The New Zealand dollar is paddling in calm waters, as NZD/USD trades close to 1-month lows. In the European session, NZD/USD is trading at 0.6176, up 0.10%. The kiwi is still smarting from a disastrous week, in which NZD/USD plunged 4.40%.

RBNZ coy on its plans

The RBNZ is in the midst of an aggressive rate-hike cycle, having raised rates by 50 basis points for a fourth consecutive time. The central bank is expected to add another 50bp hike at the October meeting, which would bring the cash rate to 3.50%. Inflation has hit 7.3%, but the RBNZ is confident that it will peak soon and expects inflation to fall to 3.8% by the end of 2023. The central bank is cautiously positive about the economic outlook, predicting that the economic downturn will not turn into a recession.

Deputy Governor Christian Hawkesby said in an interview this week that the slowdown should lower inflation and bring employment to a more “sustainable level”. Hawkesby said that the RBNZ was deliberately being ambiguous about the peak for rate levels, saying it could be at 4.00% or 4.25% or thereabouts. He added that more rate hikes are coming, while acknowledging that the pace of tightening could slow in the near future.

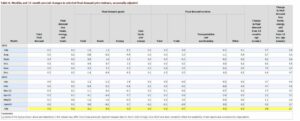

We’ll get a look at some key US events today and Wednesday that could have an impact on the direction of the US dollar. New Home Sales will be released later today, with a forecast of 575 thousand for July, following 590 thousand in June. Durable goods orders will be published on Wednesday, with the headline reading expected to slow to 0.6% in July, down sharply from 2.0% in June. With the Federal Reserve saying that rate policy will depend to a large extent on the strength of economic data, investors are keeping a close eye on key US events and we could see some movement in the currency markets following these releases.

.

NZD / USD tehniline

- NZD/USD takistuseks on 0.6227 ja 0.6366

- Toetus on 0.6126 ja 0.6075

See artikkel on mõeldud ainult üldiseks teabeks. See ei ole investeerimisnõustamine ega lahendus väärtpaberite ostmiseks või müümiseks. Arvamused on autorid; mitte tingimata OANDA Corporationi või selle sidusettevõtete, tütarettevõtete, ametnike või direktorite oma. Finantsvõimendusega kauplemine on kõrge riskiga ja ei sobi kõigile. Võite kaotada kogu oma hoiustatud raha.

- Bitcoin

- blockchain

- plokiahela vastavus

- blockchain konverents

- Keskpankade

- coinbase

- coingenius

- üksmeel

- krüptokonverents

- krüpto mineerimine

- cryptocurrency

- Detsentraliseeritud

- Defi

- Digitaalsed varad

- ethereum

- FX

- masinõpe

- MarketPulse

- Uudiste sündmused

- Uudisvood

- mitte vahetatav märk

- NZD / USD

- Platon

- plato ai

- Platoni andmete intelligentsus

- Platvormplokk

- PlatoData

- platogaming

- hulknurk

- tõend osaluse kohta

- RBNZ

- RBNZ Deputy Governor Christian Hawkesby

- Tehniline analüüs

- USA kestvuskaupade tellimused

- USA uute kodude müük

- W3

- sephyrnet