Kas soovite jälgida 2023. aasta suurimaid idufirmade rahastamistehinguid meie uue kureeritud nimekirjaga, mis sisaldab 100 miljoni dollari väärtuses ja USA-s asuvatele ettevõtetele tehtavaid ettevõtmistehinguid? Kontrollige Crunchbase Megadealsi jälgija.

See on iganädalane funktsioon, mis jookseb kokku nädala 10 parimat väljakuulutatud rahastamisvooru USA-s. Tutvuge eelmise nädala suurimate rahastamisvoorudega siin.

There were lots of big rounds this week as August roared in after a kind of sleepy July. The big rounds went to all different types of companies — from networking to biotech to sustainability. However, while there were five nine-figure rounds, none topped $200 million. Still, not a bad start to the final full month of summer.

1. Niilus, 175 miljonit dollarit, võrgundus: Ettevõtete võrgustumine võib olla idufirma jaoks raske sektor, kuhu sisse murda, kuna seda on pikka aega domineerinud tehnoloogiahiiglased. Sellegipoolest suutis San Joses Californias asuv võrgustikutöö idufirma Nile investorite pilke püüda 175 miljonit dollarit C-seeria vähem kui aasta pärast vargusest väljumist. Ettevõtte asutajaks oli endine Cisco Systems juhid John Chambers ja Pankaj Patel. Chambers töötas võrguhiiglase tegevjuhina kaks aastakümmet. Ringi juhtis kaasa Märtsi pealinn ja Saudi Araabia suveräänne investeerimisfond Sanabil Investeeringud. Nile üritab võrgutööstust häirida, pakkudes võrguteenust turvalisemate traadiga ja traadita teenustega, mida on täiustatud seire, analüüsi ja automatiseerimisega. Idee on aidata ettevõtetel lihtsustada oma kaasaegseid võrguvajadusi ja pakkuda optimaalset turvalisust, tehes samal ajal vastastikku selliseid koljaate nagu Cisco ja Juniper Networks. Startup hindamist ei pakkunud. Voor tõstab Niile'i kapitali kogusumma ettevõtte kohta 300 miljoni dollarini alates asutamisest 2018. aastal.

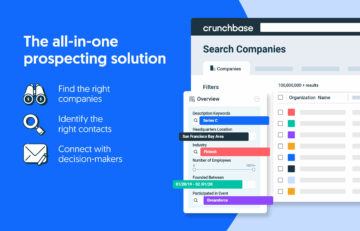

Otsige vähem. Sulgege rohkem.

Suurendage oma tulusid kõikehõlmavate potentsiaalsete potentsiaalsete lahenduste abil, mille jõuallikaks on eraettevõtete andmete liider.

2. Newlight tehnoloogiad, 125 miljonit dollarit, jätkusuutlikkus: Converting greenhouse gasses into something usable is big business right now. Newlight Technologies locked up $125 million led by GenZero to do just that. The Huntington Beach, California-based startup uses natural microorganisms to convert greenhouse gas into a material the company calls “AirCarbon,” which can substitute for a variety of other materials to build products in sectors such as fashion, foodservice and others. Newlight plans to use the new cash to expand the production of AirCarbon at both its existing California facility as well as a new production facility being built in Ohio. Founded in 2003, the company has raised nearly $232 million, Crunchbase'i kohta.

3. Jerry, $110M, auto insurance: While we all like to drive, no one enjoys car insurance. The Jerry app tries to make the whole insurance thing a little easier by finding better rates, and it can even find loans for a new ride. This week it raised $110 million in equity and debt for new features — GarageGuard, like WebMD for cars, and DriveShield, a safe-driving feature. The financing was led by existing investor Park West varahaldus. Hopefully, the new GarageGuard feature doesn’t turn everyone into an at-home mechanic. Founded in 2017, the company has raised $242 million, Crunchbase'i kohta.

4. CG onkoloogia, 105 miljonit dollarit, biotehnoloogia: With recent weeks being so biotech heavy, it almost seems like this is low on the list for our first biotech company of the week. CG Oncology locked up a $105 million round co-led by new investors Foresite pealinn ja TCGX. The Irvine, California-based firm will use the new cash to advance late-stage clinical programs for its bladder cancer treatment. Founded in 2010, the company has raised nearly $318 million.

5. Healthmap Solutions, 100 miljonit dollarit, tervishoid: Tampa, Florida-based Healthmap Solutions, a health management company focused on kidney disease, raised a $100 million round led by funds managed by WindRose Health Investors. The company has seen significant growth, as it’s contracted to manage more than $3 billion in health care spend and currently serves more than 160,000 individuals living with kidney disease. Founded in 2016, the company has raised nearly $226 million, Crunchbase'i kohta.

6. Tisento Therapeutics, 81 miljonit dollarit, biotehnoloogia: Cambridge, Massachusetts-based Tisento Therapeutics, a biotech firm looking to treat mitochondrial diseases, raised an $81 million Series A that included investment from Invus, Peter Hecht, Põhjanael and others. The round is the company’s first outside funding, per Crunchbase.

7. LightForce ortodontia, 80 miljonit dollarit, hambaravi: Burlington, Massachusetts-based LightForce Orthodontics, a maker of personalized 3D-printed braces, closed an 80 miljonit dollarit D-seeria eesotsas Ally Bridge Group. 2015. aastal asutatud ettevõte on kogunud 150 miljonit dollarit, Crunchbase'i kohta.

8. (viigine) Endor Labs, 70 miljonit dollarit, turvalisus: Palo Alto, California-based Endor Labs, an open-source security startup, raised a $70 million Series A that included investment from Lightspeed Venture Partnerid ja Kate. 2021. aastal asutatud ettevõte on kogunud 95 miljonit dollarit, Crunchbase'i kohta.

8. (viigine) Tradeshift, 70 miljonit dollarit, fintech: San Francisco-based Tradeshift, a cloud-based business network connecting buyers and suppliers, agreed to a $70 million investment from HSBC as part of a joint venture. Founded in 2009, the company has raised $1.1 billion, Crunchbase'i kohta.

10. Kyverna Therapeutics, 60 miljonit dollarit, biotehnoloogia: Emeryville, California-based Kyverna Therapeutics, a clinical-stage cell therapy startup focusing on therapies for autoimmune diseases, closed a $60 million Series B extension. The new cash brings the Series B total to $145 million. Investors in the round include Bain Capitali bioteadused ja GordonMD globaalsed investeeringud. 2018. aastal asutatud ettevõte on nüüdseks kogunud 170 miljonit dollarit, Crunchbase'i kohta.

Suured ülemaailmsed tehingud

Despite all the large raises in the U.S., the biggest occurred across the Pacific.

- Hongkongis asuv Mikroühendus, a financial market platform, raised a $458 million Series C.

Metoodika

We tracked the largest announced rounds in the Crunchbase database that were raised by U.S.-based companies for the seven-day period of July 29 to August 4. Although most announced rounds are represented in the database, there could be a small time lag as some rounds are reported late in the week.

Illustratsioon: Dom Guzman

Olge Crunchbase Daily abil kursis viimaste rahastamisvoorude, omandamiste ja muuga.

With the exception of accelerators, no firm hit double-digit deals in the U.S. last month. We look at some of July’s investors by the numbers.

The startup is led by top chip designer Jim Keller, who has worked at Apple, AMD, Tesla and Intel.

In a sign of how much the market tides have shifted, the top investor leading rounds for new unicorn startups so far this year is not who you think…

Mis juhtub, kui kombineerite tehisintellekti süsiniku eemaldamisega? Sektori segu idufirmasid rahastatakse.

- SEO-põhise sisu ja PR-levi. Võimenduge juba täna.

- PlatoData.Network Vertikaalne generatiivne Ai. Jõustage ennast. Juurdepääs siia.

- PlatoAiStream. Web3 luure. Täiustatud teadmised. Juurdepääs siia.

- PlatoESG. Autod/elektrisõidukid, Süsinik, CleanTech, Energia, Keskkond päikeseenergia, Jäätmekäitluse. Juurdepääs siia.

- BlockOffsets. Keskkonnakompensatsiooni omandi ajakohastamine. Juurdepääs siia.

- Allikas: https://news.crunchbase.com/enterprise/biggest-funding-rounds-john-chambers-nile-newlight-technologies/

- :on

- :on

- :mitte

- $ 100 miljonit

- $3

- $ UP

- 000

- 1

- 10

- 160

- 2015

- 2016

- 2017

- 2018

- 2021

- 2023

- a

- Võimalik

- kiirendid

- ülevõtmised

- üle

- edendama

- pärast

- Materjal: BPA ja flataatide vaba plastik

- kõik ühes

- Kuigi

- AMD

- summa

- an

- analytics

- ja

- teatas

- app

- õun

- OLEME

- kunstlik

- tehisintellekti

- AS

- eelis

- At

- üritab

- AUGUST

- auto

- autoimmuunne

- Automaatika

- b

- Halb

- BE

- rand

- olnud

- on

- Parem

- Suur

- suurim

- Miljard

- biotehnoloogia

- biotehnoloogia ettevõte

- mõlemad

- Murdma

- BRIDGE

- Toob

- ehitama

- ehitatud

- äri

- ostjad

- by

- Numbrite kaupa

- California

- Kutsub

- CAN

- vähk

- vähiravi

- kapital

- auto

- auto kindlustus

- süsinik

- mis

- autod

- Raha

- maadlus

- rakk

- tegevjuht

- kontrollima

- kiip

- Cisco

- kliiniline

- lähedal

- suletud

- ühendama

- Ettevõtted

- ettevõte

- Ettevõtte omad

- ühendamine

- muutma

- võiks

- CrunchBase

- kureeritud

- Praegu

- iga päev

- andmed

- andmebaas

- kuupäev

- Pakkumised

- Võlg

- aastakümnete

- Disainer

- DID

- erinev

- haigus

- haigused

- Häirima

- do

- Ei tee

- alla

- ajam

- lihtsam

- smirgel

- lõpp

- tõhustatud

- ettevõte

- omakapital

- Isegi

- igaüks

- erand

- juhid

- olemasolevate

- Laiendama

- laiendamine

- silmad

- Rajatise

- kaugele

- mood

- tunnusjoon

- FUNKTSIOONID

- lõplik

- finants-

- Finantsturg

- finantseerimine

- leidma

- leidmine

- FINTECH

- Firma

- esimene

- viis

- keskendunud

- keskendumine

- eest

- endine

- Rajatud

- Alates

- täis

- fond

- kogumispensioni

- rahastamise

- rahastamistehingud

- rahastamisvoorud

- raha

- GAS

- saamine

- hiiglane

- hiiglased

- Globaalne

- läheb

- kasvuhoonegaas

- Kasv

- juhtub

- Raske

- Olema

- Tervis

- Tervishoiuamet

- raske

- aitama

- Tulemus

- loodetavasti

- Kuidas

- aga

- HTTPS

- Huntington

- idee

- in

- sisaldama

- lisatud

- inimesed

- tööstus

- kindlustus

- Intel

- Intelligentsus

- sisse

- investeering

- investor

- Investorid

- IT

- ITS

- Jim

- John

- ühine

- ühisettevõte

- Juuli

- lihtsalt

- hoidma

- neer

- Laps

- Labs

- suur

- suurim

- viimane

- Hilja

- juht

- juhtivate

- Led

- vähem

- elu

- valgus

- nagu

- nimekiri

- vähe

- elu-

- Laenud

- lukus

- Pikk

- Vaata

- otsin

- Madal

- tegema

- tegija

- juhtima

- juhitud

- juhtimine

- Turg

- materjal

- materjalid

- miljon

- Kaasaegne

- järelevalve

- kuu

- rohkem

- kõige

- palju

- Natural

- peaaegu

- vajadustele

- võrk

- võrgustike loomine

- Sellegipoolest

- Uus

- Uued funktsioonid

- ei

- mitte ükski

- nüüd

- numbrid

- toimunud

- of

- pakkuma

- pakkumine

- Ohio

- on

- onkoloogia

- ONE

- avatud lähtekoodiga

- optimaalne

- Muu

- teised

- meie

- välja

- väljaspool

- Vaikne ookean

- osa

- kohta

- periood

- Isikliku

- plaanid

- inimesele

- Platon

- Platoni andmete intelligentsus

- PlatoData

- sisse

- Produktsioon

- Toodet

- Programmid

- tõstatatud

- tõstab

- Rates

- hiljuti

- Hiljutine rahastamine

- eemaldamine

- Teatatud

- esindatud

- tulu

- Sõitma

- õige

- ümber

- voorud

- jookseb

- s

- San

- San Jose

- Saudi

- Saudi Araabia

- sektor

- Sektorid

- kindlustama

- turvalisus

- turvalisuse käivitamine

- tundub

- nähtud

- Seeria

- Seeria A

- B-seeria

- Seeria C

- teenib

- Teenused

- nihutatud

- kirjutama

- märkimisväärne

- lihtsustama

- alates

- väike

- So

- nii kaugel

- Lahendused

- mõned

- midagi

- suveräänne

- suveräänne investeerimisfond

- kulutama

- algus

- käivitamisel

- stardirahastamine

- Alustavatel

- jääma

- Stealth

- Veel

- selline

- suvi

- Tarnijate

- Jätkusuutlikkus

- tech

- tehnikahiiglased

- Tehnoloogiad

- Teslal

- kui

- et

- .

- oma

- ravimid

- Ravimeetodid

- ravi

- Seal.

- asi

- mõtlema

- see

- sel nädalal

- Sel aastal

- looded

- seotud

- aeg

- et

- ülemine

- Top 10

- ülaosaga

- Summa

- jälgida

- käsitlema

- ravi

- Pöörake

- kaks

- liigid

- meie

- ükssarvik

- kasutatav

- kasutama

- kasutusalad

- Hindamine

- sort

- ettevõtmine

- oli

- Tee..

- we

- Jõukus

- nädal

- iga nädal

- nädalat

- Hästi

- läks

- olid

- Läände

- millal

- mis

- kuigi

- WHO

- kogu

- will

- traadita

- koos

- töötas

- aasta

- sa

- Sinu

- sephyrnet