De nombreuses entreprises qui bénéficieraient de la blockchain l'ont évitée. Son empreinte carbone, ses dépenses et ses liens avec des crypto-monnaies volatiles ont contribué à donner à la blockchain une réputation toxique qu'elle ne pouvait pas ébranler et que les entreprises ne toucheraient pas.

That was until ‘the Merge’. This – now widely used – term references the restructure of the world’s largest programmable blockchain: Ethereum. Put simply, this September the cryptography driving the system has been switched from proof of work (PoW) to proof of stake (PoS). This essentially replaced the huge, energy-intensive computers that were the network’s core validators, with individuals and companies. It is expected to reduce the energy consumption of Ethereum by 99% and reduce the global use of energy by 0.02%, selon Vitalik Buterin, améliorant considérablement sa durabilité. The Surge, l'épilogue de la fusion, finira par augmenter la capacité et réduire les frais sur le réseau.

C'est clairement une étape importante vers l'introduction d'Ethereum dans le courant dominant et cela marque une évolution de la technologie blockchain. Mais qu'est-ce que la réputation améliorée de la blockchain vraiment signifie pour un usage institutionnel?

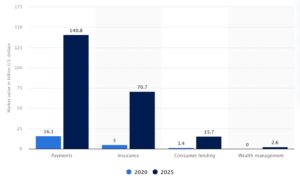

Press coverage has focused on more widespread crypto usage; however, the real impact will be on the institutional side – particularly within financial services. Now the stage is set for innovations, it is likely that parts of the industry may turn towards decentralised infrastructure. Blockchain can offer safe and secure transaction processing at a fraction of the cost, particularly when compared to the enormous expense and burden of today’s systems.

This has never been more relevant. The digital asset market is maturing significantly just as its traditional counterpart enters a period of turmoil and uncertainty. As the world hurtles towards another recession, businesses will be examining how to save money and cut costs. A greener, more cost-efficient blockchain could form part of the answer and reduce the institution’s huge IT expenditures.

If implemented correctly, blockchain could save billions in infrastructure and associated IT costs. Rather than paying for service level agreements, data centres, cloud hosting and other services, financial institutions can and will leverage blockchain infrastructure at a fraction of the cost of running the same transactions in-house. Cost efficiencies aside, tokenisation could improve several areas within asset management specifically, such as issuance, exchange and servicing as well as simplify processes involving a host of intermediaries. Potential benefits include improved access to, and personalisation of, investment solutions.

Pour le capital-investissement, la blockchain pourrait permettre la propriété fractionnée et les fonds décentralisés, ce qui non seulement augmentera la transparence, mais créera plus de flexibilité autour de la liquidité pour ce qui ne pouvait auparavant être que des investissements à long terme et immobilisés.

However, there is still a missing piece of the puzzle to be considered: interoperability. For true mainstream adoption of blockchain to occur within businesses, users need to be able to transact across multiple networks. Currently, it is not particularly easy to share information from one blockchain to another. To put this into context, if interoperability within email communication had never been achieved, Outlook users wouldn’t be able to send messages to Gmail accounts and vice versa.

Même si une adoption généralisée s'est produite à la suite de la fusion, tant que différentes chaînes de blocs - y compris Ethereum - ne pourront pas communiquer efficacement entre elles, tous les avantages de la technologie pour les entreprises ne seront pas débloqués.

- fourmi financière

- blockchain

- conférence blockchain fintech

- carillon fintech

- coinbase

- cognitif

- crypto conférence fintech

- FinTech

- application fintech

- innovation fintech

- Fintextra

- OpenSea

- PayPal

- technologie payante

- voie de paiement

- Platon

- platon ai

- Intelligence des données Platon

- PlatonDonnées

- jeu de platogamie

- rasoir

- Revolut

- Ripple

- fintech carré

- bande

- fintech tencent

- photocopieuse

- zéphyrnet