Payments unicorn Stripe has cut its internal validation by 11% to $63 billion, Informatsioon teatas, viidates asjaga tuttavale allikale.

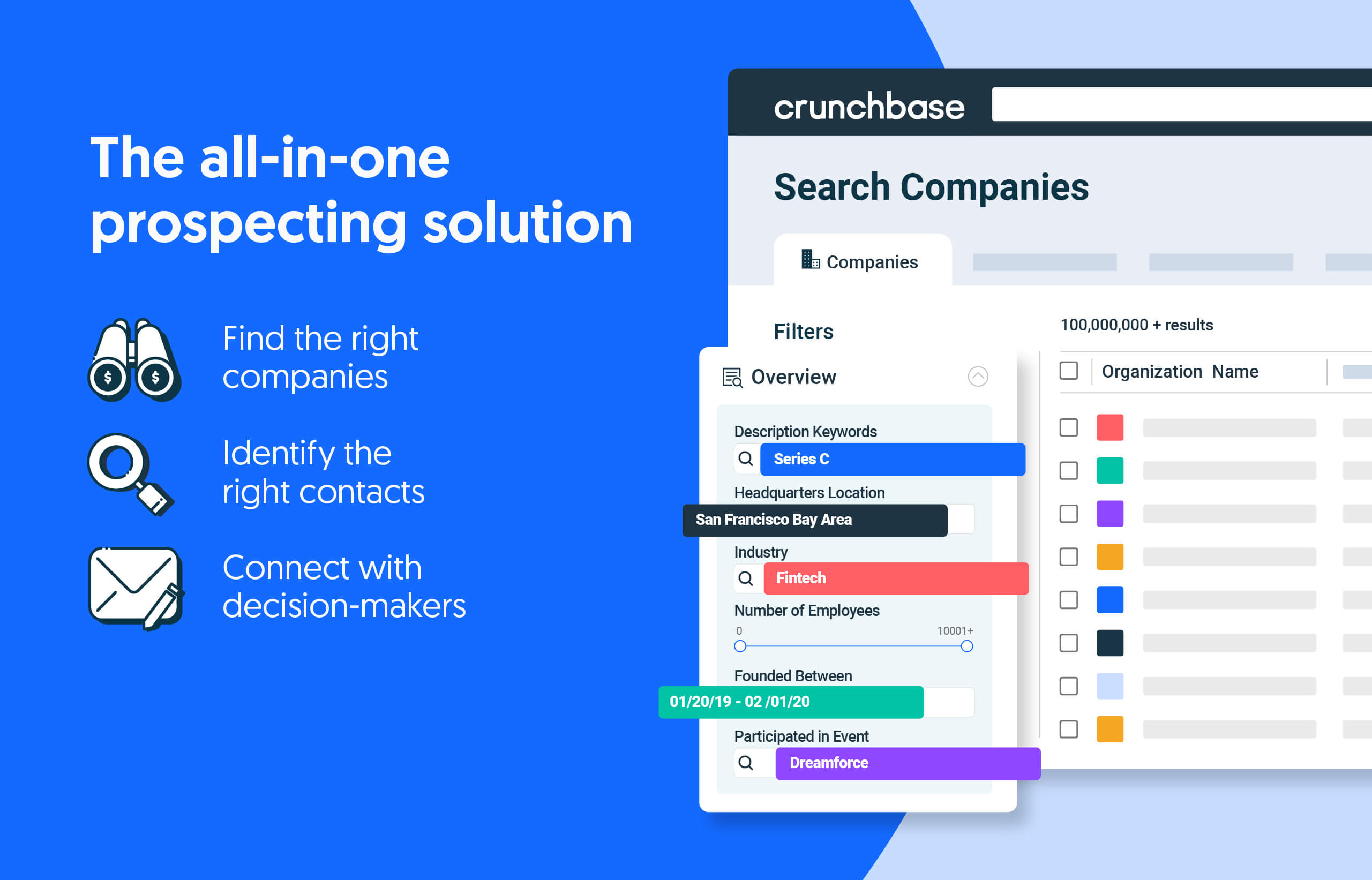

Otsige vähem. Sulgege rohkem.

Suurendage oma tulusid kõikehõlmavate potentsiaalsete potentsiaalsete lahenduste abil, mille jõuallikaks on eraettevõtete andmete liider.

Even at that valuation, the San Francisco-based company remains one of the most highly valued private companies in the world. But its latest price cut is indicative of the falling valuations for unicorn startups over the past year as companies and investors reset their expectations.

Global venture funding in 2022 fell 35% year over year (though still topped 2020 and every other year before). Late-stage startups have been particularly hard hit as public market turmoil stalls the IPO pipeline.

Stripe’s latest cut comes after it already trimmed its internal valuation last year by 28%, from $95 billion. Competitor Checkout.com slashed its internal valuation by 70% to $11 billion last year. Other unicorns, including cybersecurity startup Snyk and AI/ML platform developer Dataiku, have raised new money but at lower valuations, in what’s known as a down round. In one of the more dramatic examples, fintech unicorn Klarna last year saw its valuation plummet 86% to $6.7 billion in a new funding round.

Seotud lugemine

Illustratsioon: Dom Guzman

Olge Crunchbase Daily abil kursis viimaste rahastamisvoorude, omandamiste ja muuga.

- SEO-põhise sisu ja PR-levi. Võimenduge juba täna.

- Platoblockchain. Web3 metaversiooni intelligentsus. Täiustatud teadmised. Juurdepääs siia.

- Allikas: https://news.crunchbase.com/fintech-ecommerce/stripe-cuts-valuation-unicorn-shares/

- $ 6.7 miljardit

- 2020

- 2022

- 35%

- 7

- a

- ülevõtmised

- pärast

- AI / ML

- kõik ühes

- juba

- ja

- enne

- Miljard

- lähedal

- Ettevõtted

- ettevõte

- konkurent

- cover

- CrunchBase

- lõigatud

- Küberturvalisus

- iga päev

- andmed

- kuupäev

- arendaja

- alla

- dramaatiliselt

- näited

- ootused

- Langev

- tuttav

- FINTECH

- Alates

- rahastamise

- rahastamisvoorud

- Raske

- kõrgelt

- Tulemus

- HTTPS

- in

- Kaasa arvatud

- info

- sisemine

- Investorid

- IPO

- IT

- teatud

- viimane

- Eelmisel aastal

- hiljemalt

- juht

- Turg

- küsimus

- raha

- rohkem

- Uus

- Uus rahastus

- ONE

- Muu

- eriti

- minevik

- torujuhe

- inimesele

- Platon

- Platoni andmete intelligentsus

- PlatoData

- Pisut

- sisse

- hind

- Hinnad

- era-

- Eraettevõtted

- avalik

- Avalik turg

- tõstatatud

- hiljuti

- Hiljutine rahastamine

- jäänused

- tulu

- ümber

- voorud

- San

- Jaga

- aktsiahinnad

- Lahendused

- allikas

- käivitamisel

- Alustavatel

- jääma

- Veel

- triip

- .

- oma

- et

- ülaosaga

- ükssarvik

- ükssarved

- kinnitamine

- Hindamine

- Valuutavad väärtused

- hinnatud

- ettevõtmine

- aasta

- Sinu

- sephyrnet