Timing is Everything

New York Yankees player, Yogi Berra famously said, “You don’t have to swing hard to hit a home run. If you got the timing, it’ll go.” In all walks of life, the same is true. Timing can be as much of a blessing as a curse. Being too far ahead of the curve can be as harmful as being too late to the party.

At present, the crypto market is experiencing a pump that permabears are calling a relief rally while permabulls are calling it the start of the new bull run. Fear pervades both sides of the divide. Some worry they’ll lose out if they don’t buy now and others are too scared to buy in case there’s another leg down.

Situations like these serve as a useful reminder about the benefits of dollar cost averaging (DCAing) and long-term investing. With the benefit of hindsight we can all see where we should have bought and sold, but to do so in the moment is almost impossible.

For those with either FOMO or fear of the next leg down it’s essential to remind ourselves how early we still are. Although the previous bull run saw huge increases in ecosystem development and growth, many of these were just the beginning.

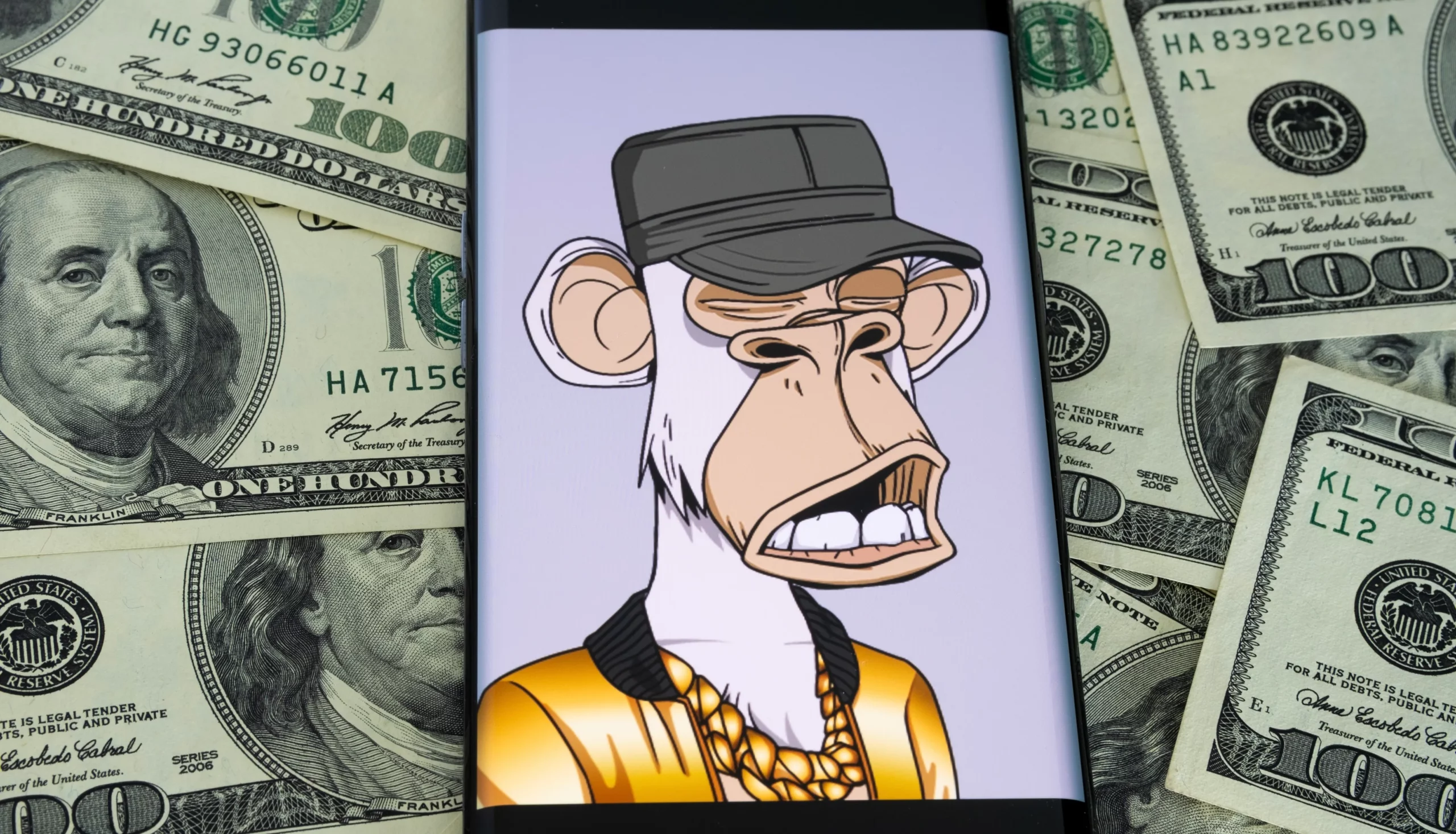

Take NFTs for instance. 2021 saw a huge increase in the popularity of NFTs with many blue-chip collections breaking into the mainstream media. Now however the excitement has died down and some are left wondering if it will ever return.

So far crypto has failed to accomplish mass adoption. This is mostly due to the barriers to entry for self-custody and wallet ownership. The concept of irreversible transactions to wallet addresses that are as complicated as nuclear launch codes isn’t enticing to the public.

The issue of how to make wallets user-friendly for non-technical people is crucial to mass adoption. Fortunately, many different teams are working on this problem, most notably Elon Musk and the engineers at Twitter.

Wherever you look in crypto there are huge amounts of potential that has yet to break through to mainstream integration. Even Mark Zuckerberg is struggling to realize his vision of the metaverse no matter how many billions of dollars and teams of engineers he devotes to it.

The situation at present has many parallels with the dot com boom of the late 1990s. Many people could see the vision and the potential, but the timing just wasn’t quite right. Many investors at that time took the hit and walked away for good, only to regret it years later.

A similar scenario has been playing out in crypto since the height of the last bull run with many people discouraged by bear market blues and bad actors. Each challenge has been seized upon by lazy journalists as easy click-bait of apocalyptical articles about the death of Bitcoin.

The reality is that this is completely normal for all nascent technologies. Being able to see a vision of the future is as much a curse as a blessing if it isn’t conjoined with patience and perseverance.

Throughout our development phase, we’ve watched the same horrors as everyone else in the space, yet we’ve kept our sights firmly on the next market cycle of increased adoption. Building in a bear market has been both a challenge and a benefit.

As we move towards the mainnet release of our MVP and the excitement in the market builds, it’s worth remembering that this is just the first step in our journey. Readers of our development updates will know how far the team has come in working to prepare the NFT loan module.

We firmly believe that our timing is right. The MVP release will allow many more people to discover and interact with Paribus products. This paves the way for our NFT loan integration later in the cycle as more liquidity pours into the market.

While we don’t time our development according to the market, we’ve been especially fortunate that it’s worked out this way. Although the slow and steady approach is easy to criticize we stand by our trust in this being the most optimal method for long-term success.

As the excitement grows around the launch of our MVP and the token price pumps higher we’d like to remind everyone that highs and lows go hand in hand. We always encourage people who hold PBX to take a long-term view rather than trying to time the rollercoaster of crypto volatility. Irrespective of how high or low PBX goes you can rest assured we’ll be steady and strong in the pace of our ongoing development.

Join Paribus-

Website | Twitter | Telegram | Medium | Discord | YouTube

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: Plato Data Intelligence: PlatoData.io