Silicon Valley investing giant מייפילד1 has raised two funds totaling almost $1 billion targeted for early-stage investment.

The Menlo Park-based firm — known as an early backer of such startups as Lyft, Marketo ו ServiceNow — announced its $580 million Mayfield XVII and the $375 million Mayfield Select III funds.

The firm last announced new funds in March 2020, when it raised $750 million across two funds. The firm now has $3 billion in total assets under management.

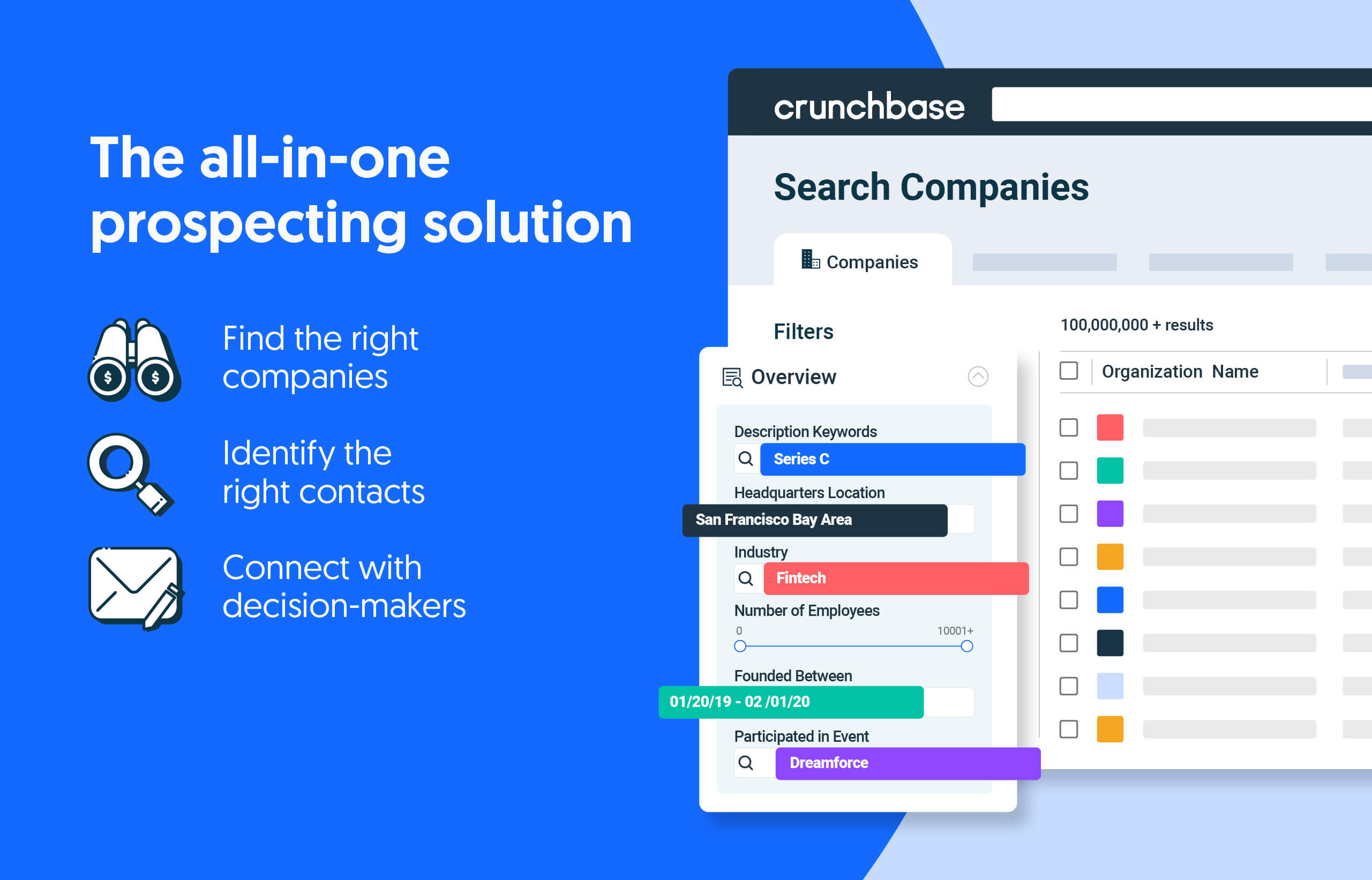

חפש פחות. סגור עוד.

הגדל את ההכנסה שלך עם פתרונות חיפוש הכל-באחד המופעלים על ידי המוביל בנתונים של חברות פרטיות.

The Mayfield XVII fund will primarily be used for early-stage investing — mainly seed and Series A rounds. The Mayfield Select III will be for follow-on rounds, as well as investments in new companies, primarily at the Series B stage.

Some themes the firm is looking to invest in include human-centered AI, the developer-first technologies, semiconductors, cybersecurity and more.

“We are grateful for the continued support of our limited partners and for the fortitude of entrepreneurs which brings us to work every day,” said Managing Partner נבין צ'דחה in a statement. “We believe that the current economic uncertainty presents an opportunity for the bold and a time to lean forward into the next era of innovation. We are excited about partnering with inception and early-stage founders looking for a people-first investor to build a bright future together.”

Recent dealmaking

While some big-name firms such as טייגר גלובל, שותפים לתובנה and many more significantly slowed their investment pace last year, Mayfield continued a deliberate and consistent cadence.

According to Crunchbase data, the firm completed 26 financing deals in the salad days of 2021, and 23 last year — when the venture and investing market was substantially easing.

So far this year, Mayfield’s pace has been a little slower, with just five deals announced. Those deals include participating in a $27 million Series A for India-based mobility platform Blu-Smart Mobility and a $51 million Series E for San Francisco-based database developer מידע על InfluxData.

איור: דום גוזמן

הישאר מעודכן בסבבי המימון האחרונים, ברכישות ועוד עם Crunchbase Daily.

באפריל 2022, 16 חברות ביצעו לפחות 10 השקעות או יותר בסטארט-אפים מבוססי ארה"ב - בראשות שתי חברות: Y Combinator ו-Techstars, ששילבו...

ההצלחה המתמשכת של שחקנים מבוססים עשויה להקשות על סטארט-אפים שאפתניים להדביק את עדר החדי-קרן.

- הפצת תוכן ויחסי ציבור מופעל על ידי SEO. קבל הגברה היום.

- PlatoAiStream. Web3 Data Intelligence. הידע מוגבר. גישה כאן.

- הטבעת העתיד עם אדריאן אשלי. גישה כאן.

- קנה ומכירה של מניות בחברות PRE-IPO עם PREIPO®. גישה כאן.

- מקור: https://news.crunchbase.com/venture/mayfield-early-stage-funding-seed-series-a/

- :יש ל

- :הוא

- 1 $ מיליארד

- $3

- $ למעלה

- 10

- 2020

- 2021

- 2022

- 23

- 26

- a

- אודות

- רכישות

- לרוחב

- AI

- All-in-One

- שאפתן

- an

- ו

- הודיע

- אַפּרִיל

- ARE

- AS

- נכסים

- At

- BE

- היה

- תאמינו

- B

- סיכה

- בָּהִיר

- מביא

- לִבנוֹת

- by

- קיידנס

- היאבקות

- סְגוֹר

- משולב

- חברות

- השלמת

- עִקבִי

- נמשך

- לכסות

- קראנץ '

- נוֹכְחִי

- אבטחת סייבר

- יומי

- נתונים

- מסד נתונים

- תַאֲרִיך

- יְוֹם

- ימים

- דילים

- מפתח

- e

- מוקדם

- בשלב מוקדם

- הקלה

- כַּלְכָּלִי

- ודאות כלכלית

- סוף

- יזמים

- תקופה

- נוסד

- כל

- כל יום

- נרגש

- רחוק

- מְמַמֵן

- פירמה

- חברות

- בעד

- קדימה

- המייסדים

- קרן

- מימון

- סבבי מימון

- כספים

- עתיד

- ענק

- אסיר תודה

- HTTPS

- in

- הַתחָלָה

- לכלול

- חדשנות

- אל תוך

- להשקיע

- השקעה

- השקעה

- השקעות

- משקיע

- IT

- שֶׁלָה

- jpg

- רק

- ידוע

- אחרון

- שנה שעברה

- מנהיג

- הכי פחות

- הוביל

- פחות

- מוגבל

- קְצָת

- הסתכלות

- עשוי

- בעיקר

- לעשות

- ניהול

- ניהול

- שותף מנהל

- רב

- צעדה

- מצעד 2020

- שוק

- מייפילד

- יכול

- מִילִיוֹן

- ניידות

- יותר

- כמעט

- חדש

- קרנות חדשות

- הבא

- עַכשָׁיו

- of

- הזדמנות

- or

- שלנו

- שלום

- משתתף

- שותף

- שותפות

- שותפים

- פלטפורמה

- אפלטון

- מודיעין אפלטון

- אפלטון נתונים

- שחקנים

- מופעל

- מתנות

- בראש ובראשונה

- מורם

- מעלה

- לאחרונה

- מימון אחרון

- הכנסה

- סיבובים

- s

- אמר

- סן

- זרע

- סמיקונדקטורס

- סדרה

- סדרה א '

- סדרה ב

- באופן משמעותי

- פתרונות

- כמה

- התמחות

- חברות סטארט

- הצהרה

- להשאר

- באופן משמעותי

- הצלחה

- כזה

- תמיכה

- ממוקד

- טכנולוגיות

- TechStars

- זֶה

- אל האני

- שֶׁלָהֶם

- זֶה

- השנה

- אלה

- זמן

- ל

- יַחַד

- סה"כ

- שתיים

- אי ודאות

- תחת

- חדקרן

- us

- מְשׁוּמָשׁ

- עֶמֶק

- מיזם

- היה

- we

- טוֹב

- מתי

- אשר

- יצטרך

- עם

- תיק עבודות

- Y קומבינטור

- שנה

- זפירנט