Ether’s price (ETH) reached $1,400 on March 10, which proved to be a bargain as the cryptocurrency rallied 27.1% until March 21, at the time of writing. However, the three reasons that supported the price gain, including correlation with tech stocks, its increasing total value locked and its deflationary token economics, all suggest that the path to $2,000 is set in stone.

There are numerous explanations for Ether’s 19.4% decline over the past six months. The Forcella rigida di Shanghai upgrade was delayed from March to early April and after Shanghai, Ethereum’s roadmap includes the “Surge,” “Verge,” “Purge,” and “Splurge” updates. In reality, the longer these intermediate steps to achieve scalability take, the greater the likelihood that competing networks will demonstrate efficacy and possibly establish a competitive advantage.

Another potentially concerning issue on the minds of investors is the real chance of price impact when validators are finally able to unlock their 32 ETH deposits following the completion of the Shappela hard fork. While it is impossible to predict how many of the 16 million ETH currently staked on the Beacon Chain will be sold on the market. There is a compelling argument in favor of the transition to liquid staking platforms, as they can use liquid staking derivatives on other decentralized finance networks without sacrificing their staking yield.

Traders could construct a narrative based on regulatory uncertainty, especially after SEC Chairman Gary Gensler’s September 2022 statement that proof-of-stake cryptocurrencies could be subject to securities laws. In February 2023, the SEC reached an agreement compelling the cryptocurrency exchange Kraken to cease offering crypto staking services to U.S.-based clients and the exchange also paid $30 million in disgorgement.

Correlazione rispetto alle aziende tecnologiche incentrate sulle applicazioni

Per capire perché Ether ha guadagnato il 15% in meno di tre giorni dopo essere stato brevemente scambiato sotto i 1,400$ il 10 marzo, i trader devono passare da un'analisi basata sui prezzi a un confronto della capitalizzazione di mercato. Il 10 marzo, la capitalizzazione di mercato di Ethereum ha chiuso a 175 miliardi di dollari.

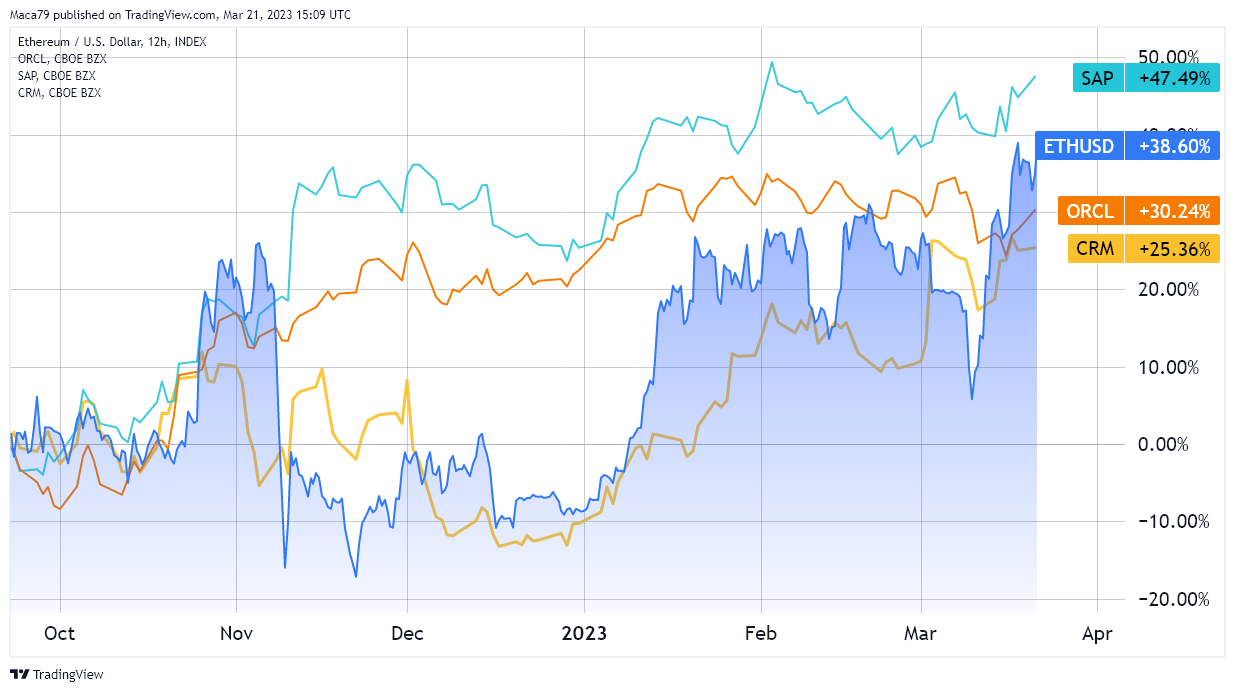

Oracle, SAP, and Salesforce are similar to Ethereum in that their software enables users to access shared computing resources and resources. This is in contrast to chipmakers NVidia and TSM, infrastructure providers Microsoft and Oracle, and technology companies Apple and Cisco that heavily rely on equipment.

The market capitalizations of Oracle, Salesforce and SAP are comparable to Ether’s at $233 billion, $188 billion, and $149 billion, respectively. Ultimately, centralized and decentralized solutions permit businesses to integrate their proprietary software so that all third parties and relevant departments can consult, process, share, and store data.

Considerando gli ultimi sei mesi di dati, il prezzo di Ether si è comportato in modo simile a quelle società. Il calo sotto i 1,400 dollari il 10 marzo era illogico se la correlazione tra i titoli tecnologici incentrati sulle applicazioni e il prezzo di Ether rimane valida.

Il valore totale bloccato di ETH si attesta a $ 30 miliardi

The Total Value Locked (TVL) of the Ethereum network was $24 billion on November 24, 2022, and increased by 30% to $30 billion by March 21, 2023. Therefore, if no other factors influence the price, one could anticipate a 30% price increase during that six-month period. Except that was not the case on March 10, when Ether traded at $1,400, representing a mere 8% increase from six months prior and indicating a disconnect between the value deposited in the network’s smart contracts and the ETH price.

Questa differenza del 22% tra l'aumento del 30% di TVL e l'aumento dell'8% del prezzo di ETH indicava che il vero valore di Ether avrebbe dovuto essere vicino a $ 1,700, un livello che è stato raggiunto tre giorni dopo, il 13 marzo 2023. Questo semplice modello esclude un numero delle variabili che influenzano la domanda e l'offerta e il conseguente livello dei prezzi, ma fornisce un'indicazione basata su dati storici.

Correlato: Coinbase presenta una petizione alla SEC spiegando che lo staking non è titoli

Il meccanismo deflazionistico di Ether è in pieno vigore

On November 10, 2021, the price of Ether was $4,869, a record high for the cryptocurrency. However, a great deal has changed since then, including the ardente of 3,016,607 ETH via the EIP-1559 Improvement Proposal. This equates to an additional $5.4 billion in capitalization that would have otherwise been created, thereby adding to the supply side and restraining price appreciation.

Currently, the market leader Bitcoin (BTC), is trading down 59% from its $69,000 all-time high. That does not necessarily mean Ether should reduce the gap versus Bitcoin, but it shows how discounted ETH currently stands at $1,780. The deflationary standard paves the way for Ether’s perception as a scarce digital asset, which is particularly promising during inflationary periods in the global economy.

Le opinioni, i pensieri e le opinioni espressi qui sono solo degli autori e non riflettono o rappresentano necessariamente le opinioni e le opinioni di Cointelegraph.

Questo articolo non contiene consigli o raccomandazioni di investimento. Ogni mossa di investimento e trading comporta dei rischi e i lettori dovrebbero condurre le proprie ricerche quando prendono una decisione.

- Distribuzione di contenuti basati su SEO e PR. Ricevi amplificazione oggi.

- Platoblockchain. Web3 Metaverse Intelligence. Conoscenza amplificata. Accedi qui.

- Fonte: https://cointelegraph.com/news/ethereum-price-at-1-4k-was-a-bargain-and-a-rally-toward-2k-looks-like-the-next-step

- :È

- 000

- 10

- 15%

- 2021

- 2022

- 2023

- 32 ETH

- 4k

- a

- capace

- accesso

- Raggiungere

- aggiuntivo

- Vantaggio

- consigli

- Dopo shavasana, sedersi in silenzio; saluti;

- Accordo

- Tutti

- da solo

- .

- ed

- anticipare

- Apple

- apprezzamento

- Aprile

- SONO

- argomento

- articolo

- AS

- attività

- At

- basato

- BE

- faro

- catena di faro

- sotto

- fra

- Miliardo

- Bitcoin

- brevemente

- aziende

- by

- Materiale

- berretto

- capitalizzazione

- Custodie

- centralizzata

- catena

- presidente

- possibilità

- Cisco

- clienti

- chiuso

- Cointelegraph

- Aziende

- paragonabile

- confronto

- avvincente

- concorrenti

- competitivo

- completamento

- informatica

- Segui il codice di Condotta

- costruire

- contratti

- contrasto

- Correlazione

- potuto

- creato

- CRM

- crypto

- Staking crittografico

- cryptocurrencies

- criptovaluta

- Scambio di criptovaluta

- scambio di criptovaluta Kraken

- Attualmente

- dati

- Giorni

- affare

- decentrata

- Finanza decentralizzata

- soluzioni decentralizzate

- decisione

- Rifiuta

- deflazionistico

- Ritardato

- Richiesta

- dimostrare

- dipartimenti

- depositato

- Derivati

- differenza

- digitale

- Asset digitale

- giù

- Cadere

- durante

- Presto

- Economia

- economia

- EIP-1559

- Abilita

- è assimilato

- usate

- particolarmente

- stabilire

- ETH

- prezzo etico

- etere

- Etere (ETH)

- Ethereum

- rete ethereum

- Prezzo Ethereum

- di Ethereum

- Ogni

- Tranne

- exchange

- spiegando

- espresso

- Fattori

- favorire

- Febbraio

- Infine

- finanziare

- i seguenti

- Nel

- forcella

- da

- pieno

- Guadagno

- divario

- Gary

- Gary Gensler

- Gensler

- globali

- Economia globale

- grande

- maggiore

- Hard

- hard fork

- Avere

- pesantemente

- qui

- Alta

- storico

- Come

- Tuttavia

- HTTPS

- Impact

- impossibile

- miglioramento

- in

- inclusi

- Compreso

- Aumento

- è aumentato

- crescente

- indicato

- indicando

- indicazione

- inflazionistico

- influenza

- Infrastruttura

- integrare

- Intermedio

- investimento

- Investitori

- problema

- IT

- SUO

- Kraken

- leader

- Livello

- piace

- Liquido

- picchettamento liquido

- bloccato

- più a lungo

- SEMBRA

- Fare

- molti

- Marzo

- Marzo 13

- Rappresentanza

- Market Cap

- Capitalizzazione di mercato

- Leader del mercato

- meccanismo

- Microsoft

- milione

- menti

- modello

- mese

- cambiano

- NARRATIVA

- Vicino

- necessariamente

- Rete

- reti

- GENERAZIONE

- Novembre

- numero

- numerose

- Nvidia

- of

- offerta

- on

- ONE

- Opinioni

- oracolo

- ORCL

- Altro

- altrimenti

- proprio

- pagato

- particolarmente

- parti

- passato

- sentiero

- pubblica

- periodo

- periodi

- Platone

- Platone Data Intelligence

- PlatoneDati

- potenzialmente

- predire

- prezzo

- Aumento di prezzo

- Precedente

- processi

- promettente

- Proof-of-Palo

- proposta

- proprio

- dimostrato

- fornire

- fornitori

- radunare

- a raggiunto

- lettori

- di rose

- Realtà

- motivi

- raccomandazioni

- record

- ridurre

- riflettere

- normativo

- pertinente

- resti

- rappresentare

- che rappresenta

- riparazioni

- Risorse

- rispettivamente

- risultante

- Rischio

- tabella di marcia

- s

- sacrificando

- forza di vendita

- linfa

- Scalabilità

- Scarsa

- SEC

- Presidente della SEC

- Il presidente della SEC Gary Gensler

- Valori

- Settembre

- set

- shanghai

- Condividi

- condiviso

- dovrebbero

- Spettacoli

- simile

- Allo stesso modo

- Un'espansione

- da

- SIX

- Sei mesi

- smart

- Smart Contract

- So

- Software

- venduto

- Soluzioni

- Fonte

- messo in gioco

- Staking

- Standard

- si

- dichiarazione

- step

- Passi

- Azioni

- STONE

- Tornare al suo account

- fornire

- Domanda e offerta

- supportato

- ondata

- Interruttore

- Fai

- Tech

- titoli tecnologici

- Tecnologia

- società tecnologiche

- che

- I

- loro

- in tal modo

- perciò

- Strumenti Bowman per analizzare le seguenti finiture:

- Terza

- terzi

- tre

- tempo

- a

- token

- economia simbolica

- Totale

- valore totale bloccato

- verso

- negoziate

- Traders

- Trading

- vero

- vero valore

- TVL

- in definitiva

- Incertezza

- capire

- Aggiornamenti

- upgrade

- uso

- utenti

- validatori

- APPREZZIAMO

- limite

- contro

- via

- visualizzazioni

- vs

- Modo..

- quale

- while

- volere

- con

- senza

- sarebbe

- scrittura

- dare la precedenza

- zefiro