Passive income might sound too good to be true for some. The prospect of making money without needing to actively work for it each day is something everybody wants. But actually, passive income is highly attainable for most people. However, passive income is not free money, and it’s a mistake to think that there is absolutely no work involved.

Making a lot of money through passive income usually requires research and careful strategizing. There are several ways to earn passive income, each with its own pros and cons. Some methods come with greater risk, or are more difficult to get into, but yield higher rewards. Others might be low-risk or easier to get started with, but offer a lower return on investment.

Let’s take a look at some of the best investment opportunities for passive income. What are the best passive income investments, and what are the pros and cons of each option?

Best Ways to Invest Money For Passive Income

Real estate and rental properties

One of the most common sources of passive income is real estate investment. It’s relatively easy to convert real estate into income. Land is an infinite resource, and everyone needs a place to live or work– or both.

Renting properties to tenants is usually low risk with at least a moderate return on investment. The amount of work required for rental assets and real estate investment will vary from one property to the next. Maintenance and renovation in older or run-down properties often require a greater financial commitment. But these properties can also be purchased for less than more modern or well-maintained spaces.

Regardless of the condition of the property, real estate investment is generally a low-risk investment for passive income. This is in part because real estate is a real, tangible asset. It does not dramatically depreciate in value, and it will always serve a practical, essential purpose for somebody.

It should be noted, however, that not all rental activities are counted as passive for tax purposes. Qualified real estate professionals are considered active participants in the operations of their rental properties. However, in nearly all other cases, rental properties are a form of passive income. This is true even if you spend time doing maintenance and renovation on the property.

Tax regulations aside, real estate is consistently one of the best investment opportunities for passive income. This is because it usually returns relatively high profits for little work. In the best-case scenario, property upkeep is minimal, and income is steady.

Dividend stocks

When many people hear the term passive income, it’s likely they think of dividend stocks before anything else. And there is a pretty good reason for this. With the right investments, dividend stocks can return incredible investment for no work at all.

Investors are able to buy shares, or dividend stocks, in public companies. When these companies make money, a small percentage of their profits are returned to the shareholders, as dividends. The cost of stocks, and their dividend yields, can fluctuate from week to week, or even day to day.

For this reason, dividend stocks can often be one of the most volatile passive investment options. Because these stocks are not tangible, they come with a bit more risk than real estate. The value of a stock might fluctuate based on the company’s success or public perception.

Of course, this means that the success of a dividend stock investment is highly dependent on the stock itself. This means that certain investments are less risky than others. Established big-name companies (e.g. McDonald’s, General Electric) often return strong yields, but shares may be harder to come by.

The most reliable companies for dividend stock investments tend to be those that deal in essential products or services. Utilities, pharmaceutical, and healthcare companies, for instance, are generally considered more reliable than other public companies.

Peer-to-Peer lending

Peer-to-peer (P2P) lending is also fairly volatile, but offers tremendous potential. In this investment model, investors can lend money directly to an individual or business. The investors then receive a return based on a percentage that is agreed upon at the time of investment. Peer-to-peer lending typically refers to crowdfunding investments made through online platforms like Lending Club.

P2P investing is an appealing passive investment opportunity because it requires absolutely no work after the initial investment. As a P2P investor, all you need to do is provide an initial financial investment to a business or person. Then you just sit back and wait for the passive income to roll in.

This strategy is not without some obvious risk, of course. The return on investment is entirely dependent on the success of the company being invested in. If the company struggles, then your investment might not return much at all. Rather than generating passive income, you could simply lose money on a bad investment.

However, the best-case scenario makes P2P lending one of the best ways to invest money for passive income if you play your cards right. Making one or two smart investments can net huge returns for no work at all. While that still doesn’t qualify as printing free money, it’s not very far off from it. All it takes is some careful research and one smart decision.

Creating a service or product

One of the most underrated things to invest in to make passive income is yourself. Believe it or not, there are actually several ways to make passive income without major financial commitments or risky investments. You also have the option to create a product or service that can generate passive income for you indefinitely.

For instance, you could write a self-help book or publish an online course about a subject you are knowledgeable about. These resources can then be sold online for a small fee to anyone who’s interested. While the initial creation of the service required work, your future income will not. Thus, it is a form of passive income.

The best-case scenario for this type of passive income would be any of the world’s biggest artists. The likes of Paul McCartney and J.K. Rowling are multi-millionaires thanks largely to royalties (passive income) from their own creative works. Of course, you shouldn’t count on publishing the next Harry Potter to generate passive income. But even a modest return on a created product or service can be a nice passive income stream. This can also be the most personally rewarding and enriching form of passive income.

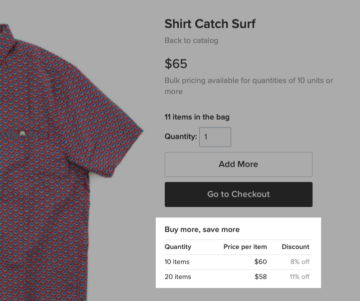

You might also receive passive income by setting up an online business. It is possible to sell products online without materially participating in the business. Selling products you haven’t manufactured yourself, either through dropshipping or another means, is a common form of passive income.

This can be one of the best passive income investments because it is relatively low risk. With dropshipping, for instance, most businesses only pay fees based on their sales. So even if you don’t make much passive income, you also are not spending much.

Starting an Online Passive Income Business

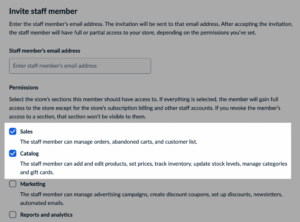

Online businesses are often overlooked as investment opportunities for passive income. But this is not to say there is no work or responsibility involved. However, the tools and resources are accessible enough to make it a realistic option for anybody.

There is a relatively low barrier of entry for starting a business to sell online. And with the right products and business model, it can be a highly reliable passive income stream.

Want to learn more about how to make passive income by selling online? Ecwid has plenty of resources and tools to help you build your online store. Read about how to get started selling on Amazon, or learn how to set up your store with Ecwid.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.ecwid.com/blog/best-passive-income-investments.html

- Able

- About

- absolutely

- accessible

- active

- actively

- activities

- actually

- After

- All

- always

- amount

- and

- Another

- anyone

- appealing

- Artists

- asset

- Assets

- Attainable

- back

- Bad

- barrier

- based

- because

- before

- being

- believe

- BEST

- best investment

- Biggest

- Bit

- book

- build

- business

- business model

- businesses

- buy

- Cards

- careful

- cases

- certain

- club

- come

- commitment

- Common

- Companies

- company

- Company’s

- condition

- Cons

- considered

- Cost

- could

- course

- created

- creation

- Creative

- Crowdfunding

- day

- deal

- decision

- dependent

- depreciate

- difficult

- directly

- dividend

- dividends

- Doesn’t

- doing

- Dont

- dramatically

- each

- earn

- easier

- either

- Electric

- enough

- enriching

- entirely

- entry

- essential

- established

- estate

- Even

- everyone

- fairly

- fee

- Fees

- financial

- fluctuate

- form

- Free

- from

- future

- General

- General Electric

- generally

- generate

- generating

- get

- good

- greater

- healthcare

- help

- High

- higher

- highly

- How

- However

- HTML

- HTTPS

- huge

- in

- Income

- incredible

- individual

- initial

- instance

- interested

- Invest

- invested

- investing

- investment

- Investments

- Investopedia

- investor

- Investors

- involved

- IT

- itself

- Land

- largely

- LEARN

- LEND

- lending

- likely

- little

- live

- Look

- lose

- Lot

- Low

- low barrier

- made

- maintenance

- major

- make

- make money

- MAKES

- Making

- manufactured

- many

- many people

- McCartney

- means

- methods

- might

- minimal

- mistake

- model

- Modern

- money

- more

- most

- nearly

- Need

- needing

- needs

- net

- next

- not spending

- noted

- obvious

- offer

- Offers

- ONE

- online

- Online Business

- online platforms

- online store

- Operations

- opportunities

- Opportunity

- Option

- Options

- Other

- Others

- own

- p2p

- p2p lending

- part

- participants

- passive

- passive income

- Paul

- Pay

- People

- percentage

- perception

- person

- Personally

- Pharmaceutical

- Place

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- Play

- Plenty

- possible

- potential

- Practical

- pretty

- Product

- Products

- profits

- properties

- property

- PROS

- prospect

- provide

- public

- public companies

- publish

- Publishing

- purchased

- purpose

- purposes

- qualified

- qualify

- Read

- real

- real estate

- realistic

- reason

- receive

- refers

- regulations

- relatively

- reliable

- require

- required

- requires

- research

- resource

- Resources

- responsibility

- return

- returns

- rewarding

- Rewards

- Risk

- Risky

- Roll

- royalties

- sales

- scenario

- sell

- Selling

- serve

- service

- Services

- setting

- several

- Shareholders

- Shares

- should

- simply

- small

- smart

- sold

- some

- something

- Sound

- Sources

- spaces

- spend

- Spending

- started

- steady

- Still

- stock

- Stocks

- store

- Strategy

- stream

- strong

- Struggles

- subject

- success

- Take

- takes

- tax

- The

- their

- things

- this year

- Through

- time

- too

- tools

- tremendous

- true

- typically

- Underrated

- usually

- utilities

- value

- volatile

- wait

- ways

- week

- What

- while

- will

- without

- Work

- works

- world’s

- would

- write

- year

- Yield

- yields

- Your

- yourself

- zephyrnet