Before the pandemic, co-living as a housing solution was already gaining popularity as urbanization caused rents to rise in major cities. Now, the concept of living in accommodations with communal spaces is making a comeback after the pandemic left a rental affordability crisis and loneliness epidemic in its wake.

Early this year, the largest co-living operator in North America, Common, announced a merger with Habyt, the largest co-living operator for Europe and Asia. The result is a global leader in co-living that will operate 30,000 units worldwide, many of them co-living spaces. It is estimated that there were 74,000 total co-living bedrooms either for-rent or in development in the U.S. in 2022. At the end of 2019, real estate investment firm CBRE found that there were about 5,000 beds in only about 150 co-living communities around the country. It’s a rapidly accelerating trend, and research shows it may have staying power.

What Is Co-Living?

Co-living has always been a way to save money on rent—groups of friends, especially young single people, often rent shared spaces to save money on their monthly housing costs. But modern co-living spaces are different. Buildings constructed or renovated with the intent of unrelated individuals sharing the same living space often come with top-of-the-line amenities. Think of higher-end decor and furnishings, fitness and yoga studios, expansive co-working areas, and perks like cleaning services and high-speed WiFi. People typically live in individual, furnished bedrooms but share common areas like kitchens, bathrooms, laundry facilities, and living areas.

There are variations in how these spaces are operated. Some companies, like Outsite, use a membership model, where digital nomads can book spaces for as few as three nights. Others, like Bungalow, work as a tech platform that connects roommates seeking housing in major cities and subleases homes to them. Companies like Common offers a combination of private units with co-working spaces and shared units with private bedrooms.

The rising popularity of co-living spaces has also created a market for co-owned units. For example, the Co-Own Co. in Denver allows homebuyers to purchase a share of a unit with a private bedroom and bathroom. It’s a way for individuals to start building equity for a fraction of the typical cost of buying a home in the city. Some developers are also applying the co-living concept to single-family homeownership by building communities with a common house and other amenities and providing programming designed to foster community.

A Solution to Two Distinct Problems

Skyrocketing rents

The rent-to-income ratio in the U.S. is now 30%, an increase from 27.2% in 2019. In some cities, the problem is far worse—in New York, the ratio is 68.5%, and in Miami, it’s 41.6%. High rents are making it difficult for residents to afford elevated prices on gas and groceries and to stash away enough savings to hope for homeownership.

The surge in rental prices, which hit 17.1% year-over-year growth at its peak in February of 2022, was mostly due to limited inventory and high demand for more space during the pandemic. In some pandemic boomtowns, such as Austin, Texas, rents more than doubled within a year.

The rental market is starting to cool—national average asking rents are declining, according to Zillow. Multifamily inventory is forecasted to increase in 2023 as well. But rents remain elevated at 8.4% higher when compared to the same time last year, and apartment homes are still out of reach for many residents of urban areas. In 2022, there were 16% more chronically homeless individuals than there were in 2020. Since limited space relative to the number of residents seeking apartments is a significant part of the problem, co-living is a natural solution.

Even before the pandemic, local governments were examining the prospect of shared living spaces as a potential fix for unaffordable rents. Through SharedNYC, New York City’s Department of Housing Preservation and Development selected three proposals for shared housing developments with various models designed to provide housing to low-income residents. And in San Jose, California, lawmakers adjusted the local zoning code to include co-living, allowing a new development with 800 units to begin construction.

For decades in the U.S., boarding houses prevented homelessness for low-income urban workers. In the 1960s, it’s estimated that there were about 2 million “single room occupancy” units, similar in concept to modern co-living units. The National Alliance to End Homelessness sees the return of shared housing as a solution that would end homelessness for most people. Most modern co-living spaces rent for just slightly below market rate, but there’s an opportunity for multifamily developments that use a co-living model to bring even more affordable units to market.

The epidemic of loneliness

Renters who choose co-living may get more bang for their buck—luxury apartment amenities at below-market rental prices—but that’s not the primary reason most people rent a modern co-living unit, according to a survey co-organized by IKEA’s research and design lab. Respondents said the best benefit of co-living was the opportunity for social interaction.

Co-living spaces offer numerous opportunities for community building through both incidental interactions and intentional programming. Digital nomads can take a moment to socialize at the “water cooler,” just like employees who work in offices. Families can get support with child-rearing. Solo seniors can gather for meals. And everyone can have someone to call if they’re injured or need help. There are additional benefits for transplants who may need to move quickly without support—not only does co-living offer easier access to furnished spaces, but it also delivers an instant social circle. Some co-living companies even work to place roommates with common interests.

That’s kind of a breath of fresh air for the astounding percentage of Americans experiencing “serious loneliness.” A report from the Harvard Graduate School of Education puts the figure at 36% of all Americans, including 51% of mothers with young children and 61% of young adults. Social isolation can increase your risk of several serious health issues and is a risk factor that rivals even smoking when it comes to premature death. Loneliness is correlated with higher rates of anxiety, depression, and even suicide.

Issues with the Co-Living Model

Some co-living companies have yet to work out the operational kinks. For example, residents of Common’s co-living spaces complained of unsanitary conditions, poor security, hostility among roommates, and poor communication from the support team. Residents of Bungalow properties in New York reported finding strangers in their bedrooms, which were kept unlocked due to local law. They also complained of poor communication and sudden lease terminations, calling the operation a “scam.”

The complaints are drawing the attention from local lawmakers, who could respond by cracking down on this form of rental housing rather than relaxing regulations to make it more viable. For example, allowing locks on individually-rented bedrooms in New York might solve the problem in part, but if tenant complaints point to other unfair practices, the co-living model might be banned in the city altogether.

But in some cities, like Philadelphia and Minneapolis, lawmakers are embracing the idea of “single room occupancy” rentals, bringing legislation to allow the units in multifamily and commercial zones.

A New Asset Class for Investors

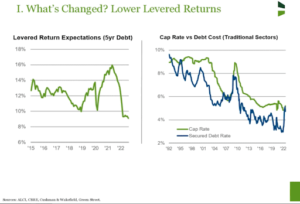

Co-living isn’t just a solution for loneliness and unaffordable rents. It’s also an emerging asset class for real estate investors. Despite some problems with the co-living business model, co-living companies generally report the higher rental income per square foot than traditional rental models. For example, in New York, earnings for co-living units are reported to be 40% to 50% higher than traditional apartment rents.

A report from students at MIT also suggests that co-living buildings should be more resilient during an economic downturn than traditional multifamily housing. Indeed, during the COVID-19 pandemic, co-living spaces continued to earn a 23.2% premium per square foot over rents per square foot for traditional studio apartments in comparable markets, according to research from real estate services firm Cushman & Wakefield.

The MIT report also indicates that co-living is on the verge of becoming more widely accepted, both among lawmakers and the general public. Early signs show that co-living will become a “fundamental asset class within residential real estate,” the report states. While the model is still in its infancy and comes with some potential headaches, it may become a welcome alternative to traditional long-term multifamily rentals for some investors, especially in urban areas where housing prices are making it more difficult to yield positive cash flow.

New! The State of Real Estate Investing 2023

After years of unprecedented growth, the housing market has shifted course and has entered a correction. Now is your time to take advantage. Download the 2023 State of Real Estate Investing report written by Dave Meyer, to find out which strategies and tactics will profit in 2023.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.biggerpockets.com/blog/co-living-units-are-helping-investors-generate-higher-returns

- 000

- 2%

- 2019

- 2020

- 2022

- 2023

- a

- About

- accelerating

- access

- According

- Additional

- adults

- ADvantage

- affordable

- After

- AIR

- All

- Alliance

- Allowing

- allows

- alternative

- always

- america

- Americans

- among

- and

- Anxiety

- Apartment

- apartments

- Applying

- areas

- around

- asia

- asset

- asset class

- attention

- austin

- author

- average

- banned

- become

- becoming

- before

- below

- benefit

- benefits

- BEST

- Block

- Bloomberg

- boarding

- book

- border

- Breath

- bring

- Bringing

- Building

- business

- business model

- Buying

- california

- call

- calling

- Can Get

- Cash

- cash flow

- caused

- CBRE

- CDC

- Children

- Choose

- Circle

- Cities

- City

- class

- Cleaning

- Co-working

- combination

- come

- Comeback

- commercial

- Common

- Communication

- Communities

- community

- community building

- Companies

- comparable

- compared

- complaints

- concept

- conditions

- connects

- construction

- continued

- Cost

- Costs

- could

- country

- course

- COVID-19

- COVID-19 pandemic

- created

- Dave

- Death

- decades

- Declining

- decor

- delivers

- Demand

- Denver

- Department

- depression

- Design

- designed

- Despite

- developers

- Development

- developments

- different

- difficult

- digital

- distinct

- down

- download

- DOWNTURN

- drawing

- during

- Early

- earn

- Earnings

- easier

- Economic

- economic downturn

- Education

- either

- elevated

- emerging

- employees

- enough

- entered

- Epidemic

- equity

- especially

- estate

- estimated

- Ether (ETH)

- Europe

- Even

- everyone

- Examining

- example

- expansive

- experiencing

- facilities

- families

- February

- few

- Figure

- Find

- finding

- Firm

- First

- fitness

- Fix

- flow

- Foot

- form

- Foster

- found

- fraction

- fresh

- friends

- from

- GAS

- General

- general public

- generally

- generate

- get

- Global

- Governments

- graduate

- groceries

- Growth

- harvard

- headaches

- Health

- help

- helping

- Hidden

- High

- higher

- Home

- homelessness

- Homes

- hope

- House

- housing

- housing market

- How

- HTML

- HTTPS

- idea

- in

- incidental

- include

- Including

- Income

- Increase

- indicates

- individual

- individuals

- instant

- instant social

- intent

- Intentional

- interaction

- interactions

- interests

- inventory

- investing

- investment

- Investors

- isolation

- IT

- Kind

- Know

- lab

- largest

- Last

- Last Year

- Law

- lawmakers

- leader

- Legislation

- LG

- Limited

- live

- living

- local

- Locks

- Loneliness

- long-term

- major

- make

- Making

- many

- Market

- Markets

- meals

- membership

- Meyer

- Miami

- might

- million

- MIT

- model

- models

- Modern

- moment

- money

- monthly

- more

- most

- move

- National

- Natural

- necessarily

- Need

- New

- New York

- North

- north america

- number

- numerous

- NYC

- offer

- Offers

- offices

- operate

- operated

- operation

- operational

- operator

- Opinions

- opportunities

- Opportunity

- Other

- Others

- pandemic

- part

- Peak

- People

- percentage

- perks

- philadelphia

- Place

- platform

- plato

- Plato Data Intelligence

- PlatoData

- Point

- poor

- popularity

- positive

- potential

- power

- practices

- Premature

- Premium

- Prices

- primary

- private

- PRNewswire

- Problem

- problems

- Profit

- Programming

- properties

- Proposals

- prospect

- provide

- providing

- public

- purchase

- Puts

- quickly

- rapidly

- Rate

- Rates

- ratio

- reach

- real

- real estate

- reason

- regulations

- remain

- Rent

- rentals

- report

- Reported

- represent

- research

- residents

- resilient

- Respond

- result

- return

- Reuters

- Rise

- rising

- Risk

- Risk Factor

- rivals

- Room

- round

- Said

- same

- San

- San Jose

- Save

- Savings

- School

- security

- seeking

- sees

- selected

- seniors

- serious

- Services

- several

- Share

- shared

- sharing

- should

- show

- significant

- Signs

- similar

- since

- single

- Smoking

- Social

- Social isolation

- socialize

- solution

- SOLVE

- some

- Someone

- Space

- spaces

- square

- start

- Starting

- Stash

- State

- States

- Still

- strategies

- Students

- studio

- studios

- such

- sudden

- Suggests

- Suicide

- support

- surge

- tactics

- Take

- team

- tech

- tenant

- texas

- The

- The State

- their

- this year

- three

- Through

- time

- to

- Total

- traditional

- Transplants

- Trend

- true

- typical

- typically

- u.s.

- unit

- units

- unprecedented

- urban

- Urban Areas

- use

- various

- verge

- viable

- Wake

- webp

- welcome

- What

- which

- while

- WHO

- widely

- wifi

- will

- within

- without

- Work

- work out

- workers

- worldwide

- would

- written

- year

- years

- Yield

- Yoga

- young

- Your

- zephyrnet

- Zillow

- zones