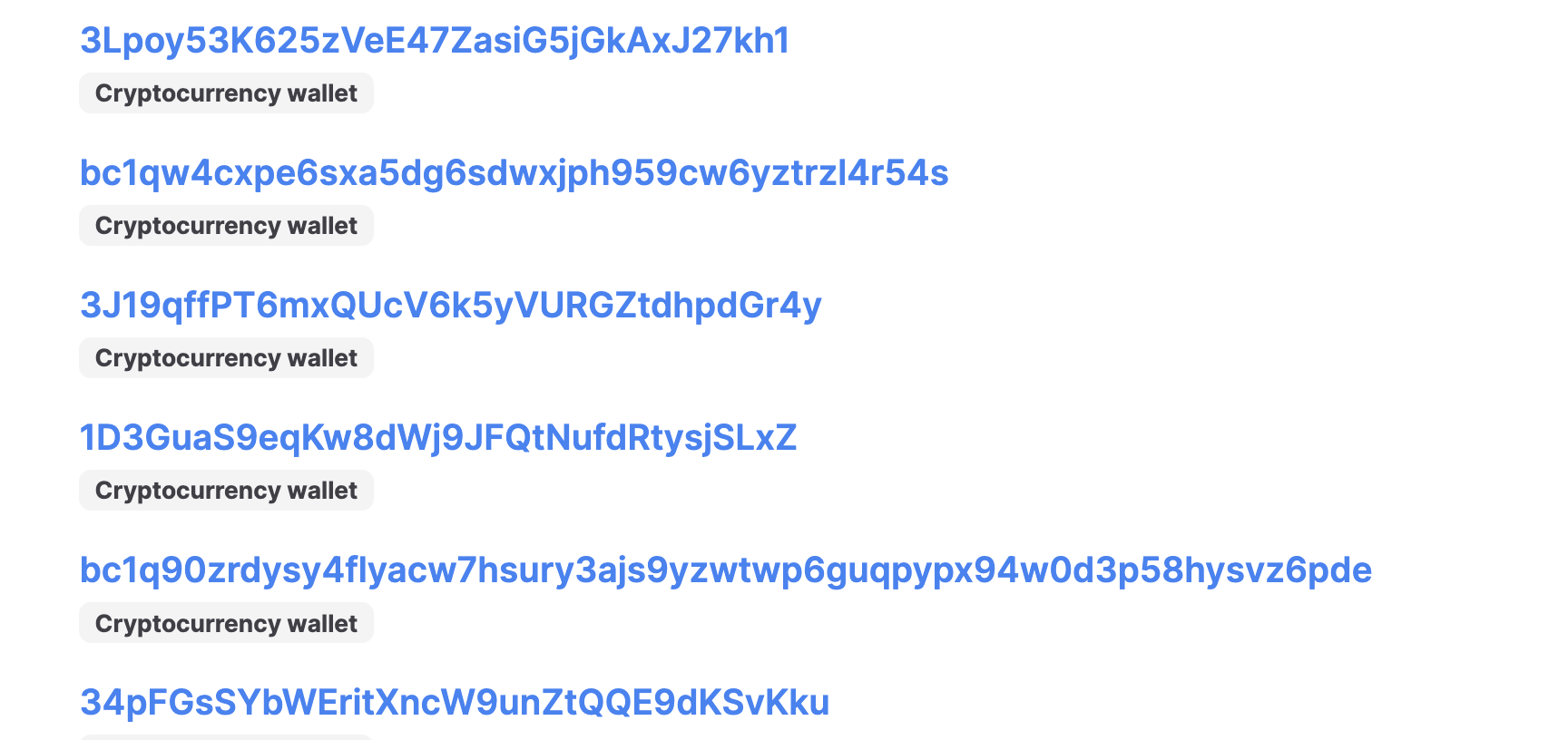

Just a few years after the US Treasury announced a first, sanctions on two bitcoin addresses, the list has now grown to 398 addresses being under US Treasury sanctions.

That’s according to OpenSanctions, a project that uses more than 50 sources to track assets under sanctions.

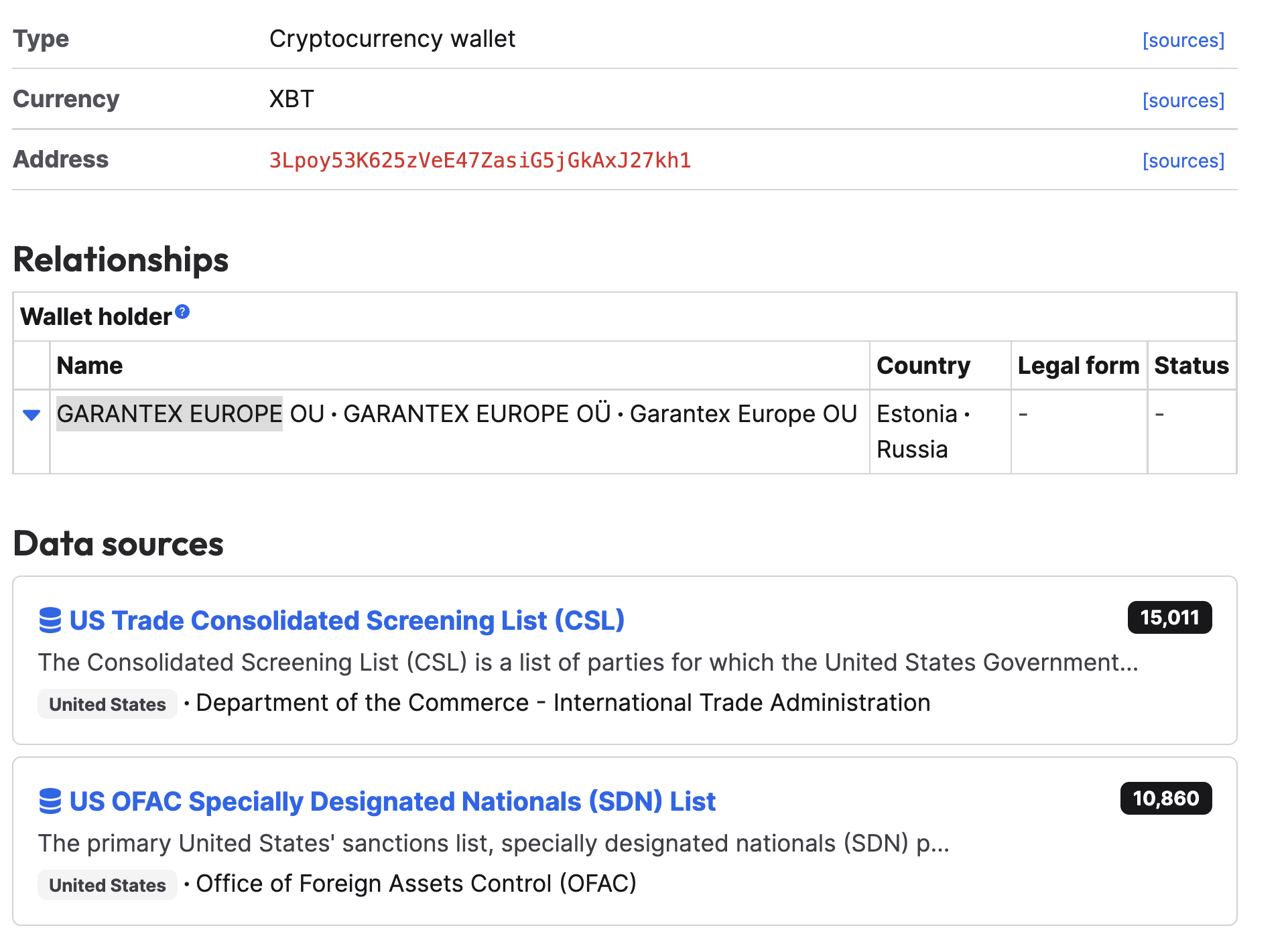

They list for example 3Lpoy53K625zVeE47ZasiG5jGkAxJ27kh1, which they claim belongs to GARANTEX EUROPE, an entity connected to Estonia and Russia, and under OFAC’s specially designated nationals list.

That’s just one address we picked at random out of hundreds, with it remaining a bit unclear how they put names to bitcoin addressees which are pseudo-anonymous.

We haven’t checked the veracity of this data, but their code is open source on GitHub, so anyone can verify.

The only listed crypto source is ransomwhe.re, a site that collects addresses known to be linked to ransomware payments.

They track an incredible 7,508 such ransomware theft addresses, making this potentially a data mine, especially for enforcement but also exchanges.

They do not list any source like ChainAnalysis, however. The sanctioned bitcoin addresses therefore may directly come from the Treasury, which does the identity attribution, with OpenSanctions potentially acting more as an aggregator.

Yet the public, though pseudoanonymous, nature of bitcoin is clearly leading to more sophisticated systems of follow the money.

Making crypto crime in the future potentially very difficult as your address might be frozen, not by the network, but by everything else if it is flagged by these systems.

The bitcoin themself can still move, however, and a sanctioned Russian entity, as an example, can still transfer the coins to an innocent third party in Russia, China, or India.

The address mentioned above for example has moved their bitcoin, though it isn’t much, just $183 with that transfer made back in 2019.

But interestingly they sent it to an address that has received 343 bitcoin, though its final balance is now zero.

Moving from here gets more dicey in as far as establishing culpability. If this 3EV address was part of sanctions, and OpenSanctions says it isn’t, then it would have been easy as any transfer can be checked with suspicion if it is innocent or not, but now you have to kind of square that.

As you might expect, nothing comes up on this 3EV address, so we have no clue who it is. Exchanges or companies that specialize in blockchain analysis may do, but often they probably don’t either.

Most of transfers out of this address are also for very small amounts, but with one of the transfers and just two hops, we end up at a fairly big address.

And the best part of it is that this address, 13x, also has a final balance of nothing. Following on from here may get a bit more interesting with some small addresses of less than 1,000 BTC having some bitcoin, like 200, as a final balance.

But at this point we’re so far from where we started that you’d need some corroborating evidence that any of these latter addresses have anything to do with the sanctioned one.

All illustrating that you can sanction the address, but can you quite sanction the bitcoin? Also, is it counter-productive to publish these sanctioned addresses, instead of a semi-kafkaesqian private list for exchanges?

Because you can’t quite enforce anything at the network level, and so transporting the old system to the new one without changes, might seem to work on the surface but actually misses a lot of nuances.

A new system might be needed instead to take into account the very fast moving nature of bitcoin as where this specific sanctioned address is concerned, for example, the sanction does not seem to quite have worked because it is easy to lose track of the coins after some movements.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- Fourth

- machine learning

- news

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- Trustnodes

- W3

- zephyrnet