As overall startup investment declines, the share of funding done by corporate venture backers appears to be on the rise.

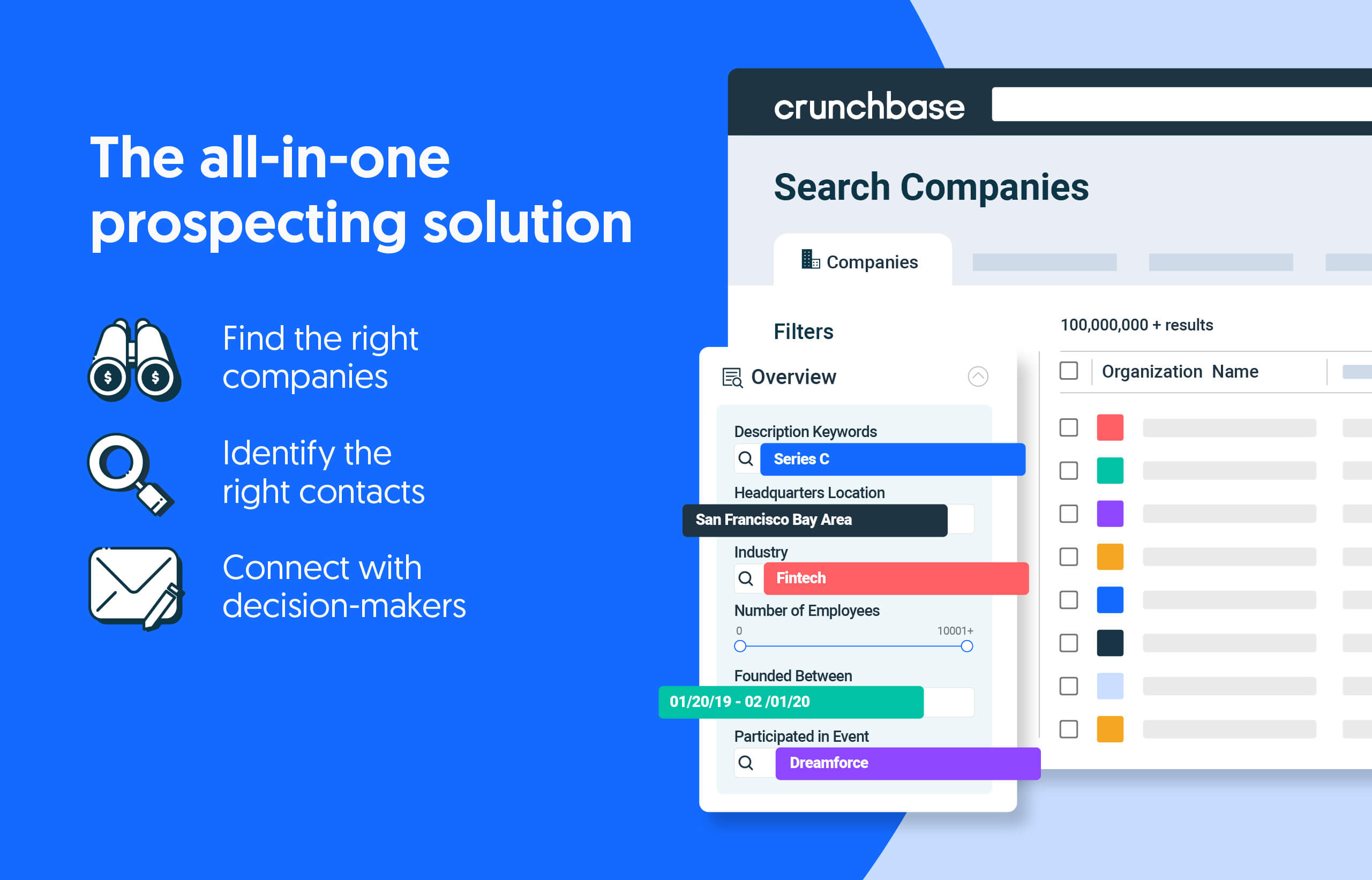

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

So far in 2023, several of the most active corporate investors are leading or co-leading a larger share of rounds compared to last year. They’re also leading a number of the year’s largest financings.

Per an analysis of Crunchbase data, roughly a quarter 1 of U.S. rounds of $100 million and up this year listed a corporate investor 2 as lead or co-lead backer. This includes the largest financing by a long shot: Microsoft’s $10 billion investment in OpenAI.

Several other jumbo-sized deals this year count Google or its venture firm, GV, as lead backer. This includes a $300 million Google investment into AI platform Anthropic, as well as GV-led Series B rounds for genetic medicine startups Aera Therapeutics and Chroma Medicine of $193 million and $135 million, respectively.

Corporate VCs leading more deals

GV is one of a few active corporate investors that are leading a larger portion of deals this year.

Per Crunchbase data, so far in 2023, GV has led nearly 60% of rounds it’s joined. That’s up from just over a quarter in 2022.

Salesforce Ventures 3, a voluminous check-writer for startups in enterprise software and related areas, has been taking a larger role in investments too. It led or co-led more than half of its deals this year, up from less than one-fifth in 2022, per Crunchbase data

And Intel Capital, traditionally one of the busiest dealmakers in corporate venture, is also increasingly taking the lead. So far this year, the software- and deeptech-focused investor has led over half of the rounds it’s backed, up from roughly a third last year.

Even heavy industry is investing big. One of the most prominent deals along these lines this year is a $120 million financing for low-carbon steelmaker Boston Metal led by industrial heavyweight ArcelorMittal.

Corporates are getting ‘pulled in’

There are a few likely contributing factors to corporate investors’ increasingly prominent role in startup funding.

One is that other venture investors, including many of the biggest growth-stage firms, have been scaling back. SoftBank Vision Fund and Tiger Global Management, two names that used to reliably top our most active investor lists, have carried out particularly dramatic pullbacks. More broadly, a majority of the most active seed and venture investors globally cut their deal-making pace in the first quarter of this year.

As other VCs slim down, corporate investors are apparently being asked to bulk up.

“It’s quite interesting, the degree to which they are more pulled in than they’ve experienced in the past,” said Andrew Binns, co-founder of Change Logic, a business consultancy that works with established companies on innovation strategy. Corporate investors with stakes in startups are seeing more requests to take a larger role in follow-on rounds or provide bridge financing, he said.

Of course, corporate investors don’t write huge checks or lead new rounds just because someone asked. They’re no more likely than anyone else to prop up high valuations for startups in sectors where competitors have already taken a haircut. A deal has to make strategic sense, financial sense, or, optimally, both.

However, corporate investors may have different time horizons or investment goals than most venture firms. GV, for instance, counts Alphabet as its sole limited partner and touts that it “operates on long time horizons and deals in decades — not rounds.” Microsoft’s OpenAI investment announcement, meanwhile, was chock full of strategic rationale for the deal, with plans to deploy its technology in supercomputing, developer tools and consumer-facing products.

Having an exceptionally long time horizon or a strategic reason to enter a deal makes the decision to extend financing to a startup a little more compelling in a time when the IPO market is stagnant, big M&A deals are down, and valuations are still under pressure.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

We look at the intersection between cybersecurity and artificial intelligence.

The appetite for intranet platforms has remained resilient during the pandemic, with over $2.4 billion raised in the space in 2022.

Mavenir expects to use the new capital for — what else? — adding AI tools.

Five companies joined The Crunchbase Unicorn Board in April 2023 — the sixth month in a row for single digits. Three are in the AI sector.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: https://news.crunchbase.com/venture/vcs-corporate-investors-lead-rounds-ai-chart/

- :has

- :is

- :not

- :where

- $100 million

- $193 million

- $UP

- 2022

- 2023

- a

- acquisitions

- active

- adding

- AI

- AI platform

- all-in-one

- along

- already

- also

- an

- analysis

- and

- anyone

- appetite

- April

- ARE

- areas

- artificial

- artificial intelligence

- AS

- At

- back

- backed

- backers

- BE

- because

- been

- being

- between

- Big

- bigger

- Biggest

- Billion

- board

- both

- BRIDGE

- broadly

- business

- by

- capital

- Checks

- Close

- Co-founder

- Companies

- compared

- compelling

- competitors

- consultancy

- contributing

- Corporate

- course

- cover

- CrunchBase

- Cut

- Cybersecurity

- daily

- data

- Date

- deal

- dealmakers

- Deals

- decades

- decision

- Declines

- Degree

- deploy

- Developer

- different

- digits

- done

- Dont

- down

- dramatic

- during

- end

- Enter

- Enterprise

- enterprise software

- established

- expects

- experienced

- extend

- factors

- far

- few

- financial

- financing

- Firm

- firms

- First

- For

- For Startups

- from

- full

- funding

- funding rounds

- getting

- Global

- Goals

- GV

- Half

- Have

- he

- heavy

- Heavyweight

- High

- horizon

- Horizons

- HTTPS

- huge

- in

- includes

- Including

- increasingly

- industrial

- industry

- Innovation

- Innovation Strategy

- instance

- Intelligence

- interesting

- intersection

- into

- investing

- investment

- investment goals

- Investments

- investor

- Investors

- IPO

- IT

- ITS

- joined

- jpg

- just

- larger

- largest

- Last

- Last Year

- lead

- leader

- leading

- Led

- less

- likely

- Limited

- limited partner

- lines

- Listed

- Lists

- little

- Long

- long time

- Look

- low-carbon

- M&A

- Majority

- make

- MAKES

- many

- Market

- May..

- Meanwhile

- medicine

- Microsoft

- million

- Month

- more

- most

- names

- nearly

- New

- no

- number

- of

- on

- ONE

- OpenAI

- or

- Other

- our

- out

- over

- overall

- Pace

- pandemic

- particularly

- partner

- past

- plans

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- powered

- pressure

- Products

- prominent

- provide

- Quarter

- raised

- reason

- recent

- Recent Funding

- related

- remained

- requests

- resilient

- respectively

- revenue

- Rise

- Role

- roughly

- rounds

- ROW

- s

- Said

- scaling

- sector

- Sectors

- seed

- seeing

- sense

- Series

- Series B

- several

- Share

- shot

- single

- sixth

- So

- so Far

- Software

- Solutions

- Someone

- Space

- startup

- startup funding

- Startups

- stay

- Still

- Strategic

- Strategy

- Supercomputing

- Take

- taking

- Technology

- than

- that

- The

- their

- These

- they

- Third

- this

- this year

- three

- time

- to

- too

- tools

- top

- traditionally

- two

- u.s.

- under

- unicorn

- use

- used

- Valuations

- VCs

- venture

- vision

- was

- WELL

- What

- when

- which

- with

- works

- write

- year

- Your

- zephyrnet