NFT bubble, when more than 12 ETH was burned every minute, equating to 121,000 per week.

The Merge will unify the Eth2 Proof of Stake Beacon Chain with the current Ethereum mainnet execution layer next month. The upgrade has been tipped to usher in a more than 99% improvement in the networks energy efficiency and a 90% decrease in new Ether issuance.

While many analysts are still tweeting that Ethereum will become deflationary when the upgrade goes live, the recent drop in network activity is challenging this hypothesis.

Burn Rate

The current burn-rate would offset two-thirds of Ether issuance after The Merge, according to Justin Drake, a researcher at the Ethereum Foundation. In a recent appearance on The Defiant Podcast, Drake predicted that 1,600 ETH will be issued daily once Ethereum has transitioned to Proof of Stake, equal to 11,200 Ether each week.

Ethereums burn rate will change over time, steadily increasing as stakers lock up ETH to run a node and become a network validator.

Speaking during the fifth EthCC conference in July, Vitalik Buterin, Ethereums co-founder and chief scientist, said that new Ether will be issued annually at the complicated rate of 166 times the square root of the number of staked ETH.

This means that if 1M ETH is staked, 166,000 new Ether will enter into circulation each year, but if 100M ETH is staked, issuance will only be increased to 1.66M Ether.

According to Staking Rewards, nearly 13,15M ETH or 10.8% of circulating Ether is currently locked up for staking, According to Buterins equation, 1,649 new ETH would be issued daily under Proof of Stake, equal to 11,543 Ether weekly.

Despite The Merge not yet taking effect, Ethereum has already produced 26 days of deflationary issuance since transaction fee burning was introduced.

NFT Activity

Ethereum has posted two full weeks of deflationary issuance so far, according to data from Watch The Burn. The first week occurred at the end of October towards the peak of the broader digital asset markets, with surging NFT activity driving the second week of negative issuance in January.

The largest daily burn on record occurred on May 1 as fees soared amid the extreme gas wars surrounding Yuga Labs Otherdeeds NFT land sale. More than 58,000 Ether were destroyed in a single day, worth nearly $160M at the time.

Ethereums most recent deflationary day was posted on May 12, when 5,391.66 ETH was permanently removed from supply.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- The Defiant

- W3

- zephyrnet