The cryptocurrency is inching slowly upwards after losses yesterday. Its total cap, at $922 billion, has fallen by 5% in a week, and by 32% in a month. It has, however, risen by 1% in 24 hours, along with most major coins. This invites hope for a weekend recovery, which the market is long overdue, even if macroeconomic conditions remain negative. As such, here's our pick of the 5 best cryptocurrency to buy for the recovery.

5 parimat krüptovaluutat, mida taastumiseks osta

1. Õnneplokk (LBLOCK)

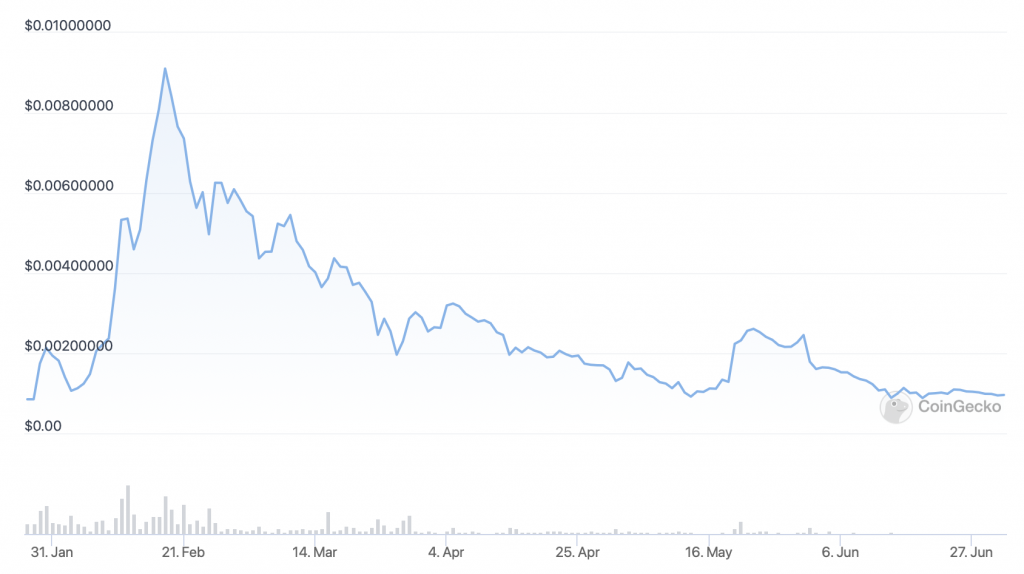

LBLOCK on hetkel 0.00095626 dollarit, mis tähendab murdosa (0.2%) kasvu viimase 24 tunni jooksul. Kuid altcoin on viimase nädalaga langenud 12% ja viimase 46 päevaga 30%.

LBLOCK is down by 90% since its all-time high of $0.00974554, set in February. On the other hand, it's up by 120% since launching in late January.

See, et LBLOCK on turule toomisest saadik endiselt üleval, on hea märk tuleviku jaoks ja hiljutised Lucky Blocki arengud viitavad sellele, et turutingimuste paranemisel võib see jõudsalt kasvada. Esiteks korraldab Lucky Block krüptomängude platvorm nüüd regulaarseid auhindade loosimist, mis garanteerivad minimaalne jackpot 50,000 XNUMX dollarit. Lisaks on see läbinud oma tulevase ERC-20 märgi auditi.

V2 märgi audit läbitud! ✅

See tähendab, et jõuame tsentraliseeritud börside noteerimisele lähemale! 🤩

Lase #CountdownToCEXs alusta! 🥳 @SolidProof_io #crypto #audit #CEX #nimekirjad #blockchain pic.twitter.com/TZJMPdNOdZ

- Lucky Block (@luckyblockcoin) Juuni 23, 2022

In other words, an Ethereum-based version of LBOCK is imminent. It had originally launched on Binance Smart Chain, yet a migration to Ethereum will open up significant liquidity for the coin. Likewise, it paves the way for more exchange listings, something which will expand its market substantially. This is why it's one of our 5 best cryptocurrency to buy for the recovery.

2. Bitcoin (BTC)

BTC on viimase 1.5 tunni jooksul tõusnud 24%, ulatudes 19,664 18,780 dollarini. Eile oli see langenud 7 38 dollarile, mis tõi esile edasise languse võimaluse. Ja selle praegune trend jääb negatiivseks, olles nädalaga langenud XNUMX% ja kuuga XNUMX%.

BTC's indicators are at a very low ebb. Its relative strength index (in purple) is touching 30, indicating that the market is overselling it. Likewise, its 30-day moving average (in red) has fallen to its lowest level relative to its 200-day average (in blue) for a year. This strongly signals an eventual recovery.

Bitcoin remains the market's leader for a reason. It commands institutsionaalseteks investeeringuteks umbes 26 miljardit dollarit, mis näib keskmises kuni pikas perspektiivis tõusvat. Näiteks, Jacobi Asset Management teatas äsja the launch of Europe's first-ever spot Bitcoin ETF. It will go live this month on the Euronext Amsterdam exchange, paving the way for more institutional and mainstream investment in bitcoin.

More generally, it's bitcoin that continues to attract outside interest. There continue to be nations which turn to BTC during periods of very high inflation (e.g. Türgi ja Argentina), samuti need, mis on muutnud selle seaduslikuks maksevahendiks (El Salvador ja Kesk-Aafrika Vabariigi). Suure tõenäosusega see trend jätkub ka siis, kui turg taas positiivsemaks muutub.

3. Liivakast (SAND)

At $1.13, SAND has risen by 15% in a day. It's also up by 12% in a week and by 35% in the past 14 days. That said, it is down by 22% in a month.

Looking at SAND's chart, it had been due a rally. Its RSI has fallen below 30, while its 30-day average had collapsed far below its 200-day. Of course, with conditions remaining challenging, it can't be said how long its current spurt will last.

Tundub, et LIIV on hetkel tõusmas seoses silla avanemisega Liivakasti ja kahe kihi platvormi polügooni vahel. See võimaldab liivakasti kasutajatel LAND-i mittevahetatavaid märke ja SAND-i polügoonile (ja peale) üle kanda, mis vähendab kulusid ja suurendab tõhusust.

🌉 Oleme valmis LAND-i kasutusele võtma @ 0xPolygon 🌉

🔸Iga LAND sild annab 10 mSAND raha tagasi!

🔸Mõlema mSAND panustamisprogrammi LAND kordajad on tagasi!

🔸LAND müük ja LAND panustamise funktsioonid (Polygonil) on peagi tulemas!SILDA KOHE ➡️ https://t.co/jlcSKxuBWh pic.twitter.com/1tuAAsqEZP

- liivakast (@TheSandboxGame) Juuni 28, 2022

Laiemat pilti vaadates on Sandbox oma mängu-/metaverse platvormil näinud palju kõrgetasemelist tegevust. Eelkõige teatas riistvara rahakoti tootja Ledger, et on valinud liivakasti oma esimeseks virtuaalseks asukohaks metaversumis. Arvestades Ledgeri kaalu krüptovaluutade sektoris, on see platvormile suur tunnustus.

Tere tulemast LedgerVerse'i @TheSandboxGame: Ledger's first step into the metaverse and the first to turn gaming into Web3 education. 🎮

Vallutage ülesandeid, võitlege petturitega ja võitke Web3 auhindu. 🥇

Kapten krüptoturvalisust.

Õppige. Mängi. Teeni. Tulemas suvi 2022. pic.twitter.com/56kS9FLZK6

- Pearaamat (@Ledger) Juuni 22, 2022

It's worth remembering that the Sandbox racked up around 350 miljonit dollarit virtuaalse maa müük 2021. aastal, more than any other similar platform. This highlights its potential, and also why we've included it among our 5 best cryptocurrency to buy for the recovery.

4. Ethereum (ETH)

ETH on viimase 2.5 tunni jooksul tõusnud 24%. 1,072 dollariga on see viimase nädalaga langenud 6% ja viimase kuuga 45%.

ETH's indicators are much like BTC's, suggesting a bottom. Its RSI is close to 30, while its 30-day average is far below its 200-day. Of course, the market is going through an unprecedentedly difficult time right now, so it's hard to say whether a rally is imminent.

Siiski on ETH-l suur keskmise ja pikaajalise potentsiaal. See on suuresti tingitud sellest, et Ethereum on üleminekul panuse tõendamise konsensuse mehhanismile. See muudab esimese kihi plokiahela vähem energiamahukaks, skaleeritavamaks ja investoritele atraktiivsemaks.

Palju õnne #Ethereum kogukonna edukal ühendamisel Ropsteni testvõrgus.

Panustatud väärtus on üle 22.78 miljardi dollari ja see on valmis eelseisvaks põhivõrgu ühendamiseks panuse tõestamiseks.

See on 12.8 miljonit $ ETH = 10.78% pakkumisest.

Reaalajas diagramm: https://t.co/PDQg3lCJCl pic.twitter.com/GiFI3BtSKA

- klaasnupp (@glassnode) Juuni 8, 2022

Due at some point in late summer, the ‘Merge' will massively boost investor confidence in Ethereum. The introduction of staking will increase demand for ETH, and with 10% of ETH's supply already staked on the PoS Beacon Chain, the cryptocurrency could become deflationary. When you add the fact that Ethereum on juba lukustatud koguväärtuse järgi suurim plokiahel, it's easy to see why ETH is one of our 5 best cryptocurrency to buy for the recovery.

11/ At the current stake amount, the Ethereum network will be paying out ~600,000 ETH per year, instead of 4,850,000 under the current PoW model, or 88% less in "sell pressure"! At the same time, stakers will still be earning ~4.6% in their staked ETH, a nice return to attract.

- eric.eth (@econoar) Juuni 10, 2022

5. Arweave (AR)

AR on viimase 20 tunni jooksul tõusnud 24% ja on 10 dollarit. Samuti on see nädalaga tõusnud 2% ja kahe nädalaga 15%, jäädes viimase 35 päevaga 30% allapoole.

AR's chart shows a gradual increase in momentum. Its RSI has gone from under 30 a couple of weeks ago to nearly 50 today. At the same time, its 30-day average is still well below its 200-day, so there's plenty of room left for a bigger recovery.

It seems that AR is rallying right now due to the launch of Arweave's very own domain registry system. Basically, its Arweave's own version of the Ethereum Name Service, enabling users to purchase ArNS-based domain names using AR. This has caused demand for AR to rise as users move to claim their own domains.

Täna käivitame Arweave'i nimesüsteemi (ArNS) pilootprogrammi – Smartweave'il põhineva sõbralike alamdomeenide kataloogi, mida võimaldab https://t.co/ljKQFJO6vN lüüsid @arweaveteam permaweb!

🧵 1 pic.twitter.com/62tQDABgyz

— 🐘🔗ario.arweave.dev (@ar_io_network) Juuni 29, 2022

Looking at AR's fundamentals, it's encouraging to note that Arweave — a decentralised data storage network — on viimase aasta jooksul näinud tehingute kasvu. From 1.75 million daily transactions August 2021, its traffic increased to 48.8 million daily transactions by May of this year. This figure has since declined, as a result of the market downturn, but it's likely to continue witnessing growth once the economic picture improves.

Teie kapital on ohus.

Loe rohkem:

- "

- 000

- 10

- 2021

- 2022

- 28

- a

- tegevus

- aafrika

- juba

- Altcoin

- vahel

- summa

- amsterdam

- teatas

- AR

- ümber

- eelis

- varahaldus

- audit

- AUGUST

- keskmine

- Põhimõtteliselt

- BBC

- majakakett

- muutuma

- alla

- BEST

- vahel

- suurem

- suurim

- Miljard

- binants

- Bitcoin

- Bitcoin ETF

- Blokeerima

- blockchain

- suurendada

- BRIDGE

- BTC

- ostma

- osta Bitcoin

- kapital

- põhjustatud

- kesk-

- tsentraliseeritud

- kett

- raske

- valitud

- nõudma

- lähemale

- CNBC

- Münt

- Mündid

- tulevad

- kogukond

- Tingimused

- usaldus

- üksmeel

- jätkama

- pidev

- kulud

- võiks

- Paar

- krüpto

- cryptocurrency

- Praegune

- iga päev

- andmed

- andmete salvestamine

- päev

- Päeva

- deflatsiooniline

- Nõudlus

- juurutada

- dev

- arenguid

- raske

- Ekraan

- domeen

- Domeenid

- alla

- langes

- ajal

- iga

- teenima

- Teenimine

- Majanduslik

- Käsitöö

- efektiivsus

- võimaldab

- võimaldades

- julgustav

- energia

- ERC-20

- ETF

- ETH

- ethereum

- eeterum (ETH)

- ethereumi võrk

- Euroopa

- näide

- vahetamine

- Laiendama

- FUNKTSIOONID

- Joonis

- esimene

- murdosa

- Alates

- Põhialused

- edasi

- tulevik

- Mängud

- mäng

- üldiselt

- saamine

- Klaasisõlm

- läheb

- hea

- toetusi

- suur

- Kasvama

- Kasv

- garantii

- riistvara

- Riistvara rahakott

- võttes

- siin

- Suur

- rõhutab

- omamine

- lootus

- Kuidas

- aga

- HTTPS

- parandama

- lisatud

- Suurendama

- kasvanud

- indeks

- inflatsioon

- Institutsionaalne

- huvi

- investeering

- investor

- Investorid

- IT

- Jaanuar

- Juuli

- algatama

- käivitatud

- käivitamine

- juht

- pearaamat

- Õigus

- Tase

- Tõenäoliselt

- Likviidsus

- Näita

- elama

- liising

- lukus

- Pikk

- pikaajaline

- kaod

- tehtud

- mainstream

- peamine

- tegema

- juhtimine

- juht

- Tootja

- Turg

- vahendid

- mehhanism

- Merge

- Metaverse

- miljon

- miinimum

- mudel

- Impulss

- kuu

- rohkem

- kõige

- liikuma

- liikuv

- nimed

- Rahvaste

- negatiivne

- võrk

- mitte-asendatav

- mitteelustatavad märgid

- avatud

- avamine

- Muu

- enda

- perioodid

- pilt

- piloot

- inimesele

- mängima

- rohke

- Punkt

- hulknurk

- PoS

- positiivne

- võimalus

- potentsiaal

- PoW

- surve

- hind

- preemia

- protsess

- Programm

- Programmid

- Proof-of-Stake

- avalik

- ostma

- külalistele

- ralli

- RE

- hiljuti

- taastumine

- regulaarne

- jääma

- ülejäänud

- jäänused

- esindavad

- esindab

- tagasipöördumine

- Reuters

- Hüved

- tõusev

- Oht

- Ütlesin

- müük

- sama

- SAND

- liivakast

- skaalautuvia

- Petturid

- sektor

- turvalisus

- müüma

- teenus

- komplekt

- kirjutama

- märkimisväärne

- sarnane

- alates

- nutikas

- So

- mõned

- midagi

- Kaubandus-

- kaalul

- Staking

- Veel

- ladustamine

- tugevus

- edukas

- suvi

- varustama

- süsteem

- .

- Läbi

- aeg

- täna

- sümboolne

- märgid

- ülemine

- liiklus

- Tehingud

- üle

- puperdama

- all

- ajal 30

- tulemas

- ülespoole

- Kasutajad

- väärtus

- versioon

- virtuaalne

- nähtavus

- W3

- rahakott

- Web3

- nädal

- nädalavahetus

- kas

- kuigi

- võitma

- jooksul

- sõnad

- väärt

- aasta