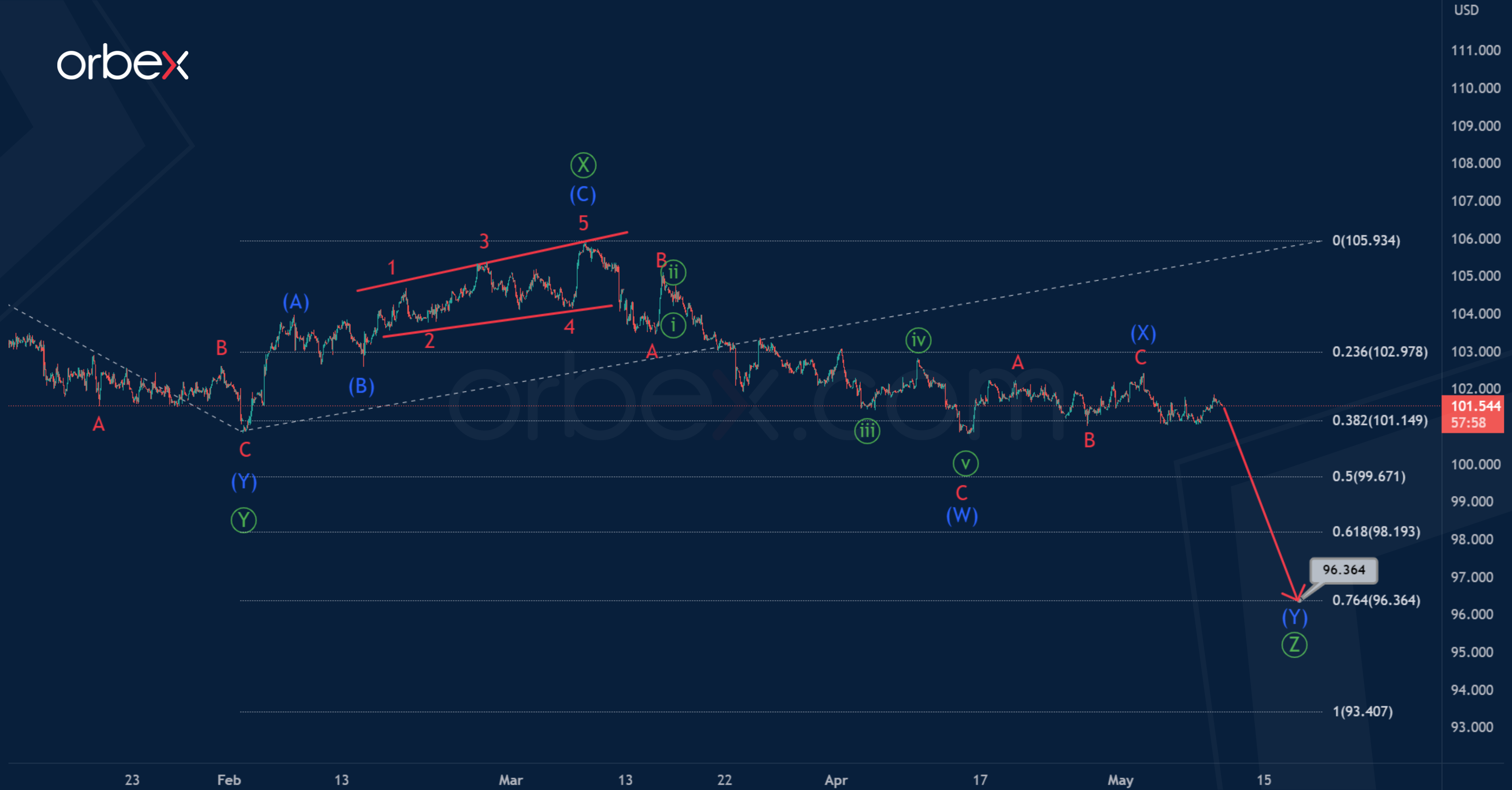

In the long term, the dollar index forms a triple zigzag. This consists of primary sub-waves Ⓦ-Ⓧ-Ⓨ-Ⓧ-Ⓩ. At the moment, the sub-waves Ⓦ-Ⓧ-Ⓨ-Ⓧ look complete. The second intervening wave Ⓧ is a standard zigzag.

Most likely, the price drop in the primary wave Ⓩ will continue in the next coming days. Judging by the internal structure, this wave can take the form of an intermediate double zigzag.

Koniec niedźwiedziego wzoru oczekiwany jest w pobliżu 96.364. Na tym poziomie fala pierwotna Ⓩ będzie stanowić 76.4% fali Ⓨ.

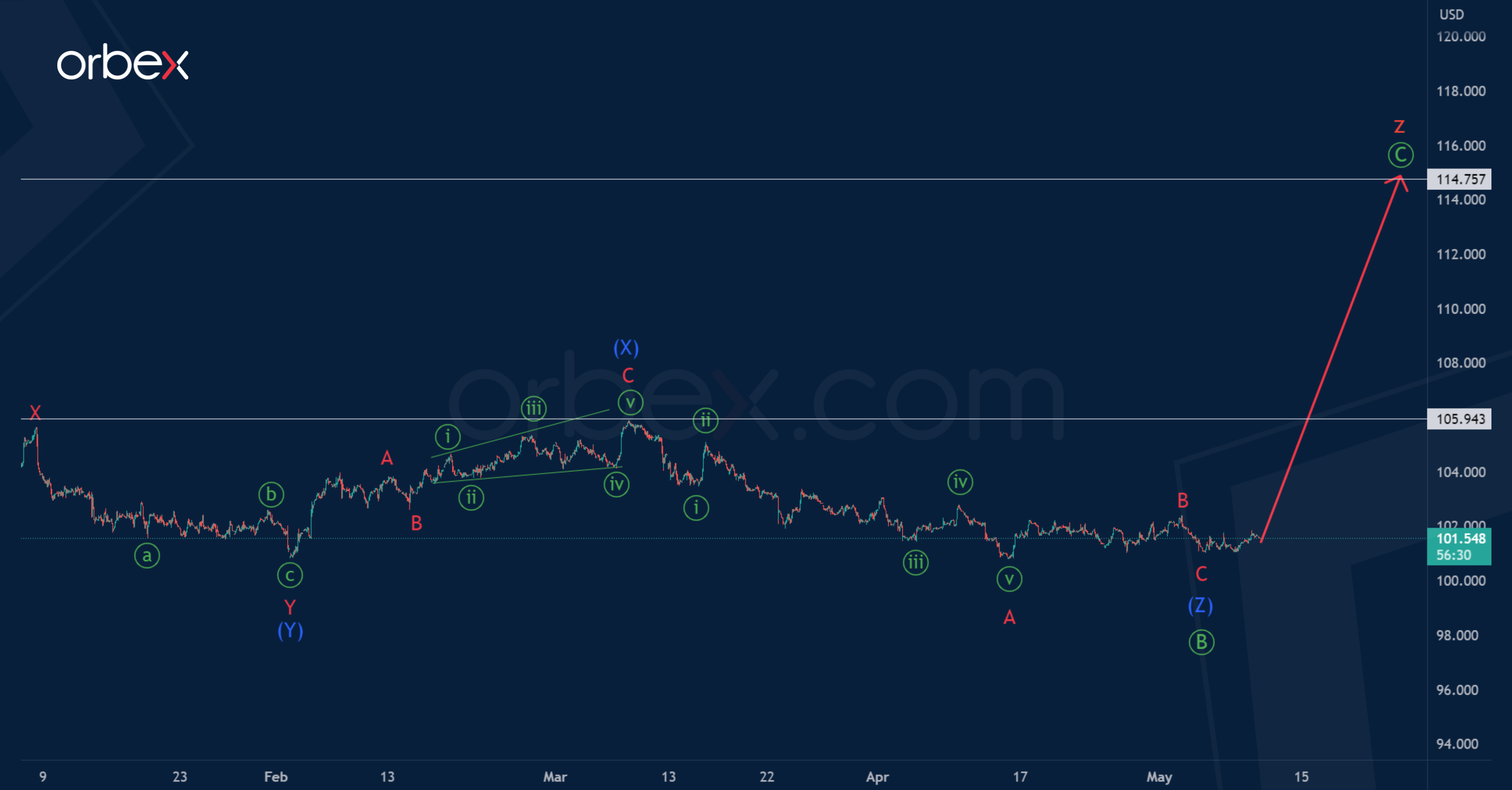

Proponujemy rozważyć alternatywny scenariusz, w którym fala z tworzy się w potrójnym zygzaku w-x-y-x-z.

The structure of the wave z is similar to the zigzag Ⓐ-Ⓑ-Ⓒ. In its composition, the first impulse Ⓐ and the correction Ⓑ in the form of an intermediate double zigzag have ended. The entire wave z can end near 114.75, that is, at the maximum of the primary impulse wave Ⓐ.

However, the first target for bulls is the maximum of 105.94, which was marked by the intermediate intervening wave (X).

Sprawdź swoją strategię, jak DXY poradzi sobie z Orbex

- Dystrybucja treści i PR oparta na SEO. Uzyskaj wzmocnienie już dziś.

- PlatoAiStream. Analiza danych Web3. Wiedza wzmocniona. Dostęp tutaj.

- Wybijanie przyszłości w Adryenn Ashley. Dostęp tutaj.

- Kupuj i sprzedawaj akcje spółek PRE-IPO z PREIPO®. Dostęp tutaj.

- Źródło: https://www.orbex.com/blog/en/2023/05/dxy-bearish-wave-y-breaks-100

- :Jest

- a

- alternatywny

- an

- i

- At

- BE

- niedźwiedzi

- przerwy

- Byki

- by

- CAN

- Wykres

- przyjście

- kompletny

- Rozważać

- kontynuować

- Dni

- Dolar

- Indeks dolara

- Podwójna

- Spadek

- Dxy

- zakończenia

- Cały

- Eter (ETH)

- spodziewany

- i terminów, a

- W razie zamówieenia projektu

- Nasz formularz

- utworzony

- formularze

- Have

- W jaki sposób

- HTTPS

- obraz

- in

- wskaźnik

- Pośredni

- wewnętrzny

- interweniować

- JEGO

- poziom

- Prawdopodobnie

- relacja na żywo

- długo

- Popatrz

- wyraźny

- Masterclass

- Maksymalna szerokość

- maksymalny

- moment

- Blisko

- Następny

- of

- on

- Wzór

- plato

- Analiza danych Platona

- PlatoDane

- Cena

- pierwotny

- zaproponować

- scenariusz

- druga

- podobny

- standard

- Strategia

- Struktura

- Brać

- cel

- że

- Połączenia

- to

- do

- Potroić

- URL

- była

- fala

- który

- będzie

- w

- X

- Twój

- zefirnet

![Klasa mistrzowska 728 x 90 [EN]](https://platoaistream.com/wp-content/uploads/2023/05/dxy-bearish-wave-y-breaks-100-1.png)