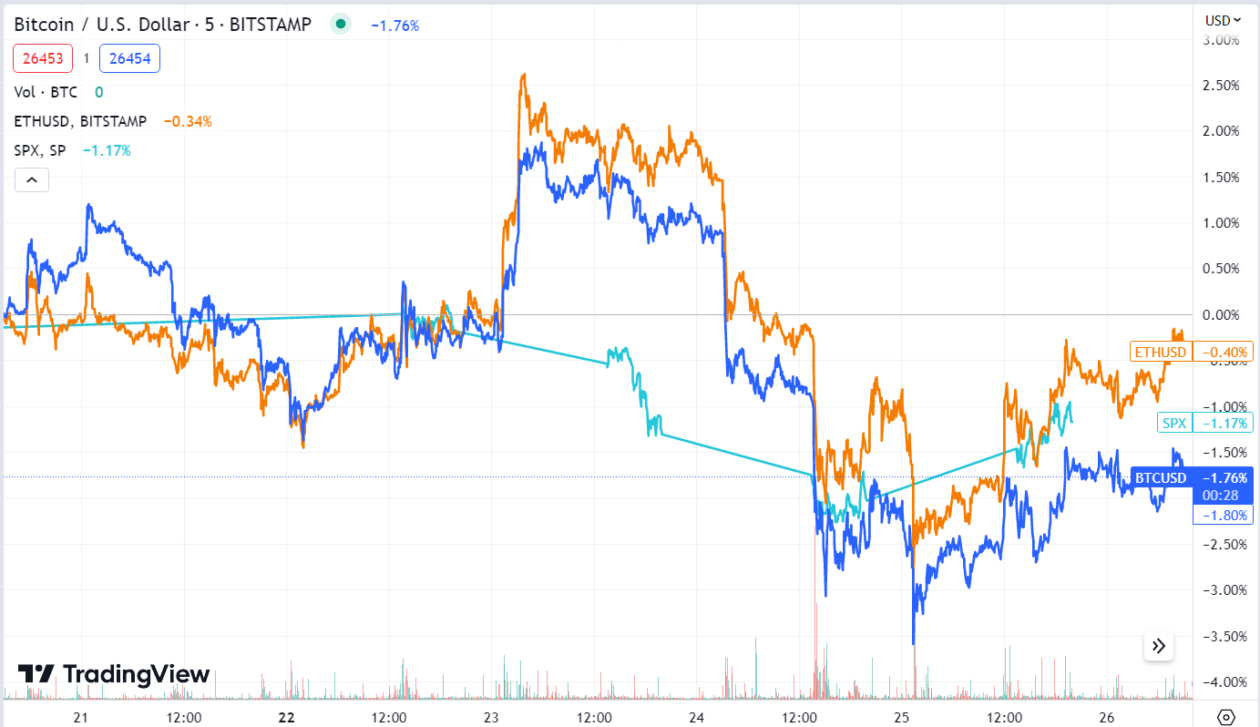

Bitcoin fell 1.40% from May 19 to May 26 to trade at US$26,451 at 7:00 p.m. Friday in Hong Kong. The world’s largest cryptocurrency by market capitalization has been trading under US$30,000 since April 19. Ether rose 0.34% over the week to US$1,813 recapturing US$1,800 on Thursday.

The lack of progress in U.S. debt ceiling negotiations continued to erode risk appetite as the June 1 deadline neared. On Wednesday, Fitch Ratings placed the U.S.’ AAA rating on a negative rating watch, saying that debt ceiling negotiations raised the risks of the government missing payments on some of its obligations.

“Bitcoin and Ether have shrugged off the U.S. debt ceiling negotiations and the potential ripple effects for crypto. President Biden has already declared the country will not default on its debt,” Lucas Kiely, the chief investment officer of digital asset platform Yield App , said . “With liquidity tight, the crypto market doesn’t seem to be too concerned over these macro events. It will take something much more substantial to move these markets.”

Johnny Louey, a crypto research analyst at trading platform LiquidityTech Protocol , disagreed, saying that the debt ceiling negotiations are the main factors weighing down Bitcoin price.

“Although the debt ceiling has been raised and revised 78 times since 1960, investors are aware of the default risk if negotiations fail. This is the first time Bitcoin encountered such an economic incident and it’s reasonable to assume a risk-off approach would be appropriate,” said Louey .

The global crypto market capitalization stood at US$1.11 trillion on Friday at 7:00 p.m. in Hong Kong, down 0.89% from US$1.12 trillion a week ago, according to CoinMarketCap data. With a market cap of US$512 billion, Bitcoin represented 46.1% of the market, while Ether, valued at US$218 billion, accounted for 19.6%.

"Kogu krüptovaluutade turukapitalisatsioon on püsinud aasta aega sisuliselt muutumatuna," ütles Kiely. "Tetheri plaan laiendada oma Bitcoini osalust võib ajutiselt hindu tõsta, kuid üldiselt ei avalda see tõenäoliselt suurt mõju. Bitcoini 2024. aasta poole võrra vähendamine võib kaasa tuua hinnatõusu, kuid me pole veel hakanud nägema selle mõju.

On May 17, Tether , the company behind the world’s largest stablecoin USDT, revealed its plans to “regularly allocate” as much as 15% of its net operational profits to buy Bitcoin, aiming to boost its reserves portfolio. Tether held approximately US$1.5 billion in Bitcoin reserves, at the time of the announcement.

Seisev Bitcoin saavutab kõigi aegade kõrgeima taseme

The amount of Bitcoin that has been inactive for at least a year rose to an all-time high of 68.46% on Wednesday, according to data aggregator MacroMicro .

“It could mean short-term selling pressure decreases if the Bitcoin holdings in short-term holdings shift to longer-term holders. However, we will not be able to tell whether the addresses belong to institutional investors or not,” Tom Wan, a research analyst at 21.co , the parent company of 21Shares, an issuer of crypto exchange-traded products, said.

Yield Appi Kiely sõnul viitab see sellele, et üha rohkem investoreid kogu maailmas kavatseb hoida oma Bitcoini pikaajaliselt.

"See suundumus tõenäoliselt jätkub ja isegi kiireneb - isegi potentsiaalselt hüperbitkoiniseerumiseni -, arvestades ebakindlust, mis on seotud areneva regulatiivse maastiku ja Bitcoini kui väärtuse säilitaja kasvava tunnustamisega," ütles Kiely.

"Hüperbitkoiniseerimine" on kontseptsioon, mis spekuleerib Bitcoini võimaliku tõusu üle, et saada maailmas üldlevinud rahavormiks.

Märkimisväärsed liikujad: RNDR & KAVA

The Render Network’s native cryptocurrency was this week’s biggest gainer among the top 100 coins by market capitalization listed on CoinMarketCap, rallying 16.55% to US$2.83. The token started picking up momentum last Saturday, after the announcement of the new Render Foundation website. This is Render’s second consecutive week as the biggest gainer in the top 100 cryptos.

The Render Network leverages idle graphics processing units for digital rendering purposes, catering to areas such as 3D modeling, gaming imagery, and virtual reality.

Kava, the governance token of a layer-1 blockchain of the same name, was this week’s second-biggest gainer, rising 10.70% to US$1.09. The coin started picking up momentum on Monday, following the launch of the Kava mainnet last week.

Järgmine nädal: kas võla ülemmäära tehing võib Bitcoini krabikõnni murda?

U.S. President Joe Biden and House Speaker Kevin McCarthy are reportedly closing in on a deal that would raise the government’s debt ceiling for two years while capping spending on most items. Yet, the June 1 deadline is fast approaching, causing investor concerns about a potential default.

WuuTrade'i Kenjajevi sõnul painab ebakindlus võla ülemmäära läbirääkimiste ümber krüptoturgu seni, kuni tehinguni jõutakse.

“The sideways [movement] of Bitcoin is very much related to the current market risks and the fear. Investors’ activity during any economic risk talks is rather cautious. Hence the sideways in US$26,000 – US$30,000,” wrote Kenjaev, adding that positive news surrounding the U.S. economy will break the crab walk .

Investorid ootavad järgmisel nädalal USA maikuu töökohtade aruande avaldamist, mis sisaldab olulisi andmeid mittefarmide palgafondide kohta. See teave on sageli baromeetriks, et ennustada Föderaalreservi järgmisi samme intressimäärade korrigeerimisel. ING Economics prognoosib maikuuks mittefarmide palgafondide kasvu 195,000 3.5 võrra. Lisaks eeldavad nad, et mais tõuseb töötuse määr pisut 3.4%ni, võrreldes XNUMX%ga eelmisel kuul.

Krüptoruumis plaanib Ethereumi kihi 2 võrk Optimism järgmisel kolmapäeval, aasta pärast mündi turuletulekut, suurendada oma juhtimismärgi (OP) ringlust. Laienemine on osa Optimismi strateegiast suurendada hääletatavate žetoonide kogumit Token House'is, selle OP omanike rühmas, kes vastutab juhtimisküsimuste ettepanekute tegemise ja hääletamise eest.

See related article: Big buys fail to lift NFT markets as regulatory uncertainty weighs heavy on crypto

- SEO-põhise sisu ja PR-levi. Võimenduge juba täna.

- PlatoAiStream. Web3 andmete luure. Täiustatud teadmised. Juurdepääs siia.

- Tuleviku rahapaja Adryenn Ashley. Juurdepääs siia.

- Ostke ja müüge IPO-eelsete ettevõtete aktsiaid koos PREIPO®-ga. Juurdepääs siia.

- Allikas: https://bitrss.com/news/309885/weekly-market-wrap-bitcoin-weighed-down-by-debt-ceiling-uncertainty

- :on

- :on

- :mitte

- ][lk

- $ UP

- 000

- 1

- 10

- 100

- 11

- 12

- 15%

- 17

- 195

- 2024

- 21Jahud

- 26

- 3d

- 3D modelleerimine

- 7

- a

- AAA

- Võimalik

- MEIST

- Vastavalt

- tegevus

- lisades

- Lisaks

- aadressid

- kohandused

- pärast

- Agregaator

- tagasi

- Eesmärk

- juba

- vahel

- summa

- an

- analüütik

- ja

- Teadaanne

- ennetada

- mistahes

- app

- söögiisu

- lähenemine

- läheneb

- asjakohane

- umbes

- Aprill

- OLEME

- valdkondades

- ümber

- artikkel

- AS

- eelis

- At

- ootamas

- teadlik

- BE

- muutuma

- olnud

- taga

- biden

- Suur

- suurim

- Miljard

- Bitcoin

- Bitcoin Hind

- bitcoini reserve

- blockchain

- suurendada

- Murdma

- kuid

- ostma

- osta Bitcoin

- Ostab

- by

- kork

- Kapitaliseerimine

- põhjustades

- ettevaatlik

- lagi

- juht

- ringluses

- Sulgemine

- CO

- Münt

- CoinMarketCap

- Mündid

- ettevõte

- võrreldes

- mõiste

- mures

- Murettekitav

- järjestikune

- jätkama

- jätkas

- võiks

- riik

- otsustav

- krüpto

- Krüptoturg

- krüptovälja

- cryptocurrencies

- cryptocurrency

- Krüptoid

- Praegune

- andmed

- tegelema

- Võlg

- väheneb

- vaikimisi

- digitaalne

- Digitaalne vara

- Ei tee

- alla

- ajal

- Majanduslik

- Ökonoomika

- majandus

- mõju

- Kogu

- põhiliselt

- Eeter

- Eeter (ETH)

- ethereum

- Isegi

- sündmused

- lõpuks

- areneb

- börsil kaubeldavad

- Laiendama

- laiendamine

- tegurid

- FAIL

- KIIRE

- hirm

- Föderaal-

- Föderaalreservi oma

- esimene

- Esimest korda

- fitch

- Järel

- eest

- vorm

- Sihtasutus

- Reede

- Alates

- mäng

- antud

- Globaalne

- Globaalne krüpto

- valitsemistava

- Valitsus

- graafika

- Grupp

- Kasvavad

- Pooleks

- Olema

- raske

- Held

- sellest tulenevalt

- Suur

- Hits

- hoidma

- omanikud

- Holdings

- Hong

- Hong Kong

- maja

- aga

- HTTPS

- Hüperbitkoiniseerumine

- Idle

- if

- mõju

- in

- inaktiivne

- juhtum

- hõlmab

- Suurendama

- üha rohkem

- info

- ING

- Institutsionaalne

- institutsionaalsetele investoritele

- kavatsevad

- huvi

- INTRESS

- sisse

- investeering

- investor

- Investorid

- Emitent

- küsimustes

- IT

- kirjed

- ITS

- Tööturg

- töökohtade aruanne

- Joe Biden

- juuni

- KAVA

- hoidma

- Kong

- puudus

- maastik

- suur

- suurim

- viimane

- algatama

- viima

- kõige vähem

- võimendab

- Tõenäoliselt

- Likviidsus

- Loetletud

- Pikk

- Makro

- põhiline

- mainnet

- Turg

- Turupiirkond

- Turukapitalisatsioon

- turu mähis

- turud

- mai..

- keskmine

- puuduvad

- modelleerimine

- Impulss

- Esmaspäev

- raha

- kuu

- rohkem

- kõige

- liikuma

- liikumine

- Movers

- palju

- nimi

- emakeelena

- negatiivne

- läbirääkimised

- neto

- võrk

- Uus

- uudised

- järgmine

- NFT

- NFT turud

- Mittepõllumajanduslik

- Mitterahaline palgafond

- kohustusi

- of

- maha

- Ohvitser

- sageli

- on

- OP

- töökorras

- Optimism

- or

- üle

- üldine

- emafirma

- osa

- maksed

- Palgaarvestus

- kava

- planeerimine

- plaanid

- inimesele

- Platon

- Platoni andmete intelligentsus

- PlatoData

- Punkt

- ujula

- portfell

- positiivne

- potentsiaal

- potentsiaalselt

- prognoosimine

- president

- president laienema

- president joe biden

- surve

- hind

- Hinnad

- töötlemine

- Toodet

- kasum

- Edu

- Prognooside

- protokoll

- eesmärkidel

- tõstma

- tõstatatud

- määr

- pigem

- hinnang

- hinnangust

- jõudis

- Reaalsus

- mõistlik

- tunnustamine

- kohta

- regulatiivne

- regulatiivne maastik

- seotud

- vabastama

- jäi

- rendering

- aru

- esindatud

- teadustöö

- reservid

- vastutav

- Revealed

- Ripple

- Tõusma

- tõusev

- Oht

- riskiisu

- riskide

- ROSE

- s

- Ütlesin

- sama

- laupäev

- ütlus

- Teine

- nägemine

- tundub

- Müük

- teenib

- suunata

- lühiajaline

- külgsuunas

- alates

- mõned

- midagi

- Ruum

- Kõneleja

- Kulutused

- stabiotsiin

- stabiilne münt USDT

- algus

- alustatud

- Sammud

- salvestada

- väärtuse hoidla

- Strateegia

- mahukas

- selline

- Soovitab

- varustama

- ümbritsev

- Võtma

- Läbirääkimised

- öelda

- termin

- Tether

- et

- .

- oma

- Need

- nad

- see

- neljapäeval

- aeg

- korda

- et

- sümboolne

- märgid

- liiga

- ülemine

- kaubelda

- Kauplemine

- Kauplemisterminal

- Trend

- triljon

- kaks

- meie

- USA majandus

- kõikjal

- Ebakindlus

- all

- töötus

- töötuse määr

- üksused

- kuni

- USDT

- väärtus

- hinnatud

- väga

- virtuaalne

- Virtuaalne reaalsus

- Hääletamine

- oli

- Watch

- we

- veebisait

- Kolmapäev

- nädal

- iga nädal

- kaalumine

- kaalub

- kas

- mis

- kuigi

- will

- koos

- jooksul

- maailma

- ülemaailmne

- oleks

- pakkima

- aasta

- aastat

- veel

- saak

- Saagis App

- sephyrnet