Silicon Valley investing giant मेफ़ील्ड1 has raised two funds totaling almost $1 billion targeted for early-stage investment.

The Menlo Park-based firm — known as an early backer of such startups as Lyft, Marketo और अभी मरम्मत करें — announced its $580 million Mayfield XVII and the $375 million Mayfield Select III funds.

The firm last announced new funds in March 2020, when it raised $750 million across two funds. The firm now has $3 billion in total assets under management.

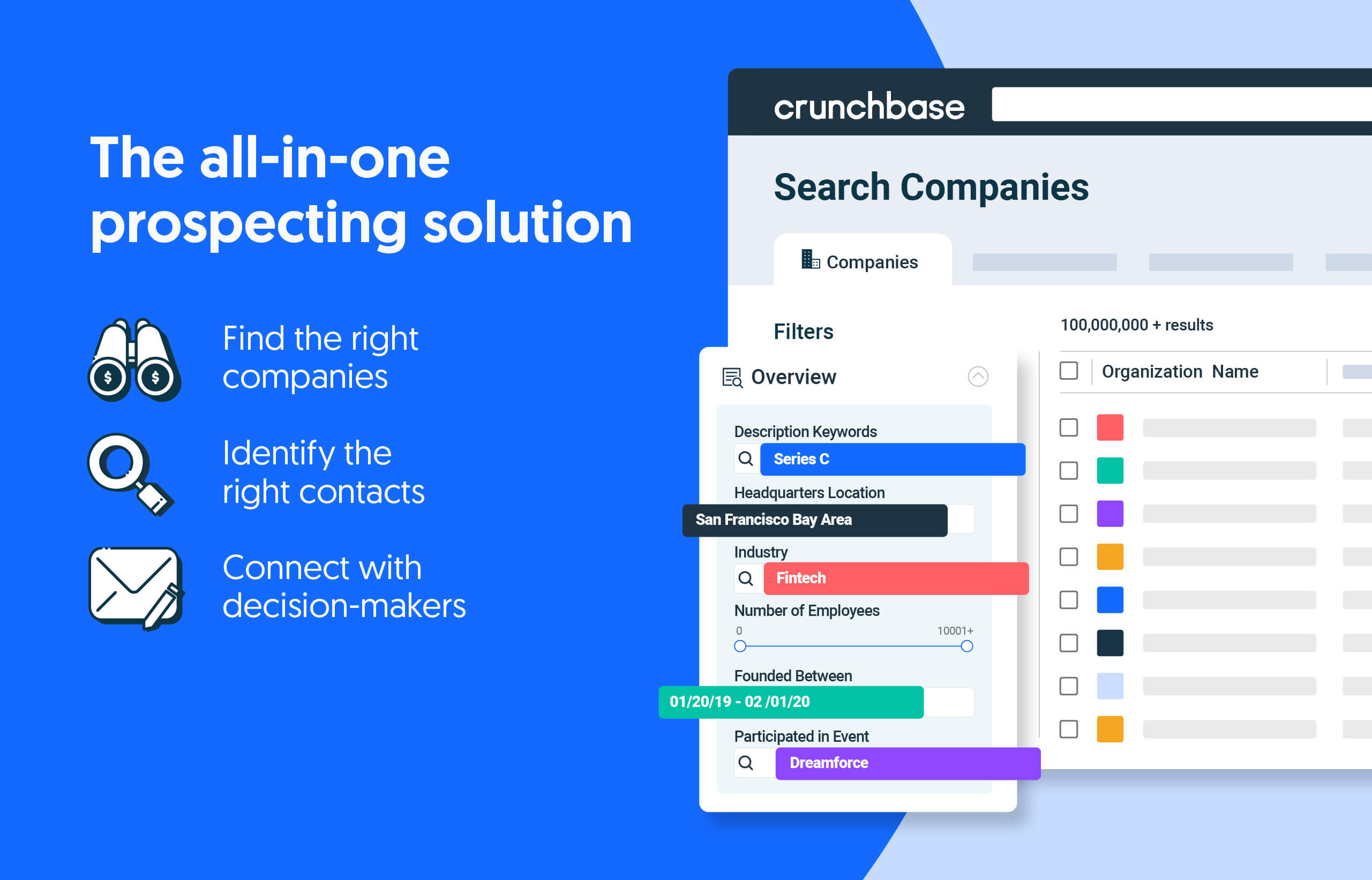

कम खोजें. और अधिक बंद करें.

निजी-कंपनी डेटा में अग्रणी द्वारा संचालित ऑल-इन-वन पूर्वेक्षण समाधानों के साथ अपना राजस्व बढ़ाएं।

The Mayfield XVII fund will primarily be used for early-stage investing — mainly seed and Series A rounds. The Mayfield Select III will be for follow-on rounds, as well as investments in new companies, primarily at the Series B stage.

Some themes the firm is looking to invest in include human-centered AI, the developer-first technologies, semiconductors, cybersecurity and more.

“We are grateful for the continued support of our limited partners and for the fortitude of entrepreneurs which brings us to work every day,” said Managing Partner नवीन चड्ढा in a statement. “We believe that the current economic uncertainty presents an opportunity for the bold and a time to lean forward into the next era of innovation. We are excited about partnering with inception and early-stage founders looking for a people-first investor to build a bright future together.”

Recent dealmaking

While some big-name firms such as टाइगर ग्लोबल, इनसाइट पार्टनर्स and many more significantly slowed their investment pace last year, Mayfield continued a deliberate and consistent cadence.

According to Crunchbase data, the firm completed 26 financing deals in the salad days of 2021, and 23 last year — when the venture and investing market was substantially easing.

So far this year, Mayfield’s pace has been a little slower, with just five deals announced. Those deals include participating in a $27 million Series A for India-based mobility platform Blu-Smart Mobility and a $51 million Series E for San Francisco-based database developer इन्फ्लुएंडाटा.

उदाहरण: डोम गुज़मैन

क्रंचबेस डेली के साथ हाल के फंडिंग राउंड, अधिग्रहण और बहुत कुछ के साथ अद्यतित रहें।

In April 2022, 16 firms made at least 10 investments or more into U.S.-based startups — led by two firms: Y Combinator and Techstars, which combined...

स्थापित खिलाड़ियों की निरंतर सफलता महत्वाकांक्षी स्टार्टअप के लिए यूनिकॉर्न झुंड के साथ तालमेल बिठाना कठिन बना सकती है।

- एसईओ संचालित सामग्री और पीआर वितरण। आज ही प्रवर्धित हो जाओ।

- प्लेटोआईस्ट्रीम। Web3 डेटा इंटेलिजेंस। ज्ञान प्रवर्धित। यहां पहुंचें।

- मिंटिंग द फ्यूचर डब्ल्यू एड्रिएन एशले। यहां पहुंचें।

- PREIPO® के साथ PRE-IPO कंपनियों में शेयर खरीदें और बेचें। यहां पहुंचें।

- स्रोत: https://news.crunchbase.com/venture/mayfield-early-stage-funding-seed-series-a/

- :हैस

- :है

- 1 $ अरब

- $3

- $यूपी

- 10

- 2020

- 2021

- 2022

- 23

- 26

- a

- About

- अधिग्रहण

- के पार

- AI

- ऑल - इन - वन

- महत्त्वाकांक्षी

- an

- और

- की घोषणा

- अप्रैल

- हैं

- AS

- संपत्ति

- At

- BE

- किया गया

- मानना

- बिलियन

- पिन

- उज्ज्वल

- लाता है

- निर्माण

- by

- ताल

- कुश्ती

- समापन

- संयुक्त

- कंपनियों

- पूरा

- संगत

- निरंतर

- आवरण

- CrunchBase

- वर्तमान

- साइबर सुरक्षा

- दैनिक

- तिथि

- डाटाबेस

- तारीख

- दिन

- दिन

- सौदा

- डेवलपर

- e

- शीघ्र

- प्राथमिक अवस्था

- सहजता

- आर्थिक

- आर्थिक अनिश्चितता

- समाप्त

- उद्यमियों

- युग

- स्थापित

- प्रत्येक

- प्रतिदिन

- उत्तेजित

- दूर

- वित्तपोषण

- फर्म

- फर्मों

- के लिए

- आगे

- संस्थापकों

- कोष

- निधिकरण

- फंडिंग का दौर

- धन

- भविष्य

- विशाल

- आभारी

- HTTPS

- in

- आरंभ

- शामिल

- नवोन्मेष

- में

- निवेश करना

- निवेश करना

- निवेश

- निवेश

- निवेशक

- IT

- आईटी इस

- जेपीजी

- केवल

- जानने वाला

- पिछली बार

- पिछले साल

- नेता

- कम से कम

- नेतृत्व

- कम

- सीमित

- थोड़ा

- देख

- बनाया गया

- मुख्यतः

- बनाना

- प्रबंध

- प्रबंध

- पार्टनर को मैनेज करना

- बहुत

- मार्च

- मार्च 2020

- बाजार

- मेफील्ड

- हो सकता है

- दस लाख

- गतिशीलता

- अधिक

- लगभग

- नया

- नई निधि

- अगला

- अभी

- of

- अवसर

- or

- हमारी

- शांति

- भाग लेने वाले

- साथी

- भागीदारी

- भागीदारों

- मंच

- प्लेटो

- प्लेटो डेटा इंटेलिजेंस

- प्लेटोडाटा

- खिलाड़ियों

- संचालित

- प्रस्तुत

- मुख्यत

- उठाया

- उठाता

- हाल

- हाल ही में अनुदान

- राजस्व

- राउंड

- s

- कहा

- सेन

- बीज

- अर्धचालक

- कई

- श्रृंखला ए

- श्रृंखला बी

- काफी

- समाधान ढूंढे

- कुछ

- ट्रेनिंग

- स्टार्टअप

- कथन

- रहना

- काफी हद तक

- सफलता

- ऐसा

- समर्थन

- लक्षित

- टेक्नोलॉजीज

- Techstars

- कि

- RSI

- लेकिन हाल ही

- इसका

- इस वर्ष

- उन

- पहर

- सेवा मेरे

- एक साथ

- कुल

- दो

- अनिश्चितता

- के अंतर्गत

- गेंडा

- us

- प्रयुक्त

- घाटी

- उद्यम

- था

- we

- कुंआ

- कब

- कौन कौन से

- मर्जी

- साथ में

- काम

- वाई कॉबिनेटर

- वर्ष

- आपका

- जेफिरनेट