Paljud ettevõtted, kes saaksid plokiahelast kasu, on seda vältinud. Selle süsiniku jalajälg, kulud ja seosed muutlike krüptovaluutadega aitasid kaasa sellele, et plokiahelal on mürgine maine, mida see ei saanud kõigutada ja mida ettevõtted ei puudutaks.

That was until ‘the Merge’. This – now widely used – term references the restructure of the world’s largest programmable blockchain: Ethereum. Put simply, this September the cryptography driving the system has been switched from proof of work (PoW) to proof of stake (PoS). This essentially replaced the huge, energy-intensive computers that were the network’s core validators, with individuals and companies. It is expected to reduce the energy consumption of Ethereum by 99% and reduce the global use of energy by 0.02%, Vitalik Buterini järgi, parandades oluliselt selle jätkusuutlikkust. Surge, ühinemise epiloog, suurendab lõpuks võrgu läbilaskevõimet ja vähendab tasusid.

See on selgelt märkimisväärne samm Ethereumi peavoolu toomise suunas ja see tähistab plokiahela tehnoloogia arengut. Mida teeb aga plokiahela paranenud maine tõesti mõeldud institutsionaalseks kasutamiseks?

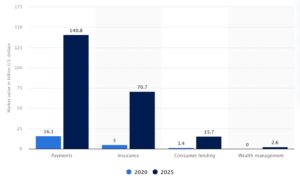

Press coverage has focused on more widespread crypto usage; however, the real impact will be on the institutional side – particularly within financial services. Now the stage is set for innovations, it is likely that parts of the industry may turn towards decentralised infrastructure. Blockchain can offer safe and secure transaction processing at a fraction of the cost, particularly when compared to the enormous expense and burden of today’s systems.

This has never been more relevant. The digital asset market is maturing significantly just as its traditional counterpart enters a period of turmoil and uncertainty. As the world hurtles towards another recession, businesses will be examining how to save money and cut costs. A greener, more cost-efficient blockchain could form part of the answer and reduce the institution’s huge IT expenditures.

If implemented correctly, blockchain could save billions in infrastructure and associated IT costs. Rather than paying for service level agreements, data centres, cloud hosting and other services, financial institutions can and will leverage blockchain infrastructure at a fraction of the cost of running the same transactions in-house. Cost efficiencies aside, tokenisation could improve several areas within asset management specifically, such as issuance, exchange and servicing as well as simplify processes involving a host of intermediaries. Potential benefits include improved access to, and personalisation of, investment solutions.

Erakapitali puhul võib plokiahel võimaldada osaomandit ja detsentraliseeritud fonde, mis mitte ainult ei suurenda läbipaistvust, vaid loob likviidsuse osas rohkem paindlikkust, mis varem võis olla ainult pikaajaline lukustatud investeeringud.

However, there is still a missing piece of the puzzle to be considered: interoperability. For true mainstream adoption of blockchain to occur within businesses, users need to be able to transact across multiple networks. Currently, it is not particularly easy to share information from one blockchain to another. To put this into context, if interoperability within email communication had never been achieved, Outlook users wouldn’t be able to send messages to Gmail accounts and vice versa.

Isegi kui ühinemise tulemusel laialdane kasutuselevõtt leidis aset, kuni erinevad plokiahelad, sealhulgas Ethereum, ei suuda üksteisega tõhusalt suhelda, ei avane tehnoloogia ettevõtete jaoks täielikud eelised.

- sipelga rahaline

- blockchain

- plokiahela konverents fintech

- fintech

- coinbase

- coingenius

- krüptokonverents fintech

- FINTECH

- fintechi rakendus

- fintech innovatsioon

- Fintextra

- OpenSea

- PayPal

- paytech

- väljamakse

- Platon

- plato ai

- Platoni andmete intelligentsus

- PlatoData

- platogaming

- razorpay

- revolut

- Ripple

- square fintech

- triip

- tencent fintech

- fotokopeeraparaat

- sephyrnet