PRÓXIMOS EVENTOS:

- Lunes: Producción industrial de Japón, IPC de Nueva Zelanda, FML del PBoC.

- Martes: Actas de la reunión del RBA, informe de empleo del Reino Unido, ZEW alemán, IPC de Canadá, ventas minoristas de EE. UU., producción manufacturera de EE. UU., índice del mercado inmobiliario NAHB de EE. UU.

- Miércoles: PIB de China, producción industrial de China, ventas minoristas de China, tasa de desempleo de China, IPC e IPP del Reino Unido, inicio de viviendas y permisos de construcción en EE. UU.

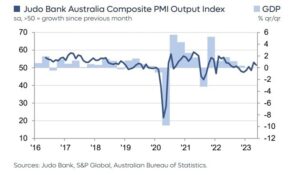

- Jueves: Informe de empleo de Australia, solicitudes de desempleo en EE. UU., habla el presidente de la Reserva Federal, Powell.

- Viernes: IPC de Japón, LPR del PBoC, ventas minoristas del Reino Unido, ventas minoristas de Canadá.

Lunes

The New Zealand CPI Y/Y is expected to

tick lower to 5.9% vs. 6.0% prior, while the Q/Q figure is seen at 2.0% vs.

1.1% prior. The elevated inflation rate is mainly due to the sharp rise in fuel

prices. Unless we get a big upside surprise, the RBNZ is unlikely to respond

with another rate hike as it has stated that it’s ready to look through the

short-term “noise”.

IPC de Nueva Zelanda interanual

The PBoC is likely to keep the MLF and LPR

rates unchanged on Monday and Friday respectively as the economic outlook has

started to improve a little as seen with the latest PMI

cifras. Por otro lado, el inflación

cifras last week disappointed, which might

give them space to go for another rate cut, although the monthly reading has

been positive for the last 3 months.

PBoC

Martes

The UK employment change is expected at

-195K vs. -207K prior and the unemployment rate to remain unchanged at 4.3%.

The average earnings excluding bonus are seen at 7.8% vs. 7.8% prior, while the

average earnings including bonus are expected at 8.3% vs. 8.5% prior. La

BoE has paused at the last meeting and, as Gobernador

Bailey has stated recently,

“future decisions are going to be tight”,

so strong readings might lead to another rate hike at the upcoming meeting,

especially if the inflation data surprises to the upside later in the week.

Tasa de desempleo del Reino Unido

Se espera que el IPC canadiense interanual sea del 4.0%.

vs. 4.0% prior, while the M/M figure is seen at 0.1% vs. 0.4% prior. There’s no

consensus at the moment for the Core measures, although those are the ones

that the BoC will look at to decide what to do at the next week’s meeting. Porque

a reminder, underlying inflation has been surprising to the upside and that’s

lo que es que otros

to trigger another rate hike

del BoC si las cifras de esta semana se mantienen elevadas.

Medidas de inflación de Canadá

Se espera que las ventas minoristas M/M de EE. UU.

rise 0.3% vs. 0.6% prior, while the Core measure is seen at 0.2% vs. 0.6%

prior. Watch out for the Control Group, which is seen as the best gauge of

gasto del consumidor. This report is unlikely to change anything for the Fed as

the central bank is expected to keep rates unchanged at the November decision

así como.

Ventas minoristas en EE. UU., año contra año

Miércoles

El IPC del Reino Unido Y/Y se espera en 6.5% vs.

6.7% prior, while the M/M figure is seen at 0.4% vs. 0.3% prior. The Core CPI

Y/Y is expected at 6.0% vs. 6.2% prior, while there’s no consensus at the

moment for the monthly rate. The BoE is likely to look through an upside

surprise in the inflation data if the labour market report shows weakness.

On the other hand, if both the reports show strength, then we are likely to see

another rate hike at the upcoming meeting.

IPC subyacente del Reino Unido interanual

Jueves

The US Jobless Claims have been showing

strength for several weeks. Apellidos

semana though, we got a miss in Continuing

Claims, which measures ongoing unemployment benefits and can be viewed as an

indicator of how easily workers can find another job after getting unemployed. It

could be something or it could be nothing, but it’s certainly worth to keep an

ojo en. This week the consensus sees Initial Claims at 213K vs. 209K prior,

while there’s no consensus on Continuing Claims at the time of writing.

Reclamaciones por desempleo en EE. UU.

Viernes

Se espera que el IPC subyacente japonés Y/Y sea de

2.7% vs. 3.1% prior, while there’s no consensus at the moment for the Core-Core

figure and the Headline CPI, which were previously 4.3% and 3.2% respectively.

The Tokyo CPI, which is seen as a leading indicator for national CPI,

disappointed recently and, although the BoJ

is going to revise its inflation forecasts higher,

they are unlikely to normalise their monetary policy unless they see

sustained wage growth or big upside surprises in the inflation data.

IPC subyacente interanual de Japón

- Distribución de relaciones públicas y contenido potenciado por SEO. Consiga amplificado hoy.

- PlatoData.Network Vertical Generativo Ai. Empodérate. Accede Aquí.

- PlatoAiStream. Inteligencia Web3. Conocimiento amplificado. Accede Aquí.

- PlatoESG. Carbón, tecnología limpia, Energía, Ambiente, Solar, Gestión de residuos. Accede Aquí.

- PlatoSalud. Inteligencia en Biotecnología y Ensayos Clínicos. Accede Aquí.

- Fuente: https://www.forexlive.com/news/weekly-market-outlook-16-20-october-20231015/

- :posee

- :es

- 1

- 2%

- 26

- 7

- 8

- a

- Después

- Aunque

- an

- y

- Otra

- cualquier cosa

- somos

- AS

- At

- Australia

- promedio

- Muralla exterior

- Banca

- BE

- esto

- beneficios

- MEJOR

- Big

- BoC

- Banco de Inglaterra

- Depósito

- ambas

- Construir la

- pero

- PUEDEN

- Ubicación: Canadá

- IPC de Canadá

- Ventas minoristas de Canadá

- canadiense

- central

- Banco Central

- ciertamente

- Presidente

- el cambio

- China

- ventas al por menor de china

- reclamaciones

- Consenso

- consumidor

- continuo

- control

- Core

- podría

- IPC

- Corte

- datos

- decidir

- Koops

- decisiones

- do

- dos

- Ganancias

- pasan fácilmente

- Economic

- elevado

- empleo

- especialmente

- excluyendo

- esperado

- ojos

- Fed

- Presidente de la Fed

- Presidente de la Fed Powell

- Figura

- Figuras

- Encuentre

- previsiones

- Viernes

- Desde

- Combustible

- calibre

- PIB

- Alemán

- obtener

- conseguir

- Donar

- Go

- va

- tiene

- Grupo procesos

- Incremento

- mano

- Tienen

- titular

- Caminata

- viviendas

- mercado de la vivienda

- Cómo

- HTTPS

- if

- mejorar

- in

- Incluye

- índice

- Indicador

- industrial

- Producción Industrial

- inflación

- tasa de inflación

- inicial

- IT

- SUS

- Japón

- Japonés

- Trabajos

- las solicitudes de desempleo

- Empleo

- informe de trabajos

- jpg

- Guardar

- Del Trabajo

- Apellidos

- luego

- más reciente

- Lead

- líder

- que otros

- pequeño

- Mira

- inferior

- LPR

- principalmente

- Fabricación

- Mercado

- perspectiva del mercado

- Informe del Mercado

- medir

- medidas

- reunión

- podría

- minutos

- perder

- MLF

- momento

- Lunes

- Monetario

- La política monetaria

- mensual

- meses

- Nacional

- Nuevo

- Nueva Zelanda

- Next

- no

- nada

- Noviembre

- octubre

- of

- on

- las

- en marcha

- or

- Otro

- salir

- Outlook

- pausa

- PBOC

- LPR del Banco Popular de China

- FML del PBOC

- permisos

- Platón

- Inteligencia de datos de Platón

- PlatónDatos

- política

- positivo

- Powell

- ppi

- previamente

- Precios

- Anterior

- Producción

- Rate

- Alza de la tarifa

- Tarifas

- RBA

- RBNZ

- Reading

- ready

- recientemente

- permanecer

- recordatorio

- reporte

- Informes

- respectivamente

- Responder

- el comercio minorista

- Ventas al por menor

- revisar

- Subir

- ventas

- ver

- visto

- ve

- Varios

- agudo

- a corto plazo

- Mostrar

- demostración

- Shows

- So

- algo

- Espacio

- Habla

- Gastos

- fundó

- comienza

- dijo

- fuerza

- fuerte

- sorpresa

- sorpresas

- sorprendente

- sostenido

- esa

- La

- la Reserva Federal

- su

- Les

- luego

- ellos

- así

- esta semana

- ¿aunque?

- A través de esta formación, el personal docente y administrativo de escuelas y universidades estará preparado para manejar los recursos disponibles que derivan de la diversidad cultural de sus estudiantes. Además, un mejor y mayor entendimiento sobre estas diferencias y similitudes culturales permitirá alcanzar los objetivos de inclusión previstos.

- garrapata

- equipo

- a

- Tokio

- IPC de Tokio

- detonante

- Uk

- IPC del Reino Unido

- Empleo en el Reino Unido

- Ventas minoristas en el Reino Unido

- subyacente

- desempleo

- tasa de desempleo

- poco probable

- próximos

- Al revés

- us

- Vivienda en EE. UU.

- Nuevas viviendas en EE. UU.

- Reclamaciones por desempleo en EE. UU.

- Índice del mercado de la vivienda de la NAHB de EE. UU.

- Ventas minoristas en EE. UU.

- visto

- vs

- salario

- Ver ahora

- we

- semana

- una vez por semana

- Semanas

- tuvieron

- ¿

- Que es

- que

- mientras

- seguirá

- los trabajadores.

- valor

- la escritura

- Zelanda

- zephyrnet