The cryptocurrency is inching slowly upwards after losses yesterday. Its total cap, at $922 billion, has fallen by 5% in a week, and by 32% in a month. It has, however, risen by 1% in 24 hours, along with most major coins. This invites hope for a weekend recovery, which the market is long overdue, even if macroeconomic conditions remain negative. As such, here's our pick of the 5 best cryptocurrency to buy for the recovery.

5 meilleures crypto-monnaies à acheter pour la reprise

1. Bloc chanceux (LBLOCK)

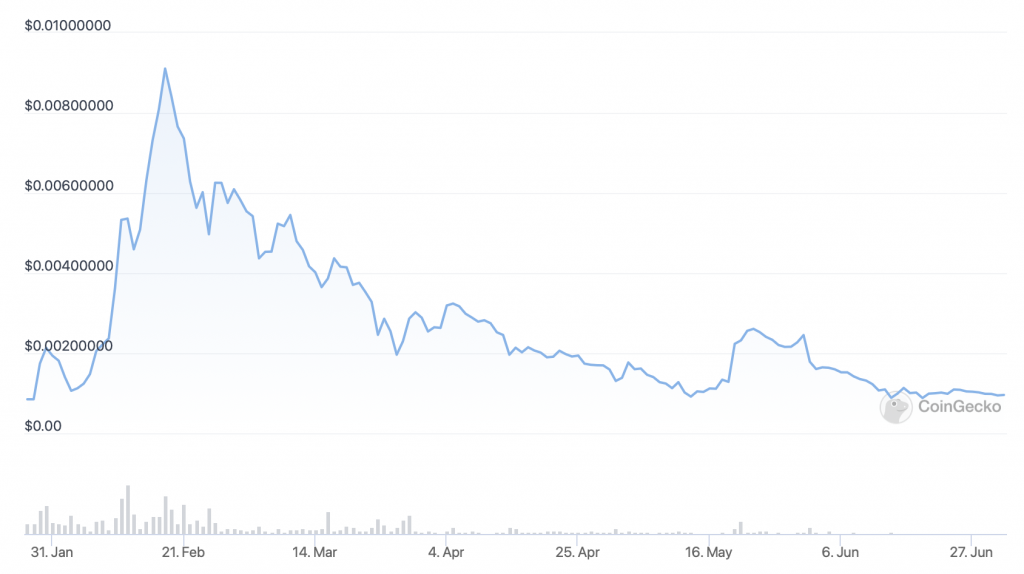

LBLOCK est de 0.00095626 $ pour le moment, ce qui représente une augmentation fractionnaire (0.2 %) au cours des dernières 24 heures. Cependant, l'altcoin a baissé de 12 % la semaine dernière et de 46 % au cours des 30 derniers jours.

LBLOCK is down by 90% since its all-time high of $0.00974554, set in February. On the other hand, it's up by 120% since launching in late January.

Le fait que LBLOCK soit toujours en hausse depuis son lancement est un bon signe pour l'avenir, et les développements récents de Lucky Block suggèrent qu'il pourrait croître fortement lorsque les conditions du marché s'amélioreront. D'une part, la plate-forme de jeux cryptographiques Lucky Block organise désormais des tirages au sort réguliers, ce qui garantit un jackpot minimum de 50,000 XNUMX $. En plus de cela, il a réussi l'audit pour son prochain jeton ERC-20.

Audit de jeton V2 réussi ! ✅

Cela signifie que nous nous rapprochons des cotations sur des bourses centralisées ! 🤩

Laissez le #Compte à rebours vers les CEX commencer! 🥳 @SolidProof_io #crypto #Audit #CEX #Annonces #blockchain pic.twitter.com/TZJMPdNOdZ

– Bloc chanceux (@luckyblockcoin) Le 23 juin 2022

In other words, an Ethereum-based version of LBOCK is imminent. It had originally launched on Binance Smart Chain, yet a migration to Ethereum will open up significant liquidity for the coin. Likewise, it paves the way for more exchange listings, something which will expand its market substantially. This is why it's one of our 5 best cryptocurrency to buy for the recovery.

2. Bitcoin (BTC)

Le BTC a augmenté de 1.5 % au cours des dernières 24 heures, atteignant 19,664 18,780 $. Il était tombé aussi bas que 7 38 $ hier, soulignant la possibilité de nouvelles chutes. Et sa tendance actuelle reste négative, ayant chuté de XNUMX% en une semaine et de XNUMX% en un mois.

BTC's indicators are at a very low ebb. Its relative strength index (in purple) is touching 30, indicating that the market is overselling it. Likewise, its 30-day moving average (in red) has fallen to its lowest level relative to its 200-day average (in blue) for a year. This strongly signals an eventual recovery.

Bitcoin remains the market's leader for a reason. It commands environ 26 milliards de dollars d'investissements institutionnels, qui devrait augmenter à moyen et long terme. Par exemple, Jacobi Asset Management vient d'annoncer the launch of Europe's first-ever spot Bitcoin ETF. It will go live this month on the Euronext Amsterdam exchange, paving the way for more institutional and mainstream investment in bitcoin.

More generally, it's bitcoin that continues to attract outside interest. There continue to be nations which turn to BTC during periods of very high inflation (e.g. Turquie ainsi que Argentine), ainsi que ceux qui lui ont donné cours légal (El Salvador ainsi que La République centrafricaine). Cette tendance se poursuivra très probablement lorsque le marché redeviendra plus positif.

3. Le bac à sable (SABLE)

At $1.13, SAND has risen by 15% in a day. It's also up by 12% in a week and by 35% in the past 14 days. That said, it is down by 22% in a month.

Looking at SAND's chart, it had been due a rally. Its RSI has fallen below 30, while its 30-day average had collapsed far below its 200-day. Of course, with conditions remaining challenging, it can't be said how long its current spurt will last.

Il semble que SAND augmente en ce moment en raison de l'ouverture d'un pont entre le Sandbox et la plate-forme de couche deux Polygon. Cela permet aux utilisateurs de Sandbox de transférer des jetons non fongibles LAND et SAND vers (et sur) Polygon, ce qui réduit les coûts et améliore l'efficacité.

🌉 Nous sommes prêts à déployer LAND pour @ 0xPolygone (I.e.

🔸Chaque LAND ponté accorde un cashback de 10 mSAND !

🔸Les multiplicateurs LAND sur les deux programmes de jalonnement mSAND sont de retour !

🔸 Les fonctionnalités de vente de LAND et de jalonnement de LAND (sur Polygon) arrivent bientôt !BRIDGE MAINTENANT ➡️ https://t.co/jlcSKxuBWh pic.twitter.com/1tuAAsqEZP

- Le bac à sable (@TheSandboxGame) Le 28 juin 2022

En regardant la situation dans son ensemble, le Sandbox a été témoin de nombreuses activités de haut niveau sur sa plate-forme de jeu/métaverse. Plus particulièrement, le fabricant de portefeuilles matériels Ledger a annoncé qu'il avait choisi le Sandbox comme son tout premier emplacement virtuel dans le métaverse. C'est une grande approbation pour la plate-forme, étant donné le poids de Ledger dans le secteur de la crypto-monnaie.

Bienvenue au LedgerVerse à @TheSandboxGame: Ledger's first step into the metaverse and the first to turn gaming into Web3 education. 🎮

Partez à la conquête de quêtes, combattez les escrocs et gagnez des récompenses Web3. 🥇

Maîtrisez la sécurité cryptographique.

Apprendre. Jouer. Gagner. Sortie été 2022. pic.twitter.com/56kS9FLZK6

- Grand livre (@Ledger) Le 22 juin 2022

It's worth remembering that the Sandbox racked up around 350 millions de dollars de ventes de terrains virtuels en 2021, more than any other similar platform. This highlights its potential, and also why we've included it among our 5 best cryptocurrency to buy for the recovery.

4. Ethereum (ETH)

L'ETH a augmenté de 2.5 % au cours des dernières 24 heures. À 1,072 6 $, il a chuté de 45 % la semaine dernière et de XNUMX % le mois dernier.

ETH's indicators are much like BTC's, suggesting a bottom. Its RSI is close to 30, while its 30-day average is far below its 200-day. Of course, the market is going through an unprecedentedly difficult time right now, so it's hard to say whether a rally is imminent.

Pourtant, l'ETH a un grand potentiel à moyen et long terme. C'est en grande partie parce qu'Ethereum est en train de passer à un mécanisme de consensus de preuve de participation. Cela rendra la blockchain de couche XNUMX moins énergivore, plus évolutive et plus attrayante pour les investisseurs.

Félicitations à #Ethereum communauté sur une fusion réussie sur le testnet de Ropsten.

Il y a plus de 22.78 milliards de dollars de valeur jalonnée et prête pour la prochaine fusion du réseau principal vers la preuve de participation.

Cela représente 12.8M $ ETH = 10.78 % de l'offre.

Graphique en direct: https://t.co/PDQg3lCJCl pic.twitter.com/GiFI3BtSKa

- glassnode (@glassnode) Le 8 juin 2022

Due at some point in late summer, the ‘Merge' will massively boost investor confidence in Ethereum. The introduction of staking will increase demand for ETH, and with 10% of ETH's supply already staked on the PoS Beacon Chain, the cryptocurrency could become deflationary. When you add the fact that Ethereum est déjà la plus grande blockchain en valeur totale verrouillée, it's easy to see why ETH is one of our 5 best cryptocurrency to buy for the recovery.

11/ Au montant actuel de la mise, le réseau Ethereum paiera ~600,000 4,850,000 ETH par an, au lieu de 88 4.6 XNUMX dans le modèle PoW actuel, soit XNUMX % de moins en « pression de vente » ! Dans le même temps, les parieurs gagneront toujours environ XNUMX % de leurs ETH mis en jeu, un bon retour à attirer.

- eric.eth (@econoar) Le 10 juin 2022

5. Tisser (RA)

AR est en hausse de 20% au cours des dernières 24 heures, à 10 $. Il a également augmenté de 2 % en une semaine et de 15 % en quinze jours, tout en restant en baisse de 35 % au cours des 30 derniers jours.

AR's chart shows a gradual increase in momentum. Its RSI has gone from under 30 a couple of weeks ago to nearly 50 today. At the same time, its 30-day average is still well below its 200-day, so there's plenty of room left for a bigger recovery.

It seems that AR is rallying right now due to the launch of Arweave's very own domain registry system. Basically, its Arweave's own version of the Ethereum Name Service, enabling users to purchase ArNS-based domain names using AR. This has caused demand for AR to rise as users move to claim their own domains.

Aujourd'hui, nous lançons notre programme pilote du système de noms Arweave (ArNS) - un répertoire de sous-domaines conviviaux basé sur Smartweave et activé par https://t.co/ljKQFJO6vN passerelles sur le @arweaveteam permaweb!

1/3 pic.twitter.com/62tQDABgyz

— 🐘🔗ario.arweave.dev (@ar_io_network) Le 29 juin 2022

Looking at AR's fundamentals, it's encouraging to note that Arweave — a decentralised data storage network — a connu une augmentation des transactions au cours de l'année écoulée. From 1.75 million daily transactions August 2021, its traffic increased to 48.8 million daily transactions by May of this year. This figure has since declined, as a result of the market downturn, but it's likely to continue witnessing growth once the economic picture improves.

Votre capital est à risque.

Lire la suite:

- "

- 000

- 10

- 2021

- 2022

- 28

- a

- activité

- Africaine

- déjà

- Altcoin

- parmi

- montant

- amsterdam

- annoncé

- AR

- autour

- atout

- la gestion d'actifs

- audit

- Août

- moyen

- En gros

- bbc

- chaîne de balises

- devenez

- ci-dessous

- LES MEILLEURS

- jusqu'à XNUMX fois

- plus gros

- Le plus grand

- Milliards

- binance

- Bitcoin

- Bitcoin ETF

- Block

- blockchain

- renforcer

- PONT

- BTC

- acheter

- Acheter bitcoin

- capital

- causé

- central

- centralisée

- chaîne

- difficile

- choisi

- réclamer

- plus

- CNBC

- Coin

- Pièces de monnaie

- Venir

- Communautés

- conditions

- confiance

- Consensus

- continuer

- continue

- Costs

- pourriez

- Couples

- Crypto

- crypto-monnaie

- Courant

- Tous les jours

- données

- stockage de données

- journée

- jours

- déflationniste

- Demande

- déployer

- dev

- développements

- difficile

- Commande

- domaine

- domaines

- down

- chuté

- pendant

- chacun

- gagner

- Revenus

- Économique

- Éducation

- efficace

- permet

- permettant

- encourageant

- énergie

- ERC-20

- ETF

- ETH

- Ethereum

- éthéréum (ETH)

- réseau ethereum

- Europe

- exemple

- échange

- Développer vous

- Fonctionnalités:

- Figure

- Prénom

- fractionnaire

- de

- Notions de base

- plus

- avenir

- Games

- jeux

- généralement

- obtention

- en Glassno

- aller

- Bien

- subventions

- l'

- Croître

- Croissance

- guarantir

- Matériel

- Portefeuille de matériel

- ayant

- ici

- Haute

- Faits saillants

- tenue

- d'espérance

- Comment

- Cependant

- HTTPS

- améliorer

- inclus

- Améliore

- increased

- indice

- inflation

- DOCUMENTS

- intérêt

- un investissement

- investor

- Investisseurs

- IT

- Janvier

- Juillet

- lancer

- lancé

- lancement

- leader

- Ledger

- Légal

- Niveau

- Probable

- Liquidité

- Annonces

- le travail

- emplacement

- fermé

- Location

- long-term

- pertes

- LES PLANTES

- Courant dominant

- majeur

- faire

- gestion

- manager

- Fabricants

- Marché

- veux dire

- mécanisme

- aller

- Métaverse

- million

- minimum

- modèle

- Élan

- Mois

- PLUS

- (en fait, presque toutes)

- Bougez

- en mouvement

- noms

- Nations

- négatif

- réseau et

- non fongible

- jetons non fongibles

- ouvert

- ouverture

- Autre

- propre

- périodes

- image

- pilote

- plateforme

- Jouez

- Beaucoup

- Point

- Polygone

- PoS

- positif

- possibilité

- défaillances

- PoW

- la parfaite pression

- prix

- prix

- processus

- Programme

- Programmes

- Preuve de pieu

- public

- achat

- quêtes

- rallier

- RE

- récent

- récupération

- Standard

- rester

- restant

- reste

- représentation

- représente

- retourner

- Reuters

- Programme de fidélité

- hausse

- Analyse

- Saïd

- vente

- même

- SAND

- tas de sable

- évolutive

- Les escrocs

- secteur

- sécurité

- vendre

- service

- set

- signer

- significative

- similaires

- depuis

- smart

- So

- quelques

- quelque chose

- Spot

- pieu

- Staking

- Encore

- storage

- force

- réussi

- été

- la quantité

- combustion propre

- La

- Avec

- fiable

- aujourd'hui

- jeton

- Tokens

- top

- circulation

- Transactions

- transférer

- sous

- au cours 30

- prochain

- vers le haut

- utilisateurs

- Plus-value

- version

- Salle de conférence virtuelle

- définition

- W3

- Wallet

- Web3

- semaine

- weekend

- que

- tout en

- gagner

- dans les

- des mots

- vaut

- an