- The EUR/USD pair reached a demand zone, so a rebound is natural.

- 米国のデータは後に決定的なものとなる可能性がある。

- 価格の動きは、買い手が疲れ果てていることを示しています。

The EUR/USD price plunged in the last hour, extending below yesterday’s lows. The pair is trading at 1.0806 at the time of writing.

–についてもっと知りたいですか 外国為替ロボット? 詳細ガイドを確認してください-

Fundamentally, the German Prelim GDP came in worse than expected, while the Spanish Flash CPI came in better than expected.

The FED is expected to deliver a 25 bps hike on Wednesday. The Federal Funds Rate should be increased from 4.50% to 4.75%. On the other hand, the European Central Bank is expected to increase the Main Refinancing Rate from 2.50% to 3.00% on Thursday.

The FOMC, ECB, and the NFP are seen as the most important events of the week, which is why the fundamental factors could change the sentiment.

Better than-expected US data today should force the currency pair to drop deeper. The CB Consumer Confidence could be reported higher at 109.1 versus 108.3 in the previous reporting period, which could be good for the greenback. The HPI and Chicago PMI figures will be released as well.

Earlier, the Eurozone data came in mixed. The Euro took a hit from German Retail Sales. The indicator reported a 5.3% drop versus the 0.1% drop expected. Later, the Eurozone Prelim Flash GDP could move the price in the short term.

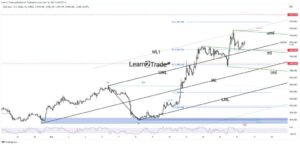

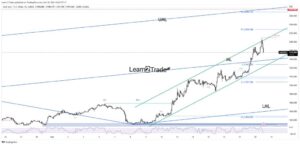

EUR/USD price technical analysis: Demand zone

Technically, the EUR/USD pair failed to stay above the upper median line (UML) of the ascending pitchfork, signaling exhausted buyers. It has validated its breakdown below the median line (ML) zone, so a rebound is possible.

–についてもっと知りたいですか 南アフリカの外国為替ブローカー? 詳細ガイドを確認してください-

A larger downside movement could be activated only if the rate drops and closes below 1.0766. From a technical point of view, failing to stay above the upper median line (UML) may announce a breakdown through the lower median line (LML). This scenario indicates a potential drop toward the downside warning line (WL1).

今外国為替を取引したいですか? eToroに投資しましょう!

このプロバイダーとCFDを取引するとき、個人投資家の口座の68%がお金を失います。 あなたはあなたのお金を失うことの高いリスクを冒す余裕があるかどうかを考慮する必要があります

- SEO を活用したコンテンツと PR 配信。 今日増幅されます。

- Platoblockchain。 Web3メタバースインテリジェンス。 知識の増幅。 こちらからアクセスしてください。

- 情報源: https://www.forexcrunch.com/eur-usd-price-strongly-bearish-ahead-of-us-consumer-confidence/

- 1

- 1%の低下

- a

- 私たちについて

- 上記の.

- アカウント

- Action

- アフリカの

- 先んじて

- 分析

- &

- アナウンス

- 銀行

- 弱気の

- 以下

- より良いです

- 内訳

- バイヤー

- 中央の

- 中央銀行

- CFD取引

- 変化する

- チェック

- シカゴ

- シカゴPMI

- 閉じ

- 信頼

- 検討

- consumer

- コンテナ

- 可能性

- 消費者物価指数

- 通貨

- データ

- 決定的な

- より深い

- 配信する

- 需要

- 詳細な

- 下側

- Drop

- ドロップス

- ECB

- EUR / USD

- ユーロ

- 欧州言語

- 欧州中央銀行

- ユーロ圏

- イベント

- 予想される

- 延伸

- 要因

- Failed:

- FRBは

- 連邦政府の

- フェデラル・ファンド・レート

- フィギュア

- フラッシュ

- FOMC

- 強

- 外国為替

- から

- 基本的な

- 資金

- 国内総生産

- ドイツ語

- ドイツの小売販売

- 良い

- グリーンバック

- ハイ

- より高い

- ハイキング

- ヒット

- HTTPS

- 重要

- in

- 増える

- 増加した

- を示し

- インジケータ

- 興味がある

- 投資する

- 投資家

- IT

- より大きい

- 姓

- 学習

- LINE

- 失う

- 負け

- 安値

- メイン

- 最大幅

- 混合

- ML

- お金

- 他には?

- 最も

- 運動

- ナチュラル

- NFP

- その他

- 期間

- プラトン

- プラトンデータインテリジェンス

- プラトデータ

- PMI

- ポイント

- 視点

- 可能

- 潜在的な

- 前

- ブランド

- 価格行動

- プロバイダー

- レート

- 達した

- リバウンド

- リリース

- 報告

- 各種レポート作成

- 小売

- 小売売上高

- リスク

- 行

- セールス

- 感情

- ショート

- すべき

- So

- スペイン語

- 滞在

- 強く

- SVG

- 取る

- 技術的

- テクニカル分析

- 介して

- 時間

- 〜へ

- 今日

- に向かって

- トレード

- トレーディング

- us

- 検証済み

- 対

- 詳しく見る

- 警告

- Wednesday

- 週間

- かどうか

- which

- while

- 意志

- 書き込み

- あなたの

- ゼファーネット