Bloomberg’s senior item specialist Mike McGlone says another deflationary period might be showing up to the monetary scene, from which Bitcoin (BTC) and gold could benefit.

The expert tells his 47,700 Twitter devotees that falling gamble on resources might develop into a deflationary stage that helps the lead digital currency, the yellow metal and US bonds.

"Liiga kuumad aktsiad vs. Bitcoini küpsemine? 1H [esimene pool] langevad riskivarad võtavad inflatsiooni meeletu kiirusega, mis võib väljenduda pandeemiaeelsete deflatsioonijõudude ilmnemises 2H [teisel poolel]. Selle stsenaariumi peamised kasusaajad võivad olla kuld, Bitcoin ja USA riigikassa pikad võlakirjad.

Allikas: Mike McGlone / Twitter

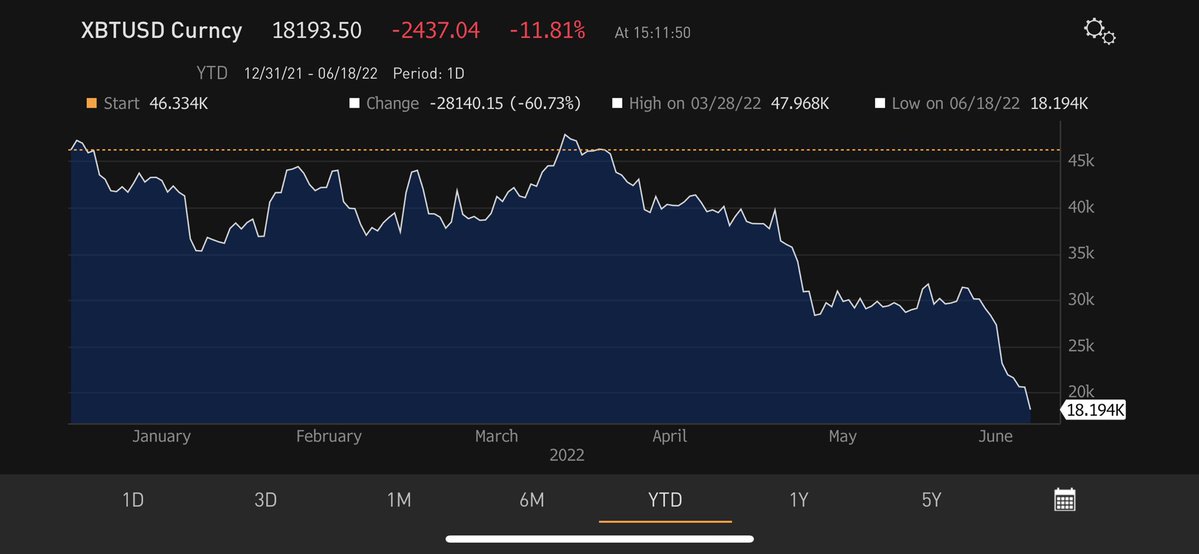

As Bitcoin kept plunging over the course of the end of the week, McGlone anticipated that this week would see significantly more decreases in risk resources. He says the enormous downfalls could decrease the requirement for the Federal Reserve to keep up with its position on financial tightening.

„Laupäeval langes Bitcoin üle 10%, mis viitab suure riskiga varade langusnädalale. Föderatsiooni 75 bps [baaspunktide] tõus võib olla viimane, riskivarade deflatsioon karmistab neid. 1929. aasta – agressiivsed intressitõusud, hoolimata aktsiaturgude langusest, ülemaailmsest SKTst ja tarbijate meeleolust.

Allikas: Mike McGlone / Twitter

Allikas: Mike McGlone / Twitter

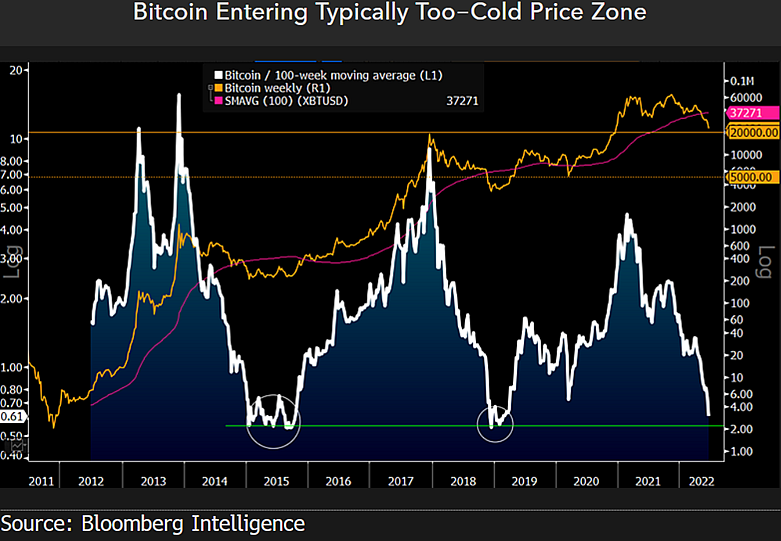

Last week, the Bloomberg investigator said that the $20,000 level for Bitcoin could be the new $5,000.

During the 2018 bear market, the $5,000 cost region filled in as help for Bitcoin for about a year. In 2020, the $5,000 level likewise gone about as help for Bitcoin despite the fact that BTC momentarily penetrated the region several times.

„20,000 5,000 dollari suurune Bitcoin võib olla uus 2022 dollarit – Bitcoini globaalse kasutuselevõtu algusaegade ja pakkumise vähenemise põhijuhtum võib valitseda, kuna hind läheneb tavaliselt liiga külmale tasemele. On mõistlik, et üks ajaloo parimaid tulemusi andvaid varasid langeks [XNUMX. aasta esimesel poolel].

Allikas: Mike McGlone / Twitter

Allikas: Mike McGlone / Twitter

Kontrolli hinda Toiming

Don’t Miss a Beat – Subscribe to get crypto email cautions conveyed straightforwardly to your inbox

Jälgi meid puperdama, Facebook ja Telegramm

Surfake Daily Hodli segu

Actually take a look at Latest News Headlines

Disclaimer: Opinions communicated at The Daily Hodl are not speculation counsel. Financial backers ought to take care of any outstanding concerns prior to making any high-risk interests in Bitcoin, cryptographic money or advanced resources. Kindly be prompted that your exchanges and exchanges are despite copious advice to the contrary, and any loses you might bring about are your obligation. The Daily Hodl doesn’t suggest the trading of any cryptographic forms of money or advanced resources, nor is The Daily Hodl a venture counselor. If it’s not too much trouble, note that The Daily Hodl partakes in member showcasing.

Included Image: Shutterstock/Art Furnace

#Bloomberg #Analyst #Bitcoin #Gold #Benefit #Potential #Incoming #Deflationary #Phase #Daily #Hodl

- Münditark. Euroopa parim Bitcoini ja krüptobörs.

- Platoblockchain. Web3 metaversiooni intelligentsus. Täiustatud teadmised. TASUTA PÄÄS.

- CryptoHawk. Altcoini radar. Tasuta prooviversioon.

- Source: https://cryptoinfonet.com/bloomberg-analyst-says-bitcoin-and-gold-could-benefit-from-potential-incoming-deflationary-phase-the-daily-hodl/

- "

- 000

- 10

- 2020

- 2022

- 9

- a

- MEIST

- Vastuvõtmine

- edasijõudnud

- nõuanne

- analüütik

- Teine

- lähenemisviisid

- eelis

- vara

- alus

- Bear Market

- kasu

- Bitcoin

- bitcoini adopteerimine

- Bitcoinist

- Bloomberg

- Võlakirjad

- tooma

- BTC

- mis

- juhul

- tarbija

- võiks

- krüpto

- krüptograafia

- valuuta

- iga päev

- Päeva

- deflatsioon

- deflatsiooniline

- Vaatamata

- arendama

- digitaalne

- digitaalse valuuta

- Varajane

- tohutu

- Vahetused

- ekspert

- Föderaal-

- Föderaalreserv

- finants-

- esimene

- vormid

- Alates

- põhiline

- SKP

- Globaalne

- Kuldne

- aitama

- aitab

- kõrge riskiga

- ajalugu

- HODL

- HTTPS

- pilt

- inflatsioon

- el

- IT

- hoidma

- hiljemalt

- Uudised

- viima

- Tase

- taset

- Tõenäoliselt

- LINK

- Vaata

- TEEB

- Tegemine

- Turg

- liige

- metall

- võib

- Rahaline

- raha

- rohkem

- uudised

- Arvamused

- periood

- faas

- võrra

- positsioon

- potentsiaal

- hind

- esmane

- Produktsioon

- piirkond

- Reserv

- Vahendid

- Oht

- Ütlesin

- stseen

- tunne

- tunne

- mitu

- esitlus

- spetsialist

- spekulatsioonid

- Stage

- varu

- aktsiaturg

- varud

- tellima

- varustama

- võtmine

- ütleb

- .

- korda

- Kauplemine

- häda

- puperdama

- tüüpiliselt

- us

- ettevõtmine

- nädal

- oleks

- aasta

- Sinu