The cryptocurrency is inching slowly upwards after losses yesterday. Its total cap, at $922 billion, has fallen by 5% in a week, and by 32% in a month. It has, however, risen by 1% in 24 hours, along with most major coins. This invites hope for a weekend recovery, which the market is long overdue, even if macroeconomic conditions remain negative. As such, here's our pick of the 5 best cryptocurrency to buy for the recovery.

Las 5 mejores criptomonedas para comprar para la recuperación

1. Bloque de la suerte (LBLOCK)

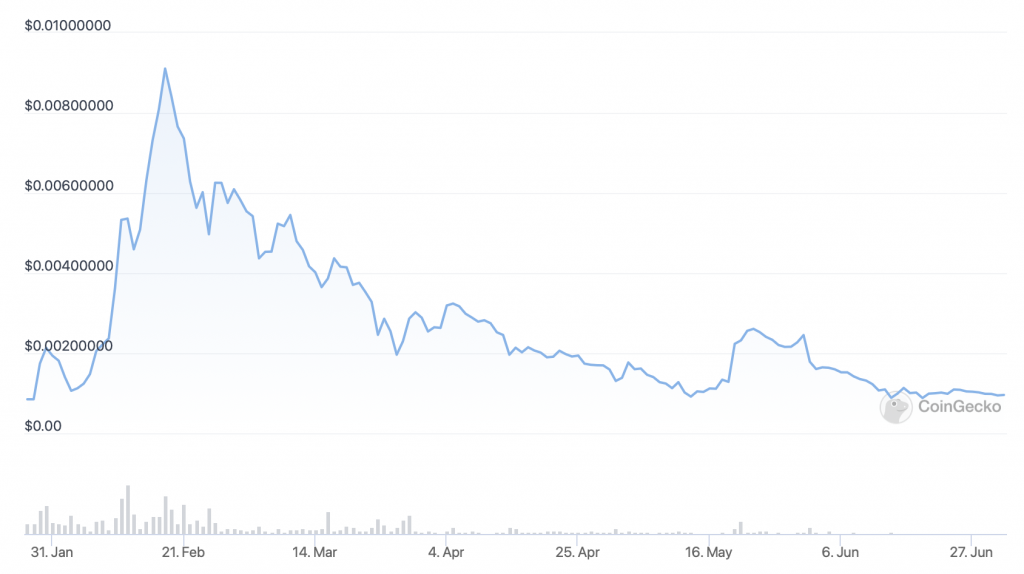

LBLOCK es $0.00095626 en este momento, lo que representa un aumento fraccional (0.2%) en las últimas 24 horas. Sin embargo, la altcoin bajó un 12% la semana pasada y un 46% en los últimos 30 días.

LBLOCK is down by 90% since its all-time high of $0.00974554, set in February. On the other hand, it's up by 120% since launching in late January.

Que LBLOCK siga activo desde su lanzamiento es una buena señal para el futuro, y los desarrollos recientes de Lucky Block sugieren que podría crecer con fuerza cuando mejoren las condiciones del mercado. Por un lado, la plataforma de juegos criptográficos Lucky Block ahora realiza sorteos de premios regulares, que garantizan un premio mayor mínimo de $ 50,000. Además de esto, pasó la auditoría de su próximo token ERC-20.

¡Se pasó la auditoría del token V2! ✅

That means that we're getting closer to listings on centralized exchanges! 🤩

Deje que el #CuentaRegresivaParaCEX ¡empezar! 🥳 @SolidProof_io #crypto #auditoría #CEX #listados #blockchain pic.twitter.com/TZJMPdNOdZ

- Bloque de la suerte (@luckyblockcoin) Sábado, Junio 23, 2022

In other words, an Ethereum-based version of LBOCK is imminent. It had originally launched on Binance Smart Chain, yet a migration to Ethereum will open up significant liquidity for the coin. Likewise, it paves the way for more exchange listings, something which will expand its market substantially. This is why it's one of our 5 best cryptocurrency to buy for the recovery.

2. Bitcoin (BTC)

BTC ha subido un 1.5% en las últimas 24 horas, alcanzando los 19,664 dólares. Había caído tan bajo como $ 18,780 ayer, destacando la posibilidad de nuevas caídas. Y su tendencia actual sigue siendo negativa, habiendo caído un 7% en una semana y un 38% en un mes.

BTC's indicators are at a very low ebb. Its relative strength index (in purple) is touching 30, indicating that the market is overselling it. Likewise, its 30-day moving average (in red) has fallen to its lowest level relative to its 200-day average (in blue) for a year. This strongly signals an eventual recovery.

Bitcoin remains the market's leader for a reason. It commands alrededor de $ 26 mil millones en inversión institucional, que parece destinado a aumentar a medio y largo plazo. Por ejemplo, Jacobi Asset Management acaba de anunciar the launch of Europe's first-ever spot Bitcoin ETF. It will go live this month on the Euronext Amsterdam exchange, paving the way for more institutional and mainstream investment in bitcoin.

More generally, it's bitcoin that continues to attract outside interest. There continue to be nations which turn to BTC during periods of very high inflation (e.g. Turquía y Argentina), así como aquellos que lo han hecho de curso legal (El Salvador y la República Centroafricana). Lo más probable es que esta tendencia continúe cuando el mercado vuelva a ser más positivo.

3. La caja de arena (SAND)

At $1.13, SAND has risen by 15% in a day. It's also up by 12% in a week and by 35% in the past 14 days. That said, it is down by 22% in a month.

Looking at SAND's chart, it had been due a rally. Its RSI has fallen below 30, while its 30-day average had collapsed far below its 200-day. Of course, with conditions remaining challenging, it can't be said how long its current spurt will last.

Parece que SAND está aumentando en este momento debido a la apertura del puente entre Sandbox y la plataforma Polygon de capa dos. Esto permite a los usuarios de Sandbox transferir tokens LAND no fungibles y SAND a (y sobre) Polygon, algo que reduce los costos y mejora la eficiencia.

🌉 Estamos listos para desplegar LAND a @ 0xPolygon 🌉

🔸¡Cada TIERRA puenteada otorga un reembolso de 10 mSAND!

🔸¡Vuelven los multiplicadores LAND en ambos programas de staking de mSAND!

🔸¡Las funciones de venta de LAND y LAND staking (en Polygon) llegarán pronto!PUENTE AHORA ➡️ https://t.co/jlcSKxuBWh pic.twitter.com/1tuAAsqEZP

- The Sandbox (@TheSandboxGame) Sábado, Junio 28, 2022

Mirando el panorama general, Sandbox ha sido testigo de mucha actividad de alto perfil en su plataforma de juegos/metaverso. En particular, el fabricante de billeteras de hardware Ledger anunció que había elegido Sandbox como su primera ubicación virtual en el metaverso. Este es un gran respaldo para la plataforma, dado el peso que tiene Ledger dentro del sector de las criptomonedas.

Bienvenido el LedgerVerse a @ArenaJuegos: Ledger's first step into the metaverse and the first to turn gaming into Web3 education. 🎮

Conquista misiones, lucha contra los estafadores y gana recompensas Web3. 🥇

Domina la criptoseguridad.

Aprender. Tocar. Ganar. Próximamente verano 2022. pic.twitter.com/56kS9FLZK6

- Libro mayor (@Ledger) Sábado, Junio 22, 2022

It's worth remembering that the Sandbox racked up around $350 millones en ventas de terrenos virtuales en 2021, more than any other similar platform. This highlights its potential, and also why we've included it among our 5 best cryptocurrency to buy for the recovery.

4. Ethereum (ETH)

ETH ha subido un 2.5% en las últimas 24 horas. A $1,072, ha caído un 6% en la última semana y un 45% en el último mes.

ETH's indicators are much like BTC's, suggesting a bottom. Its RSI is close to 30, while its 30-day average is far below its 200-day. Of course, the market is going through an unprecedentedly difficult time right now, so it's hard to say whether a rally is imminent.

Aún así, ETH tiene un gran potencial a mediano y largo plazo. Esto se debe en gran parte a que Ethereum está en proceso de cambiar a un mecanismo de consenso de prueba de participación. Esto hará que la cadena de bloques de capa uno consuma menos energía, sea más escalable y más atractiva para los inversores.

Felicitaciones a la #Ethereum comunidad en una fusión exitosa en la red de prueba de Ropsten.

Hay más de $ 22.78B en valor apostado y listo para la próxima fusión de la red principal a la prueba de participación.

Esto representa 12.8M $ ETH = 10.78% de la oferta.

Gráfico en vivo: https://t.co/PDQg3lCJCl pic.twitter.com/GiFI3BtSKa

- glassnode (@glassnode) Sábado, Junio 8, 2022

Due at some point in late summer, the ‘Merge' will massively boost investor confidence in Ethereum. The introduction of staking will increase demand for ETH, and with 10% of ETH's supply already staked on the PoS Beacon Chain, the cryptocurrency could become deflationary. When you add the fact that Ethereum ya es la cadena de bloques más grande por valor total bloqueado, it's easy to see why ETH is one of our 5 best cryptocurrency to buy for the recovery.

11/ At the current stake amount, the Ethereum network will be paying out ~600,000 ETH per year, instead of 4,850,000 under the current PoW model, or 88% less in "sell pressure"! At the same time, stakers will still be earning ~4.6% in their staked ETH, a nice return to attract.

- eric.eth (@econoar) Sábado, Junio 10, 2022

5. Arweave (AR)

AR ha subido un 20% en las últimas 24 horas, a $10. También ha subido un 2% en una semana y un 15% en una quincena, manteniéndose un 35% a la baja en los últimos 30 días.

AR's chart shows a gradual increase in momentum. Its RSI has gone from under 30 a couple of weeks ago to nearly 50 today. At the same time, its 30-day average is still well below its 200-day, so there's plenty of room left for a bigger recovery.

It seems that AR is rallying right now due to the launch of Arweave's very own domain registry system. Basically, its Arweave's own version of the Ethereum Name Service, enabling users to purchase ArNS-based domain names using AR. This has caused demand for AR to rise as users move to claim their own domains.

Hoy lanzamos nuestro programa piloto de Arweave Name System (ArNS), un directorio basado en Smartweave de subdominios amigables habilitados por https://t.co/ljKQFJO6vN puertas de enlace en el @arweaveteam permanenteweb!

🧵 1/3 pic.twitter.com/62tQDABgyz

— 🐘🔗ario.arweave.dev (@ar_io_network) Sábado, Junio 29, 2022

Looking at AR's fundamentals, it's encouraging to note that Arweave — a decentralised data storage network — ha sido testigo de un aumento de las transacciones durante el último año. From 1.75 million daily transactions August 2021, its traffic increased to 48.8 million daily transactions by May of this year. This figure has since declined, as a result of the market downturn, but it's likely to continue witnessing growth once the economic picture improves.

Tu capital está en riesgo.

Más información:

- Cómo comprar criptomonedas

- Cómo comprar Lucky Block

- Dónde comprar Ethereum

- Cómo comprar Bitcoin

- Las mejores criptomonedas para invertir

- Coinsmart. El mejor intercambio de Bitcoin y criptografía de Europa.

- Platoblockchain. Inteligencia del Metaverso Web3. Conocimiento amplificado. ACCESO LIBRE.

- CriptoHawk. Radar de altcoins. Prueba gratis.

- Fuente: https://insidebitcoins.com/news/5-best-cryptocurrency-to-buy-for-the-recovery-july-2021-week-1

- "

- 000

- 10

- 2021

- 2022

- 28

- a

- actividad

- Africano

- ya haya utilizado

- Altcoin

- entre

- cantidad

- Ámsterdam

- anunció

- AR

- en torno a

- activo

- gestión de activos

- auditoría

- AGOSTO

- promedio

- Básicamente

- BBC

- cadena de baliza

- a las que has recomendado

- a continuación

- MEJOR

- entre

- más grande

- Mayor

- mil millones

- binance

- Bitcoin

- ETF de Bitcoin

- Bloquear

- blockchain

- empujón

- PUENTE

- BTC

- comprar

- Comprar bitcoin

- capital

- causado

- central

- centralizado

- cadena

- desafiante

- elegido

- reclamo

- más cerca

- CNBC

- Monedas

- Monedas

- viniendo

- vibrante e inclusiva

- condiciones

- confianza

- Consenso

- continue

- continúa

- Precio

- podría

- Parejas

- cripto

- criptomoneda

- Current

- todos los días

- datos

- almacenamiento de datos

- día

- Días

- deflacionista

- Demanda

- desplegar

- Dev

- desarrollos

- difícil

- Pantalla

- dominio

- dominios

- DE INSCRIPCIÓN

- caído

- durante

- cada una

- generarte

- Ganancias

- Economic

- Educación

- eficiencia

- permite

- permitiendo

- alentador

- energía

- ERC-20

- ETF

- ETH

- Etereum

- Etereum (ETH)

- red ethereum

- Europa

- ejemplo

- Intercambio

- Expandir

- Caracteristicas

- Figura

- Nombre

- fraccionario

- en

- Las Bases (Fundamentales)

- promover

- futuras

- Juegos

- juego de azar

- en general

- conseguir

- en Glassno

- va

- candidato

- subvenciones

- maravillosa

- Crecer

- Crecimiento

- garantizamos

- Materiales

- Monedero de hardware

- es

- esta página

- Alta

- destacados

- tenencia

- esperanza

- Cómo

- Sin embargo

- HTTPS

- mejorar

- incluido

- aumente

- aumentado

- índice

- inflación

- Institucional

- intereses

- inversión extranjera

- inversor

- Inversionistas

- IT

- Enero

- Julio

- lanzamiento

- lanzado

- lanzamiento

- líder

- Libro mayor

- Legal

- Nivel

- que otros

- Liquidez

- Propiedades

- para vivir

- Ubicación

- cerrado

- Largo

- compromiso a largo plazo

- pérdidas

- hecho

- Corriente principal

- gran

- para lograr

- Management

- gerente

- Fabricante

- Mercado

- significa

- mecanismo

- ir

- Metaverso

- millones

- mínimo

- modelo

- Momentum

- Mes

- más,

- MEJOR DE TU

- movimiento

- emocionante

- nombres

- Naciones

- negativas

- del sistema,

- no fungible

- tokens no fungibles

- habiertos

- apertura

- Otro

- EL DESARROLLADOR

- períodos

- imagen

- piloto

- plataforma

- Jugar

- Mucho

- punto

- Polígono

- PoS

- positivo

- posibilidad

- posible

- PoW

- presión

- precio

- premio

- Programa

- Programas

- Prueba de Estaca

- público

- comprar

- misiones

- reunir

- RE

- reciente

- recuperación

- regular

- permanecer

- restante

- permanece

- que representa

- representa

- volvemos

- Reuters

- Recompensas

- creciente

- Riesgo

- Said

- ventas

- mismo

- SAND

- arenero

- escalable

- Los estafadores

- sector

- EN LINEA

- venta

- de coches

- set

- firmar

- importante

- similares

- desde

- inteligente

- So

- algo

- algo

- Spot

- stake

- replanteo

- Sin embargo

- STORAGE

- fuerza

- exitosos

- verano

- suministro

- te

- El

- A través de esta formación, el personal docente y administrativo de escuelas y universidades estará preparado para manejar los recursos disponibles que derivan de la diversidad cultural de sus estudiantes. Además, un mejor y mayor entendimiento sobre estas diferencias y similitudes culturales permitirá alcanzar los objetivos de inclusión previstos.

- equipo

- hoy

- ficha

- Tokens

- parte superior

- tráfico

- Transacciones

- transferir

- bajo

- under 30

- próximos

- hacia arriba

- usuarios

- propuesta de

- versión

- Virtual

- la visibilidad

- W3

- Billetera

- Web3

- semana

- fin de semana

- sean

- mientras

- ganar

- dentro de

- palabras

- valor

- año