Silicon Valley investing giant メイフィールド1 has raised two funds totaling almost $1 billion targeted for early-stage investment.

The Menlo Park-based firm — known as an early backer of such startups as Lyft, Marketo & ServiceNow — announced its $580 million Mayfield XVII and the $375 million Mayfield Select III funds.

The firm last announced new funds in March 2020, when it raised $750 million across two funds. The firm now has $3 billion in total assets under management.

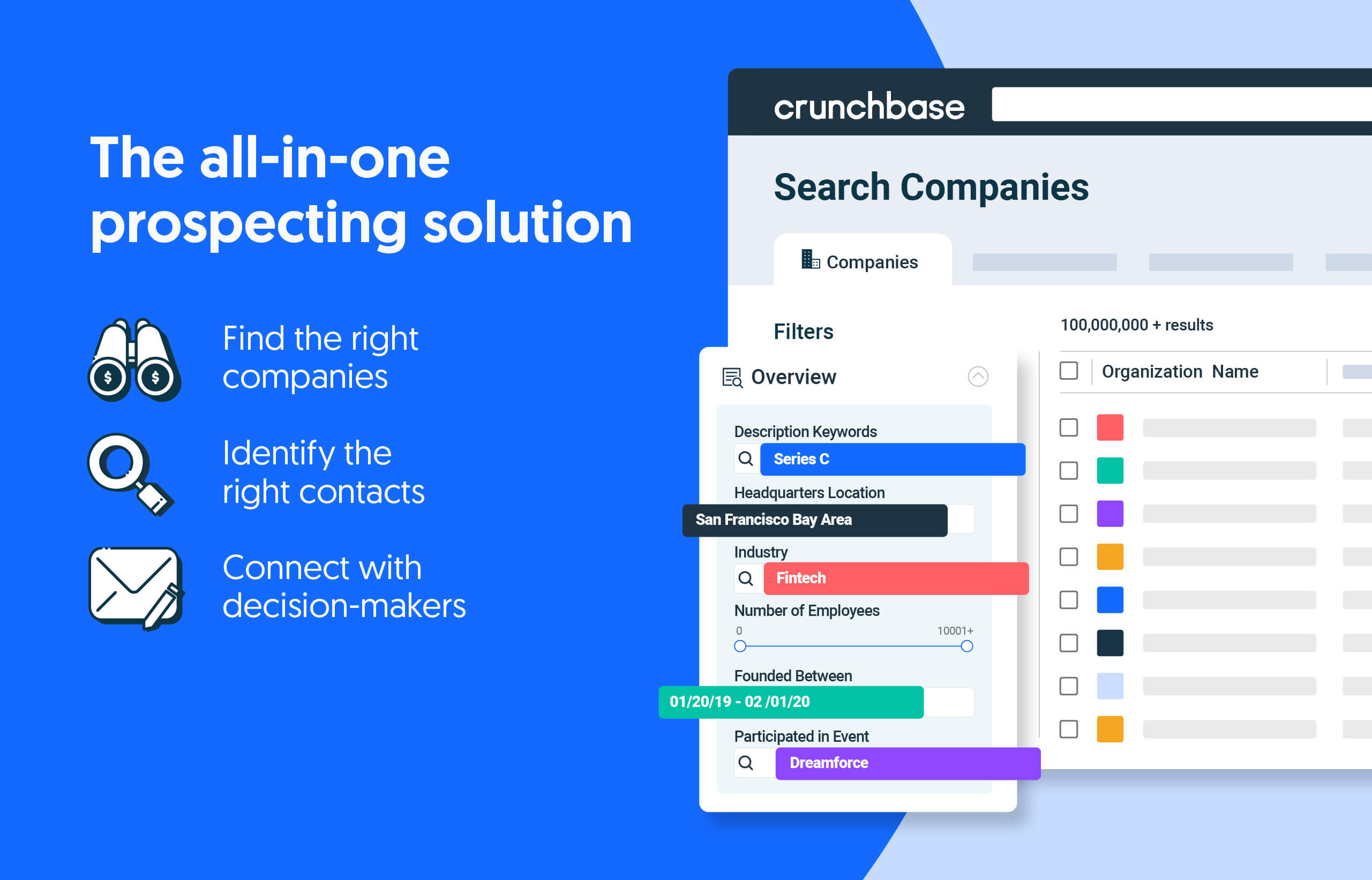

検索を減らします。もっと閉じてください。

非公開企業データのリーダーを活用したオールインワンの見込み客ソリューションで収益を拡大しましょう。

The Mayfield XVII fund will primarily be used for early-stage investing — mainly seed and Series A rounds. The Mayfield Select III will be for follow-on rounds, as well as investments in new companies, primarily at the Series B stage.

Some themes the firm is looking to invest in include human-centered AI, the developer-first technologies, semiconductors, cybersecurity and more.

“We are grateful for the continued support of our limited partners and for the fortitude of entrepreneurs which brings us to work every day,” said Managing Partner ナビンチャダ in a statement. “We believe that the current economic uncertainty presents an opportunity for the bold and a time to lean forward into the next era of innovation. We are excited about partnering with inception and early-stage founders looking for a people-first investor to build a bright future together.”

Recent dealmaking

While some big-name firms such as タイガーグローバル, Insight Partners and many more significantly slowed their investment pace last year, Mayfield continued a deliberate and consistent cadence.

According to Crunchbase data, the firm completed 26 financing deals in the salad days of 2021, and 23 last year — when the venture and investing market was substantially easing.

So far this year, Mayfield’s pace has been a little slower, with just five deals announced. Those deals include participating in a $27 million Series A for India-based mobility platform Blu-Smart Mobility and a $51 million Series E for San Francisco-based database developer 流入データ.

図: ドム・グスマン

Crunchbase Dailyで、最近の資金調達ラウンドや買収などの最新情報を入手してください。

2022 年 16 月には、Y Combinator と Techstars の 10 社を筆頭に、XNUMX 社が米国を拠点とするスタートアップ企業に少なくとも XNUMX 件以上の投資を行った。

確立されたプレーヤーの継続的な成功により、野心的なスタートアップがユニコーンの群れに追いつくのが難しくなる可能性があります。

- SEO を活用したコンテンツと PR 配信。 今日増幅されます。

- プラトアイストリーム。 Web3 データ インテリジェンス。 知識増幅。 こちらからアクセスしてください。

- 未来を鋳造する w エイドリエン・アシュリー。 こちらからアクセスしてください。

- PREIPO® を使用して PRE-IPO 企業の株式を売買します。 こちらからアクセスしてください。

- 情報源: https://news.crunchbase.com/venture/mayfield-early-stage-funding-seed-series-a/

- :持っている

- :は

- 2022年の174億4000万ドル

- $3

- $UP

- 10

- 2020

- 2021

- 2022

- 23

- 26

- a

- 私たちについて

- 買収

- 越えて

- AI

- オールインワン

- 野心的な

- an

- &

- 発表の

- 4月

- です

- AS

- 資産

- At

- BE

- き

- 信じる

- 10億

- 大胆な

- 明るい

- もたらす

- ビルド

- by

- ケイデンス

- レスリング

- 閉じる

- 組み合わせた

- 企業

- 記入済みの

- 整合性のある

- 継続します

- カバー

- CrunchBaseに

- 電流プローブ

- サイバーセキュリティ

- daily

- データ

- データベース

- 日付

- 中

- 日

- 特価

- Developer

- e

- 早い

- 初期段階

- イージング

- 経済

- 経済の不安定性

- end

- 起業家

- 時代

- 設立

- あらゆる

- 毎日

- 興奮した

- 遠く

- 資金調達

- 会社

- 企業

- フォワード

- 創設者

- ファンド

- 資金調達

- 資金調達ラウンド

- 資金

- 未来

- 巨大な

- 感謝する

- HTTPS

- in

- 開始

- include

- 革新的手法

- に

- 投資する

- 投資

- 投資

- インベストメント

- 投資家

- IT

- ITS

- JPG

- ただ

- 既知の

- 姓

- 昨年

- リーダー

- 最低

- ツェッペリン

- less

- 限定的

- 少し

- 探して

- 製

- 主に

- make

- 管理

- 管理する

- マネージングパートナー

- 多くの

- 3月

- 行進2020

- 市場

- メイフィールド

- かもしれない

- 百万

- モビリティ

- 他には?

- ほぼ

- 新作

- 新しい資金

- 次の

- 今

- of

- 機会

- or

- 私たちの

- 平和

- 参加する

- パートナー

- パートナー

- パートナー

- プラットフォーム

- プラトン

- プラトンデータインテリジェンス

- プラトデータ

- プレーヤー

- パワード

- プレゼント

- 主に

- 隆起した

- 提起

- 最近

- 最近の資金

- 収入

- ラウンド

- s

- 前記

- サン

- シード

- 半導体関連装置

- シリーズ

- シリーズA

- シリーズB

- 著しく

- ソリューション

- 一部

- ステージ

- スタートアップ

- ステートメント

- 滞在

- 実質上

- 成功

- そのような

- サポート

- 対象となります

- テクノロジー

- TechStars

- それ

- アプリ環境に合わせて

- この

- 今年

- それらの

- 時間

- 〜へ

- 一緒に

- トータル

- 2

- 不確実性

- 下

- ユニコーン

- us

- 中古

- 谷

- ベンチャー

- ました

- we

- WELL

- いつ

- which

- 意志

- 仕事

- Y Combinator

- 年

- あなたの

- ゼファーネット