In 1964, a performance-artist named Dorothy Podber walked into Andy Warhol’s studio.

Dorothy saw four paintings leaning against the wall in a stack. Each one was 40-by-40 inches. Here’s what they looked like:

Podber asked Warhol if she could shoot them. Assuming she wanted to photograph the paintings, Warhol agreed. But Podber pulled on a pair of black gloves, removed a revolver from her purse, and fired a single shot into the stack of paintings.

This didn’t make Podber popular. In fact, Warhol banned her from his studio.

But it sure made the four paintings popular. These were Warhol’s Marilyn paintings. They soon became known as The Shot Marilyns — and even today, their value continues to soar:

- Aastal 1967, Blue Shot Marilyn was purchased for $5,000.

- Aastal 1989, Red Shot Marilyn was bought for $4.1 million.

- Aastal 1989, Orange Shot Marilyn was acquired for $17.3 million. In 2017, that same painting traded hands for around $200 million — for a gain of 1,156%.

9. mail Blue Shot Marilyn is set to be auctioned at Christie’s. It’s predicted to sell for up to $500 million. That would make it the most expensive 20th-century artwork ever to sell at auction.

I don’t expect you’re in the market for a $500-million painting…

But today, I’ll show you how to dip your toe into the market-beating returns of art — even if you’re starting with just a few hundred bucks.

Suurim rikkuse pood

In volatile markets like we’re experiencing today, the wealthy have always found ways to protect and grow their wealth.

Näiteks investeerivad nad New Yorgi või Londoni luksuskorteritesse või kullakangidesse.

Kuid viimasel ajal on nad pöördunud millegi uue poole: kunsti.

Maailma suurima varahalduri BlackRocki tegevjuht nimetab kunsti "üheks suurimaks rahvusvahelise rikkuse hoiukohaks".

BlackRock has about $10 trillion in assets under management. So when its CEO makes a claim, it might pay to listen!

Kolm põhjust, miks rikkad kunsti investeerivad

Põhjuseid, miks kunst võib olla nii võimas investeering, on palju.

For starters, it provides diversification. So even if the stock market is crashing, art can keep growing in value.

Lisaks pakub kunst kaitset inflatsiooni vastu. Inflatsiooniajal, nagu praegu, on see väärtuslik nipp.

Kuid võib-olla kõige tähtsam on see, et kunst võib pakkuda turgu võitvat tulu.

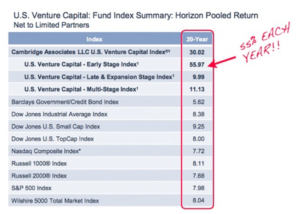

Näiteks alates 1995. aastast on üks populaarne kunstiindeks ületanud laiapõhjalist S&P 500. peaaegu 3x.

Võib-olla aitavad need eelised selgitada, miks Knight Franki globaalse rikkuse aruande kohaselt kogub või omab 37% inimestest, kelle väärtus on vähemalt 30 miljonit dollarit, kujutavat kunsti.

But now, art isn’t just for the super-wealthy anymore…

Introducing: Freeport

Today, I’d like to introduce you to a soon-to-be-launched investment platform called Freeport.

Freeport offers a straightforward way for ordinary investors like us to get exposure to fine art.

For each piece of art it offers, Freeport creates a business entity that holds the art as its sole asset. Shares are then issued in that entity, enabling you to gain exposure to extraordinary (and extraordinarily expensive) pieces without needing to purchase the entire asset yourself.

The art will be kept in a secure vault on the East Coast of the U.S. In the future, the company plans to allow viewing of the art — by you, and perhaps by the public.

Freeport intends that investors like you will soon be able to sell your shares on a secondary market, or you can hold your shares until the physical art has been resold — hopefully at a big profit.

Freeport’s First Offerings

Freeport’s first offerings will be a series of Andy Warhol prints.

These include “Mick Jagger” (1975), “Double Mickey” (1981), and — yes — “Marilyn” (1967).

Each piece of art is limited to 1,000 investors.

The Freeport platform is launching soon.

To join the waitlist so you can get first dibs when it opens, sign up here for free »

Invest Like the Rich

Pidage meeles, et siin kehtivad kõik tüüpilised hoiatused investeerimise kohta:

Näiteks ärge investeerige rohkem, kui saate endale lubada kaotada; investeerida sellesse, mida tead; ja kastke varvas enne sukeldumist kindlasti vette.

Furthermore, since Freeport doesn’t have a secondary market yet, its art won’t be “liquid.” That means it can’t necessarily be converted into cash at the snap of your fingers.

Nii et ärge investeerige oma üüri- või toiduraha siia.

Kuid kui soovite investeerida nagu rikkad, võib kunst olla suurepärane koht alustamiseks!

Head investeerimist

Pange tähele: Crowdability ei ole seotud ühegi idufirma või investeerimisplatvormiga, millest me kirjutame. Oleme sõltumatu idufirmade ja alternatiivsete investeeringute hariduse ja uurimistöö pakkuja.

Parimate soovidega,

Matthew Milner

asutaja

Crowdability.com

- SEO-põhise sisu ja PR-levi. Võimenduge juba täna.

- Platoblockchain. Web3 metaversiooni intelligentsus. Täiustatud teadmised. Juurdepääs siia.

- Allikas: https://www.crowdability.com/article/how-to-make-1156-profits-on-a-warhol

- :on

- ][lk

- $ UP

- 000

- 1

- 10

- 2017

- a

- Võimalik

- MEIST

- Vastavalt

- omandatud

- vastu

- Materjal: BPA ja flataatide vaba plastik

- alternatiiv

- alati

- ja

- korterid

- kehtima

- OLEME

- ümber

- kunst

- kunstiteoseid

- AS

- eelis

- vara

- At

- Oksjon

- Oksjonil

- keelatud

- baarid

- BE

- enne

- Kasu

- BEST

- Suur

- Must

- BlackRock

- ostnud

- laiapõhjaline

- äri

- by

- kutsutud

- Kutsub

- CAN

- Saab

- Raha

- tegevjuht

- Christie

- nõudma

- Rannik

- koguma

- ettevõte

- pidev

- ümber

- võiks

- Krahh

- loob

- Kastke

- mitmekesistamine

- Ei tee

- Ära

- iga

- Ida

- idarannik

- Käsitöö

- võimaldades

- Kogu

- üksus

- Eeter (ETH)

- Isegi

- KUNAGI

- näide

- ootama

- kallis

- kogevad

- Selgitama

- Säritus

- erakordselt

- erakordne

- vähe

- lõpp

- Kaunid kunstid

- esimene

- eest

- avastatud

- tasuta

- Vaba Sadam

- Alates

- tulevik

- kasu

- saama

- Globaalne

- Kuldne

- suur

- suurim

- toidupoed

- Kasvama

- Kasvavad

- Käed

- Olema

- hekk

- aitama

- siin

- hoidma

- omab

- loodetavasti

- Kuidas

- Kuidas

- HTTPS

- Ma teen

- oluline

- in

- tolli

- sisaldama

- sõltumatud

- indeks

- inimesed

- inflatsioon

- Inflatsiooniline

- kavatseb

- rahvusvaheliselt

- kehtestama

- Investeeri

- investeerimine

- investeering

- Investorid

- Välja antud

- IT

- ITS

- liituma

- jpg

- hoidma

- ratsu

- Teadma

- teatud

- suurim

- käivitamine

- nagu

- piiratud

- London

- Vaatasin

- otsin

- kaotama

- Luksus

- tehtud

- tegema

- TEEB

- juhtimine

- juht

- palju

- Turg

- turud

- vahendid

- võib

- miljon

- meeles

- raha

- rohkem

- kõige

- Nimega

- tingimata

- vajav

- Uus

- New York

- of

- Pakkumised

- Pakkumised

- on

- ONE

- Avaneb

- tavaline

- enda

- maali

- maalid

- Maksma

- ehk

- füüsiline

- tükk

- tükki

- Koht

- plaanid

- inimesele

- Platvormid

- Platon

- Platoni andmete intelligentsus

- PlatoData

- populaarne

- võimas

- ennustada

- pildid

- Kasum

- kasum

- kaitsma

- anda

- tarnija

- annab

- avalik

- ostma

- ostetud

- rahakott

- põhjustel

- hiljuti

- osas

- suhe

- Eemaldatud

- Rent

- aru

- teadustöö

- Tulu

- Rikas

- s

- S&P

- S&P 500

- sama

- kesk-

- Järelturg

- kindlustama

- müüma

- Seeria

- komplekt

- Aktsiad

- tulistama

- näitama

- kirjutama

- alates

- ühekordne

- Tõmme

- So

- Varsti

- Kestab

- Alustuseks

- Käivitus

- Alustavatel

- varu

- aktsiaturg

- salvestada

- kauplustes

- lihtne

- stuudio

- selline

- et

- .

- Tulevik

- oma

- Neile

- Need

- korda

- et

- täna

- kaubeldakse

- triljon

- Pööramine

- tüüpiline

- meie

- all

- us

- väärtuslik

- väärtus

- võlvkelder

- Voolav

- kõndis

- Sein

- tagaotsitav

- Vesi

- Tee..

- kuidas

- Jõukus

- M

- will

- koos

- ilma

- maailma

- väärt

- oleks

- kirjutama

- Sinu

- ise

- sephyrnet