From 2008 to 2022, private funds enjoyed turbocharged growth when their assets under management (AUM) soared five-fold to reach $13 trillion. The AUM metric came to rival returns as the golden benchmark of success and drove a surge in compensation for general

partners and their teams. Money rolled into private markets, and with channels to private wealth management opening up for smaller investors, the future looked even more prosperous.

The mantra for many became “growth at all costs.” Firms added headcount and raised salaries, anticipating continued increases in management fees. Then came 2022 and 2023. The tide turned as interest rates and inflation quadrupled. Fundraising slowed, leaving

many funds unable to sustain the management fees that expansion requires.

Eraturgude hetkeseis

High-interest rates and inflation have dampened the outlook for private funds, and are likely to squeeze their returns beyond 2024. They’ll have limited room to compensate with financial engineering, such as leveraging in the portfolio. All companies face

higher costs for both new and existing borrowing. Moreover, the impact on their asset values may not yet be fully recognized by portfolio companies and private equity funds.

This has pushed funds to reevaluate their earnings strategy. After a hard outlook at their profitability models, many have turned to cost-cutting measures. It’s widely reported that VC and private funds pulled back from adding headcount for 2024. Some imposed

layoffs affecting

5–15% nende tööjõust. Teised võtavad tööle ja vallandavad samaaegselt, et kohandada sisemisi meeskondi oma muutuva klientuuri teenindamiseks.

Lisaks on "varajase kasutuselevõtuga" jaeinvestorid, nagu kõrge netoväärtusega üksikisikud (HNWI), kaldunud suuremate fondiperekondade poole. See on pannud väiksematele ettevõtetele suuremat survet oma tulude suurendamiseks ja uute tulijate ligimeelitamiseks.

Kuidas suurendada kasumlikkust väljakutseid pakkuvas keskkonnas

2024. aasta alguses on fondid ja nende portfelliettevõtted keskendunud oma EBITDA suurendamisele. Seda on lihtsam öelda kui teha. Makrotegurid mõjutavad tõenäoliselt tootlust seni, kuni need ei ületa likviidsemate investeeringute, näiteks aktsiate, pakutavat.

Kui erafondid ei suuda parema tootluse alusel konkurentidest eristuda, osutub investorite kaasamine keerulisemaks. Parandamiseks peavad paljud fondid järgima nõuandeid, mida nad sageli portfelliettevõtetele jagavad, sealhulgas:

-

Töötõhusus: saavutage rohkem ilma töötajate arvu suurendamata. See hõlmab üldisi kulude kärpimise meetmeid ja kapitalistruktuuride optimeerimist.

-

Mitmekesistamine ja kasv: mitmekesistada sihtturge ja tootevalikut, keskendudes samal ajal kasvupüüdlustele, eriti arvestades jaeinvestorite võimalikku huvi.

-

Tehnoloogia integreerimine: kasutage toimingute sujuvamaks muutmiseks spetsiaalselt loodud tehnoloogiat. Automatiseerimine, eriti töövoo ja protsesside haldamisel, võib kulusid oluliselt vähendada, kuna kaob vajadus palgata täiendavaid töötajaid.

-

Töötajate arvu juhtimine. Lõika personali ainult seal, kus see kasvu ei sega.

Jätkake jõupingutusi kasvamiseks ja töötage vastavalt

Strategically, smaller funds should continue pursuing growth, so they don’t miss out on the most compelling shift to hit private markets yet: retail investors. It’s true that funds do spend more per “new million dollars” to attract and service smaller investors.

That does not mean growth has to conflict with cost controls. In fact, growth and cost efficiency are both essential this year.

Some funds that target personnel in various operational departments for layoffs could see unwanted results. For example, the investor relations (IR) team—once an afterthought at private equity firms—is essential today. IR is indispensable for engaging with

larger numbers of smaller investors.

Niisiis, kuidas saavad fondid jätkuvalt kasvu kiirendada ilma operatiivtöötajaid lisamata? Parim lahendus on kasutada töövoogu ja protsesside automatiseerimist, mis on palju madalama hinnaga kui inimeste palkamine.

Säilitage klientide ja investorite suhted eelarvekärbete tingimustes

Private equity has long been a high-margin business. GPs traditionally think of profitability as their management fees—directly driven by AUM—minus operating costs. At first glance, current conditions appear to call for cutting those costs. But to do so

while a fund expands its client base will strain capacity and potentially compromise the investor experience. Client-facing and investor relations teams are pivotal to:

-

suhteid säilitada, arvestades jaeinvestorite arvu kasvu

-

rahuldada klientide nõudmisi perearstide suurema läbipaistvuse järele

-

juhendada LP-sid läbi pikemate raha kogumise ajakavade

-

täitma regulatiivseid nõudeid aruandluse suurendamiseks

Top-line performance no longer sells itself. Transparency of portfolios and liquidity constraints, along with accessible IR and customer service, can also sway which funds investors choose. These characteristics allow funds to differentiate their brand for

building momentum and relationships with a growing number of smaller investors.

Mõned ettevõtted, kes näevad IR personali komplekteerimisel koondamise vajadust, isegi

küsisid vanempartnerid to resign in 2023. This willingness to reduce the size of the deal team is a departure from traditional practices. It reflects the growing recognition that firms need to retain the professionals who attract and directly support investors—they

sustain the fundraising that, in turn, sustains management fees.

Kasutage spetsiaalselt loodud tehnoloogiat

Private funds often struggle to run their operations with vertical-agnostic apps—systems not built with private equity teams and investors in mind. Even modernized systems designed specifically for private equity usually won’t automatically bring about lower

headcount. But, they can greatly reduce the need for additional hiring.

While investor relations grew in importance, the IR technology stack evolved accordingly with automation for back-office operations as well. The help comes at the right time. According to Bloomberg Tax analysis, there’s a shortage of accountants and auditors,

whose ranks have shrunk 17% since 2019. The takeaway here is that technology specifically designed for private markets will be most effective in maximizing their team’s productivity.

Hallake inimeste ja tehnoloogia tasakaalu, et kasumlikult kasvada

Ükski erakapitaliettevõte ei taha jääda maha, kui tema eakaaslased kasvavad. See on peamine põhjus, miks mitte lasta kulude kontrollimisel halvendada parema investorite kogemuse õitsengut, mille nimel nad on töötanud.

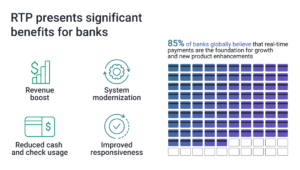

Private funds’ path to higher profitability with growth does not center on improving their internal cash and debt management. Instead, gains will come from operational efficiencies achieved by digital transformation that streamlines back-office, customer

service, and support functions.

Nutikas personalijuhtimine jääb võtmeks. Mitmed fondid on leidnud õige tasakaalu, hoides töötajate arvu mõnes võtmevaldkonnas stabiilsena, laiendades samal ajal IR- ja klienditeenindusmeeskondi, et toetada jaeinvestorite kasvu.

Funds that automate their due diligence and onboarding processes enable IR professionals to focus on what they are best at. This supports multiple goals: greater profitability and efficiency, and faster growth with a better investor experience. When interest

rates come down, and funding flows in more easily, the smaller and mid-sized firms that have boosted capability and efficiency will be poised to take full advantage of the retail boom.

- SEO-põhise sisu ja PR-levi. Võimenduge juba täna.

- PlatoData.Network Vertikaalne generatiivne Ai. Jõustage ennast. Juurdepääs siia.

- PlatoAiStream. Web3 luure. Täiustatud teadmised. Juurdepääs siia.

- PlatoESG. Süsinik, CleanTech, Energia, Keskkond päikeseenergia, Jäätmekäitluse. Juurdepääs siia.

- PlatoTervis. Biotehnoloogia ja kliiniliste uuringute luureandmed. Juurdepääs siia.

- Allikas: https://www.finextra.com/blogposting/25620/private-market-firms-struggle-to-balance-growth-and-operational-spend?utm_medium=rssfinextra&utm_source=finextrablogs

- :on

- :on

- :mitte

- : kus

- $ UP

- 1

- 15%

- 2008

- 2019

- 2022

- 2023

- 2024

- a

- MEIST

- juurdepääsetav

- täitma

- Vastavalt

- vastavalt

- saavutada

- üle

- lisatud

- lisades

- Täiendavad lisad

- ADEelis

- nõuanne

- mõjutades

- pärast

- Materjal: BPA ja flataatide vaba plastik

- võimaldama

- mööda

- Ka

- an

- analüüs

- ja

- ennetamine

- ilmuma

- OLEME

- valdkondades

- AS

- eelis

- vara

- At

- meelitada

- meelitades

- audiitorid

- juures M

- automatiseerima

- automaatselt

- Automaatika

- tagasi

- Saldo

- baas

- põhineb

- BE

- sai

- olnud

- algab

- taga

- võrrelda

- BEST

- Parem

- Peale

- Bloomberg

- õitsevad

- juhatus

- buum

- suurendada

- Kiirendatud

- Laenamine

- mõlemad

- bränd

- tooma

- eelarve

- Ehitus

- ehitatud

- äri

- kuid

- by

- helistama

- tuli

- CAN

- ei saa

- võime

- Võimsus

- kapital

- Raha

- keskus

- raske

- muutuv

- kanalid

- omadused

- Vali

- klient

- klientuur

- Tulema

- tuleb

- Ettevõtted

- kaalukad

- Hüvitis

- konkurendid

- kompromiss

- Tingimused

- konflikt

- piiranguid

- jätkama

- jätkas

- kontrolli

- Maksma

- kulud

- võiks

- looma

- Praegune

- Praegune olek

- klient

- Kasutajatugi

- lõigatud

- lõikamine

- tegelema

- Võlg

- Nõudlus

- osakonnad

- lahkumine

- juurutada

- kavandatud

- eristada

- raske

- digitaalne

- Digitaalne Transformation

- hoolsus

- otse

- mitmekesistada

- do

- ei

- Töötuabiraha

- tehtud

- Ära

- alla

- ajendatud

- kaks

- Töötasu

- lihtsam

- kergesti

- EBITDA

- Tõhus

- kasutegur

- efektiivsus

- jõupingutusi

- jõupingutusi

- võimaldama

- kaasamine

- Inseneriteadus

- omakapital

- eriti

- oluline

- Isegi

- arenenud

- näide

- olemasolevate

- laiendades

- laieneb

- laiendamine

- kogemus

- nägu

- asjaolu

- tegurid

- peredele

- kaugele

- kiiremini

- Tasud

- vähe

- finants-

- Finextra

- süütamise

- Firma

- ettevõtetele

- esimene

- Voolud

- Keskenduma

- keskendunud

- järgima

- eest

- avastatud

- Alates

- täis

- täielikult

- funktsioonid

- fond

- rahastamise

- Toetuste kogumine

- raha

- tulevik

- Kasum

- Üldine

- antud

- Pilk

- Eesmärgid

- kuldne

- GPS

- suurem

- suuresti

- kasvasid

- Kasvama

- Kasvavad

- Kasv

- Raske

- Olema

- töötajate arv

- aitama

- siin

- Suur

- Kõrge netoväärtusega üksikisikud

- rohkem

- palkama

- Töökohad

- Tulemus

- omamine

- Kuidas

- HTTPS

- mõju

- tähtsus

- kehtestatud

- parandama

- Paranemist

- in

- hõlmab

- Kaasa arvatud

- kasvanud

- Tõstab

- kasvav

- inimesed

- inflatsioon

- selle asemel

- integratsioon

- huvi

- Intressimäärad

- segab

- sisemine

- sisse

- Investeeringud

- investor

- Investorid

- IT

- ITS

- ise

- jpg

- hoidma

- pidamine

- Võti

- Võtmevaldkonnad

- suurem

- koondamisi

- jätmine

- lahkus

- laskma

- Finantsvõimendus

- võimendav

- nagu

- Tõenäoliselt

- piiratud

- Vedelik

- Likviidsus

- Pikk

- enam

- Vaatasin

- vähendada

- LP-d

- Makro

- peamine

- juhtimine

- Mantra

- palju

- Turg

- turud

- maksimeerimine

- mai..

- keskmine

- meetmed

- meetriline

- miljon

- meeles

- miss

- segu

- mudelid

- Impulss

- raha

- rohkem

- Pealegi

- kõige

- mitmekordne

- Vajadus

- neto

- Uus

- uustulnukad

- ei

- number

- numbrid

- of

- pakkuma

- sageli

- on

- Pardal

- ainult

- avamine

- tegutsevad

- töökorras

- Operations

- optimeerimine

- teised

- välja

- väljavaade

- partnerid

- tee

- partnerit

- Inimesed

- kohta

- jõudlus

- Personal

- Keskses

- Platon

- Platoni andmete intelligentsus

- PlatoData

- valmis

- portfell

- portfellid

- potentsiaal

- potentsiaalselt

- tavad

- surve

- era-

- Erakapital

- eraturud

- tõenäoliselt

- protsess

- Protsessi juhtimine

- Protsessid

- Toode

- tootlikkus

- spetsialistid

- kasumlikkus

- jõukas

- Tõesta

- jätkates

- lükatakse

- Lükkamine

- panema

- Neljakordistunud

- tõstatatud

- auastmed

- Rates

- jõudma

- põhjus

- tunnustamine

- tunnustatud

- vähendama

- peegeldab

- regulatiivne

- suhted

- Suhted

- jääma

- eemaldades

- Teatatud

- Nõuded

- Vajab

- Tulemused

- jaemüük

- Jaeinvestorid

- säilitama

- Tulu

- õige

- rivaal

- Valtsitud

- ruum

- jooks

- Ütlesin

- palgad

- vaata

- nägemine

- Müüb

- vanem

- teenus

- mitu

- suunata

- puudus

- peaks

- märgatavalt

- üheaegselt

- alates

- SUURUS

- väiksem

- So

- tõusnud

- lahendus

- mõned

- eriti

- kulutama

- Pigistama

- Kestab

- Personal

- personalitöö

- riik

- stabiilne

- varud

- Strateegia

- kiirendama

- lihtsustab

- struktuuride

- võitlus

- edu

- selline

- toetama

- Toetab

- hüppeline

- süsteemid

- Võtma

- sihtmärk

- maks

- meeskond

- meeskonnad

- Tehnoloogia

- kui

- et

- .

- Tulevik

- oma

- SIIS

- Need

- nad

- mõtlema

- see

- Sel aastal

- need

- Läbi

- Tõus ja mõõn

- aeg

- et

- täna

- tööriist

- suunas

- traditsiooniline

- traditsiooniliselt

- Transformation

- läbipaistvus

- triljon

- tõsi

- Pöörake

- Pöördunud

- ei suuda

- all

- kuni

- soovimatu

- tavaliselt

- Väärtused

- eri

- VC

- tahab

- Jõukus

- varahaldus

- kaaluge

- Hästi

- M

- millal

- mis

- kuigi

- WHO

- kelle

- laialdaselt

- will

- Tahe

- koos

- ilma

- töötas

- töövoog

- väärt

- WSJ

- aasta

- veel

- sephyrnet