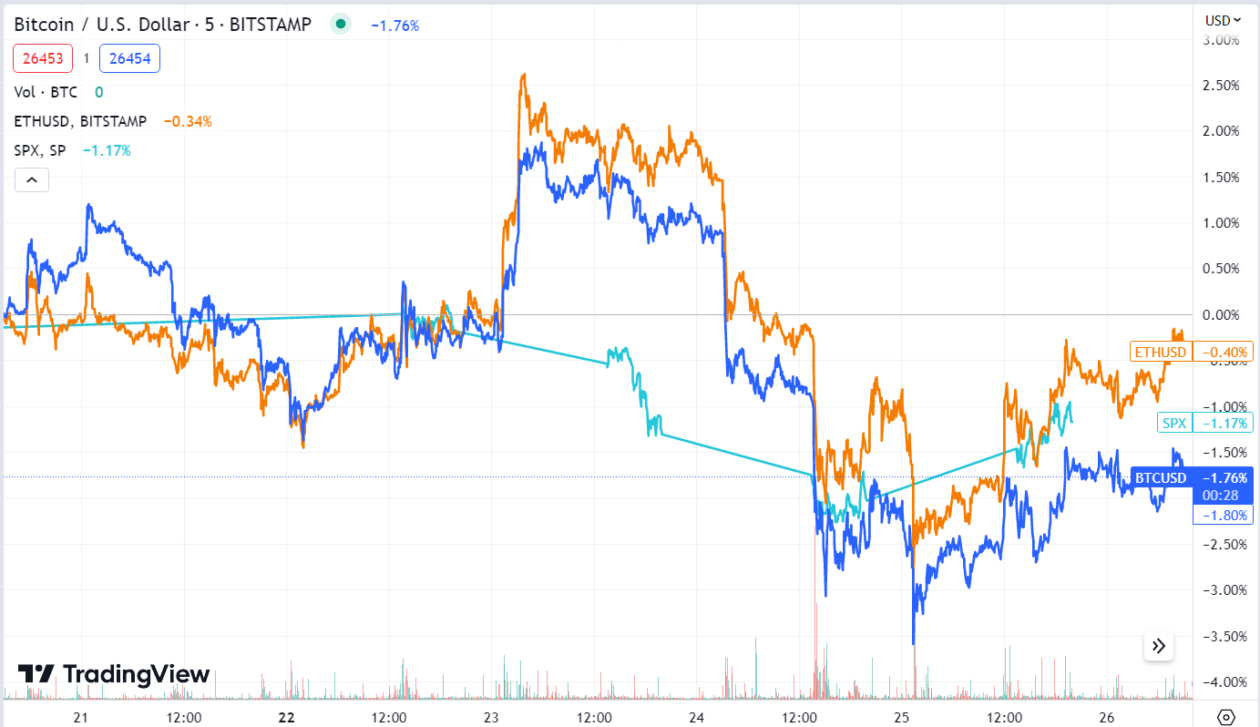

Bitcoin fell 1.40% from May 19 to May 26 to trade at US$26,451 at 7:00 p.m. Friday in Hong Kong. The world’s largest cryptocurrency by market capitalization has been trading under US$30,000 since April 19. Ether rose 0.34% over the week to US$1,813 recapturing US$1,800 on Thursday.

The lack of progress in U.S. debt ceiling negotiations continued to erode risk appetite as the June 1 deadline neared. On Wednesday, Fitch Ratings placed the U.S.’ AAA rating on a negative rating watch, saying that debt ceiling negotiations raised the risks of the government missing payments on some of its obligations.

“Bitcoin and Ether have shrugged off the U.S. debt ceiling negotiations and the potential ripple effects for crypto. President Biden has already declared the country will not default on its debt,” Lucas Kiely, the chief investment officer of digital asset platform Yield App , said . “With liquidity tight, the crypto market doesn’t seem to be too concerned over these macro events. It will take something much more substantial to move these markets.”

Johnny Louey, a crypto research analyst at trading platform LiquidityTech Protocol , disagreed, saying that the debt ceiling negotiations are the main factors weighing down Bitcoin price.

“Although the debt ceiling has been raised and revised 78 times since 1960, investors are aware of the default risk if negotiations fail. This is the first time Bitcoin encountered such an economic incident and it’s reasonable to assume a risk-off approach would be appropriate,” said Louey .

The global crypto market capitalization stood at US$1.11 trillion on Friday at 7:00 p.m. in Hong Kong, down 0.89% from US$1.12 trillion a week ago, according to CoinMarketCap data. With a market cap of US$512 billion, Bitcoin represented 46.1% of the market, while Ether, valued at US$218 billion, accounted for 19.6%.

“Toda la capitalización de mercado de las criptomonedas se ha mantenido esencialmente sin cambios durante un año”, dijo Kiely. “El plan de Tether para expandir sus tenencias de Bitcoin puede aumentar temporalmente los precios, pero en general no es probable que tenga un gran impacto. La reducción a la mitad de Bitcoin en 2024 podría conducir a un aumento de los precios, sin embargo, todavía tenemos que comenzar a ver los efectos de la misma".

On May 17, Tether , the company behind the world’s largest stablecoin USDT, revealed its plans to “regularly allocate” as much as 15% of its net operational profits to buy Bitcoin, aiming to boost its reserves portfolio. Tether held approximately US$1.5 billion in Bitcoin reserves, at the time of the announcement.

Bitcoin inactivo alcanza un máximo histórico

The amount of Bitcoin that has been inactive for at least a year rose to an all-time high of 68.46% on Wednesday, according to data aggregator MacroMicro .

“It could mean short-term selling pressure decreases if the Bitcoin holdings in short-term holdings shift to longer-term holders. However, we will not be able to tell whether the addresses belong to institutional investors or not,” Tom Wan, a research analyst at 21.co , the parent company of 21Shares, an issuer of crypto exchange-traded products, said.

Según Kiely de Yield App, esto sugiere que cada vez más inversores en todo el mundo tienen la intención de mantener su Bitcoin a largo plazo.

“Es probable que esta tendencia continúe e incluso se acelere, incluso potencialmente hasta el punto de la hiperbitcoinización, dada la incertidumbre relacionada con un panorama regulatorio en evolución y el creciente reconocimiento de Bitcoin como una reserva de valor”, dijo Kiely.

La "hiperbitcoinización" es un concepto que especula sobre el eventual ascenso de Bitcoin para convertirse en la forma de dinero omnipresente en el mundo.

Motores notables: RNDR y KAVA

The Render Network’s native cryptocurrency was this week’s biggest gainer among the top 100 coins by market capitalization listed on CoinMarketCap, rallying 16.55% to US$2.83. The token started picking up momentum last Saturday, after the announcement of the new Render Foundation website. This is Render’s second consecutive week as the biggest gainer in the top 100 cryptos.

The Render Network leverages idle graphics processing units for digital rendering purposes, catering to areas such as 3D modeling, gaming imagery, and virtual reality.

Kava, the governance token of a layer-1 blockchain of the same name, was this week’s second-biggest gainer, rising 10.70% to US$1.09. The coin started picking up momentum on Monday, following the launch of the Kava mainnet last week.

Próxima semana: ¿Podría un acuerdo de techo de deuda romper el camino del cangrejo de Bitcoin?

U.S. President Joe Biden and House Speaker Kevin McCarthy are reportedly closing in on a deal that would raise the government’s debt ceiling for two years while capping spending on most items. Yet, the June 1 deadline is fast approaching, causing investor concerns about a potential default.

Según Kenjaev de WuuTrade, la incertidumbre en torno a las negociaciones del techo de la deuda seguirá pesando sobre el criptomercado hasta que se llegue a un acuerdo.

“The sideways [movement] of Bitcoin is very much related to the current market risks and the fear. Investors’ activity during any economic risk talks is rather cautious. Hence the sideways in US$26,000 – US$30,000,” wrote Kenjaev, adding that positive news surrounding the U.S. economy will break the crab walk .

Los inversores están a la espera de la publicación de la próxima semana del informe de empleos de EE. UU. para mayo, que incluye los datos cruciales de las nóminas no agrícolas. Esta información a menudo sirve como barómetro para predecir los próximos pasos de la Reserva Federal con respecto a los ajustes de las tasas de interés. ING Economics ha proyectado un aumento de 195,000 en las nóminas no agrícolas para mayo. Además, prevén un ligero repunte de la tasa de paro hasta el 3.5% para mayo, frente al 3.4% del mes anterior.

En el espacio criptográfico, Optimism, una red de capa 2 de Ethereum, planea aumentar el suministro circulante de su token de gobierno (OP) el próximo miércoles, un año después del lanzamiento de la moneda. La expansión es parte de la estrategia de Optimism para aumentar el grupo de tokens votables dentro de Token House, su grupo de titulares de OP responsables de proponer y votar sobre cuestiones de gobierno.

See related article: Big buys fail to lift NFT markets as regulatory uncertainty weighs heavy on crypto

- Distribución de relaciones públicas y contenido potenciado por SEO. Consiga amplificado hoy.

- PlatoAiStream. Inteligencia de datos Web3. Conocimiento amplificado. Accede Aquí.

- Acuñando el futuro con Adryenn Ashley. Accede Aquí.

- Compra y Vende Acciones en Empresas PRE-IPO con PREIPO®. Accede Aquí.

- Fuente: https://bitrss.com/news/309885/weekly-market-wrap-bitcoin-weighed-down-by-debt-ceiling-uncertainty

- :posee

- :es

- :no

- ][pag

- $ UP

- 000

- 1

- 10

- 100

- 11

- 12

- 15%

- 17

- 195

- 2024

- 21 acciones

- 26

- 3d

- Modelado 3D

- 7

- a

- AAA

- Poder

- Nuestra Empresa

- Conforme

- actividad

- la adición de

- Adicionalmente

- direcciones

- ajustes

- Después

- Aggregator

- .

- Con el objetivo

- ya haya utilizado

- entre

- cantidad

- an

- analista

- y

- Anuncio

- anticiparse a

- cualquier

- applicación

- apetito

- enfoque

- que se acerca

- adecuado

- aproximadamente

- Abril

- somos

- áreas

- en torno a

- artículo

- AS

- activo

- At

- en espera

- conscientes

- BE

- a las que has recomendado

- esto

- detrás de

- Biden

- Big

- Mayor

- mil millones

- Bitcoin

- Precio de Bitcoin

- reservas de bitcoin

- blockchain

- empujón

- Descanso

- pero

- comprar

- Comprar bitcoin

- Compra

- by

- tapa

- capitalización

- causando

- cautelosos

- techo

- jefe

- circulante

- cierre

- CO

- Monedas

- CoinMarketCap

- Monedas

- compañía

- en comparación con

- concepto

- preocupado

- Inquietudes

- consecutivo

- continue

- continuado

- podría

- país

- crucial

- cripto

- Crypto Market

- espacio criptográfico

- criptomonedas

- criptomoneda

- Criptos

- Current

- datos

- acuerdo

- Deuda

- disminuye

- Predeterminado

- digital

- Activo digital

- No

- DE INSCRIPCIÓN

- durante

- Economic

- Ciencias económicas

- economia

- los efectos

- Todo

- esencialmente

- Éter

- Éter (ETH)

- Etereum

- Incluso

- Eventos

- eventual

- evolución

- intercambiado en bolsa

- Expandir

- expansión

- factores importantes

- FALLO

- RÁPIDO

- miedo

- Federal

- Reserva Federal

- Nombre

- primer vez

- Fitch

- siguiendo

- formulario

- Fundación

- Viernes

- en

- juego de azar

- dado

- Buscar

- cripto global

- gobierno

- Gobierno

- gráficos

- Grupo procesos

- Creciendo

- A la mitad

- Tienen

- pesado

- Retenida

- por lo tanto

- Alta

- Golpes

- mantener

- titulares

- Inversiones

- Hong

- 香港

- Hogar

- Sin embargo

- HTTPS

- Hiperbitcoinización

- Idle

- if

- Impacto

- in

- inactivo

- incidente

- incluye

- aumente

- cada vez más

- información

- ING

- Institucional

- inversores institucionales

- la intención de

- intereses

- TASA DE INTERÉS

- dentro

- inversión extranjera

- inversor

- Inversionistas

- Emisor

- cuestiones

- IT

- artículos

- SUS

- Empleo

- informe de trabajos

- Joe Biden

- junio

- KAVA

- Guardar

- Kong

- Falta

- paisaje

- large

- mayor

- Apellido

- lanzamiento

- Lead

- menos

- apalancamientos

- que otros

- Liquidez

- Listado

- Largo

- Macro

- Inicio

- mainnet

- Mercado

- Capitalización

- Capitalización de Mercado

- envoltura de mercado

- Industrias

- Puede..

- personalizado

- que falta

- modelado

- Momentum

- Lunes

- dinero

- Mes

- más,

- MEJOR DE TU

- movimiento

- movimiento

- en el Sur de Florida

- mucho más

- nombre

- nativo

- negativas

- negociaciones

- red

- del sistema,

- Nuevo

- noticias

- Next

- NFT

- Mercados NFT

- No agrícola

- Nóminas no agrícolas

- bonos

- of

- off

- Oficial

- a menudo

- on

- OP

- operativos.

- Optimismo

- or

- Más de

- total

- empresa matriz

- parte

- pagos

- Nóminas

- plan

- planificar

- jubilación

- plataforma

- Platón

- Inteligencia de datos de Platón

- PlatónDatos

- punto

- alberca

- portafolio

- positivo

- posible

- la posibilidad

- predecir

- presidente

- presidente biden

- presidente joe biden

- presión

- precio

- Precios

- tratamiento

- Productos

- beneficios.

- Progreso

- proyectado

- protocolo

- fines

- aumento

- elevado

- Rate

- más bien

- .

- Calificaciones

- alcanzado

- Realidad

- mejor

- reconocimiento

- con respecto a

- regulador

- panorama regulatorio

- relacionado

- ,

- se mantuvo

- representación

- reporte

- representado

- la investigación

- reservas

- responsable

- Revelado

- Ripple

- Subir

- creciente

- Riesgo

- Apetito por el riesgo

- riesgos

- ROSE

- s

- Said

- mismo

- sábado

- decir

- Segundo

- ver

- parecer

- vender

- sirve

- Turno

- a corto plazo

- de lado

- desde

- algo

- algo

- Espacio

- Speaker

- Gastos

- stablecoin

- moneda estable USDT

- comienzo

- fundó

- pasos

- tienda

- depósito de valor

- Estrategia

- sustancial

- tal

- Sugiere

- suministro

- Rodeando

- ¡Prepárate!

- Discursos

- les digas

- término

- Tether

- esa

- El

- su

- Estas

- ellos

- así

- jueves

- equipo

- veces

- a

- ficha

- Tokens

- demasiado

- parte superior

- comercio

- Plataforma de

- Trading Platform

- Tendencia

- Trillones

- dos

- nosotros

- Economía de EE.UU.

- ubicuo

- Incertidumbre

- bajo

- desempleo

- tasa de desempleo

- unidades que

- hasta

- USDT

- propuesta de

- valorado

- muy

- Virtual

- Realidad virtual

- Votar

- fue

- Ver ahora

- we

- Página web

- Miércoles

- semana

- una vez por semana

- pesó

- pesa

- sean

- que

- mientras

- seguirá

- dentro de

- mundo

- en todo el mundo

- se

- envolver

- año

- años

- aún

- Rendimiento

- Aplicación de rendimiento

- zephyrnet