The crypto market is down this week, with the total market capitalization falling by 4.4% to reach its lowest point since June 14 at $1.02 trillion. This movement has increased Bitcoin (BTC) market dominance as regulatory uncertainty hangs over the altcoin markets.

Despite the hype surrounding recently filed Ether (ETH) and BTC exchange-traded funds (ETFs), the United States Securities and Exchange Commission (SEC) continues to delay decisions on the financial instruments.

Aquí hay tres razones por las que el mercado de las criptomonedas ha caído esta semana.

Los retrasos en los ETF hacen que los inversores en criptomonedas elijan mantenerse al margen

Investor expectations of a spot BTC ETF approval had been high, especially with heavyweight endorsements and applications from BlackRock and Fidelity. However, these hopes were dashed as the SEC continued to delay its decision, citing concerns over insufficient safeguards against manipulation.

Despite the delays, VanEck y ARCA invertir have officially applied for spot Ether ETFs. The Sept. 6 filings start the clock for the SEC to make a decision. An estimated deadline for this decision is May 23, 2024.

Although Grayscale was able to win against the SEC in a U.S. appeals court, the Grayscale Bitcoin Trust (GBTC) discount is still hovering at 20% as the SEC weighs appealing the court’s decision. While analysts believe ETFs are bullish in the long term, the market has not sustained such short-term momentum.

Relacionado: Cómo proteger su criptografía en un mercado volátil: los OG y los expertos de Bitcoin opinan

La incertidumbre regulatoria y las demandas pesan sobre las criptomonedas

Financial difficulties within the Digital Currency Group (DCG), which operates GBTC, have also had a negative impact on investor sentiment. A subsidiary of DCG is grappling with a debt exceeding $1.2 billion to the Gemini exchange.

Additionally, Genesis Global Trading, which declared bankruptcy due to losses stemming from the collapse of Terra and FTX, is now suing DCG, which is run by Barry Silbert. This precarious situation could lead to forced selling of positions in the Grayscale Bitcoin Trust if DCG fails to meet its obligations.

Further compounding the market’s woes is pending regulation. The SEC has leveled a series of cargos contra Binance, the crypto market’s largest exchange, and its CEO, Changpeng Zhao, alleging misleading practices and the operation of an unregistered exchange.

The largest crypto by market cap aside from Bitcoin, Ether also lacks clarity around its legal status. While the Commodity Futures Trading Commission chair believes Ether is a commodity rather than a security, there is currently no clarification from the SEC.

While the crypto market continues to grapple with regulatory uncertainty, the Ripple chief technology officer believes the la marea está cambiando on the U.S. regulatory environment.

Las liquidaciones y el bajo volumen hacen bajar el mercado de las criptomonedas

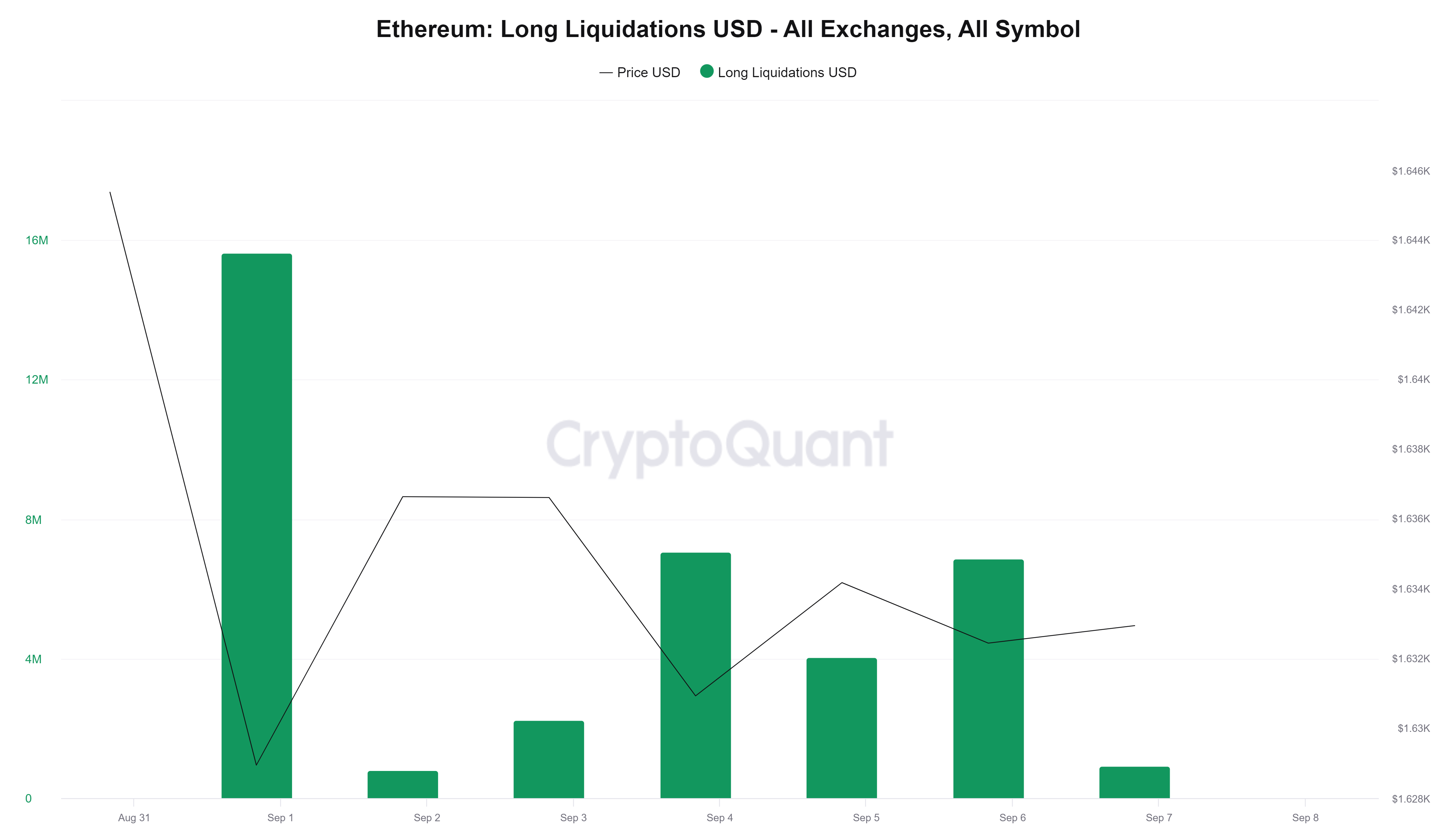

The start of September ignited a wave of Ethereum leveraged liquidations, with $37 million in liquidations occurring in the first week of this month.

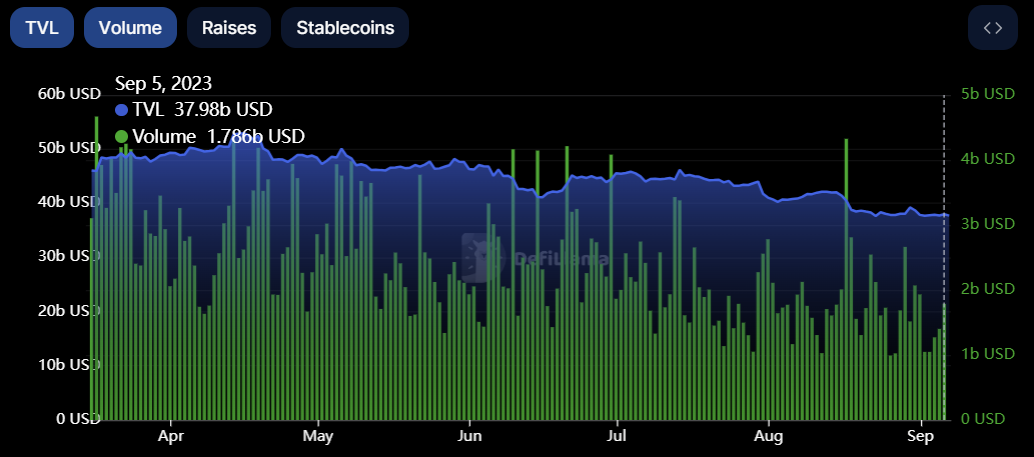

La avalancha de liquidaciones de Ether se produce cuando todo el mercado de cifrado está perdiendo el valor total bloqueado (TVL) y los volúmenes continúan disminuyendo. El mercado de criptomonedas TVL alcanzó un máximo de 2023 el 15 de abril con 53 mil millones de dólares, mientras que el valor actual es de 37.7 mil millones de dólares, lo que refleja una pérdida de más de 15 mil millones de dólares.

Algunos analistas creen the renewed strength of the U.S. dollar, which hit a six-month high on Sept. 7, will continue to be a danger to crypto assets.

A medida que el mercado de las criptomonedas navega a través de estos desafíos multifacéticos, el flujo y reflujo de diversos factores económicos y desarrollos regulatorios sin duda seguirán dando forma a su trayectoria en los próximos meses.

Este artículo es para fines de información general y no pretende ser ni debe tomarse como asesoramiento legal o de inversión. Los puntos de vista, pensamientos y opiniones expresados aquí son solo del autor y no reflejan ni representan necesariamente los puntos de vista y opiniones de Cointelegraph.

- Distribución de relaciones públicas y contenido potenciado por SEO. Consiga amplificado hoy.

- PlatoData.Network Vertical Generativo Ai. Empodérate. Accede Aquí.

- PlatoAiStream. Inteligencia Web3. Conocimiento amplificado. Accede Aquí.

- PlatoESG. Automoción / vehículos eléctricos, Carbón, tecnología limpia, Energía, Ambiente, Solar, Gestión de residuos. Accede Aquí.

- PlatoSalud. Inteligencia en Biotecnología y Ensayos Clínicos. Accede Aquí.

- ChartPrime. Eleve su juego comercial con ChartPrime. Accede Aquí.

- Desplazamientos de bloque. Modernización de la propiedad de compensaciones ambientales. Accede Aquí.

- Fuente: https://cointelegraph.com/news/why-is-the-crypto-market-down-this-week

- :posee

- :es

- :no

- 14

- 15%

- 2023

- 2024

- 23

- 7

- a

- consejos

- en contra

- solo

- también

- Altcoin

- mercados de monedas alternativas

- an

- Analistas

- y

- Apelaciones

- aplicaciones

- aplicada

- aprobación

- Abril

- somos

- en torno a

- artículo

- AS

- Activos

- At

- Bancarrota

- Barry Silbert

- BE

- esto

- CREEMOS

- cree

- mil millones

- Bitcoin

- Confianza de Bitcoin

- BlackRock

- BTC

- BTC ETF

- precio de BTT

- by

- tapa

- capitalización

- ceo

- Presidente

- retos

- Changpeng

- Changpeng Zhao

- jefe

- Director de Tecnología

- la elección de

- transparencia

- Reloj

- Cointelegraph

- Colapso

- proviene

- viniendo

- referencia

- mercancía

- Inquietudes

- continue

- continúa

- podría

- CORTE

- cripto

- Inversores Crypto

- Crypto Market

- mercado crypto

- cripto-activos

- criptomoneda

- mercado de criptomonedas

- Moneda

- Current

- En la actualidad

- PELIGRO

- DCG

- Deuda

- Koops

- decisiones

- disminuir

- retrasar

- retrasos

- desarrollos

- dificultades

- digital

- moneda digital

- grupo monetario digital

- El descuento

- do

- Dólar

- Dominio

- DE INSCRIPCIÓN

- el lado de la transmisión

- dos

- Economic

- Avales

- Todo

- Entorno

- especialmente

- estimado

- ETF

- ETFs

- Éter

- Intercambio

- Comisión de Cambio

- intercambiado en bolsa

- las expectativas

- expertos

- expresados

- factores importantes

- falla

- Que cae

- fidelidad

- archivado

- limaduras

- financiero

- Instrumentos financieros

- Nombre

- de tus señales

- Desde

- FTX

- fondos

- Futuros

- Trading de futuros

- GBTC

- Gemini

- Intercambio de Géminis

- General

- Genesis

- Genesis Global

- Genesis Global Trading

- Buscar

- Escala de grises

- Escala de grises de Bitcoin Trust

- Escala de grises de Bitcoin Trust (GBTC)

- Grupo procesos

- tenido

- Tienen

- De peso pesado

- esta página

- Alta

- Golpear

- espera

- Sin embargo

- HTTPS

- Bombo

- if

- Impacto

- in

- aumentado

- información

- instrumentos

- Destinado a

- inversión extranjera

- inversor

- sentimiento de los inversores

- Inversionistas

- SUS

- junio

- mayor

- Cripto más grande

- Demandas

- Lead

- Legal

- liquidaciones

- cerrado

- Largo

- de

- pérdidas

- Baja

- más bajo

- para lograr

- Manipulación

- Marzo

- Mercado

- Capitalización

- Capitalización de Mercado

- Dominio del mercado

- Industrias

- Puede..

- Conoce a

- millones

- engañoso

- Momentum

- Mes

- meses

- movimiento

- movimiento

- multifacético

- necesariamente

- negativas

- no

- ahora

- bonos

- ocurriendo

- of

- Oficial

- Oficialmente

- on

- opera

- Inteligente

- Opiniones

- or

- Más de

- pendiente

- Platón

- Inteligencia de datos de Platón

- PlatónDatos

- punto

- abiertas

- prácticas

- precio

- caídas de precios

- proteger

- fines

- más bien

- en comunicarse

- alcanzado

- razones

- recientemente

- reflejar

- reflejando

- Regulación

- regulador

- renovado

- representar

- resultado

- Ejecutar

- prisa

- s

- salvaguardias

- SEG

- Valores

- Securities and Exchange Commission

- vender

- sentimiento

- Septiembre

- Septiembre

- Serie

- Forma

- a corto plazo

- tienes

- desde

- situación

- Fuente

- Spot

- comienzo

- Zonas

- Estado

- Sin embargo

- filial

- tal

- Rodeando

- sostenido

- toma

- Tecnología

- término

- Terra

- que

- La

- Ahí.

- Estas

- así

- esta semana

- Tres

- A través de esta formación, el personal docente y administrativo de escuelas y universidades estará preparado para manejar los recursos disponibles que derivan de la diversidad cultural de sus estudiantes. Además, un mejor y mayor entendimiento sobre estas diferencias y similitudes culturales permitirá alcanzar los objetivos de inclusión previstos.

- a

- Total

- valor total bloqueado

- Plataforma de

- trayectoria

- Trillones

- Confía en

- TVL

- nosotros

- dólar estadounidense

- Incertidumbre

- bajo

- indudablemente

- United

- Estados Unidos

- no registrado

- propuesta de

- diversos

- vistas

- volátiles

- volumen

- volúmenes

- fue

- Trenzado

- semana

- pesar

- pesa

- tuvieron

- que

- mientras

- porque

- seguirá

- ganar

- dentro de

- tú

- zephyrnet

- Zhao