Bitcoin (BTC) noticed a dramatic change of temper into June 22 as multi-day highs gave approach to a contemporary dive below $20,000.

BTC might see accumulation under key trendline

Data from Cointelegraph Markets Pro and TradingView confirmed BTC/USD abruptly halting its newest beneficial properties to hit lows of $19,947 on Bitstamp.

The largest cryptocurrency had passed $21,700 the day before, its finest efficiency since June 16, however momentum waned throughout Wall Street trading.

For standard trader and analyst Rekt Capital, there was hazard in BTC/USD being unable to reclaim its 200-week transferring common (MA).

As a classic support line in earlier bear markets, Bitcoin had previously retained the 200-week MA as assist with wicks under it characterizing macro value bottoms.

“If BTC can’t reclaim the 200-week MA as support… Then one of the scenarios of what could happen would involve downside to new lows before the formation of an Accumulation Range for the first time below the 200-week MA,” he warned.

The 200-week MA stood at $22,420 on the time of writing.

Fellow trader Credible Crypto was extra optimistic on the short-term perspective, telling Twitter followers that he didn’t foresee spot value going a lot decrease.

About to re-visit our weekly demand stage after we bounced off of it over the previous couple of days. Not anticipating new native lows here- in search of the GREEN area to carry and for us to place in one other native excessive into the RED resistance area between 22-24k. $BTC https://t.co/FbngeJw8NT pic.twitter.com/F79eokL5W6

— CrediBULL Crypto (@CredibleCrypto) June 22, 2022

Zooming out, Crypto Tony, likewise, highlighted the “demand zone” that BTC/USD was now appearing in.

“On the macro we can see a few things here. We broke down clearly from a distribution range. We are now testing the first demand zone from this range. A reaction is expected, but not a bottom yet in my opinion,” he tweeted:

“A wick down to $17k – $15k on the cards.”

Whales look to scale back BTC publicity

For the biggest BTC hodlers, in the meantime, indicators of change had been already seen in on-chain knowledge.

Related: That’s not hodling! Over 50% of Bitcoin addresses still in profit

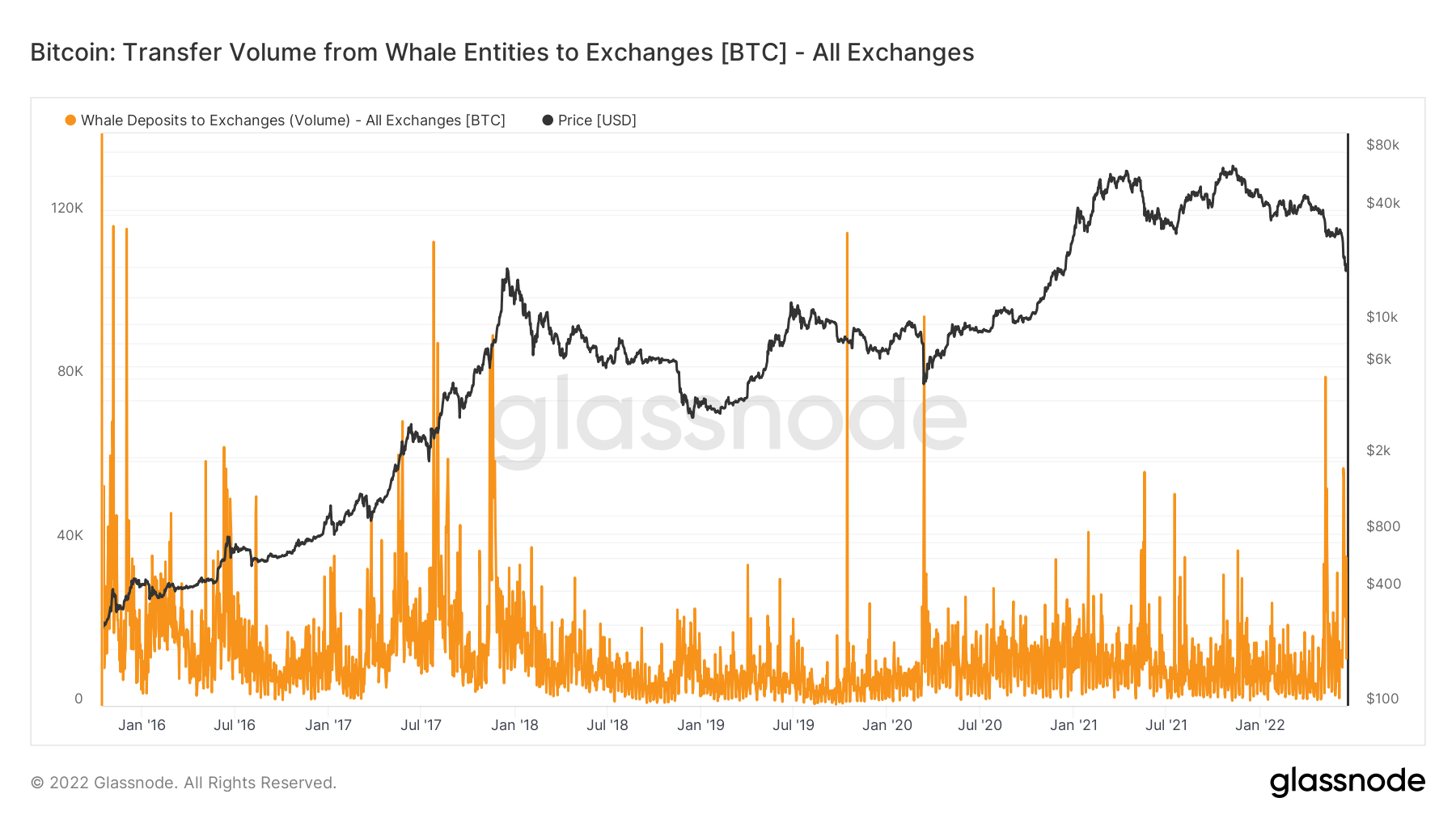

According to on-chain analytics agency Glassnode, on June 20 and 21, Bitcoin whales deposited over 50,000 BTC to exchanges. This adopted 58,000 BTC in inflows on a single day on June 13.

Overall inflows from whale wallets thus remained elevated on an intraday foundation, whereas nonetheless not matching the degrees seen throughout some earlier sell-offs.

On May 9, for instance, the identical group despatched over 80,000 BTC to trade accounts, probably the most since March 2020.

As Cointelegraph reported earlier this week, whale consumers in the meantime created a possible main assist stage simply above $19,000.

The views and opinions expressed listed below are solely these of the creator and don’t essentially mirror the views of Cointelegraph.com. Every funding and trading transfer includes threat, you must conduct your individual analysis when making a call.

The post Bitcoin value wicks under $20K as whales ship 50K BTC to exchanges appeared first on Bitcoin Upload.

- "

- 000

- 2020

- 420

- 9

- a

- addresses

- agency

- already

- analysis

- analyst

- analytics

- approach

- AREA

- before

- being

- below

- between

- Biggest

- Bitcoin

- bitcoin whales

- Bitstamp

- BTC

- BTC/USD

- call

- capital

- Cards

- carry

- change

- Cointelegraph

- Common

- Conduct

- Consumers

- could

- Couple

- created

- creator

- credible

- crypto

- cryptocurrency

- day

- Days

- Demand

- distribution

- down

- dramatic

- efficiency

- essentially

- Exchanges

- expected

- expressed

- First

- first time

- Foundation

- from

- funding

- Glassnode

- going

- Green

- Group

- happen

- here

- Highlighted

- Hodlers

- However

- HTTPS

- includes

- individual

- instance

- IT

- Key

- knowledge

- largest

- LINK

- Listed

- Look

- Macro

- Making

- March

- march 2020

- Markets

- matching

- meantime

- might

- mirror

- Momentum

- most

- On-Chain

- Opinion

- Opinions

- Other

- perspective

- possible

- previous

- properties

- range

- reaction

- remained

- Scale

- Search

- short-term

- since

- single

- some

- Spot

- Stage

- standard

- Still

- street

- support

- Testing

- The

- things

- throughout

- time

- trade

- trader

- Trading

- transfer

- Transferring

- under

- us

- value

- Wall Street

- Wallets

- week

- weekly

- whales

- What

- would

- writing

- Your