- The dollar held firm ahead of the CPI report.

- The yen retraced gains from Kazuo Ueda’s remarks.

- A surge in oil prices has raised worries of inflationary pressures in the US.

The dollar has been strong before the US inflation report, contributing to the bullish USD/JPY forecast. Moreover, it strengthened against the yen as traders continued to analyze comments made by Japan’s top central banker.

-Kas sa otsid automatiseeritud kauplemise? Vaadake meie üksikasjalikku juhendit -

The US currency saw an increase of approximately 0.2% against the yen, reaching 147.39. This move marked a solid retracement of its most substantial one-day percentage gain in two months. This occurred Monday following remarks from Bank of Japan (BOJ) Governor Kazuo Ueda.

According to Alvin Tan, the head of Asia FX strategy at RBC Capital Markets, investors had more time to consider Ueda’s comments thoroughly. Moreover, Tan noted, “To our understanding, the statement was somewhat conditional, as (Ueda) did not make any firm promises.”

Additionally, influential ruling party lawmaker Hiroshige Seko indicated his preference for maintaining an ultra-loose monetary policy on Tuesday. This came after Ueda’s comments, which had led to a strengthening yen and higher bond yields.

Recently, the yen has been weakening against the dollar, primarily due to the BOJ’s dovish stance compared to the Fed. The Federal Reserve embarked on an aggressive rate-hike cycle in March 2022.

Data revealed that Japan’s annual wholesale inflation had slowed for the eighth consecutive month in August. However, it remained at 3.2%, surpassing the central bank’s 2% target.

As markets awaited critical US inflation data, concerns grew due to a surge in oil prices. This raised worries that inflationary pressures might be more deeply rooted than anticipated.

USD/JPY peamised sündmused täna

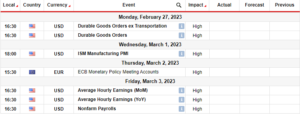

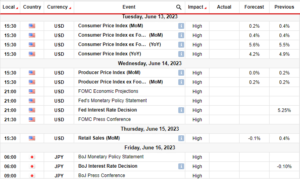

Today, market participants are anxious to watch:

- Monthly headline US inflation.

- Annual headline US inflation.

- Core monthly US inflation.

USD/JPY technical forecast: Bulls set to challenge 147.80 resistance.

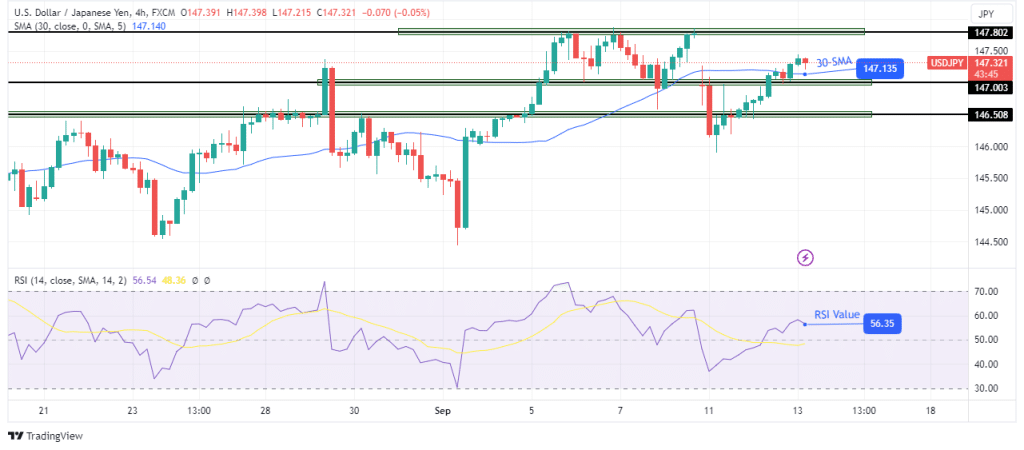

. USD / JPY pair has crossed the charts above the 30-SMA and 147.00 key levels. The bullish retracement has become a reversal as bulls have taken back control with the break above the SMA.

- Kui olete huvitatud Forexi päevakauplemine seejärel lugege läbi meie alustamise juhend -

Moreover, The RSI now supports bullish momentum, which could propel the price to the nearest resistance at 147.80. This will also allow the price to fill the gap it made when it broke below the SMA. A break above the 147.80 resistance would make a higher high, further confirming the bullish trend.

Kas soovite praegu Forexiga kaubelda? Investeerige eTorosse!

Selle pakkujaga CFD-dega kauplemisel kaotavad 67% jaeinvestorite kontost raha. Peaksite kaaluma, kas saate endale lubada suure riski kaotada oma raha.

- SEO-põhise sisu ja PR-levi. Võimenduge juba täna.

- PlatoData.Network Vertikaalne generatiivne Ai. Jõustage ennast. Juurdepääs siia.

- PlatoAiStream. Web3 luure. Täiustatud teadmised. Juurdepääs siia.

- PlatoESG. Autod/elektrisõidukid, Süsinik, CleanTech, Energia, Keskkond päikeseenergia, Jäätmekäitluse. Juurdepääs siia.

- PlatoTervis. Biotehnoloogia ja kliiniliste uuringute luureandmed. Juurdepääs siia.

- ChartPrime. Tõsta oma kauplemismängu ChartPrime'iga kõrgemale. Juurdepääs siia.

- BlockOffsets. Keskkonnakompensatsiooni omandi ajakohastamine. Juurdepääs siia.

- Allikas: https://www.forexcrunch.com/usd-jpy-forecast-dollar-stays-firm-against-yen-ahead-of-cpi/

- :on

- :mitte

- 1

- 2%

- 2022

- 39

- 80

- a

- üle

- Kontod

- pärast

- vastu

- agressiivne

- eespool

- võimaldama

- Ka

- an

- analüüsima

- ja

- aastane

- Oodatud

- mistahes

- umbes

- OLEME

- AS

- Aasia

- At

- AUGUST

- Automatiseeritud

- tagasi

- Pank

- Jaapani pank

- Jaapani Pank (BoJ)

- pankur

- BE

- muutuma

- olnud

- enne

- alla

- kahju

- võlakiri

- Võlakirjade tootlus

- Murdma

- Murdis

- Bullish

- Bullid

- by

- tuli

- CAN

- kapital

- Kapitaliturud

- kesk-

- CFD-dega

- väljakutse

- Äritegevus

- kontrollima

- kommentaarid

- võrreldes

- Murettekitav

- järjestikune

- Arvestama

- jätkas

- kaasa

- kontrollida

- võiks

- THI

- kriitiline

- Läbikriipsutatud

- valuuta

- tsükkel

- andmed

- päev

- üksikasjalik

- DID

- dollar

- Dovish

- kaks

- Kaheksas

- asunud

- sündmused

- Toidetud

- Föderaal-

- Föderaalreserv

- täitma

- Firma

- Järel

- eest

- Ennustus

- forex

- Alates

- edasi

- FX

- kasu

- Kasum

- lõhe

- saamine

- Kuberner

- kasvasid

- suunata

- olnud

- Olema

- juhataja

- pealkiri

- Held

- Suur

- rohkem

- tema

- aga

- HTTPS

- in

- Suurendama

- osutatud

- inflatsioon

- Inflatsiooniline

- Inflatsioonirõhk

- Mõjuv

- huvitatud

- Investeeri

- investor

- Investorid

- IT

- ITS

- Jaapan

- Jaapani omad

- Võti

- võtmetasanditel

- seadusandja

- Led

- taset

- otsin

- kaotama

- kaotamine

- tehtud

- säilitamine

- tegema

- Märts

- märgitud

- Turg

- turud

- max laiuse

- võib

- Impulss

- Esmaspäev

- Rahaline

- Rahapoliitika

- raha

- kuu

- igakuine

- kuu

- rohkem

- Pealegi

- kõige

- liikuma

- märkida

- nüüd

- toimunud

- of

- Õli

- on

- meie

- paar

- osalejad

- partei

- protsent

- Platon

- Platoni andmete intelligentsus

- PlatoData

- poliitika

- hind

- Hinnad

- eelkõige

- Lubadused

- Propell

- tarnija

- tõstatatud

- rbc

- jõuda

- Lugenud

- jäi

- aru

- Reserv

- Vastupidavus

- jaemüük

- retracement

- Revealed

- Ümberpööramine

- Oht

- RSI

- valitsev

- nägin

- komplekt

- peaks

- SMA

- tahke

- mõnevõrra

- väljavõte

- Strateegia

- tugevdamine

- tugev

- mahukas

- Toetab

- hüppeline

- Võtma

- võtnud

- sihtmärk

- Tehniline

- kui

- et

- .

- Fed

- SIIS

- see

- põhjalikult

- aeg

- et

- ülemine

- kaubelda

- Ettevõtjad

- Kauplemine

- Trend

- Teisipäev

- kaks

- mõistmine

- us

- meile inflatsioon

- USA inflatsiooniaruanne

- USD / JPY

- oli

- Watch

- millal

- kas

- mis

- hulgimüük

- will

- koos

- oleks

- Yahoo

- Jeen

- saagikus

- sa

- Sinu

- sephyrnet