Introduction

It’s clear that web3 gaming is experiencing a period of creative transition and upheaval. We are navigating the aftermath of Axie’s ascendancy validating the web3 gaming vertical, as well its subsequent retrenchment alongside the broader market softness over recent months. However, I continue to believe that innovation tends to follow disruption; we can and should expect web3 technologies to become increasingly integrated into the next generation of interactive entertainment, a trend I’ll call convergent gaming.

Convergent gaming is the foundational shift of interactive entertainment from legacy, centralized systems of game development to those powered by the same underlying core web3 technologies and primitives that CoinFund has already been exploring and supporting for the past 7 years. This trend will expose the continued inability of centralized systems of development and monetization to serve an increasingly global, fat-tailed and demanding player base. At the same time, this shift will crown new winners who enable deeper levels of engagement, with greater reach and positive-sum economic activity that have never before been seen in the history of gaming. Convergent gaming is driven by four major themes: gap-closing gameplay, incumbent lethargy, truly open economies, and the enablement of even more creators. We’ll explore each of these in discrete sections below.

Theme 1: Gap-closing Gameplay:

The sad truth is that many cryptonative games available today are not fun enough to stand on their own, but it’s a situation that is being remedied in real time. Specifically, the “second gen” studios and titles are much more deliberate about leveraging best practices and modern gameplay design philosophies. We are finally seeing high quality, and genre specific, exploration, combat, narrative, and itemization systems being designed and deployed on the player-facing UX side. This is largely driven by founders coming over from quality traditional studios and publishers in the hopes of dominating the competition within a new paradigm.

For example, a premium third person extraction shooter in development, Gunzilla’s Off the Grid, is much more focused on balancing player encounter time-to-kill, deliberately introducing randomness to make gun metas harder to solve (and thus engage the player base more), while optimizing session experiences through evenly distributed points of interest within a map with strong native narrative design as well. An action role playing game under development, Crystals of Naramunz, is taking some of the best elements from the Diablo, Path of Exile, and Guild Wars series in terms of class progression, skills-as-items (which should also play well in the “everything is an NFT” end state), and incorporating tokens powered by open economies.

Based on our observations, almost all major gaming genres at this point have web3-native projects under development all trying to launch a product that can successfully capture and keep the next 5M+ users.

Theme 2: Incumbents’ Innovation Dilemma:

Traditional game publishers are struggling under the creative and commercial successes of their pasts. They often find themselves falling short due to rushed timetables driven by financial pressure from public equity investors. At the same time, the relatively small (for now) size of web3 gaming markets likely has led incumbents to underinvest in the opportunity, opening the door to native game developers to have multiple (mostly uncontested) shots on goal.

The open economies of web3 games run counter to the status quo of extractive monetization by incumbents, especially in the world of F2P mobile games. Over the past few years, gamers’ patience has been eroded as rushed/buggy launches, feature regression (sequels having fewer gameplay elements than predecessors) and poor framerate / cross-platform porting. Major incumbents have been chastised for offering less for more, EA (Battlefield 2042), 343 Industries (Halo Infinite), and CD Projekt Red (Cyberpunk 2077) have all been the subject of ire.

Many large game studios are focused on trying to win their customers back by trying to be just a little bit less aggressive (for a history lesson, check out EA’s Battlefront 2 Loot Box fiasco from 2017) and aren’t fully exploring NFTs beyond surface-level implementations (cosmetic items in a flanker brand’s F2P mode), and others any have backed off after triggering a vocal but likely non-representative minority. This is almost a textbook definition of falling into the innovator’s dilemma trap, as they now are effectively in the process of shutting the door on new monetization models that can actually be used to activate an even larger percentage of the adult population (for example, opening up not only primary but secondary market transaction revenue).

Understandably, this is due in part to preserving their primary revenue streams today (for example, Riot is estimated to be making hundreds of millions per year from their annual championship skins set at effectively 100% gross margin per unit), but most of the incumbents choosing to bide their time under the assumption that they can quickly catch up once the market is fully validated are being overly optimistic about how much time they will need to catch up once the train leaves the station.

Theme 3: Truly Open Economies

We expect high velocity virtual assets (individual items and/or a game’s medium of exchange currency) to take on more monetary premia than ever before. Improved liquidity, marketability, value preservation, and immutability all confer permanent value enhancements over the current non-transferable, centralized, and closed economies driven purely by single-sided consumption.

Open networks of players, creators, buyers and sellers are facilitating an important shift. Similar to the initial trends seen in early game NFTs like Axie Infinity, community analysis suggests that opening up the secondary market in video games, so long as inflation concerns are offset by limited availability, durability etc., helps developers have their new monetization cake and eat it too by sharing the wealth creation with players themselves. In the analog world, other examples of successful secondary markets helping versus hurting an ecosystem can be seen by how Magic the Gathering has encouraged a robust economy for its paper (non-digital) cards for 30+ years, managing formats via rotations, restricted and reserved lists, etc.

I came of age during the heyday of World of Warcraft, and personally have befriended gold farmers and proprietors of farming operations. Most of those behaviors were against the Blizzard terms of service, yet represented a form of victimless, voluntary engagement that still constitutes a gray market in games today. Gold farming thrived because you needed gold for end-game reagent crafting, skill training, and equipment repair. If the average player only wants to do 1 hour of in-game chores over a week but 10 are required to be competitive in the end-game, lower opportunity cost laborers will naturally fill the gap. The way forward is to encourage market forces that favor truly fun gameplay through open economies.

Theme 4: More Creators, Everywhere

As tooling continues to improve, more and more players become devs as low-code and no-code environments are stood up. The winning games in the convergent future likely will have parts of their content created by centralized devs to start, but “seasons” of new content and opt-in economic resets power greater community contribution than ever before.

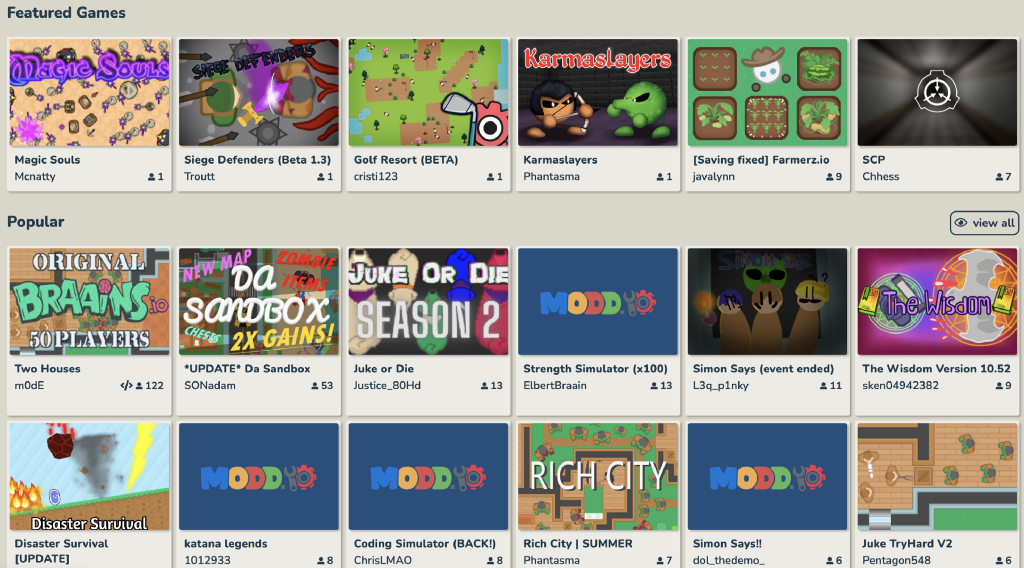

The development of critical middleware such as full-stack prototyping (modd.io), metaverse business intelligence (datawisp.io), and bridge-like SDKs are all going to make game design and creation an even more democratized process. We saw a similar phenomena when the amalgamation of broadband internet, and cameras on laptops and smartphones enabled a whole generation of content creators.

In the hypothetical future an individual or group of passionate but inexperienced (by traditional resume standards) game devs will have more opportunities to contribute to collaboratively-designed games before then leveraging a game studio DAO to greenlight / fund a game of their own.

Conclusion

As I’ve said in many conversations over the past year, it has been amazing to see what used to be a closet hobby of mine, gaming, become a trend that can help further broaden the visibility and impact of distributed ledger technologies, a realization that seems so obvious in hindsight. At the same time, my own firsthand experience with how much care goes into the game design/systems that end up being sustainably popular classics (FF7’s materia, God of War’s story, Escape from Tarkov’s armor vs. penetration, Elden Ring’s genius nudging of player exploration, just to name a few examples from a long list) as well as why others fall short (Halo Infinite’s lack of open world points of interest, Diablo Immortal’s likely overtuned monetization which could hurt longevity and Diablo 4 box sales). Overall, I can’t help but be excited for the new experiences being crafted by game developers who understand the power and responsibility of incorporating web3 into their toolkit of design. See you all in the open metaverse!

The views expressed here are those of the individual CoinFund Management LLC (“CoinFund”) personnel quoted and are not the views of CoinFund or its affiliates. Certain information contained herein has been obtained from third-party sources, including from portfolio companies of funds managed by CoinFund. While taken from sources believed to be reliable, CoinFund has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; CoinFund has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by CoinFund. (An offering to invest in a CoinFund fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by CoinFund, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by CoinFund (excluding investments for which the issuer has not provided permission for CoinFund to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://www.coinfund.io/portfolio.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

Convergent Gaming: Blockchain as the Hero, not the Villain was originally published in The CoinFund Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

- Coinsmart. Europe's Best Bitcoin and Crypto Exchange.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. FREE ACCESS.

- CryptoHawk. Altcoin Radar. Free Trial.

- Source: https://blog.coinfund.io/convergent-gaming-blockchain-as-the-hero-not-the-villain-b7d2aab258?source=rss----f5f136d48fc3---4

- "

- 10

- 7

- a

- ability

- About

- acquire

- Action

- activity

- addition

- Advertising

- advice

- advisory

- affiliates

- against

- Agreement

- All

- alongside

- already

- amazing

- among

- analysis

- annual

- Assets

- assurance

- availability

- available

- average

- Axie

- backed

- Battlefield

- because

- become

- before

- being

- below

- BEST

- best practices

- Beyond

- Bit

- blockchain

- Box

- broaden

- business

- business intelligence

- buyers

- cameras

- capture

- Cards

- care

- Catch

- CD

- centralized

- certain

- change

- class

- closed

- combat

- coming

- commercial

- community

- Companies

- competition

- competitive

- constitute

- consumption

- content

- continue

- continues

- contribute

- Conversation

- conversations

- Core

- could

- created

- creation

- Creative

- creators

- critical

- Currency

- Current

- Customers

- DAO

- decision

- deeper

- deployed

- described

- Design

- designed

- developed

- developers

- Development

- Devs

- differ

- digital

- Digital Assets

- Disruption

- distributed

- Distributed Ledger

- driven

- during

- each

- Early

- eat

- Economic

- economy

- ecosystem

- effectively

- elements

- enable

- encourage

- endorse

- engage

- engagement

- Entertainment

- entirety

- equipment

- equity

- especially

- estimated

- estimates

- etc

- example

- examples

- exchange

- excited

- excluding

- expect

- experience

- Experiences

- experiencing

- exploration

- explore

- expressed

- fan

- farmers

- farming

- Feature

- Finally

- financial

- FLEET

- focused

- follow

- form

- Forward

- founders

- from

- full

- fun

- fund

- funds

- further

- Furthermore

- future

- game

- gameplay

- Games

- gaming

- gap

- Gates

- gathering

- generation

- GitHub

- Global

- goal

- going

- Gold

- gray

- greater

- Grid

- Group

- having

- help

- helping

- helps

- here

- High

- history

- hopes

- House

- How

- However

- HTTPS

- Hundreds

- immutability

- Impact

- important

- improve

- improved

- in-game

- include

- Including

- increasing

- increasingly

- independently

- individual

- industries

- Infinity

- inflation

- information

- Innovation

- integrated

- integration

- Intelligence

- interactive

- interest

- Internet

- introducing

- investment

- Investments

- Investors

- IT

- Keep

- laptops

- large

- larger

- launch

- launches

- Led

- Ledger

- Legacy

- Legal

- Level

- levels

- leveraging

- likely

- Limited

- Liquidity

- List

- Lists

- little

- LLC

- Long

- made

- major

- make

- MAKES

- Making

- managed

- management

- managing

- map

- Market

- Markets

- materials

- Matters

- medium

- mentioned

- Metaverse

- millions

- minority

- Mobile

- models

- Monetary

- monetization

- money

- months

- more

- most

- multiple

- navigating

- networks

- next

- NFTs

- obtained

- obvious

- offer

- offering

- offset

- online

- open

- opening

- Operations

- Opinions

- opportunities

- Opportunity

- optimizing

- Other

- overall

- own

- Paper

- paradigm

- part

- passionate

- People

- percentage

- performance

- period

- permanent

- person

- Personnel

- plans

- Play

- player

- players

- playing

- Point

- points

- poor

- Popular

- population

- portfolio

- power

- powered

- Premium

- pressure

- primary

- private

- process

- Product

- profitable

- progression

- projections

- projects

- prospects

- prototyping

- provide

- provided

- public

- published

- publishers

- purposes

- quality

- quickly

- reach

- real-time

- recent

- released

- relevant

- reliable

- representative

- represented

- required

- reserved

- responsibility

- Results

- resume

- revenue

- Role

- Run

- Said

- sales

- same

- secondary

- Securities

- Sellers

- sequels

- Series

- service

- Services

- set

- sharing

- shift

- Short

- similar

- situation

- Size

- small

- smartphones

- So

- SOLVE

- some

- Speaks

- specific

- specifically

- stack

- stand

- standards

- start

- State

- station

- Status

- Still

- Story

- strong

- studio

- subject

- subscription

- successful

- Successfully

- Supporting

- Systems

- taking

- tax

- Technologies

- terms

- The

- the world

- third-party

- Through

- time

- today

- Tokens

- tool

- toolkit

- traditional

- Train

- Training

- transaction

- transition

- Trends

- under

- understand

- use

- users

- ux

- validated

- value

- Vehicles

- VeloCity

- Versus

- Video

- video games

- Virtual

- virtual assets

- visibility

- Wealth

- Web3

- week

- What

- while

- WHO

- win

- winners

- winning

- within

- without

- world

- year

- years

- Your

- youtube