BoJ Noguchi reiterated the central bank’s focus on

wage growth to reach their 2% target sustainably with no policy change in

sight:

- It’s true the impact

of elevated global inflation is reaching Japan’s economy with consumer

inflation exceeding the BoJ’s 2% target since the spring of 2022. - But the rise (in

inflation) is mostly due to cost-push factors amid higher import prices. - To achieve our 2% inflation

target, we must see price rises backed by sustained wage increases. - While annual spring

wage negotiations this year achieved wage hikes unseen in 30 years, we’ve

only just reached a stage where the possibility of achieving our target

has come into sight.

BoJ Noguchi

The Switzerland November CPI missed expectations with

both the measures comfortably in the SNB’s 0-2% target range:

- CPI Y/Y 1.4% vs.

1.7% צפוי ו-1.7% קודם. - CPI M/M -0.2% vs.

-0.1% expected and 0.1% prior. - Core CPI Y/Y 1.4% vs.

1.5% קודם.

שווייץ מדד המחירים לצרכן YoY

ECB’s de Guindos (neutral – voter) maintained his

neutral stance as the central bank keeps a “wait and see” approach:

- Recent inflation

data is good news. - זה היה א

‘positive surprise’. - But it is too early

to declare victory. - עליית שכר

can still have an impact on inflation. - מדיניות מוניטרית

stance will be data dependent.

ECB’s de Guindos

The Tokyo CPI for

November fell further:

- מדד המחירים לצרכן

Y/Y 2.6% vs. 3.3% prior. - ליבה

CPI Y/Y 2.3% vs. 2.4% expected and 2.7% prior. - Core-Core

CPI Y/Y 2.7% vs. 2.7% prior.

טוקיו Core-Core CPI YoY

The Chinese Caixin Services

PMI for November beat expectations:

- Caixin Services PMI

51.5 vs. 50.8 expected and 50.4 prior.

מפתח

points from the report:

- פעילות עסקית

and new orders increase at quickest rates in three months. - Confidence around

the year-ahead improves. - הלחצים האינפלציוניים נחלשים.

China Caixin Services PMI

The RBA left the cash

rate unchanged at 4.35% as expected with a slightly dovish tone:

- Whether further

tightening of monetary policy is required to ensure that inflation returns

to target in a reasonable timeframe will depend upon the data and the

evolving assessment of risks. - Board remains

resolute in its determination to return inflation to target. - המוגבלת

information received on the domestic economy since the November meeting

has been broadly in line with expectations. - Outlook עבור

household consumption also remains uncertain. - The monthly CPI

indicator for October suggested that inflation is continuing to moderate,

driven by the goods sector; the inflation update did not, however, provide

much more information on services inflation. - מידות של

inflation expectations remain consistent with the inflation target. - התנאים ב

labour market also continued to ease gradually, although they remain tight. - Domestically, there

are uncertainties regarding the lags in the effect of monetary policy. - ריבית גבוהה יותר

rates are working to establish a more sustainable balance between

aggregate supply and demand in the economy. - Holding the cash

rate steady at this meeting will allow time to assess the impact of the

increases in interest rates on demand, inflation and the labour market.

RBA

The Eurozone PPI

for October came in line with expectations:

- PPI Y/Y -9.4% vs.

-9.5% expected and -12.4% prior. - PPI M/M 0.2% vs.

0.2% צפוי ו-0.5% קודם.

Eurozone PPI YoY

שנאבל של ה-ECB

(hawk – voter) changed her tone to a more neutral stance after the latest

inflation report:

- העלאות ריבית נוספות

“rather unlikely” after latest inflation data. - Inflation developments

are encouraging, fall in core prices remarkable. - Must be careful

about guiding policy for many months out. - Current level of

restriction is sufficient, has increased confidence 2% target will be met

ב 2025. - But must not declare

victory prematurely. - Inflation is on the

right track, but more progress is needed. - No prolonged

recession is seen. - הנתונים מציעים

economy may be bottoming out.

שנאבל של ה-ECB

The US ISM

Services PMI for November beat expectations:

- שירותי ISM PMI

52.7 vs. 52.0 expected and 51.8 prior. - Employment index 50.7 vs. 50.2 prior.

- New orders index

55.5 לעומת 55.5 קודם. - Prices paid index

58.3 לעומת 58.6 קודם. - New export orders

53.6 לעומת 48.8 קודם. - Imports 53.7 vs. 60.0 prior.

PMI של שירותי ISM בארה"ב

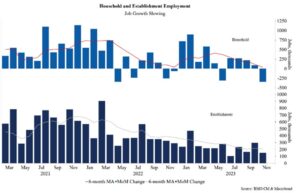

The US Job Openings for

October missed expectations by a big margin with a negative revision to the

prior reading:

- Job Openings 8.733M

vs. 9.300M expected and 9.350M prior (revised from 9.553M). - Hires 3.7% vs. 3.7% prior.

- Separations rate 3.6% vs. 3.6% prior.

- Quits 2.3% vs. 2.3%

קוֹדֵם.

משרות פנויות בארה"ב

The Australian Q3 GDP

missed expectations:

- GDP Q/Q 0.2% vs.

0.4% צפוי ו-0.4% קודם. - GDP Y/Y 2.1% vs.

1.8% צפוי ו-2.1% קודם.

Australia Q3 GDP

BoJ’s Himino just echoed

the other members’ comments with the usual focus on wage growth:

- BoJ will patiently

maintain easy policy until sustained, stable achievement of price target

is in sight. - Japan’s financial

system is likely resilient enough to weather stress from transition to

higher interest rates.

- If we do not get the

timing exit procedures wrong, the impact of a positive wage-inflation

cycle will likely benefit wide range of households, companies.

- Must make

appropriate decision on exit timing, procedure by scrutinising wage,

inflation developments. - BoJ must achieve

situation where inflation slows ahead, but not too much.

- Japan is seeing

steadily changes in price, wage behaviour.

- Solid progress is

observed in the transformation of firms’ wage- and price-setting

התנהגות. - המחיר עולה

beginning to affect wages. - Pass-through from

wages to inflation is also returning somewhat. - Without virtuous

cycle between wages and prices, Japan will most likely revert to the

deflationary state in the past.

- When Japan returns

to an economy with positive interest rate, that could improve households’

balance as a whole. - If inflation

expectations have heightened, that would mean impact of rise in real

interest rate could be smaller than that of nominal rate.

BoJ Himino

גוש האירו

Retail Sales for October missed expectations:

- קניות

Sales M/M 0.1% vs. 0.2% expected and -0.1% prior (revised from -0.3%). - קניות

Sales Y/Y -1.2% vs. -1.1% expected and -2.9% prior.

Eurozone Retail Sales YoY

ביילי של BoE

(neutral – voter) reaffirmed the central bank’s “wait and see” approach:

- Outlook עבור

inflation is uncertain. - Rates likely to need

to remain around current levels. - We remain vigilant

to financial stability risks that might arise.

BoE’s Governor Bailey

ECB’s Kazimir

(hawk – voter) pushed back against markets’ rate cuts expectations:

- עוד

rate hike is unlikely to be needed but market bets for Q1 rate cut are science

ספרות בדיונית.

ECB’s Kazimir

The US ADP missed

ציפיות:

- ADP 103K vs. 130K

expected and 106K prior (revised from 113K).

פרטים:

- Small (less than 50

employees) 6K vs. 19K prior. - Medium firms (500 –

499) 68K vs. 78K prior. - Large (greater than

499 employees) 33K vs. 18K prior.

Changes in pay:

- Job stayers 5.6% vs.

5.7% prior – slowest since September 2021. - Job changers 8.3% vs. 8.4% prior.

ADP בארה"ב

The BoC left

interest rates unchanged at 5.00% as expected:

- Statement repeats

that BoC “is prepared to raise the policy rate further if

needed”. - Data “suggest

the economy is no longer in excess demand”. - BoC saw

“further signs that monetary policy is moderating spending and relieving

price pressures”. - The slowdown in the

economy is reducing inflationary pressures in a broadening range of goods

and services prices. - המועצה

wants to see further and sustained easing in core inflation. - The global economy continues

to slow, and inflation has eased further. - US growth has been

stronger than expected but is likely to weaken in the months ahead. - Growth in the euro

area has weakened. - Oil prices are about

$10-per-barrel lower than was assumed in the October MPR. - The US dollar has

weakened against most currencies, including Canada’s. - ריבית גבוהה יותר

rates are clearly restraining spending: consumption growth in the last two

quarters was close to zero. - שוק העבודה

continues to ease: job creation has been slower than labour force growth.

BoC

ECB’s Villeroy

(neutral – voter) reaffirmed that the central bank is done with rate hikes and

the next step is rate cuts in 2024:

- Disinflation is

happening more quickly than we thought. - This is why, barring

any shocks, there will not be any new rise in rates. The question of a

rate cut could arise in 2024, but not right now.

ECB’s Villeroy

BoJ Governor Ueda didn’t

say anything explicitly about an exit from the current easy policy BUT you can

clearly read between the lines that they are considering rate hikes:

- Japan’s economy to

continue recovering moderately, supported mainly by accommodative

financial conditions and effects of economic stimulus measures. - Uncertainty over

Japan’s economy extremely high. - Closely watching the

impact of financial, forex markets on the Japanese economy, prices.

- Will patiently

continue monetary easing under YCC to support economic activity, cycle of

גידול בשכר.

- We have not yet

reached a situation in which we can achieve price target sustainably and

stably and with sufficient certainty.

- Challenging situation remains.

- It’ll become even

more challenging towards the end of this year and into early 2024.

- BoJ has not made

decision on which interest rate to target once we end negative interest

rate policy. - האפשרויות כוללות

raising rate applied to financial institutions’ reserves at BoJ, or revert

to policy targeting overnight call rate.

- Don’t have any

specific idea in mind on how much we will raise rates once we end negative

rate policy.

- Whether to keep

interest rate at zero or move it up to 0.1%, and at what pace short-term

rates will be hiked after ending negative rate policy, will depend on

economic and financial developments at the time. - Achieving 2% trend

inflation can be defined as a state where economy, void of new shocks, can

see inflation sustained around 2% and wage growth somewhat above that

רָמָה. - Would be difficult

to choose which monetary policy tools to mobilise when exit from stimulus

מתקרב. - BoJ to work closely

with govt while monitoring currency, financial market moves. - Service spending

increasing moderately as a trend. - מה חשוב

from here is for wages to keep rising and underpin consumption.

מושל BoJ Ueda

The Switzerland

Unemployment Rate for November ticked higher to 2.1% vs. 2.0% prior, while the

Seasonally adjusted unemployment rate remained unchanged at 2.1% vs. 2.2%

צפוי.

Switzerland Unemployment Rate

The US Challenger

Job Cuts for November increased to 45.51K vs. 36.84K prior. Compared to the

same month last year, job cuts are down by roughly 41% but then again there was

an exceptional number of tech layoffs in November of 2022. The 45.51K layoffs

last month brings the year-to-date total to 686,860 and that’s roughly a 115%

increase to the year-to-date total for last year through to November.

צ'לנג'ר ארה"ב קיצוצים

The US Jobless

Claims beat expectations across the board:

- Initial Claims 220K

vs. 222K expected and 219K prior (revised from 218K). - תביעות מתמשכות

1861K vs. 1910K expected and 1925K prior (revised from 1927K).

תביעות חסרות עבודה בארה"ב

BoC’s Gravelle

acknowledged the progress on inflation:

- Gravelle noted that

housing imbalances have serious consequences for shelter price inflation,

contributing 1.8 percentage points to the total October inflation rate of

3.1%. - Emphasized the need

for Canada to have more homes and a housing supply that is more responsive

to increases in demand. - Pointed out that a

jump in demographic demand, coupled with existing structural supply

issues, could explain why rent inflation continues to climb. - Stressed the

importance of all levels of government working together on housing

policies to boost supply. - Urged the reduction

of barriers to adding capacity and ensuring market flexibility to meet

future changes in housing demand. - Warned that without

more house building, inflationary pressures in the shelter sector could

continue to build. - Highlighted that

rent inflation reached a 40-year high in October, with housing supply not

keeping pace with recent increases in immigration. - Reported that

housing activity grew 8.3% in Q3 but remains far below the level needed to

meet growing housing needs. - Commented that

recent increases in immigration have boosted near-term consumption but

haven’t significantly affected inflation. - Noted that the

economy is now roughly in balance, with a focus on monitoring inflation

expectations, wage growth, and corporate pricing behaviour. - Stressed the

importance of indicators in assessing whether inflation is on a sustained

path to the 2% target. - Said that the market

has been relatively right on their previous two or three decisions, so it

seems like it’s taking in the data in the same way they are.

BoC’s Gravelle

The Japanese Average Cash Earnings increased in

October on a year-over-year basis marking the 22nd חודש רצוף

of rising wages:

- Average Cash

Earnings Y/Y 1.5% vs. 0.6% prior (revised from 1.2%). - Real wages Y/Y -2.3%.

יפן רווח מזומן ממוצע בשנה זו

The US NFP report beat expectations across the board

by a big margin:

- NFP 199K vs. 180K

expected and 150K prior. - Two-month net

revision -35K vs -101K prior. - שיעור האבטלה 3.7%

vs. 3.9% expected and 3.9% prior. - Participation rate 62.8% vs. 62.7% prior.

- U6 underemployment

rate 7.0% vs. 7.2% prior. - לפי שעה ממוצעת

earnings M/M 0.4% vs. 0.3% expected and 0.2% prior. - לפי שעה ממוצעת

earnings Y/Y 4.0% vs. 4.1% expected and 4.0% prior (revised from 4.1%). - שעות שבועיות ממוצעות

34.4 vs. 34.3 expected and 34.3 prior. - Change in private

payrolls 150K vs. 153K expected. - שינוי

manufacturing payrolls 28K vs. 30K expected. - Household survey 747K

vs. -348K prior. - Birth-death

adjustment 4K vs. 412K prior.

שיעור האבטלה בארה"ב

The highlights for next week will be:

- יום שלישי: Japan PPI, UK Labour Market report, NFIB Small

Business Optimism Index, US CPI. - יום רביעי: UK GDP, Eurozone Industrial Production, US PPI, FOMC

Policy Decision, New Zealand GDP. - יום חמישי: Australia Labour Market report, SNB Policy Decision,

BoE Policy Decision, ECB Policy Decision, US Retail Sales, US Jobless Claims,

New Zealand Manufacturing PMI. - יום שישי: Australia/Japan/Eurozone/UK/US Flash PMIs, China

Industrial Production and Retail Sales, Eurozone Wage data, US Industrial

Production, PBoC MLF.

That’s all folks. Have a nice weekend!

- הפצת תוכן ויחסי ציבור מופעל על ידי SEO. קבל הגברה היום.

- PlatoData.Network Vertical Generative Ai. העצים את עצמך. גישה כאן.

- PlatoAiStream. Web3 Intelligence. הידע מוגבר. גישה כאן.

- PlatoESG. פחמן, קלינטק, אנרגיה, סביבה, שמש, ניהול פסולת. גישה כאן.

- PlatoHealth. מודיעין ביוטכנולוגיה וניסויים קליניים. גישה כאן.

- מקור: https://www.forexlive.com/news/weekly-market-recap-04-08-december-20231208/

- :יש ל

- :הוא

- :לֹא

- :איפה

- $ למעלה

- 1

- 18k

- 2%

- 2% אינפלציה

- 2021

- 2022

- 2024

- 2025

- 220K

- 26

- 30

- 35%

- 36

- 4k

- 50

- 500

- 51

- 52

- 53

- 58

- 60

- 7

- 8

- 9

- a

- אודות

- מֵעַל

- להשיג

- הושג

- הישג

- השגתי

- הודה

- לרוחב

- פעילות

- מוסיף

- מותאם

- התאמה

- ADP

- להשפיע על

- מושפע

- לאחר

- שוב

- נגד

- לְקַבֵּץ

- קדימה

- תעשיות

- להתיר

- גם

- למרות

- בתוך

- an

- ו

- שנתי

- כל

- דבר

- יישומית

- גישה

- מתאים

- ARE

- AREA

- לְהִתְעוֹרֵר

- סביב

- AS

- לְהַעֲרִיך

- הערכה

- הערכה

- להניח

- At

- אוסטרליה

- אוסטרלי

- מְמוּצָע

- בחזרה

- מגובה

- ביילי

- איזון

- בנק

- מחסומים

- בסיס

- BE

- להיות ב

- להיות

- היה

- ההתחלה

- התנהגות

- להלן

- תועלת

- הימורים

- בֵּין

- גָדוֹל

- לוּחַ

- BoC

- BoE

- boj

- לְהַגבִּיר

- שיפרה

- שניהם

- מביא

- בְּהַרְחָבָה

- לִבנוֹת

- בִּניָן

- עסקים

- אבל

- by

- שיחה

- הגיע

- CAN

- קנדה

- קיבולת

- זהיר

- מזומנים

- מֶרכָּזִי

- בנק מרכזי

- ודאות

- המתמודד

- אתגר

- שינוי

- השתנה

- שינויים

- סין

- סינית

- בחרו

- טענות

- בבירור

- לטפס

- סְגוֹר

- מקרוב

- איך

- הערות

- חברות

- לעומת

- תנאים

- אמון

- רצופים

- השלכות

- בהתחשב

- עִקבִי

- צרכן

- צְרִיכָה

- להמשיך

- נמשך

- ממשיך

- ממשיך

- תורם

- ליבה

- אינפלציה הליבה

- משותף

- יכול

- המועצה

- יחד

- מדד המחירים לצרכן

- יצירה

- מטבעות

- מַטְבֵּעַ

- נוֹכְחִי

- חותך

- קיצוצים

- מחזור

- נתונים

- דֵצֶמבֶּר

- החלטה

- החלטות

- מוגדר

- דפלציוני

- דרישה

- דמוגרפי

- לסמוך

- תלוי

- נחישות

- התפתחויות

- DID

- קשה

- do

- דוֹלָר

- ביתי

- עשה

- דובשי

- מטה

- מצייר

- מונע

- ראוי

- מוקדם

- שכר

- להקל

- הקלה

- קל

- בנק המרכזי של אירופה

- החלטת מדיניות ה-ECB

- הדהד

- כַּלְכָּלִי

- כלכלה

- השפעה

- תופעות

- מורם

- עובדים

- מעודד

- סוף

- סיום

- מספיק

- לְהַבטִיחַ

- הבטחתי

- להקים

- יוֹרוֹ

- גוש האירו

- אֲפִילוּ

- מתפתח

- יוצא דופן

- עודף

- קיימים

- יציאה

- הציפיות

- צפוי

- להסביר

- בִּמְפוּרָשׁ

- יצוא

- מאוד

- גורמים

- ליפול

- רחוק

- פיקציה

- כספי

- גופים פיננסיים

- שוק פיננסי

- יציבות כלכלית

- חברות

- פלאש

- גמישות

- להתמקד

- ועדת שוק פתוח

- בעד

- להכריח

- מט"ח

- בשוקי המט"ח

- החל מ-

- נוסף

- עתיד

- תמ"ג

- לקבל

- גלוֹבָּלִי

- כלכלה עולמית

- טוב

- סחורות

- ממשלה

- נגיד

- ממשל

- יותר

- גדלתי

- גדל

- צמיחה

- מתרחש

- יש

- מִקְלָט

- נֵץ

- מוגבר

- לה

- כאן

- גָבוֹהַ

- גבוה יותר

- פסים

- טיול

- טיולים

- שֶׁלוֹ

- בתי מגורים

- שעות

- בית

- בית

- משקי בית

- דיור

- איך

- אולם

- HTTPS

- רעיון

- if

- הגירה

- פְּגִיעָה

- לייבא

- חשיבות

- חשוב

- לשפר

- משפר

- in

- לכלול

- כולל

- להגדיל

- גדל

- עליות

- גדל

- מדד

- אינדיקטור

- אינדיקטורים

- התעשייה

- ייצור תעשייתי

- אינפלציה

- ציפיות לאינפלציה

- שיעור אינפלציה

- אינפלציוני

- לחצים אינפלציוניים

- מידע

- מוסדות

- אינטרס

- גובה הריבית

- שערי ריבית

- אל תוך

- בעיות

- IT

- שֶׁלָה

- יפן

- יפן PPI

- יפן של

- יפני

- עבודה

- קיצוצים בעבודה

- טענות חסרי עבודה

- jpg

- לקפוץ

- רק

- שמור

- שמירה

- עבודה

- אחרון

- שנה שעברה

- האחרון

- פיטורים

- עזבו

- פחות

- רמה

- רמות

- כמו

- סביר

- מוגבל

- קו

- קווים

- ll

- עוד

- להוריד

- עשוי

- בעיקר

- לתחזק

- לעשות

- ייצור

- רב

- שולים

- שוק

- מהלכי שוק

- דוח שוק

- שוקי

- סימון

- מאי..

- אומר

- אמצעים

- לִפְגוֹשׁ

- מפגש

- נפגש

- יכול

- אכפת לי

- החטיא

- MLF

- בינוני

- מוניטרית

- מדיניות מוניטרית

- ניטור

- חוֹדֶשׁ

- אחת לחודש

- חודשים

- יותר

- רוב

- בעיקר

- המהלך

- מהלכים

- הרבה

- צריך

- ליד

- צורך

- נחוץ

- צרכי

- שלילי

- משא ומתן

- נטו

- נטרל

- חדש

- ניו זילנד

- התמ"ג של ניו זילנד

- PMI לייצור ניו זילנד

- חדשות

- הבא

- שבוע הבא

- nfp

- נחמד

- לא

- ציין

- נוֹבֶמבֶּר

- עַכשָׁיו

- מספר

- שנצפה

- אוֹקְטוֹבֶּר

- of

- on

- פעם

- רק

- פתחים

- אופטימיות

- or

- הזמנות

- אחר

- שלנו

- הַחוּצָה

- יותר

- בין לילה

- שלום

- נפרע

- עבר

- נתיב

- סבלנות

- תשלום

- שכר שכר

- PBOC

- PBOC MLF

- אחוזים

- אפלטון

- מודיעין אפלטון

- אפלטון נתונים

- PMI

- נקודות

- מדיניות

- מדיניות

- חיובי

- אפשרות

- ppi

- מוּכָן

- קודם

- מחיר

- מחירים

- תמחור

- קודם

- פְּרָטִי

- הליך

- נהלים

- הפקה

- התקדמות

- לספק

- דחף

- Q1

- Q3

- שאלה

- המהיר ביותר

- מהירות

- להעלות

- העלאה

- רכס

- ציון

- שיעור טיול

- העלאות שיעורי

- תעריפים

- במקום

- RBA

- לְהַגִיעַ

- הגיע

- הגעה

- חומר עיוני

- קריאה

- אושר מחדש

- ממשי

- סביר

- לסכם

- קיבלו

- לאחרונה

- שֵׁפֶל

- מחלים

- הפחתה

- הפחתה

- בדבר

- יחסית

- להשאר

- נשאר

- שְׂרִידִים

- ראוי לציון

- לשכור

- לדווח

- נדרש

- עתודות

- מִתאוֹשֵׁשׁ מַהֵר

- תגובה

- הגבלה

- קמעוני

- מכירות הקמעונאיות

- לַחֲזוֹר

- חוזר

- החזרות

- לחזור

- תקין

- לעלות

- עולה

- עולה

- סיכונים

- בערך

- s

- מכירות

- אותו

- ראה

- לומר

- מדע

- מגזר

- לִרְאוֹת

- ראות

- נראה

- לראות

- סֶפּטֶמבֶּר

- רציני

- שירותים

- מקלט

- טווח קצר

- מראה

- באופן משמעותי

- שלטים

- since

- מצב

- להאט

- האט

- מאט

- קטן

- קטן יותר

- SNB

- So

- במידה מסוימת

- ספציפי

- הוצאה

- אביב

- יציבות

- יציב

- התמחות

- עמדה

- מדינה

- בהתמדה

- יציב

- שלב

- עוד

- גירוי

- לחץ

- חזק יותר

- מִבנִי

- מספיק

- להציע

- מציע

- לספק

- היצע וביקוש

- תמיכה

- נתמך

- הפתעה

- סֶקֶר

- בר קיימא

- בר-קיימא

- מתמשכת

- שוויץ

- מערכת

- T

- נטילת

- יעד

- מיקוד

- טק

- מֵאֲשֶׁר

- זֶה

- השמיים

- שֶׁלָהֶם

- אז

- שם.

- הֵם

- זֶה

- השנה

- מחשבה

- שְׁלוֹשָׁה

- דרך

- הידוק

- זמן

- מסגרת זמן

- תזמון

- ל

- יַחַד

- טוקיו

- מדד המחירים לצרכן של טוקיו

- צליל

- גַם

- כלים

- סה"כ

- לקראת

- לעקוב

- טרנספורמציה

- מַעֲבָר

- מְגַמָה

- נָכוֹן

- שתיים

- Uk

- תוצר בבריטניה

- שוק העבודה בבריטניה

- לֹא בָּטוּחַ

- אי וודאויות

- תחת

- לְחַזֵק

- אבטלה

- שיעור אבטלה

- לא סביר

- עד

- עדכון

- על

- us

- מדד ארה"ב

- דולר אמריקאי

- משרות פנויות בארה"ב

- תביעות חסרות עבודה בארה"ב

- לנו NFP

- PPI בארה"ב

- מכירות קמעונאיות בארה"ב

- כרגיל

- Ve

- ניצחון

- הצבעה

- vs

- שכר

- משכורת

- רוצה

- היה

- צופה

- דֶרֶך..

- we

- מזג אוויר

- שבוע

- שבועי

- מה

- מתי

- אם

- אשר

- בזמן

- כל

- למה

- רָחָב

- טווח רחב

- יצטרך

- עם

- לְלֹא

- תיק עבודות

- עובד

- היה

- טעות

- שנה

- שנים

- עוד

- אתה

- זילנד

- זפירנט

- אפס