De volgende iteratie van consumentenfinanciering mogelijk maken

Medium, JC Bahr-de Stefano | 31 maart 2023

Building the next decade of consumer finance

- Last week in Las Vegas, I had the great pleasure of moderating a panel at Fintech Meetup re: building the next decade of consumer finance by leveraging real-time data and cash flow forecasting. I wanted to share some of the key insights shared during the session by our amazing panelists, Jose Bethancourt (Co-Founder of Methode Financieel), Ema Rouf (Co-Founder of Pave.dev), and Zane Salim (Co-Founder of Atlas)!

Siehe: CFPB doet een verzoek om informatie over "gegevensmakelaars"

- 1/ Alternative data augments FICO across the entire credit spectrum — this is about FICO+ NOT replacing FICO.

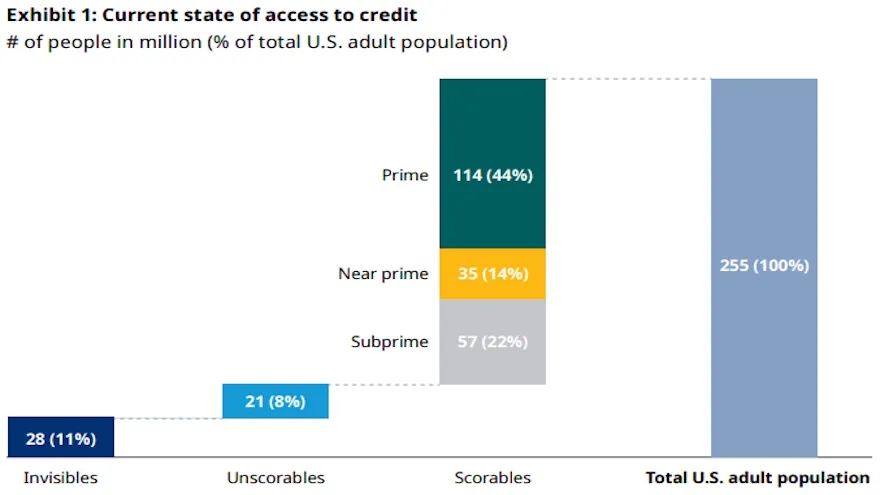

- De problem of credit invisibility in the US is growing, with an estimated 28 million adult Americans credit invisible and 21 million unscorable. To make decisions about these consumers and offer them financial services and products, alternative data, such as income and employment, can be used. This data can also help lenders make better risk-weighted decisions for many segments of users, not just credit invisible ones, and is particularly important during periods of economic stress.

- 2/ Real time data powers better products and outcomes by enabling greater access and improving the quality of risk management.

- Credit bureaus can take up to 45 days to report data, so lenders may not have the most up-to-date information on a borrower’s behavior. Atlas, a payroll-powered credit card, uses real-time data to monitor users’ financial health and adjust credit limits, allowing for better risk management and loss prevention.

- 3/ The movement to make alternative data mainstream has to happen outside of the credit bureaus.

- Credit reports do not provide a complete view of a consumer’s debt obligations as there is a lot of data that is not furnished to the credit bureaus, including most BNPL loans. However, companies like Method collect data from over 60k institutions to provide lenders with a more comprehensive view of a person’s debt obligations, combining data from credit bureaus with financial institutions’ core banking systems.

Siehe: Canada's Open Banking Journey: interview met Abe Karar, Chief Product Officer, Fintech Galaxy

- 4/ Recent innovation in infrastructure has made this data far more accessible than it has been in the past.

- Recent advancements in infrastructure and tools have made it easier to access and enrich the data. Companies such as Method and Pave are providing infrastructure that helps fintechs and banks adopt and use this data, leading to accelerated adoption.

- 5/ Mature lenders don’t want scores, they want raw data or attributes.

- Understanding the data is crucial for them to explain it to originating banks or capital providers, and the use of attribute generation can speed up model development. Pave is an example of a company offering transaction cleaning, enrichment, and their own attributes toolbox for lenders to use in their proprietary models.

Ga verder naar het volledige artikel -> hier

De Nationale Crowdfunding & Fintech Association (NCFA Canada) is een ecosysteem voor financiële innovatie dat duizenden gemeenschapsleden onderwijs, marktinformatie, rentmeesterschap, netwerken en financieringsmogelijkheden en -diensten biedt en nauw samenwerkt met de industrie, de overheid, partners en gelieerde ondernemingen om een levendige en innovatieve fintech en financiering te creëren industrie in Canada. Gedecentraliseerd en gedistribueerd, NCFA houdt zich bezig met wereldwijde belanghebbenden en helpt projecten en investeringen in fintech, alternatieve financiering, crowdfunding, peer-to-peer-financiering, betalingen, digitale activa en tokens, blockchain, cryptocurrency, regtech en insurtech-sectoren te incuberen. Aanmelden Canada's Fintech & Funding Community vandaag GRATIS! Of word een bijdragend lid en ontvang speciale voordelen. Ga voor meer informatie naar: www.ncfacanada.org

De Nationale Crowdfunding & Fintech Association (NCFA Canada) is een ecosysteem voor financiële innovatie dat duizenden gemeenschapsleden onderwijs, marktinformatie, rentmeesterschap, netwerken en financieringsmogelijkheden en -diensten biedt en nauw samenwerkt met de industrie, de overheid, partners en gelieerde ondernemingen om een levendige en innovatieve fintech en financiering te creëren industrie in Canada. Gedecentraliseerd en gedistribueerd, NCFA houdt zich bezig met wereldwijde belanghebbenden en helpt projecten en investeringen in fintech, alternatieve financiering, crowdfunding, peer-to-peer-financiering, betalingen, digitale activa en tokens, blockchain, cryptocurrency, regtech en insurtech-sectoren te incuberen. Aanmelden Canada's Fintech & Funding Community vandaag GRATIS! Of word een bijdragend lid en ontvang speciale voordelen. Ga voor meer informatie naar: www.ncfacanada.org

Wil je insider-toegang krijgen tot enkele van de meest innovatieve ontwikkelingen in #fintech. Registreer u voor #FFCON23 en hoor van wereldwijde opinieleiders wat de toekomst biedt! Klik hieronder voor Open Access-tickets voor alle virtuele programmering en on-demand content van FFCON23.Steun NCFA door ons te volgen op Twitter! |

gerelateerde berichten

- Door SEO aangedreven content en PR-distributie. Word vandaag nog versterkt.

- Platoblockchain. Web3 Metaverse Intelligentie. Kennis versterkt. Toegang hier.

- Bron: https://ncfacanada.org/empowering-the-next-iteration-of-consumer-finance/

- :is

- $UP

- 10

- 100

- 2018

- 28

- 39

- a

- Over

- versneld

- toegang

- beschikbaar

- over

- adopteren

- Adoptie

- Adult

- vooruitgang

- voorschotten

- filialen

- AI / ML

- Alles

- Het toestaan

- alternatief

- alternatieve financiering

- verbazingwekkend

- Amerikanen

- en

- April

- ZIJN

- dit artikel

- AS

- Activa

- At

- atlas

- attributen

- Bankieren

- Banksystemen

- Banken

- BD

- BE

- worden

- onder

- Betere

- blockchain

- BNPL-extensie

- lener

- Gebouw

- by

- cache

- CAN

- Canada

- hoofdstad

- kaart

- Contant geld

- cash flow

- Categorie

- CfPB

- chef

- Chief Product Officer

- Schoonmaak

- Klik

- van nabij

- Mede-oprichter

- verzamelen

- COM

- combineren

- gemeenschap

- Bedrijven

- afstand

- compleet

- uitgebreid

- consument

- consumentenfinanciering

- Consumenten

- content

- Kern

- Kernbankieren

- en je merk te creëren

- Credits

- creditkaart

- Crowdfunding

- cryptogeld

- gegevens

- dagen

- Schuld

- decennium

- gedecentraliseerde

- beslissingen

- Vraag

- Ontwikkeling

- digitaal

- Digitale activa

- verdeeld

- Dont

- gedurende

- gemakkelijker

- Economisch

- ecosysteem

- Onderwijs

- EMA

- werk

- empowering

- waardoor

- bezig

- verrijken

- Geheel

- toegang

- geschat

- Ether (ETH)

- EVENTS

- voorbeeld

- Verklaren

- FICO

- financiën

- financieel

- financiële gezondheid

- financiële inclusie

- financiële innovatie

- Financiële instellingen

- financiële diensten

- FinTech

- Fintech-sterrenstelsel

- fintechs

- stroom

- volgend

- Voor

- oppompen van

- vol

- financiering

- financieringsmogelijkheden

- Galaxy

- generatie

- krijgen

- Globaal

- Overheid

- groot

- meer

- GV

- gebeuren

- Happening

- Hebben

- Gezondheid

- horen

- hulp

- helpt

- hi

- Echter

- HP

- hr

- http

- HTTPS

- i

- belangrijk

- het verbeteren van

- in

- Inclusief

- inclusie

- Inkomen

- -industrie

- informatie

- Infrastructuur

- Innovatie

- innovatieve

- Insider

- inzichten

- instellingen

- insurtech

- Intelligentie

- Interview

- investering

- problemen

- IT

- herhaling

- jan

- mee

- jpg

- sleutel

- Groot

- LAS

- Las Vegas

- leiders

- leidend

- kredietverstrekkers

- kredietverlening

- leveraging

- als

- grenzen

- leven

- Live evenementen

- Leningen

- uit

- lot

- gemaakt

- Hoofdstroom

- maken

- management

- veel

- Maart

- Markt

- volwassen

- max-width

- Mei..

- Meetup

- lid

- Leden

- methode

- miljoen

- model

- modellen

- monitor

- meer

- meest

- beweging

- NEO

- netwerken

- Nieuwsbrief

- volgende

- verplichtingen

- of

- bieden

- het aanbieden van

- Officier

- on

- On-Demand

- online.

- open

- open bankieren

- Kansen

- buiten

- het te bezitten.

- paneel

- vooral

- partners

- verleden

- betalingen

- Bestandenuitwisseling

- periodes

- perks

- persoon

- Plato

- Plato gegevensintelligentie

- PlatoData

- dan

- plezier

- bevoegdheden

- het voorkomen

- Product

- Producten

- Programming

- projecten

- gepatenteerd

- zorgen voor

- biedt

- het verstrekken van

- kwaliteit

- Rauw

- ruwe data

- RE

- vast

- real-time

- realtime gegevens

- recent

- registreren

- Regtech

- verslag

- Rapporten

- te vragen

- Risico

- risicobeheer

- s

- Sectoren

- segmenten

- Diensten

- Sessie

- Delen

- gedeeld

- teken

- So

- sommige

- snelheid

- stakeholders

- Rentmeesterschap

- spanning

- dergelijk

- duurzaam

- Systems

- TAG

- Nemen

- dat

- De

- hun

- Ze

- Deze

- gedachte

- gedachte leiders

- duizenden kosten

- tickets

- niet de tijd of

- Titel

- naar

- vandaag

- tokens

- Toolbox

- tools

- transactie

- waar

- up-to-date

- us

- .

- gebruikers

- VEGAS

- trillend

- Bekijk

- Virtueel

- Bezoek

- gezocht

- week

- Met

- Bedrijven

- zephyrnet