The financial services (FS) sector is the engine behind the economy of the United Kingdom and virtually every other developed economy, contributing around 8.6% to the total economic output in the UK. Resilience is therefore critical for the FS sector, to keep the lights of the UK economy firmly ‘on’ for both businesses and the people that rely on them.

Tuttavia, sono state espresse preoccupazioni circa l'uso da parte dei settori finanziari del Regno Unito di alcuni fornitori di servizi cloud selezionati e l'impatto che potrebbe avere sulla stabilità finanziaria, sia a livello regionale che globale.

This does not mean the end of the FS sector using the cloud but rather a strategic shift in terms of how it is used. With every cloud there is a silver lining and as a result, there is an opportunity for cloud concentration risk to be mitigated by FS organisations using the hybrid cloud.

Il problema del rischio di concentrazione delle nuvole oggi

Secondo Finextra, cloud concentration risk can be defined as ‘when a bank’s overreliance on one provider presents operational risks and creates risks for financial stability’. But why is this such an important issue for FS organisations right now? Gartner this year previsiones that global public spending is set to reach over £400 million. The expected increase in public cloud spending will further exacerbate cloud concentration, as FS providers increasingly use a few select public cloud providers to host their data with. As the proportion of data stored in the public cloud increases, so too does the cloud concentration risk as the system is more susceptible to fail.

Nel mercato del cloud computing pubblico oggi, i principali provider (AWS, Microsoft e Google) hanno una reale posizione di potere nel mercato, con oltre il 50% del mercato globale share. This dominance means that financial services providers do not have a significant amount of choice when it comes to choosing a provider who can deliver the scale and functionality that they need, often to support the needs of a regional or global FS organisation. So how does the cloud concentration risk specifically affect the financial service sector?

Perché la concentrazione del cloud potrebbe porre problemi futuri per il settore FS

The financial sector forms the backbone of every major economy and provides the free flow of capital necessary for modern economies to operate. If the financial sector becomes less resilient in the future, then the UK economy could face real issues and at a time when the UK is previsto to go into a recession, we cannot afford for this to happen. Therefore, cloud concentration risk in the financial sector, if not dealt with effectively, could have ripple effects for businesses across the UK economy.

A maggio, the European Council and the European Parliament reached a provisional agreement on the Digital Operational Resilience Act (DORA), that is set to ensure that the European financial sector can continue operating if a period of severe operational disruption occurs. The Bank of International Settlements published a paper in July arguing that the reliance of financial institutions on a few large cloud services providers could have “systemic implications for the financial system” and the UK Treasury pubblicato un documento on mitigating risks from critical third parties to the finance sector. What this all reveals is that regulators and governments are clearly worried about the cloud concentration risk and are making the case for the risks to be minimised appropriately.

Il ruolo del cloud ibrido nella risoluzione dell'eccessiva dipendenza dal cloud

The hybrid cloud can help FS providers when it comes to issues relating to cloud overreliance. Fundamentally, the cloud concentration risk exists because FS providers are so reliant on a few large public cloud providers for their data storage. There are several benefits that the hybrid cloud can offer FS providers when it comes to solving an overreliance on the public cloud.

In primo luogo, le organizzazioni devono essere flessibili quando si tratta di archiviazione dei dati in futuro, in modo da poter essere preparate in futuro a ogni eventualità.

Secondly, FS providers must be agile enough to move data quickly should something bad happen, due to an incident or outage, or because of cost pressures that will increase over the coming months, as no organisation will be immune from inflation. On premise data centres can be part of a hybrid cloud setup, helping organisations with data sovereignty (an additional FS issue) and overall reliance on the public/private cloud.

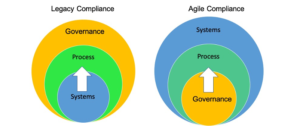

Infine, le organizzazioni FS devono essere pronte per le modifiche normative, quindi se il Regno Unito si sposta verso un quadro normativo simile a DORA, le organizzazioni possono ricorrere al cloud ibrido per garantire la conformità con i nuovi quadri normativi.

The hybrid cloud truly has the potential to help FS organisations overcome risk when it comes to cloud concentration and to ensure that the lights of the financial sector remain on, especially as the economy continues to face turbulent times in the months ahead.

- formica finanziaria

- blockchain

- conferenza blockchain fintech

- carillon fintech

- coinbase

- geniale

- criptoconferenza fintech

- Fintech

- app fintech

- innovazione fintech

- Fintextra

- OpenSea

- PayPal

- Paytech

- pagamento

- Platone

- platone ai

- Platone Data Intelligence

- PlatoneDati

- gioco di plato

- rasoio

- Revolut

- Ripple

- fintech quadrato

- striscia

- Tencent fintech

- Xero

- zefiro