Bitcoin slumped to as low as $40,280 on Jan. 19, its lowest level since Dec. 12, 2023, before rebounding to $41,979 after four hours of consistent sell pressure that liquidated most long positions on major exchanges.

As of press time, Bitcoin traded at $41,609 after failing to breach $42,000. Meanwhile, long liquidations stood at roughly $30 million and made up 85% of all liquidations over the period, based on CoinGlass andmed.

sild peamised krüptovaluutad saw similar price movements and are trading in the red for the day. However, the rebound from a crucial support level indicates resilience as investors continue to buy at that key price level.

Hoides 40,000 XNUMX dollarit

Bitcoin has held above the $40,000 threshold despite facing significant sell pressure over the past week after spot ETFs for the flagship cryptocurrency were heaks on Jan. 10, resulting in a “sell the news” event.

. ETF-id initially caused the price to surge to $49,000 before investors began taking profit on short-term positions, causing the price to dip back to levels seen in mid-December.

Initial speculation blamed the downward pressure on Halltoonid, dumping tens of thousands of its Bitcoin on the market. However, data shows that the nine new ETFs — led by BlackRock and Fidelity — have bought up more Bitcoin than GBTC dumpinguhinnaga.

Based on available data, Halltoonid has sold roughly 60,000 Bitcoin since the ETF began trading, while the “Newborn Nine” have bought roughly 72,000 BTC over the same period. This means that the downward pressure is unrelated to the ETFs, as the newer issuers seem to be actively holding the $40,000 price line.

The nine newly issued spot Bitcoin ETFs are experiencing sustained interest from investors. BlackRock ja Truuduse oma ETF have already hit $ 1 miljardit in assets under management, equating to more than 25,000 BTC.

Kasumit teenivad vaalad

Crypto Quant teadusuuringute juht Julio Moreno ütles müük on tulnud peamiselt lühiajalistelt kauplejatelt, kes sattusid positsioonidele, mis põhinesid spetsiaalselt ETF-i heakskiidul, et osta kuulujutt, ja Bitcoini vaalad, kes teenivad pärast aastast kasumit kasumit.

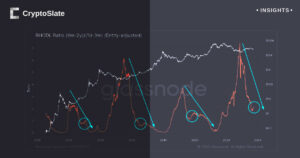

Meanwhile, the dynamics between long-term and short-term Bitcoin investors are becoming increasingly distinct, as evidenced by recent market activities, according to CryptoSlate teadustöö.

Pikaajalisi omanikke – tavaliselt neid, kes on Bitcoini hoidnud üle 155 päeva, sealhulgas vaalad – on kasumi teenimiseks oma varasid börsidele viimas. See trend ilmnes 2023. aasta juuli paiku, kui Bitcoini väärtus langes märkimisväärselt 30,000 26,000 dollarilt XNUMX XNUMX dollarile.

Täpsemalt, 17. ja 18. jaanuaril kandsid need pikaajalised investorid börsidele üle hinnanguliselt 25,000 1 BTC-d, mille väärtus oli ligikaudu XNUMX miljard dollarit. Seda sammu tõlgendatakse kui nende investeeringute sissemaksmist ilma kahjumit kandmata.

Seevastu lühiajalised Bitcoini omanikud, kes hoiavad oma investeeringuid vähem kui 155 päeva, on näidanud ebastabiilsemat mustrit. 18. jaanuaril kandsid nad börsidele kahjumiga üle märkimisväärse koguse Bitcoini, mille väärtus oli 2.4 miljardit dollarit.

See näitab nende investorite kõrgemat aktiivsust ja kasumite vähenemist. Eelkõige näib, et need, kes lootsid Bitcoini tõusu 49,000 XNUMX dollarini võimendada, on oma kasumi juba ära teeninud või seisavad silmitsi kahjumiga.

- SEO-põhise sisu ja PR-levi. Võimenduge juba täna.

- PlatoData.Network Vertikaalne generatiivne Ai. Jõustage ennast. Juurdepääs siia.

- PlatoAiStream. Web3 luure. Täiustatud teadmised. Juurdepääs siia.

- PlatoESG. Süsinik, CleanTech, Energia, Keskkond päikeseenergia, Jäätmekäitluse. Juurdepääs siia.

- PlatoTervis. Biotehnoloogia ja kliiniliste uuringute luureandmed. Juurdepääs siia.

- Allikas: https://cryptoslate.com/bitcoin-dips-to-lowest-level-since-dec-12-before-bouncing-as-buyers-hold-40k-threshold/

- :on

- :on

- $ 1 miljardit

- $ UP

- 000

- 10

- 12

- 17

- 19

- 2023

- 25

- 60

- 72

- a

- üle

- Vastavalt

- aktiivselt

- tegevus

- tegevus

- pärast

- Materjal: BPA ja flataatide vaba plastik

- juba

- vahel

- summa

- an

- ja

- heakskiit

- OLEME

- ümber

- AS

- vara

- At

- saadaval

- tagasi

- põhineb

- BE

- saada

- olnud

- enne

- hakkas

- vahel

- Miljard

- Bitcoin

- Bitcoini hoidjad

- bitcoini investorid

- bitcoin vaalad

- BlackRock

- ostnud

- rikkumine

- BTC

- ostma

- ostjad

- by

- rahahoidmine

- põhjustatud

- põhjustades

- Tulema

- järjepidev

- jätkama

- otsustav

- cryptocurrency

- Krüptoslaat

- andmed

- päev

- Päeva

- detsember

- vähenenud

- Vaatamata

- Kastke

- eristatav

- allapoole

- dünaamika

- tekkinud

- Hinnanguliselt

- ETF

- ETF-id

- sündmus

- tõendatud

- Vahetused

- kogenud

- kogevad

- ees

- vastasel

- truudus

- Lipulaev

- eest

- neli

- Alates

- Kasum

- GBTC

- sain

- olnud

- Olema

- juhataja

- Held

- rohkem

- Tulemus

- hoidma

- omanikud

- omamine

- Lahtiolekuajad

- aga

- http

- HTTPS

- in

- hõlmab

- üha rohkem

- näitab

- esialgu

- huvi

- sisse

- Investeeringud

- Investorid

- Välja antud

- emiteerijad

- ITS

- John

- jpg

- Juuli

- Võti

- Led

- vähem

- Tase

- taset

- Finantsvõimendus

- joon

- LIKVIDEERITUD

- likvideerimised

- Pikk

- pikaajaline

- kaotus

- kaod

- Madal

- madalaim

- madalaim tase

- tehtud

- peamiselt

- peamine

- juhtimine

- Turg

- vahendid

- Vahepeal

- miljon

- rohkem

- kõige

- liikuma

- liikumised

- liikuv

- Uus

- uuem

- äsja

- üheksa

- vaadeldud

- of

- on

- or

- üle

- eriti

- minevik

- Muster

- periood

- Platon

- Platoni andmete intelligentsus

- PlatoData

- positsioone

- vajutage

- surve

- hind

- Kasum

- kasum

- nagu

- mõistma

- tagasilöök

- hiljuti

- Red

- teadustöö

- vastupidavust

- tulemuseks

- ligikaudu

- sama

- nägin

- tundub

- nähtud

- müüma

- Müük

- lühiajaline

- näidatud

- Näitused

- märkimisväärne

- sarnane

- alates

- müüdud

- eriti

- spekulatsioonid

- Kaubandus-

- seisis

- mahukas

- kannatab

- toetama

- toetuse tase

- hüppeline

- püsiv

- võtnud

- võtmine

- kümneid

- kui

- et

- .

- oma

- Need

- nad

- see

- need

- tuhandeid

- künnis

- aeg

- et

- kaubeldakse

- Ettevõtjad

- Kauplemine

- üle antud

- Trend

- tüüpiliselt

- all

- väärtus

- hinnatud

- nädal

- olid

- Vaala

- millal

- mis

- kuigi

- WHO

- ilma

- aasta

- sephyrnet