DBS has rolled out self-directed crypto trading, enabling wealth clients who are accredited investors to trade cryptocurrencies on DDEx.

With clients’ bank accounts and DDEx custody accounts seamlessly linked via DBS digibank, clients’ funds can be directly debited.

Starting from a minimum investment sum of US$500, accredited wealth clients will be able to trade four cryptocurrencies namely Bitcoin, Bitcoin Cash, Ethereum, and XRP.

Previously, crypto trading on DDEX was limited to corporate and institutional investors, family offices, and clients of DBS Private Bank and DBS Treasures Private Client only.

With this latest initiative, the service is now available to accredited investors in the DBS Treasures segment as well.

For a start, some 100,000 of these clients in Singapore will be able to access the services offered by DBS’ digital asset ecosystem.

Clients will have their cryptocurrency holdings reflected alongside the rest of their portfolio in DBS digibank.

The bank said that accredited investors who are interested in accessing the crypto trading function on DBS digibank can contact their relationship managers.

DBS added that it is also working on enhancing other aspects of the user journey to make it even more seamless, such as by digitalising the onboarding process, which is slated for rollout in 2023.

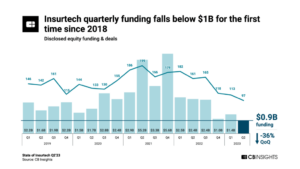

Between the months of April and June 2022 when volatility in cryptocurrency markets started increasing, the total number of trades on DDEx doubled, and the quantity of bitcoin bought rose nearly four times.

Sim S. Lim

Sim S. Lim, Group Executive, Consumer Banking and Wealth Management at DBS Bank said,

“As a trusted partner that helps our clients to grow and protect their wealth, we believe in staying ahead of the curve and providing access to the solutions they seek.

Broadening access to DDEx is yet another step in our efforts to provide sophisticated investors looking to dip their toes in cryptocurrencies with a seamless and secure way to do so.”

- ant financial

- blockchain

- blockchain conference fintech

- chime fintech

- coinbase

- coingenius

- crypto

- crypto conference fintech

- DBS

- fintech

- fintech app

- fintech innovation

- Fintechnews Singapore

- OpenSea

- PayPal

- paytech

- payway

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- razorpay

- Revolut

- Ripple

- square fintech

- stripe

- tencent fintech

- xero

- zephyrnet