Ether’s price (ETH) reached $1,400 on March 10, which proved to be a bargain as the cryptocurrency rallied 27.1% until March 21, at the time of writing. However, the three reasons that supported the price gain, including correlation with tech stocks, its increasing total value locked and its deflationary token economics, all suggest that the path to $2,000 is set in stone.

There are numerous explanations for Ether’s 19.4% decline over the past six months. The Shanghai kõva kahvel upgrade was delayed from March to early April and after Shanghai, Ethereum’s roadmap includes the “Surge,” “Verge,” “Purge,” and “Splurge” updates. In reality, the longer these intermediate steps to achieve scalability take, the greater the likelihood that competing networks will demonstrate efficacy and possibly establish a competitive advantage.

Another potentially concerning issue on the minds of investors is the real chance of price impact when validators are finally able to unlock their 32 ETH deposits following the completion of the Shappela hard fork. While it is impossible to predict how many of the 16 million ETH currently staked on the Beacon Chain will be sold on the market. There is a compelling argument in favor of the transition to liquid staking platforms, as they can use liquid staking derivatives on other decentralized finance networks without sacrificing their staking yield.

Traders could construct a narrative based on regulatory uncertainty, especially after SEC Chairman Gary Gensler’s September 2022 statement that proof-of-stake cryptocurrencies could be subject to securities laws. In February 2023, the SEC reached an agreement compelling the cryptocurrency exchange Kraken to cease offering crypto staking services to U.S.-based clients and the exchange also paid $30 million in disgorgement.

Korrelatsioon versus rakendustele keskendunud tehnoloogiaettevõtted

Et mõista, miks Ether tõusis 15% vähem kui kolme päevaga pärast lühikest kauplemist alla 1,400 dollari 10. märtsil, peavad kauplejad minema üle hinnapõhiselt analüüsilt turukapitalisatsiooni võrdlusele. 10. märtsil sulgus Ethereumi turukapital 175 miljardi dollari tasemel.

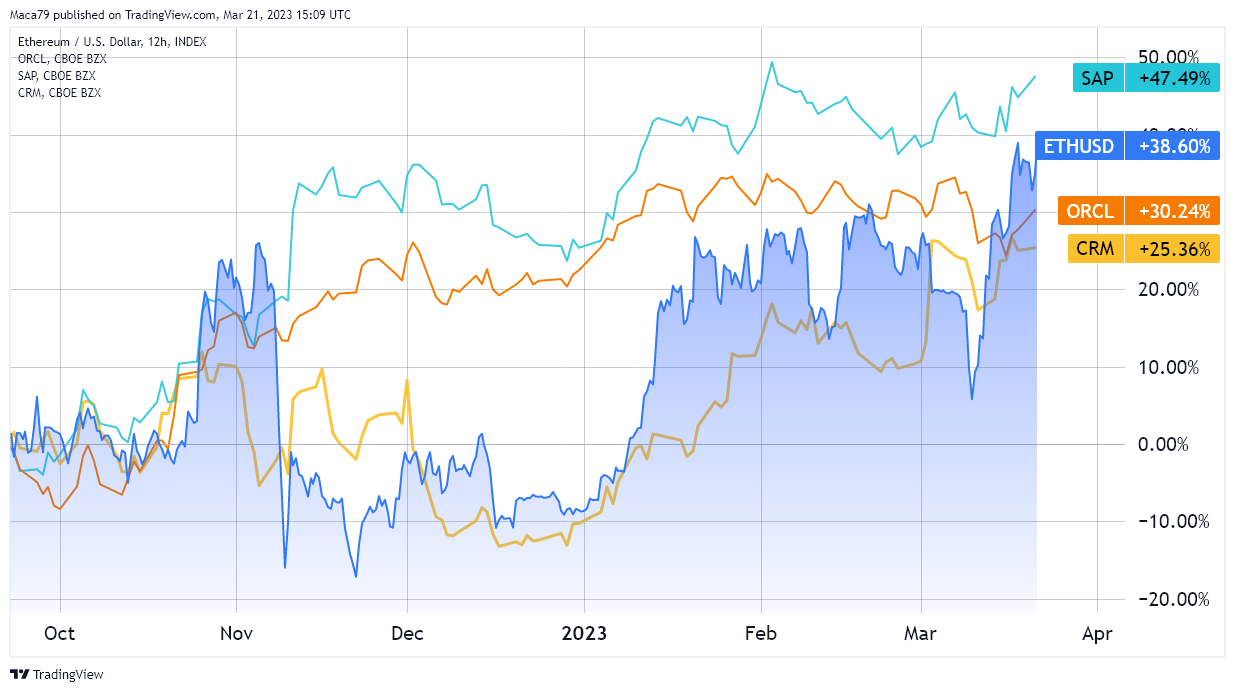

Oracle, SAP, and Salesforce are similar to Ethereum in that their software enables users to access shared computing resources and resources. This is in contrast to chipmakers NVidia and TSM, infrastructure providers Microsoft and Oracle, and technology companies Apple and Cisco that heavily rely on equipment.

The market capitalizations of Oracle, Salesforce and SAP are comparable to Ether’s at $233 billion, $188 billion, and $149 billion, respectively. Ultimately, centralized and decentralized solutions permit businesses to integrate their proprietary software so that all third parties and relevant departments can consult, process, share, and store data.

Arvestades viimase kuue kuu andmeid, on Etheri hind toiminud sarnaselt nende ettevõtetega. Langus alla 1,400 dollari 10. märtsil oli ebaloogiline, kui korrelatsioon rakendustele keskendunud tehnoloogiaaktsiate ja Etheri hinna vahel jääb kehtima.

ETH koguväärtus on 30 miljardit dollarit

The Total Value Locked (TVL) of the Ethereum network was $24 billion on November 24, 2022, and increased by 30% to $30 billion by March 21, 2023. Therefore, if no other factors influence the price, one could anticipate a 30% price increase during that six-month period. Except that was not the case on March 10, when Ether traded at $1,400, representing a mere 8% increase from six months prior and indicating a disconnect between the value deposited in the network’s smart contracts and the ETH price.

See 22% erinevus TVLi 30% tõusu ja ETH hinna 8% tõusu vahel näitas, et Etheri tegelik väärtus oleks pidanud olema 1,700 dollari lähedal, mis saavutati kolm päeva hiljem, 13. märtsil 2023. See lihtne mudel välistab arvu pakkumist ja nõudlust ning sellest tulenevat hinnataset mõjutavad muutujad, kuid see annab ajaloolistel andmetel põhineva vihje.

Seotud: Coinbase esitab SEC-ile avalduse, selgitades, et panustamine ei ole väärtpaberid

Eetri deflatsioonimehhanism töötab täies jõus

On November 10, 2021, the price of Ether was $4,869, a record high for the cryptocurrency. However, a great deal has changed since then, including the põletamine of 3,016,607 ETH via the EIP-1559 Improvement Proposal. This equates to an additional $5.4 billion in capitalization that would have otherwise been created, thereby adding to the supply side and restraining price appreciation.

Currently, the market leader Bitcoin (BTC), is trading down 59% from its $69,000 all-time high. That does not necessarily mean Ether should reduce the gap versus Bitcoin, but it shows how discounted ETH currently stands at $1,780. The deflationary standard paves the way for Ether’s perception as a scarce digital asset, which is particularly promising during inflationary periods in the global economy.

Siin avaldatud vaated, mõtted ja arvamused on ainuüksi autorid ega kajasta tingimata Cointelegraphi seisukohti ja arvamusi.

See artikkel ei sisalda investeerimisnõuandeid ega soovitusi. Iga investeerimis- ja kauplemisliikumine on seotud riskiga ning lugejad peaksid otsuse langetamisel ise uurima.

- SEO-põhise sisu ja PR-levi. Võimenduge juba täna.

- Platoblockchain. Web3 metaversiooni intelligentsus. Täiustatud teadmised. Juurdepääs siia.

- Allikas: https://cointelegraph.com/news/ethereum-price-at-1-4k-was-a-bargain-and-a-rally-toward-2k-looks-like-the-next-step

- :on

- 000

- 10

- 15%

- 2021

- 2022

- 2023

- 32 ETH

- 4k

- a

- Võimalik

- juurdepääs

- Saavutada

- Täiendavad lisad

- ADEelis

- nõuanne

- pärast

- Kokkulepe

- Materjal: BPA ja flataatide vaba plastik

- üksi

- analüüs

- ja

- ennetada

- õun

- kallinemine

- Aprill

- OLEME

- argument

- artikkel

- AS

- eelis

- At

- põhineb

- BE

- majakas

- majakakett

- alla

- vahel

- Miljard

- Bitcoin

- lühidalt

- ettevõtted

- by

- CAN

- kork

- Kapitaliseerimine

- juhul

- tsentraliseeritud

- kett

- eesistuja

- võimalus

- Cisco

- kliendid

- suletud

- Cointelegraph

- Ettevõtted

- võrreldav

- võrdlus

- kaalukad

- võistlev

- konkurentsivõimeline

- lõpetamist

- arvutustehnika

- Läbi viima

- ehitama

- lepingud

- kontrast

- Korrelatsioon

- võiks

- loodud

- CRM

- krüpto

- Krüptomäng

- cryptocurrencies

- cryptocurrency

- Krüptovaluutavahetus

- krüptovaluutavahetus Kraken

- Praegu

- andmed

- Päeva

- tegelema

- Detsentraliseeritud

- Detsentraliseeritud rahandus

- detsentraliseeritud lahendused

- otsus

- Väheneb

- deflatsiooniline

- Hilineb

- Nõudlus

- näitama

- osakonnad

- hoiule

- Derivaadid

- erinevus

- digitaalne

- Digitaalne vara

- alla

- Drop

- ajal

- Varajane

- Ökonoomika

- majandus

- EIP-1559

- võimaldab

- võrdub

- seadmed

- eriti

- looma

- ETH

- eth hind

- Eeter

- Eeter (ETH)

- ethereum

- ethereumi võrk

- Ethereumi hind

- Ethereumi omad

- Iga

- Välja arvatud

- vahetamine

- selgitades

- väljendatud

- tegurid

- soodustama

- Veebruar

- Lõpuks

- rahastama

- Järel

- eest

- kahvel

- Alates

- täis

- kasu

- lõhe

- Gary

- Gary Gensler

- Gensler

- Globaalne

- Maailma majandus

- suur

- suurem

- Raske

- raske kahvel

- Olema

- tugevalt

- siin

- Suur

- ajalooline

- Kuidas

- aga

- HTTPS

- mõju

- võimatu

- paranemine

- in

- hõlmab

- Kaasa arvatud

- Suurendama

- kasvanud

- kasvav

- osutatud

- Näitab

- näidustus

- Inflatsiooniline

- mõju

- Infrastruktuur

- integreerima

- Kesktaseme

- investeering

- Investorid

- probleem

- IT

- ITS

- Kraken

- juht

- Tase

- nagu

- Vedelik

- vedeliku panustamine

- lukus

- enam

- välimus

- Tegemine

- palju

- Märts

- märtsil 13

- Turg

- Turupiirkond

- Turukapitalisatsioon

- Turuliider

- mehhanism

- Microsoft

- miljon

- mõtetes

- mudel

- kuu

- liikuma

- NARRATIIVNE

- Lähedal

- tingimata

- võrk

- võrgustikud

- järgmine

- November

- number

- arvukad

- Nvidia

- of

- pakkumine

- on

- ONE

- Arvamused

- oraakel

- ORCL

- Muu

- muidu

- enda

- makstud

- eriti

- isikutele

- minevik

- tee

- taju

- periood

- perioodid

- Platon

- Platoni andmete intelligentsus

- PlatoData

- potentsiaalselt

- ennustada

- hind

- Hinnatõus

- Eelnev

- protsess

- paljutõotav

- Proof-of-Stake

- ettepanek

- varaline

- tõestatud

- anda

- pakkujad

- ralli

- jõudis

- lugejad

- reaalne

- Reaalsus

- põhjustel

- soovitused

- rekord

- vähendama

- kajastama

- regulatiivne

- asjakohane

- jäänused

- esindama

- esindavad

- teadustöö

- Vahendid

- vastavalt

- tulemuseks

- Oht

- tegevuskava

- s

- ohverdama

- müügijõud

- mahl

- Skaalautuvus

- Napp

- SEC

- SEK esimees

- SEC esimees Gary Gensler

- Väärtpaberite

- September

- komplekt

- Shanghai

- Jaga

- jagatud

- peaks

- Näitused

- sarnane

- Samamoodi

- lihtne

- alates

- SIX

- Kuus kuud

- nutikas

- Tarkvaralepingud

- So

- tarkvara

- müüdud

- Lahendused

- allikas

- Panus

- Staking

- standard

- seisab

- väljavõte

- Samm

- Sammud

- varud

- KIVI

- salvestada

- varustama

- Pakkumine ja nõudlus

- Toetatud

- hüppeline

- Lüliti

- Võtma

- tech

- tehnika varud

- Tehnoloogia

- tehnoloogiaettevõtted

- et

- .

- oma

- sellega

- seetõttu

- Need

- Kolmas

- kolmandad isikud

- kolm

- aeg

- et

- sümboolne

- sümboolne majandusteadus

- Summa

- koguväärtus lukustatud

- suunas

- kaubeldakse

- Ettevõtjad

- Kauplemine

- tõsi

- tõeline väärtus

- TVL

- lõpuks

- Ebakindlus

- mõistma

- Uudised

- upgrade

- kasutama

- Kasutajad

- valideerijad

- väärtus

- äärel

- Versus

- kaudu

- vaated

- vs

- Tee..

- mis

- kuigi

- will

- koos

- ilma

- oleks

- kirjutamine

- saak

- sephyrnet